Instructions For Form 5405

Instructions For Form 5405 - Complete, edit or print tax forms instantly. Complete part i and, if. November 2019) department of the treasury internal revenue service. Part ii repayment of the credit. Try it for free now! You disposed of it in 2021. I sold the home, or it ceased to. Web instructions for form 5405 internal revenue service (rev. Draw your signature, type it,. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid.

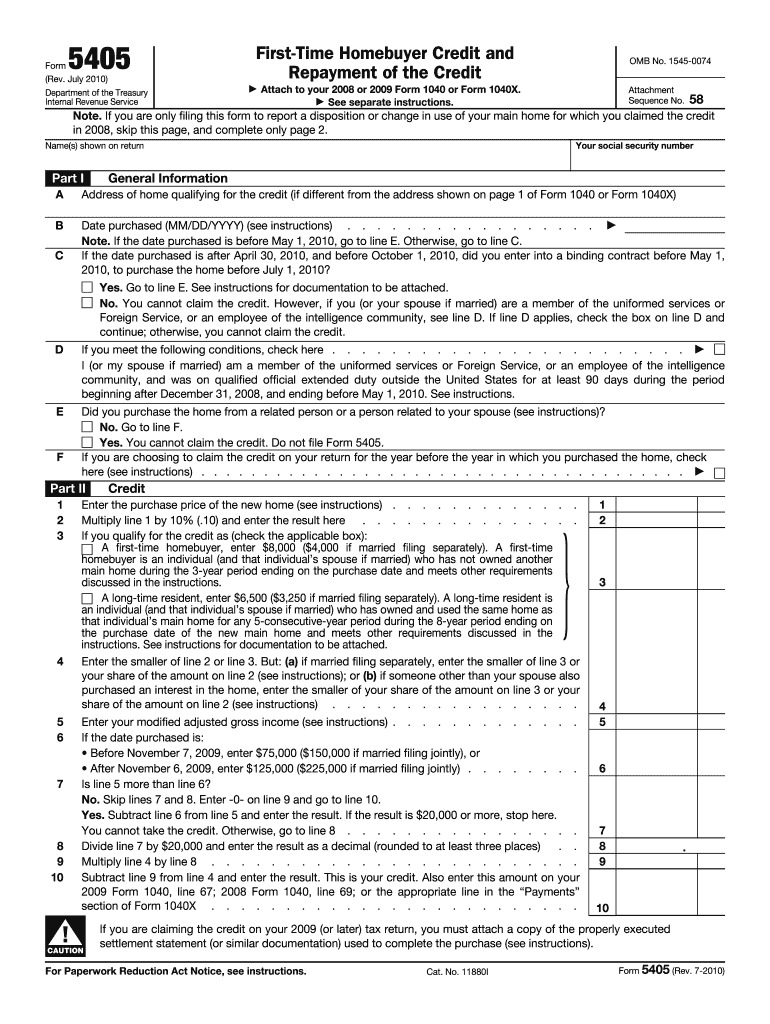

You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Complete, edit or print tax forms instantly. Web each spouse who meets either condition • you converted the entire home to business or rental 1 or 2 above must file a separate form 5405. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. Ad upload, modify or create forms. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Web a joint return for 2013 with the deceased taxpayer, see instructions. Edit your form 5405 online. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web the credit beginning on this page and the instructions for for purchases before january 1, 2011, you must line d on page 3.

Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Draw your signature, type it,. Complete, edit or print tax forms instantly. Web the credit beginning on this page and the instructions for for purchases before january 1, 2011, you must line d on page 3. Web use form 5405 to do the following:notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2015. Web per the irs instructions for form 5405: Type text, add images, blackout confidential details, add comments, highlights and more. You disposed of it in 2021. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions.

5405 Form Instructions

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Enter the amount of the credit you claimed on form. November 2019) department of the treasury internal revenue service. I sold the home, or it ceased to. December 2010)repayment of the credit department of the treasury attach to your 2009 or 2010.

Instructions for Form 5405

I sold the home, or it ceased to. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Try it for free now! Web form 5405 is the form you have to fill out to notify the irs if you sold your main home that.

540 Introduction Fall 2016 YouTube

Try it for free now! Web form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of the credit that. Web instructions for form 5405 internal revenue service (rev. Web a joint return for 2013 with the deceased taxpayer, see.

IRS Form 5405 Repayment Of First Time Homebuyer Credit Stock video

Web each spouse who meets either condition • you converted the entire home to business or rental 1 or 2 above must file a separate form 5405. Edit your form 5405 online. I sold the home, or it ceased to. For calendar year taxpayers, the due date is january 15, 2022. November 2019) department of the treasury internal revenue service.

Draft Instructions For Form 5405 FirstTime Homebuyer Credit And

Draw your signature, type it,. I sold the home, or it ceased to. Web form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of the credit that. Web a joint return for 2013 with the deceased taxpayer, see instructions..

Form 5405 Fill Out and Sign Printable PDF Template signNow

Use an earlier version of form 5405. You disposed of it in 2021. Complete part i and, if. Web form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of the credit that. Part ii repayment of the credit.

FIA Historic Database

Type text, add images, blackout confidential details, add comments, highlights and more. Web a joint return for 2013 with the deceased taxpayer, see instructions. For calendar year taxpayers, the due date is january 15, 2022. Web i (or my spouse if married) am, or was, a member of the uniformed services or foreign service, or an employee of the intelligence.

Fill Free fillable Form 5405 Repayment of the FirstTime Homebuyer

Sign it in a few clicks. Web a joint return for 2013 with the deceased taxpayer, see instructions. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Complete, edit or print tax forms instantly. Complete part i and, if.

FirstTime Homebuyer Credit and Repayment of the Credit

Try it for free now! Web use form 5405 to do the following:notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2015. You disposed of it in 2021. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Use.

Web Instructions For Form 5405 Internal Revenue Service (Rev.

If you file form 540, form 540nr, or form. Web i (or my spouse if married) am, or was, a member of the uniformed services or foreign service, or an employee of the intelligence community. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid.

In An Effort To Stimulate The Economy, The Federal Government.

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. December 2010)repayment of the credit department of the treasury attach to your 2009 or 2010. Type text, add images, blackout confidential details, add comments, highlights and more. Web use form 5405 to do the following:notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2015.

Ad Upload, Modify Or Create Forms.

For calendar year taxpayers, the due date is january 15, 2022. You disposed of it in 2021. Complete, edit or print tax forms instantly. Part ii repayment of the credit.

Web A Joint Return For 2013 With The Deceased Taxpayer, See Instructions.

Web form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of the credit that. November 2019) department of the treasury internal revenue service. Try it for free now! Enter the amount of the credit you claimed on form.

/GettyImages-185121670-be12b2817ff9419497195a93e62632cc.jpg)