When Are Form 1041 Due For 2022

When Are Form 1041 Due For 2022 - • 1041 on extension due: Keeping track of these dates and filing in a timely manner is the key to maintaining good standing with the irs. Web a trust or estate with a tax year that ends june 30 must file by october 15 of the same year. Web as this form is due to the irs quarterly, there are four deadlines to follow. Web 7 rows irs begins accepting form 1041 electronic tax returns. Web january 31, 2022: If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter. If you are located in. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Page last reviewed or updated:

For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web due date of return. Return to life cycle of a private foundation. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Calendar year estates and trusts must file form 1041 by april 18, 2023. If the estate has adopted a calendar year as its tax year, file using the rules listed under. Web when is form 1041 due? Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. • 1041 on extension due: Web as this form is due to the irs quarterly, there are four deadlines to follow.

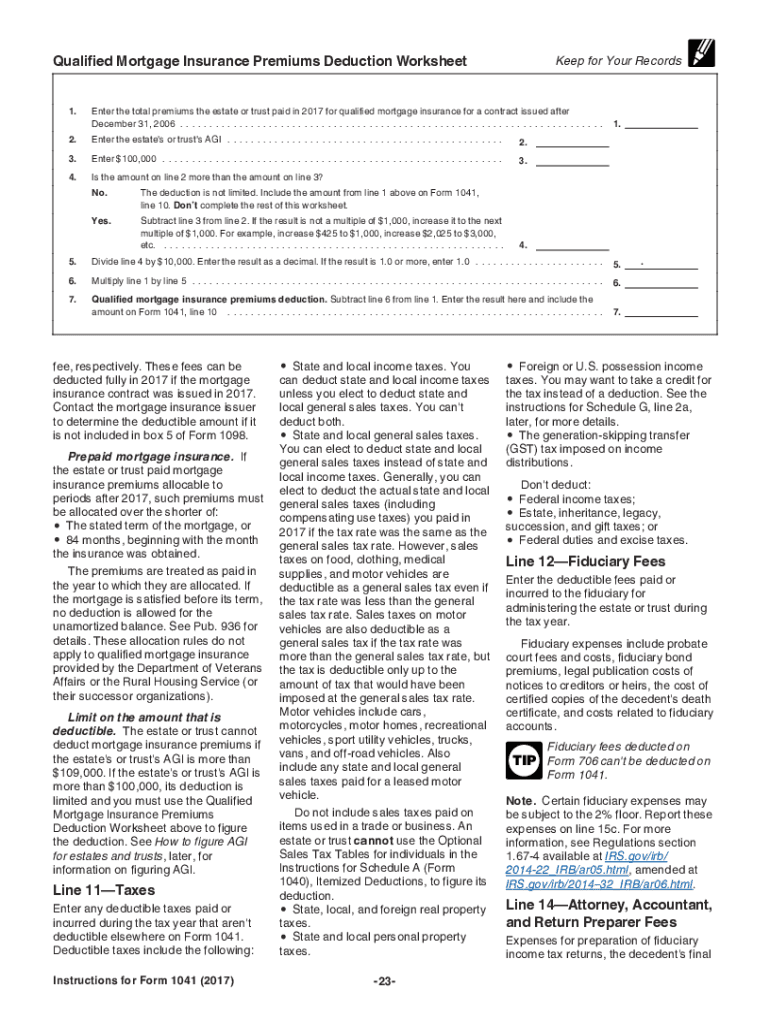

And you are not enclosing a check or money order. If the estate has adopted a calendar year as its tax year, file using the rules listed under. If the estate has adopted a fiscal year, it may pay all of its. For fiscal year, file by the 15th day of the fourth. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross income for 2022 and 2023 is from farming or fishing). Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland,. Web when is form 1041 due? Web what is the due date for irs form 1041? Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. Web october 31, 2023.

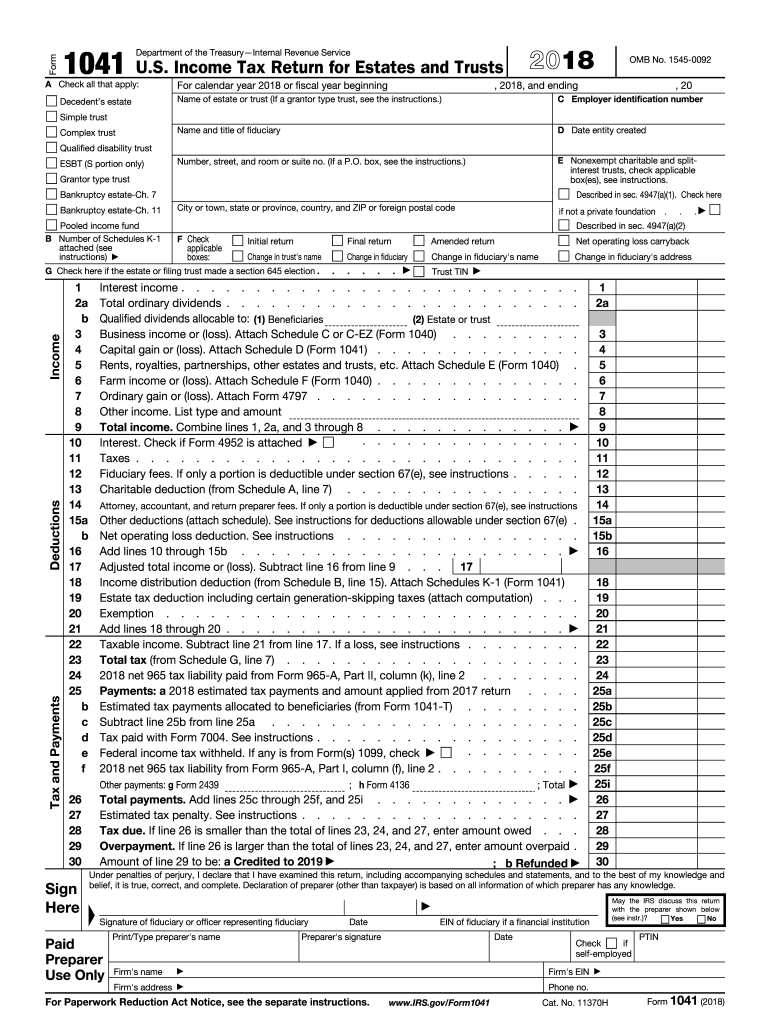

20192022 Form IRS 1041N Fill Online, Printable, Fillable, Blank

• 1041 on extension due: Web for those filing form 1040, schedule h is to be submitted with the return and is thus extended to the due date of the return. Web when is form 1041 due? Web what is the due date for irs form 1041? Search site you are here.

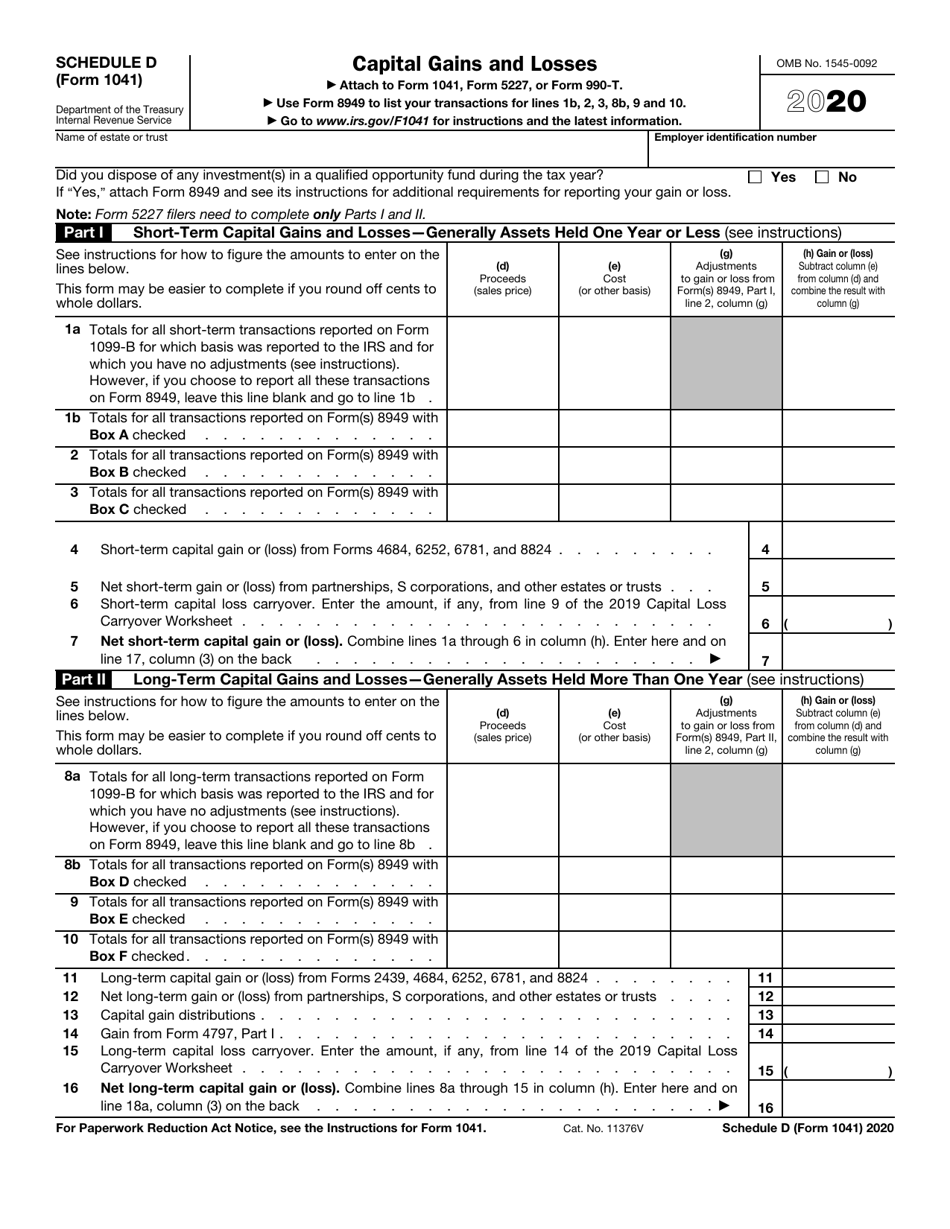

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

And you are not enclosing a check or money order. Web 7 rows irs begins accepting form 1041 electronic tax returns. For fiscal year, file by the 15th day of the fourth. Web as this form is due to the irs quarterly, there are four deadlines to follow. Keeping track of these dates and filing in a timely manner is.

Form 1041 Fill Out and Sign Printable PDF Template signNow

Web october 31, 2023. If you are located in. Web when is form 1041 due? Calendar year estates and trusts must file form 1041 by april 18, 2023. Schedule c and personal tax return (irs form 1040) due april 18, 2023.

Filing Taxes for Deceased with No Estate H&R Block

For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. If the estate has adopted a fiscal year, it may pay all of its. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if.

Can I Deduct Funeral Expenses On Form 1041 ELCTIO

If the estate has adopted a fiscal year, it may pay all of its. And you are not enclosing a check or money order. If the estate has adopted a calendar year as its tax year, file using the rules listed under. Search site you are here. Web a trust or estate with a tax year that ends june 30.

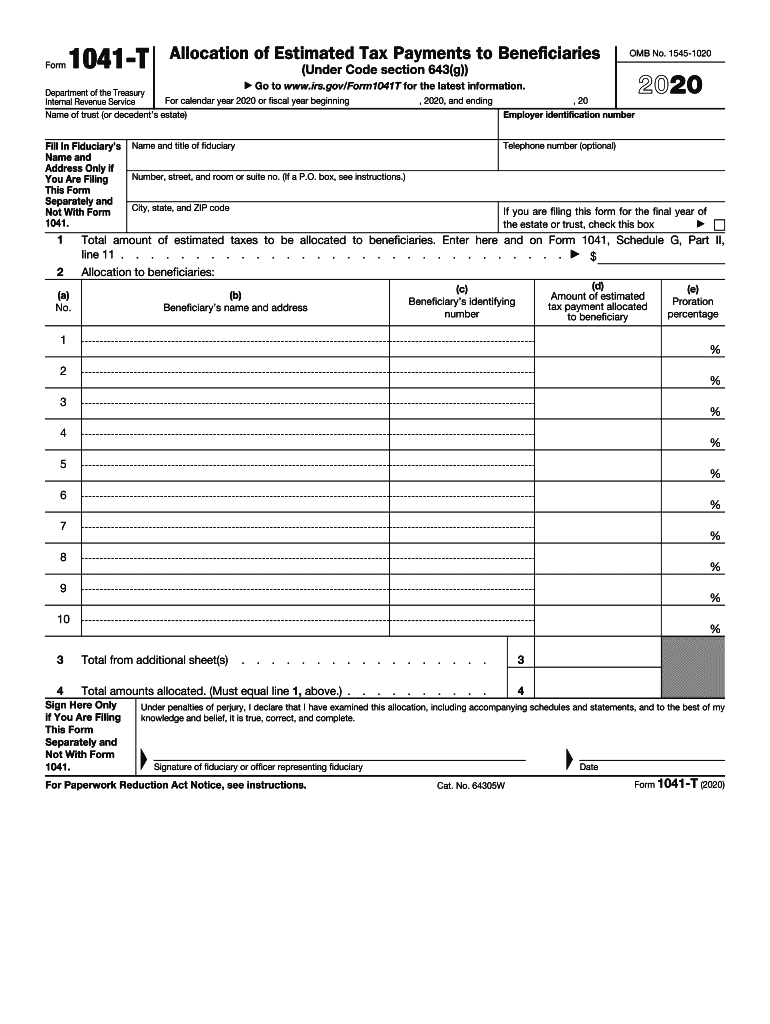

1041 Form 1041 T Allocation of Estimated Tax Payments to Fill Out and

Web for those filing form 1040, schedule h is to be submitted with the return and is thus extended to the due date of the return. You should also complete and print form 8948 to be mailed with the return. Web as this form is due to the irs quarterly, there are four deadlines to follow. Web january 31, 2022:.

Form 1041 Tax Fill Out and Sign Printable PDF Template signNow

Search site you are here. Web what is the due date for irs form 1041? Web october 31, 2023. You should also complete and print form 8948 to be mailed with the return. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the.

U.S. Tax Return for Estates and Trusts, Form 1041

• 1041 on extension due: Web estates and trusts irs form 1041 due on april 18, 2023; Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross income for 2022 and 2023 is from.

2020 Form RI DoT RI1041 Fill Online, Printable, Fillable, Blank

You should also complete and print form 8948 to be mailed with the return. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Web for those filing form 1040, schedule h is to be submitted with the return and is thus extended to the due date of the return. Page last.

When to File Taxes 2020 Tax Deadlines Camino Financial

If you are located in. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland,. Form 1040 (individuals), form 1041 (trusts) and form 1120 (c corporations) april 18, 2022:. Web due date of return. Calendar year estates and trusts must file form 1041 by april 18, 2023.

If The Estate Has Adopted A Fiscal Year, It May Pay All Of Its.

Return to life cycle of a private foundation. If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter. And you are enclosing a check or money order. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the district of columbia.

Page Last Reviewed Or Updated:

Business tax deadlines for federal tax returns. And you are not enclosing a check or money order. Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. • 1041 on extension due:

Web Estates And Trusts Irs Form 1041 Due On April 18, 2023;

Web itr due date 2023 news updates on. You should also complete and print form 8948 to be mailed with the return. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland,. Web as this form is due to the irs quarterly, there are four deadlines to follow.

Web For Those Filing Form 1040, Schedule H Is To Be Submitted With The Return And Is Thus Extended To The Due Date Of The Return.

Calendar year estates and trusts must file form 1041 by april 18, 2023. If you are located in. Keeping track of these dates and filing in a timely manner is the key to maintaining good standing with the irs. Web due date of return.