Where Do I Send Form 7004 Extension

Where Do I Send Form 7004 Extension - Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Choose form 7004 and select the form. The due dates of the returns can be found in the instructions for the applicable. You can fill it out online, or you can print it out and complete it by hand. How to fill out form 7004. Select extension of time to. There you will find a list of. You will find these codes listed on form 7004. Web follow these steps to complete your business tax extension form 7004 using expressextension: Form 7004 is the form used to file for an automatic extension of time to file your business tax return for a partnership, a multiple member llc filing as a partnership, a.

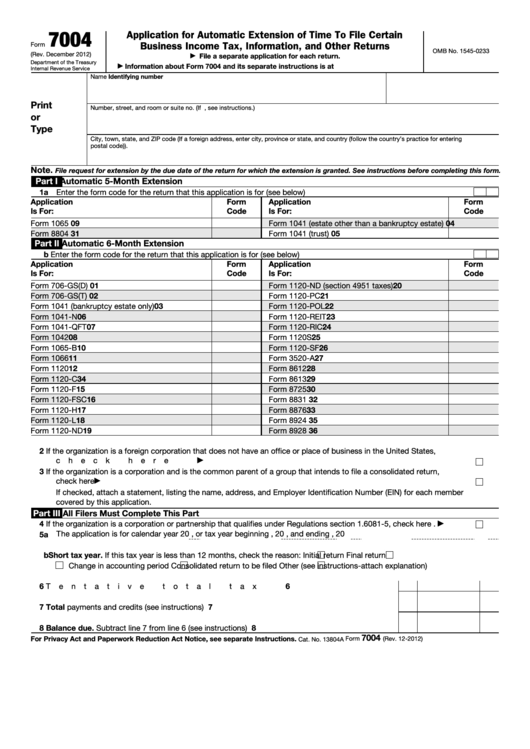

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. For example, taxpayers submitting one form 7004 with. Web in this guide, we cover it all, including: Part ii line 2 check the. There are two ways to submit form 7004: Web an interactive version of form 7004 is available on the irs website. You can fill it out online, or you can print it out and complete it by hand. Part ii includes questions for all filers. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Web follow these steps to complete your business tax extension form 7004 using expressextension:

Web submit the form. Web follow these steps to determine which address the form 7004 should be sent to: Web purpose of form. There you will find a list of. Part ii line 2 check the. How to fill out form 7004. You will find these codes listed on form 7004. Choose form 7004 and select the form. Select extension of time to. The due dates of the returns can be found in the instructions for the applicable.

IRS Form 7004 Automatic Extension for Business Tax Returns

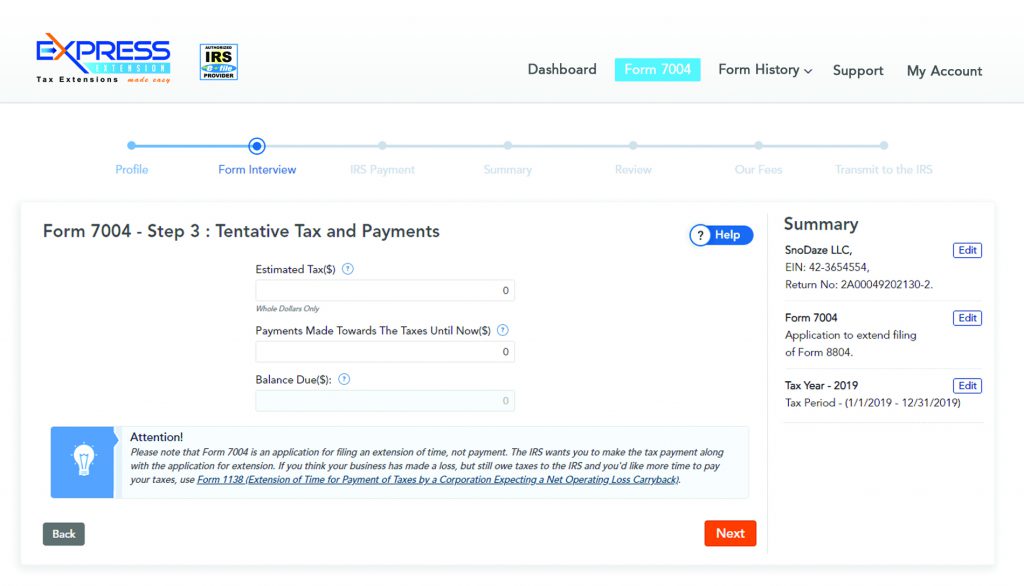

With your return open, select search and enter extend; For example, taxpayers submitting one form 7004 with. Part ii line 2 check the. Web follow these steps to complete your business tax extension form 7004 using expressextension: Web a taxpayer who needs to file forms 7004 for multiple form types may submit the forms 7004 electronically.

Fillable Form 7004 Application For Automatic Extension Of Time To

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. You can fill it out online, or you can print it out and complete it by hand. File request for extension by the due date of. Web an interactive version of form 7004 is available on the irs website. There.

What You Need To Know To Successfully File A 7004 Extension Blog

Select extension of time to. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. By completing form 7004, the following business entities will receive an extension on: You will find these codes listed on form 7004. You can fill it out online, or you can print it out.

Last Minute Tips To Help You File Your Form 7004 Blog

Web in this guide, we cover it all, including: Web follow these steps to complete your business tax extension form 7004 using expressextension: How to fill out form 7004. Web follow these steps to print a 7004 in turbotax business: Web purpose of form.

How to file an LLC extension Form 7004 YouTube

You will find these codes listed on form 7004. Web follow these steps to determine which address the form 7004 should be sent to: Web submit the form. Web an interactive version of form 7004 is available on the irs website. Web filers requesting an extension will enter (in the box located at the top of part i) the form.

The Deadline to File a Form 7004 Extension is Here! Blog

Web the first step to finding out where to send your form 7004 to the irs is accessing the agency’s “ where to file form 7004 ″ website. Find the applicable main form under the if the. Go to the irs where to file form 7004 webpage. With your return open, select search and enter extend; Web follow these steps.

How To File Your Extension Form 7004? Blog ExpressExtension

Web purpose of form. File request for extension by the due date of. With your return open, select search and enter extend; You will find these codes listed on form 7004. There you will find a list of.

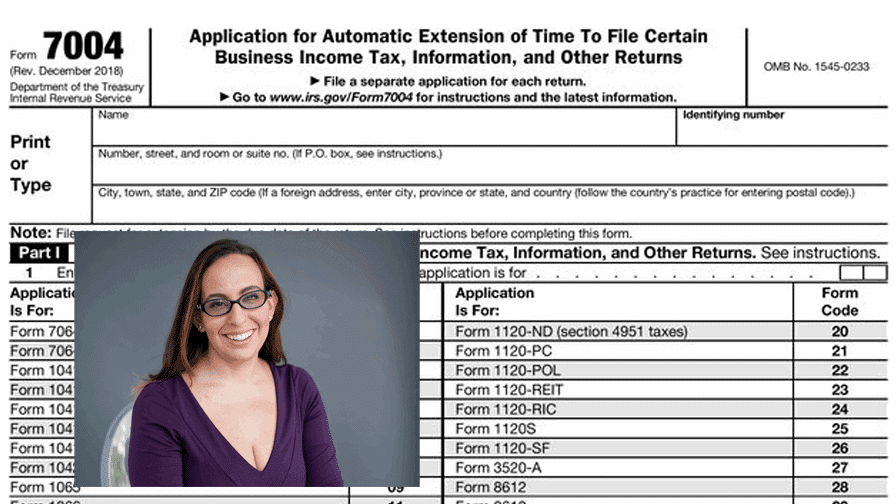

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Web make the payment who uses form 7004? For example, taxpayers submitting one form 7004 with. Web purpose of form. With your return open, select search and enter extend; Web in this guide, we cover it all, including:

2011 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

By completing form 7004, the following business entities will receive an extension on: Go to the irs where to file form 7004 webpage. Web follow these steps to complete your business tax extension form 7004 using expressextension: Select extension of time to. Choose form 7004 and select the form.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Web an interactive version of form 7004 is available on the irs website. Choose form 7004 and select the form. For example, taxpayers submitting one form 7004 with. Web a taxpayer who needs to file forms 7004 for multiple.

Web Follow These Steps To Complete Your Business Tax Extension Form 7004 Using Expressextension:

Form 7004 is the form used to file for an automatic extension of time to file your business tax return for a partnership, a multiple member llc filing as a partnership, a. Find the applicable main form under the if the. Part ii line 2 check the. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note:

Web An Interactive Version Of Form 7004 Is Available On The Irs Website.

Web a taxpayer who needs to file forms 7004 for multiple form types may submit the forms 7004 electronically. Form 1065, which is filed by partnerships form. Web filers requesting an extension will enter (in the box located at the top of part i) the form code for the return for which the extension is requested. Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns:

For Example, Taxpayers Submitting One Form 7004 With.

With your return open, select search and enter extend; There you will find a list of. Web in this guide, we cover it all, including: Web follow these steps to print a 7004 in turbotax business:

The Due Dates Of The Returns Can Be Found In The Instructions For The Applicable.

Choose form 7004 and select the form. Web follow these steps to determine which address the form 7004 should be sent to: Part ii includes questions for all filers. Web the first step to finding out where to send your form 7004 to the irs is accessing the agency’s “ where to file form 7004 ″ website.