How Much Does It Cost To File Form 990

How Much Does It Cost To File Form 990 - Web simple form 990 pricing. A qualified state or local political organization must file. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. You don't pay until you are ready to submit your return to the irs. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. There is no paper form. This fee chart is meant as a guide only and is based on our prior client experience. Us income tax return for estate and trusts. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. It's free to get started.

Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. Intended for private foundations, regardless of gross receipts. Us income tax return for estate and trusts. This fee chart is meant as a guide only and is based on our prior client experience. A qualified state or local political organization must file. There is no paper form. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. It's free to get started. You don't pay until you are ready to submit your return to the irs. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page.

Intended for private foundations, regardless of gross receipts. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. You don't pay until you are ready to submit your return to the irs. It's free to get started. A qualified state or local political organization must file. Any fees will be based upon time spent. Us income tax return for estate and trusts. This fee chart is meant as a guide only and is based on our prior client experience.

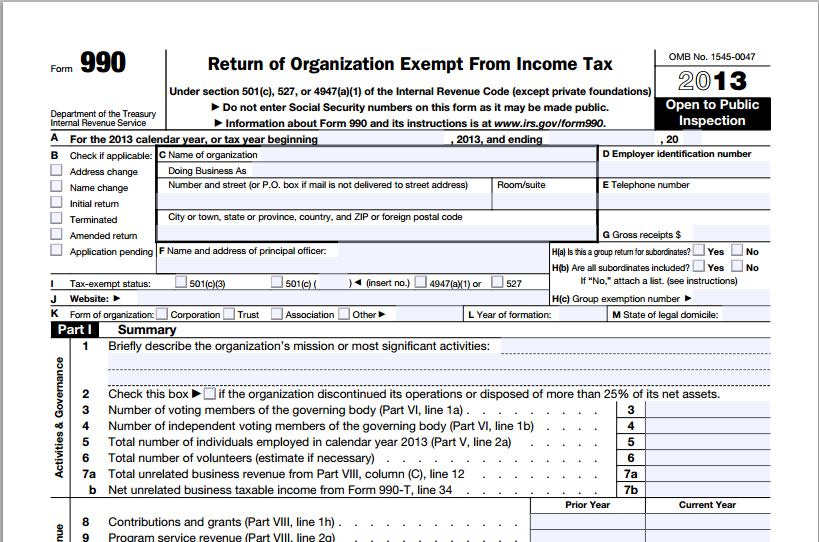

What is IRS Form 990?

A qualified state or local political organization must file. Intended for private foundations, regardless of gross receipts. Web simple form 990 pricing. It's free to get started. You don't pay until you are ready to submit your return to the irs.

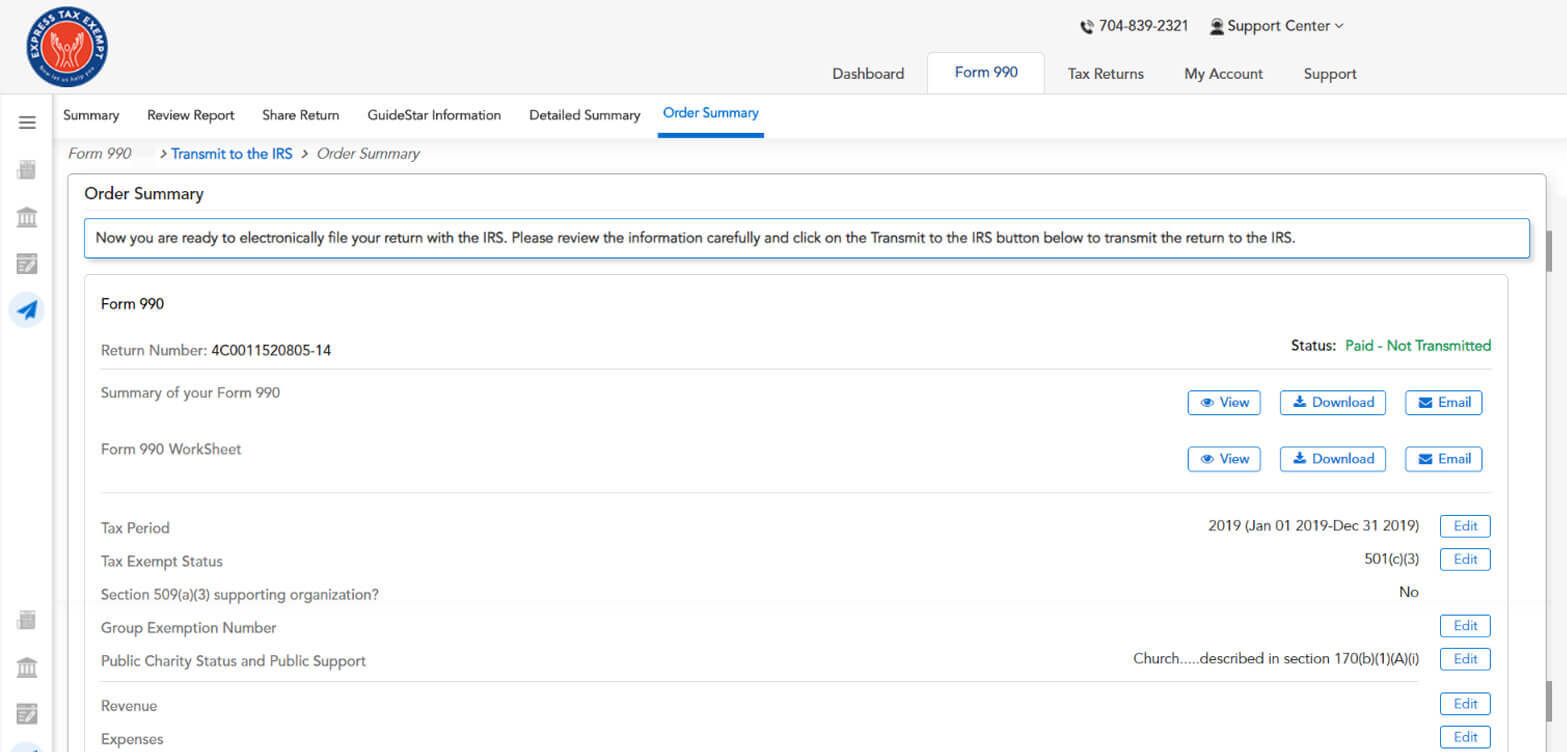

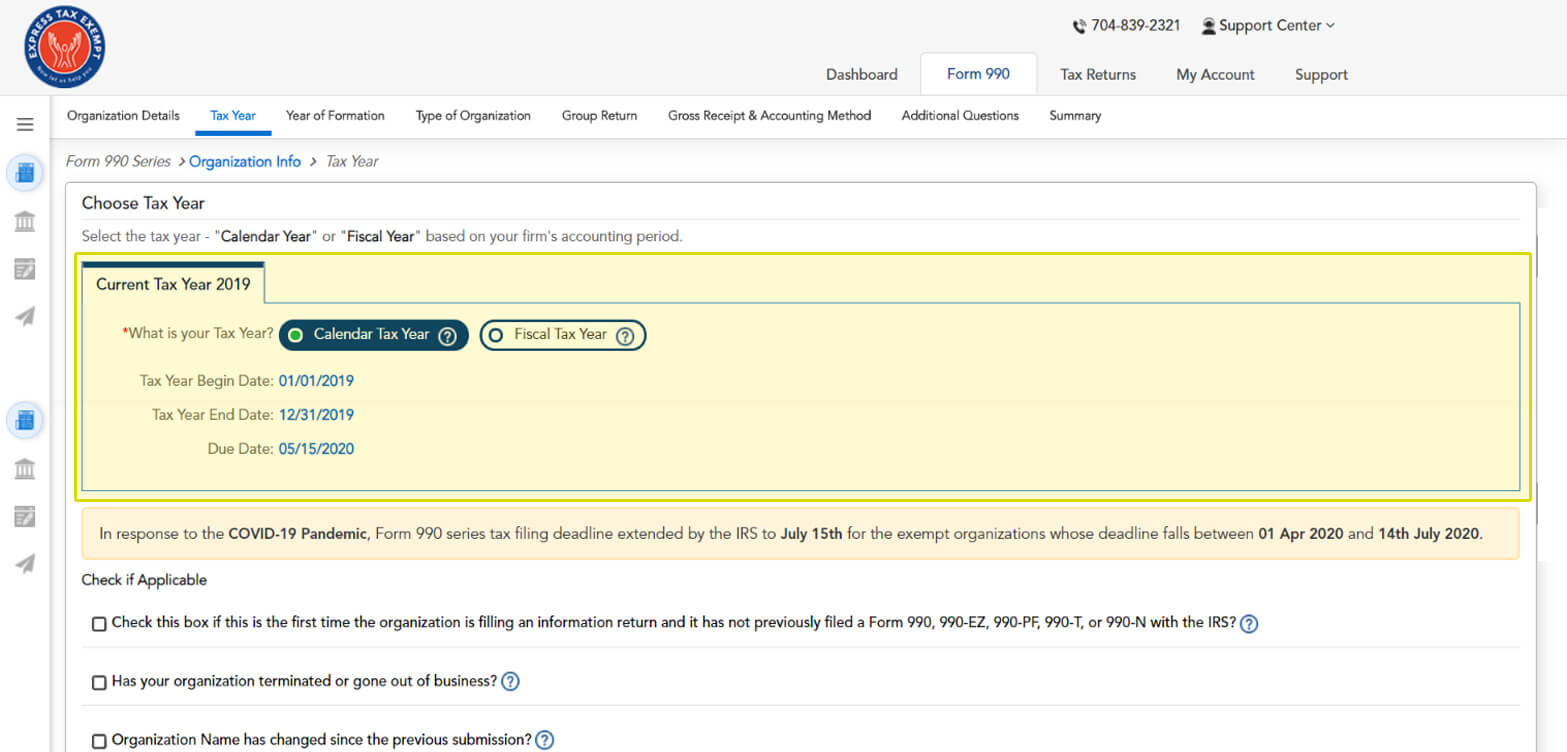

File Form 990 Online Efile 990 990 Filing Deadline 2021

Web simple form 990 pricing. It's free to get started. A qualified state or local political organization must file. You don't pay until you are ready to submit your return to the irs. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine.

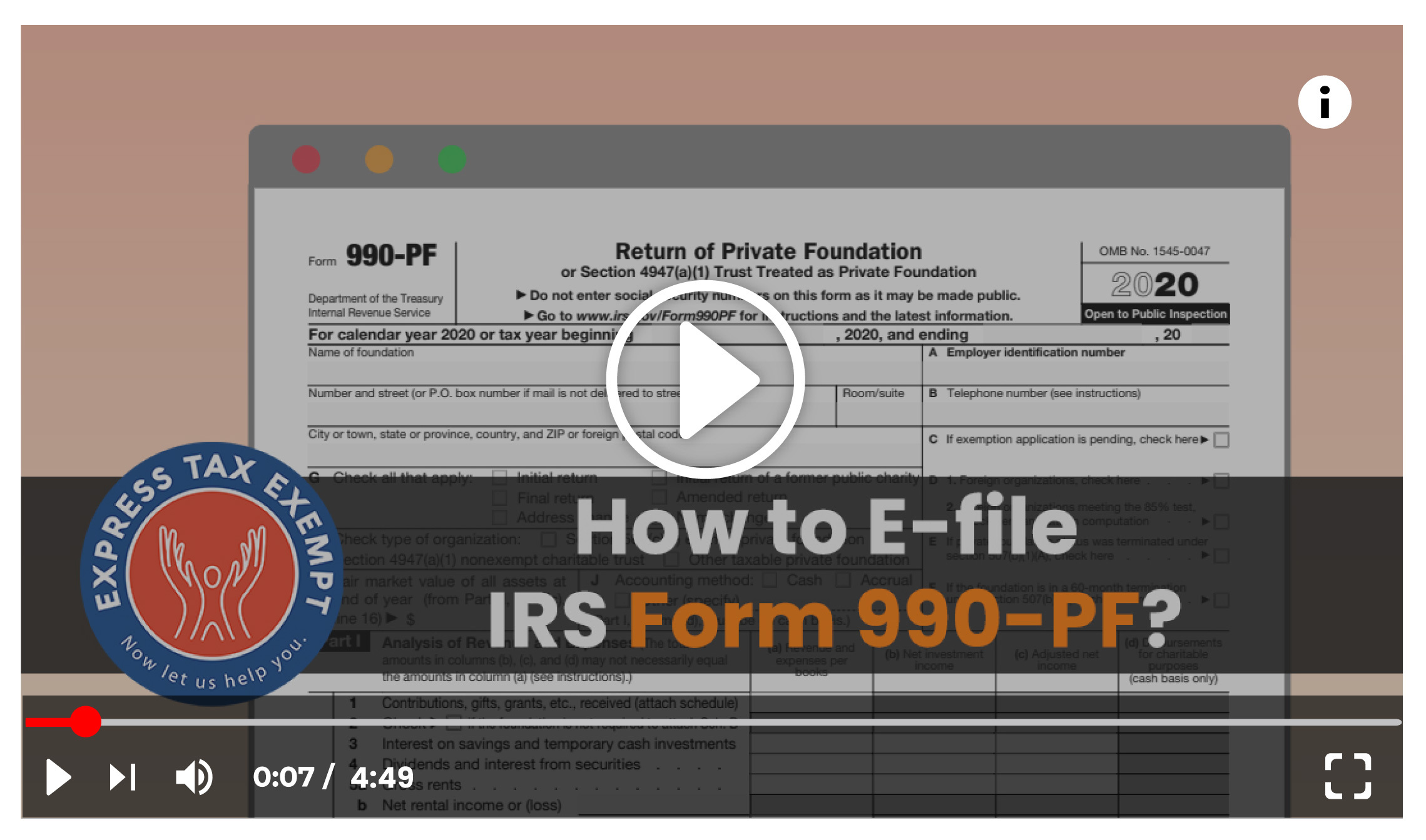

Efile Form 990PF 2021 IRS Form 990PF Online Filing

It's free to get started. There is no paper form. You don't pay until you are ready to submit your return to the irs. Any fees will be based upon time spent. This fee chart is meant as a guide only and is based on our prior client experience.

Does Your IRA Have to File a Form 990T? New Direction Trust Company

You don't pay until you are ready to submit your return to the irs. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. It's free to get started. There is no paper form. A qualified state or local political organization must file.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

Intended for organizations with both gross receipts below $200,000 and assets below $500,000. Web simple form 990 pricing. This fee chart is meant as a guide only and is based on our prior client experience. You don't pay until you are ready to submit your return to the irs. A qualified state or local political organization must file.

File Form 990 Online Efile 990 990 Filing Deadline 2021

A qualified state or local political organization must file. Any fees will be based upon time spent. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Web simple form 990 pricing. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting.

What is the IRS Form 990N and What Does It Mean for Me? Secure

Intended for organizations with both gross receipts below $200,000 and assets below $500,000. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. There is no paper form. A qualified state or local political organization must file. Any fees will be based upon time spent.

What Is A 990 N E Postcard hassuttelia

Intended for organizations with both gross receipts below $200,000 and assets below $500,000. There is no paper form. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. Any fees will be based upon time spent. Web please note, our audit and review services normally include the preparation of the irs form.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Any fees will be based upon time spent. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. You don't pay until you are ready to submit your return to the irs. A qualified state or local.

The Best Form 990 Software for Tax Professionals What You Need to Know

Web simple form 990 pricing. There is no paper form. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above.

Web Simple Form 990 Pricing.

Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. It's free to get started. Us income tax return for estate and trusts. Any fees will be based upon time spent.

Intended For Organizations With Gross Receipts Equal To Or Above $200,000 And/Or Assets Equal To Or Above $500,000.

A qualified state or local political organization must file. There is no paper form. You don't pay until you are ready to submit your return to the irs. Intended for organizations with both gross receipts below $200,000 and assets below $500,000.

This Fee Chart Is Meant As A Guide Only And Is Based On Our Prior Client Experience.

Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. Intended for private foundations, regardless of gross receipts. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page.