Form 2290 Due Date 2020

Form 2290 Due Date 2020 - Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. The short form for this date. It is important to file form 2290 before the due date to avoid penalties. Easy, fast, secure & free to try. Go to www.irs.gov/form2290 for instructions and the latest information. Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. Web irs form 2290 due date is august 31st. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. It must be filed every year.

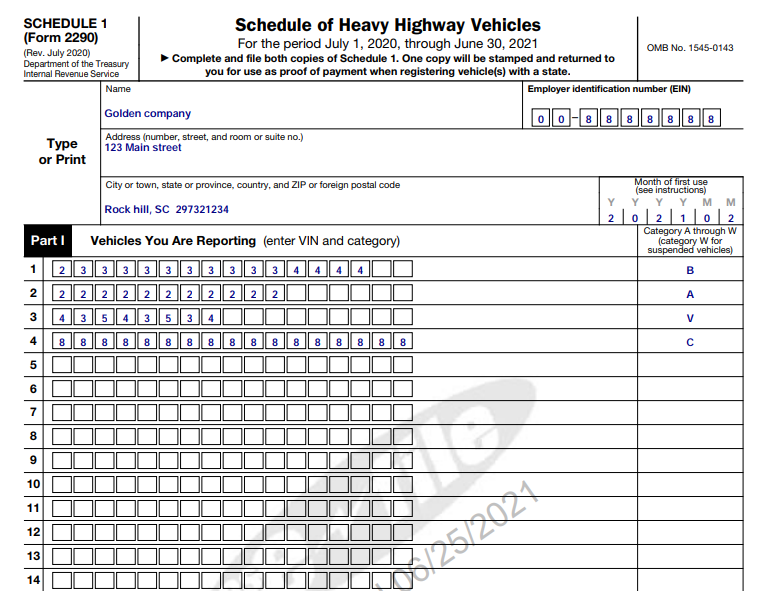

Month new vehicle is first used. The current heavy vehicle use tax begins on july 1, 2020, and ends on june 30, 2021 Web your starting date is august 22, 2020 so that means that 90 days later would be. Go to www.irs.gov/form2290 for instructions and the latest information. For newly purchased vehicles, form 2290. Try it for free now! It is important to file form 2290 before the due date to avoid penalties. Don't miss out on important info! Form 2290 specifies your due date for form 1140 and. Web get a quick guide on form 2290 & it's due date to fulfill your tax obligations and meet the deadline.

Don't miss out on important info! Do your truck tax online & have it efiled to the irs! That time of the year and time to renew federal vehicle use tax form 2290. Web the current period begins july 1, 2023, and ends june 30, 2024. Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. 2020 is a leap year, so there are 366 days in this year. Web your starting date is august 22, 2020 so that means that 90 days later would be. Month new vehicle is first used. Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year.

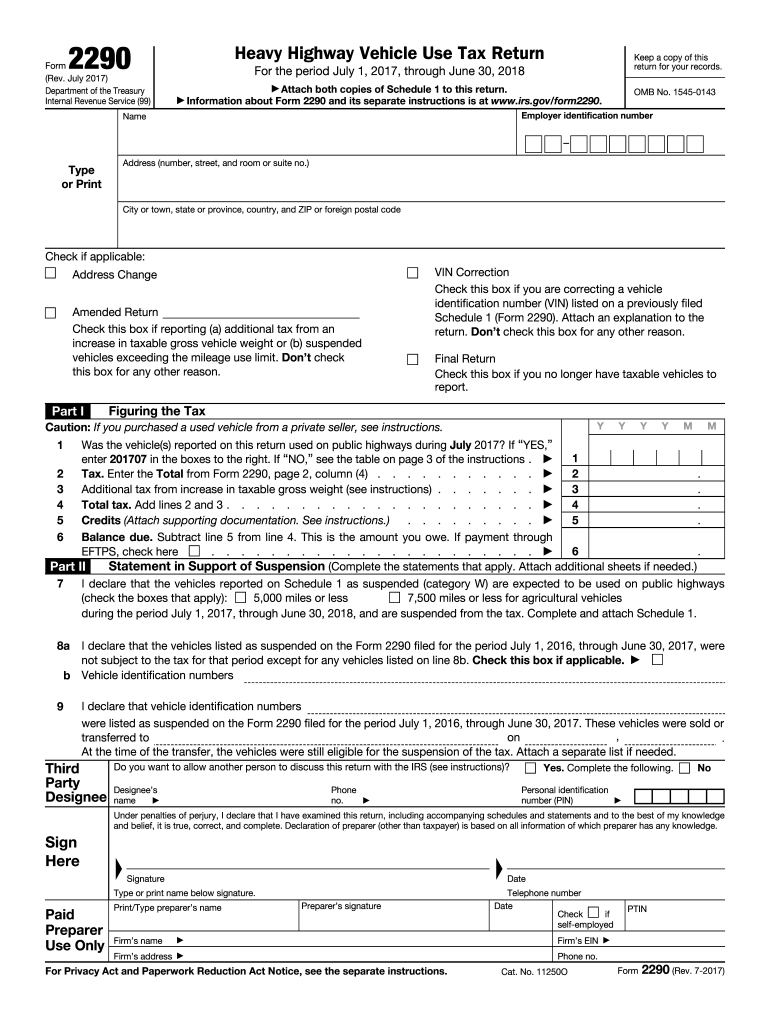

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Do your truck tax online & have it efiled to the irs! Web 2290 due date form: For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. It is important to file form 2290 before the due date to avoid penalties. Web 2290 taxes are due.

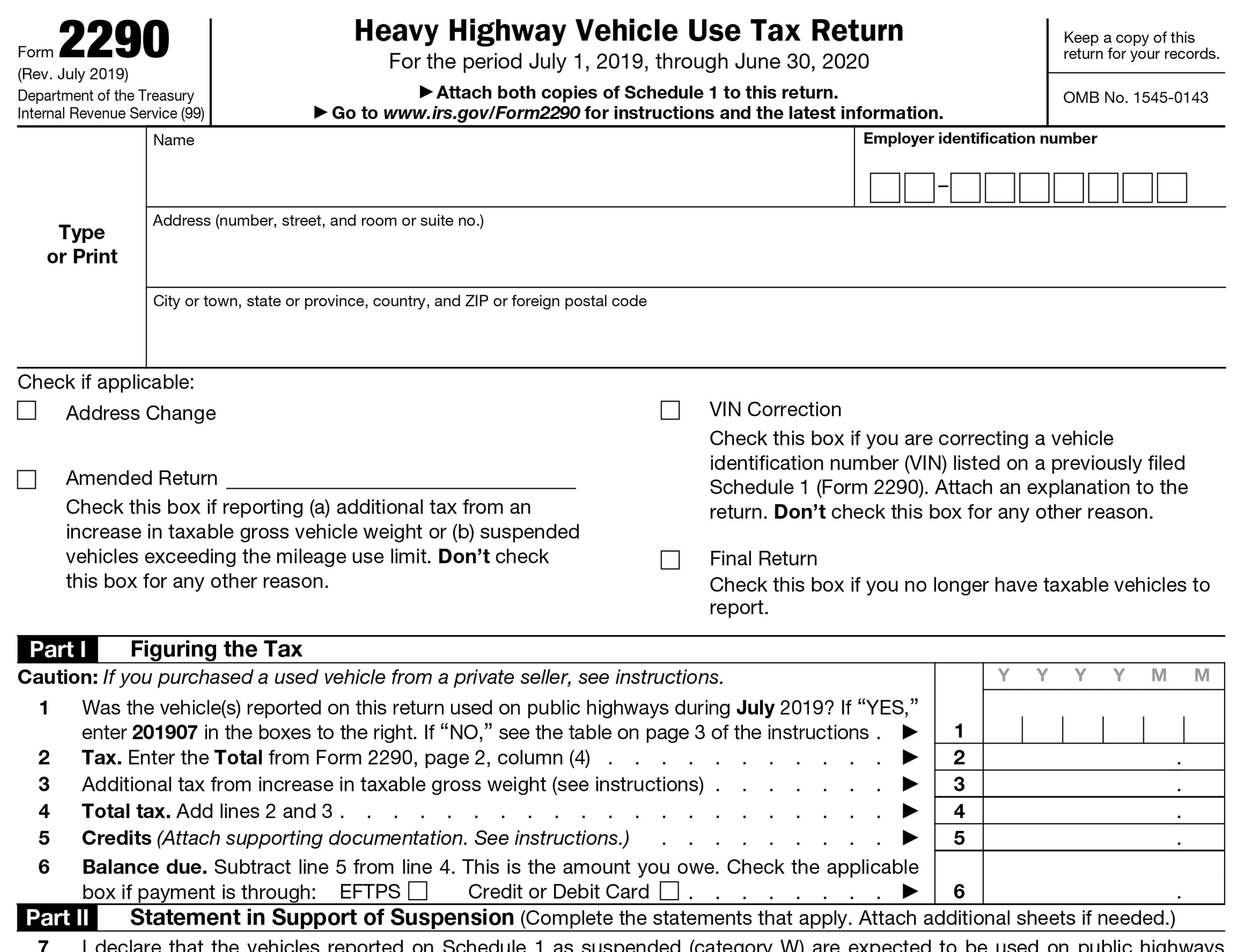

4 Things You Need to Know When Filing Your 202021 HVUT Form 2290

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Do your truck tax online & have it efiled to the irs! Web august 26, 2020 the form 2290 for hvut is.

IRS Form 2290 Due Date For 20212022 Tax Period

The current heavy vehicle use tax begins on july 1, 2020, and ends on june 30, 2021 For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. It must be filed every year. Form 2290 must be filed by the last day of the month following.

form 2290 efile for 2020 2290 Tax Due

Try it for free now! For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. Web irs form 2290 due date is august 31st. Web the tax period usually starts by july 1 and concludes by june 30 each year. The short form for this date.

Irs Form 2290 Printable Form Resume Examples

Do your truck tax online & have it efiled to the irs! A typical tax year for form 2290 begins on july 1. If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022. The current heavy vehicle use tax begins on july 1, 2020, and ends on june.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web 2290 due date form: The short form for this date. Web truckers and trucking businesses must be filed the irs form 2290 for heavy vehicle use taxes (hvut) every year by august 31st for the current tax period for heavy. Ad get ready for tax season deadlines by completing any required tax forms today. Month form 2290 must be.

Form 2290 for 20202021 To efile vehicle use tax

Web your starting date is august 22, 2020 so that means that 90 days later would be. Web 2290 due date form: Web get a quick guide on form 2290 & it's due date to fulfill your tax obligations and meet the deadline. Current tax period for heavy vehicles use tax begins on july 1st, 2019 and ends on. Web.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web irs form 2290 due date is august 31st. Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. Form 2290 specifies your due date for form 1140 and. Ad get schedule 1 in minutes, your form 2290 is efiled directly to.

Understanding Form 2290 StepbyStep Instructions for 20222023

Web irs form 2290 due date is august 31st. All taxpayers who file form 2290. 2020 is a leap year, so there are 366 days in this year. Web 2290 due date form: Web does form 2290 always reflect your due date for form 1140, irs tax withholding and estimated tax or form 1040?

IRS FORM 2290 ONLINE DUE DATE FOR 20202021

Do your truck tax online & have it efiled to the irs! Web get a quick guide on form 2290 & it's due date to fulfill your tax obligations and meet the deadline. Upload, modify or create forms. For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of.

The Short Form For This Date.

Web does form 2290 always reflect your due date for form 1140, irs tax withholding and estimated tax or form 1040? Web get a quick guide on form 2290 & it's due date to fulfill your tax obligations and meet the deadline. Web the current tax period is from july 1, 2022,to june 30, 2023. For newly purchased vehicles, form 2290.

All Taxpayers Who File Form 2290.

2020 is a leap year, so there are 366 days in this year. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web 2290 due date form: The current heavy vehicle use tax begins on july 1, 2020, and ends on june 30, 2021

Month Form 2290 Must Be Filed.

For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. Month new vehicle is first used. Form 2290 specifies your due date for form 1140 and. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Web The Tax Period Usually Starts By July 1 And Concludes By June 30 Each Year.

That time of the year and time to renew federal vehicle use tax form 2290. Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. Web irs form 2290 due date is august 31st. Web truckers and trucking businesses must be filed the irs form 2290 for heavy vehicle use taxes (hvut) every year by august 31st for the current tax period for heavy.