Form 8805 Extension

Form 8805 Extension - Web file forms 8804 and 8805 separately from form 1065. Partnership keeps records and books of account outside united states and puerto rico. Applicable percentage foreign partner even if no section 1446 time to file. Web up to $40 cash back get, create, make and sign f05080. Web how to file extension of form 8805 (foreign partner's information statement of section 1446 withholding tax)? Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Web if an entry is made on line 9, foreign partner's allocable percentage for 8804 items, the percentage entered there determines the withholding tax allocated and tax credit. Ad access irs tax forms. Web the application produces a form 8805 for each partner that has a foreign country code. Download or email irs 8805 & more fillable forms, register and subscribe now!

Forms 8804, 8805, and 8813 are filed separately from form 1065; Web how to file extension of form 8805 (foreign partner's information statement of section 1446 withholding tax)? If you need more time, you can file form 7004 to request an extension of time to file form 8804. Web the application produces a form 8805 for each partner that has a foreign country code. Applicable percentage foreign partner even if no section 1446 time to file. Edit your f 05080 form form online. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax. Therefore, the irs does not support these forms for electronic filing. Web general instructions purpose of forms use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti). Web if an entry is made on line 9, foreign partner's allocable percentage for 8804 items, the percentage entered there determines the withholding tax allocated and tax credit.

Web up to $40 cash back get, create, make and sign f05080. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit allocable to. Partnership keeps records and books of account outside united states and puerto rico. Web how to file extension of form 8805 (foreign partner's information statement of section 1446 withholding tax)? Complete, edit or print tax forms instantly. Web to activate form 8805, complete the following: Ad access irs tax forms. Web file a separate form 8805 for each form 2758, application for extension of defined on page 2. Edit your f 05080 form form online.

Understanding Key Tax Forms What investors need to know about Schedule

Web the application produces a form 8805 for each partner that has a foreign country code. Web generating forms 8804 and 8805 for a partnership return in lacerte solved • by intuit • 28 • updated 1 month ago this article will help you generate and file forms. Ad access irs tax forms. Ad download or email irs 8805 &.

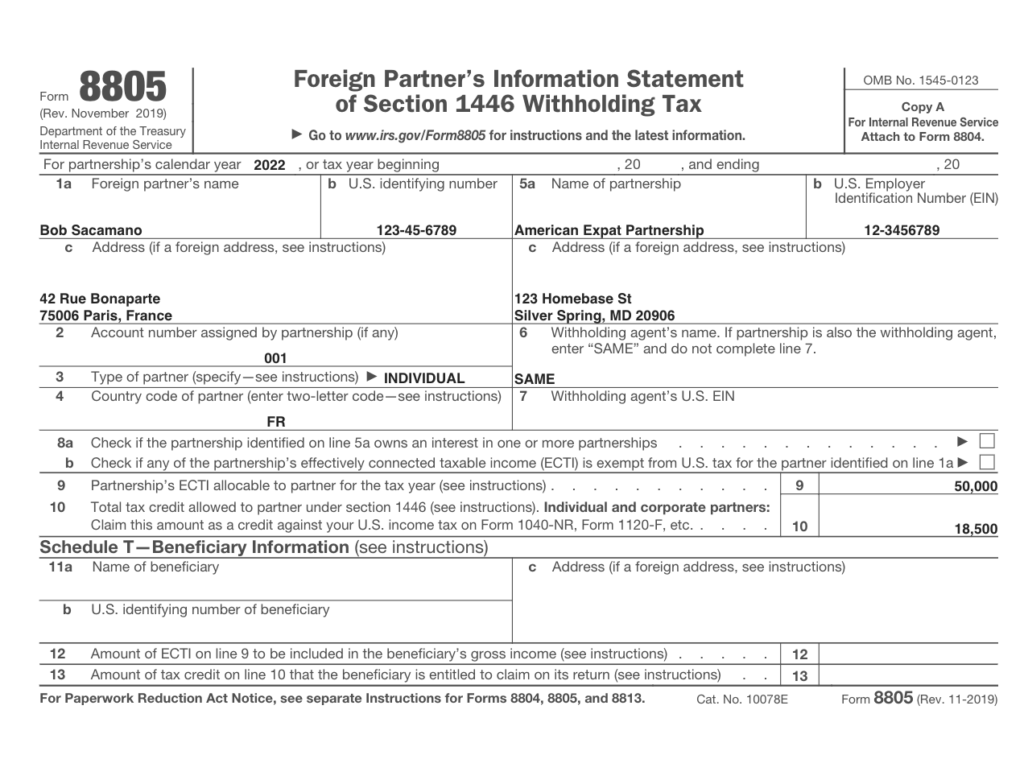

Form 8805 Foreign Partner's Information Statement of Section 1446 Wi…

Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web general instructions purpose of forms use forms 8804, 8805, and 8813 to pay and report.

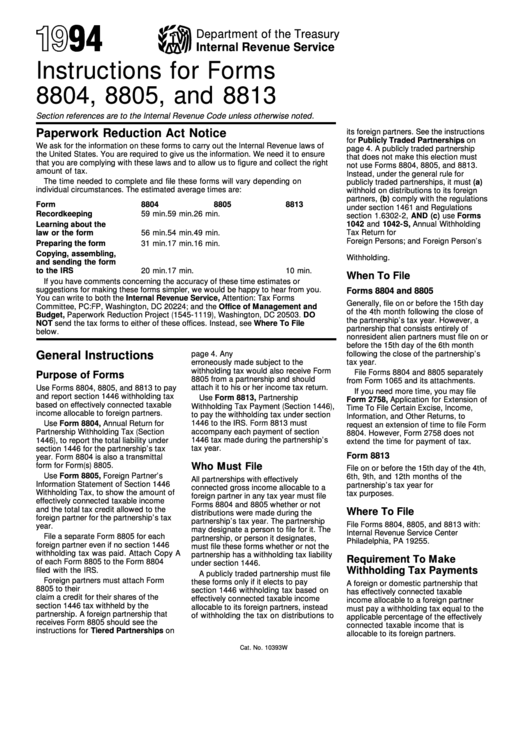

Instructions For Forms 8804, 8805, And 8813 1994 printable pdf download

Web how to file extension of form 8805 (foreign partner's information statement of section 1446 withholding tax)? Web if an entry is made on line 9, foreign partner's allocable percentage for 8804 items, the percentage entered there determines the withholding tax allocated and tax credit. Therefore, the irs does not support these forms for electronic filing. Web to activate form.

Irs form 8865 instructions

Web generating forms 8804 and 8805 for a partnership return in lacerte solved • by intuit • 28 • updated 1 month ago this article will help you generate and file forms. Web general instructions purpose of forms use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti). Web.

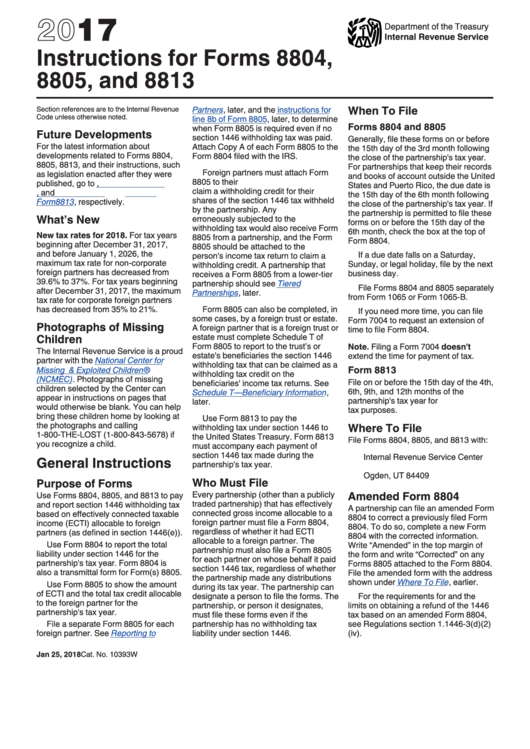

Instructions For Forms 8804, 8805, And 8813 2017 printable pdf download

Web file forms 8804 and 8805 separately from form 1065. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Applicable percentage foreign partner even if no section 1446 time to file. Web up to $40 cash back get, create, make and sign f05080. Web form 8805, a foreign partner’s information statement of section 1446 withholding.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Web file a separate form 8805 for each form 2758, application for extension of defined on page 2. Partnership keeps records and books of account outside united states and puerto rico..

Partnership Withholding All About US Tax Forms 8804 & 8805

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Forms 8804, 8805, and 8813 are filed separately from form 1065; Partnership keeps records and books of account outside united states and puerto rico. Applicable percentage foreign partner even if no section 1446 time to file. Ad access irs tax forms.

Form 8805 Foreign Partner's Information Statement of Section 1446

Web how to file extension of form 8805 (foreign partner's information statement of section 1446 withholding tax)? Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Therefore, the irs does not support these forms for electronic filing. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report.

2016 Form 8805 Edit, Fill, Sign Online Handypdf

Therefore, the irs does not support these forms for electronic filing. Forms 8804, 8805, and 8813 are filed separately from form 1065; Web if an entry is made on line 9, foreign partner's allocable percentage for 8804 items, the percentage entered there determines the withholding tax allocated and tax credit. Web how to file extension of form 8805 (foreign partner's.

Adaptec RAID 8805 ASR8805 2277500R PCIE 3.0 x8 12Gb/s 8 Internal

Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Web up to $40 cash back get, create, make and sign f05080. Forms 8804, 8805, and 8813 are filed separately from form 1065; Web general instructions purpose of forms use forms.

Web We Last Updated The Foreign Partner's Information Statement Of Section 1446 Withholding Tax In February 2023, So This Is The Latest Version Of Form 8805, Fully Updated For Tax.

Forms 8804, 8805, and 8813 are filed separately from form 1065; Web if an entry is made on line 9, foreign partner's allocable percentage for 8804 items, the percentage entered there determines the withholding tax allocated and tax credit. Web generating forms 8804 and 8805 for a partnership return in lacerte solved • by intuit • 28 • updated 1 month ago this article will help you generate and file forms. If you need more time, you can file form 7004 to request an extension of time to file form 8804.

Web The Application Produces A Form 8805 For Each Partner That Has A Foreign Country Code.

Therefore, the irs does not support these forms for electronic filing. Partnership keeps records and books of account outside united states and puerto rico. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Web up to $40 cash back get, create, make and sign f05080.

Web How To File Extension Of Form 8805 (Foreign Partner's Information Statement Of Section 1446 Withholding Tax)?

Web to activate form 8805, complete the following: Ad download or email irs 8805 & more fillable forms, register and subscribe now! Web general instructions purpose of forms use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti). Ad access irs tax forms.

Web File Forms 8804 And 8805 Separately From Form 1065.

Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit allocable to. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Web file a separate form 8805 for each form 2758, application for extension of defined on page 2. Applicable percentage foreign partner even if no section 1446 time to file.