Business Use Of Home Form

Business Use Of Home Form - Web this publication explains how to figure and claim the deduction for business use of your home. The maximum value of the home office deduction using the simplified method is $1,500 per year. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Next, you can only deduct expenses for the portions of your home that are exclusively used for business. Web a portion of your home may qualify as your principal place of business if you use it for the administrative or management activities of your trade or business and have no other fixed location where you conduct substantial administrative or management activities for that trade or business. Web first, the area you use for work in your home must be your principal place of business. Expenses for business use of your home. Actual expenses determined and records maintained: It includes special rules for daycare providers. For instructions and the latest information.

About publication 587, business use of your home (including use by daycare providers) |. You must meet specific requirements to deduct expenses for the business use of your home. Use a separate form 8829 for each home you used for the business during the year. You can't work for four hours in your kitchen and deduct your new refrigerator, for instance. Enter a 2 in the field 1=use actual expenses (default), 2=elect to use simplified method. Web this publication explains how to figure and claim the deduction for business use of your home. For instructions and the latest information. Use a separate form 8829 for each home you used for business during the year. This is based on a rate of $5 per square foot for up to 300 square feet. Department of the treasury internal revenue service.

The simplified method allows a standard deduction of $5 per square foot of home used for business, with a maximum of 300 square feet. About publication 587, business use of your home (including use by daycare providers) |. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web go to screen 29, business use of home (8829). This is based on a rate of $5 per square foot for up to 300 square feet. You must meet specific requirements to deduct expenses for the business use of your home. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web like most credits, there are requirements that a home office must meet in order to be eligible to claim the home office deduction. Department of the treasury internal revenue service.

Vehicles for Business Use

Web a portion of your home may qualify as your principal place of business if you use it for the administrative or management activities of your trade or business and have no other fixed location where you conduct substantial administrative or management activities for that trade or business. Web information about form 8829, expenses for business use of your home,.

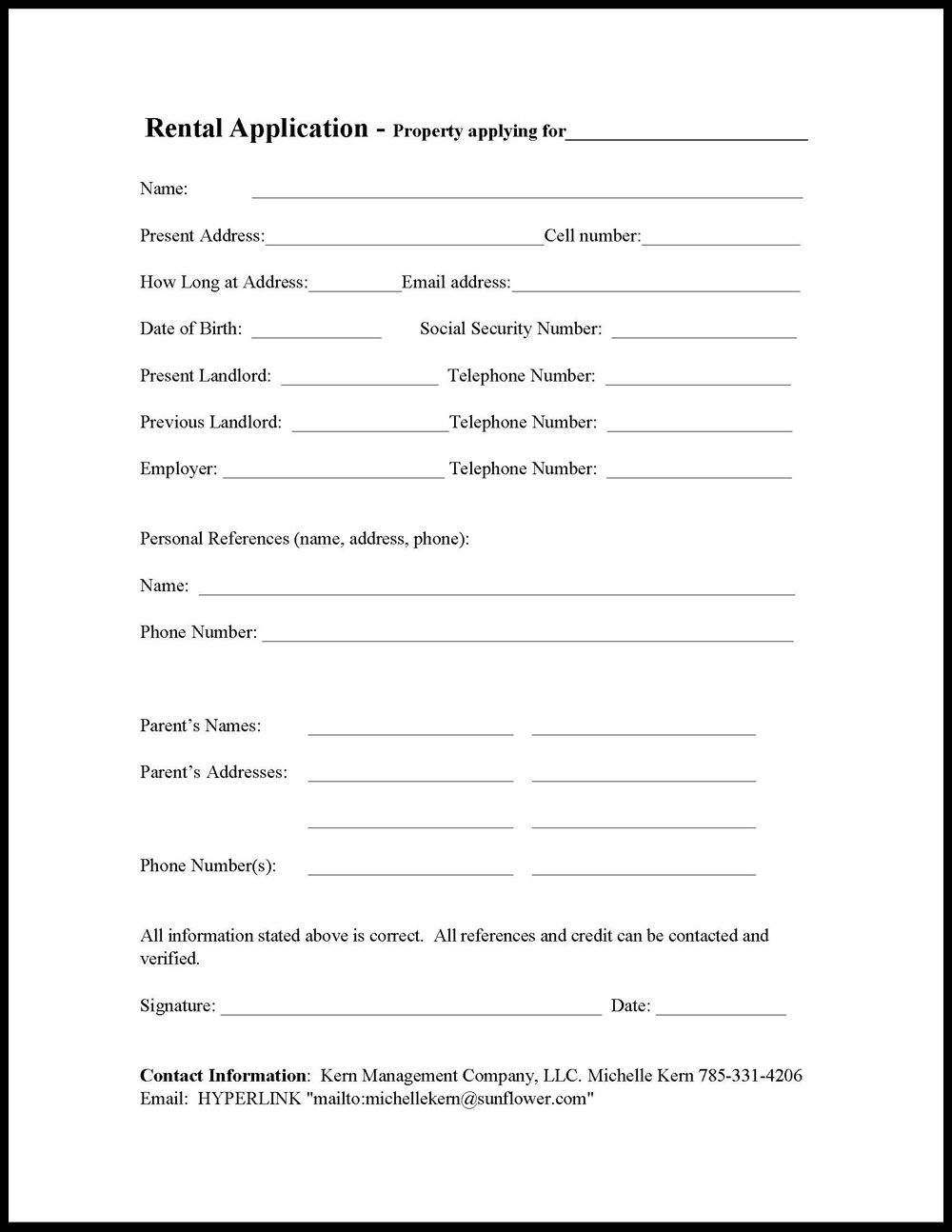

Free Printable House Rental Application Form Free Printable

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web first, the area you use for work in your home must be your principal place of business. The maximum value of the home office deduction using the simplified.

Business Plans For Dummies Templates For Word

File only with schedule c (form 1040). Web this publication explains how to figure and claim the deduction for business use of your home. You can't work for four hours in your kitchen and deduct your new refrigerator, for instance. You must meet specific requirements to deduct expenses for the business use of your home. Next, you can only deduct.

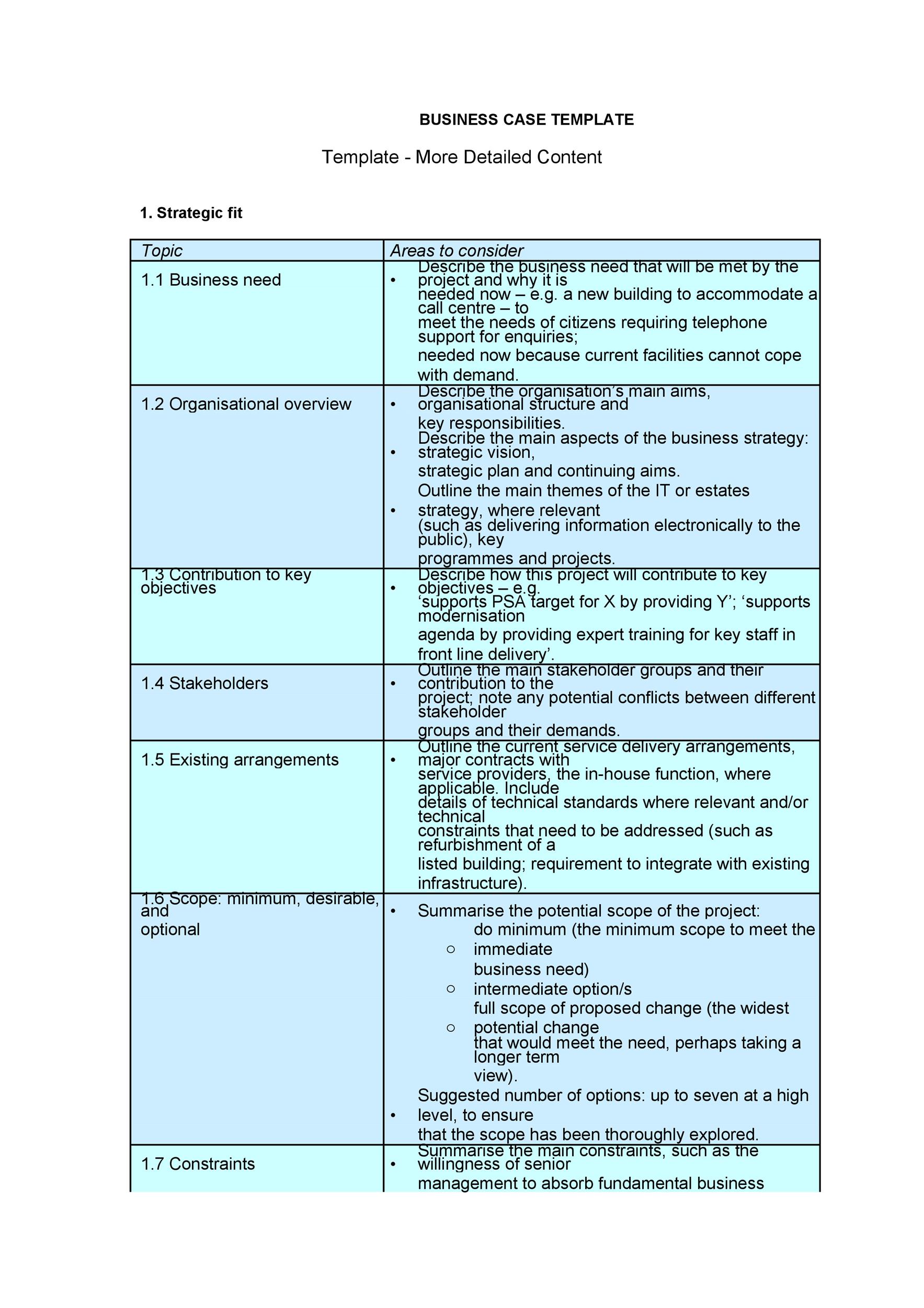

Detailed business use case diagram Download Scientific Diagram

Web this publication explains how to figure and claim the deduction for business use of your home. The maximum value of the home office deduction using the simplified method is $1,500 per year. This is based on a rate of $5 per square foot for up to 300 square feet. The simplified method allows a standard deduction of $5 per.

Form 8829Expenses for Business Use of Your Home

Next, you can only deduct expenses for the portions of your home that are exclusively used for business. File only with schedule c (form 1040). Web like most credits, there are requirements that a home office must meet in order to be eligible to claim the home office deduction. Use a separate form 8829 for each home you used for.

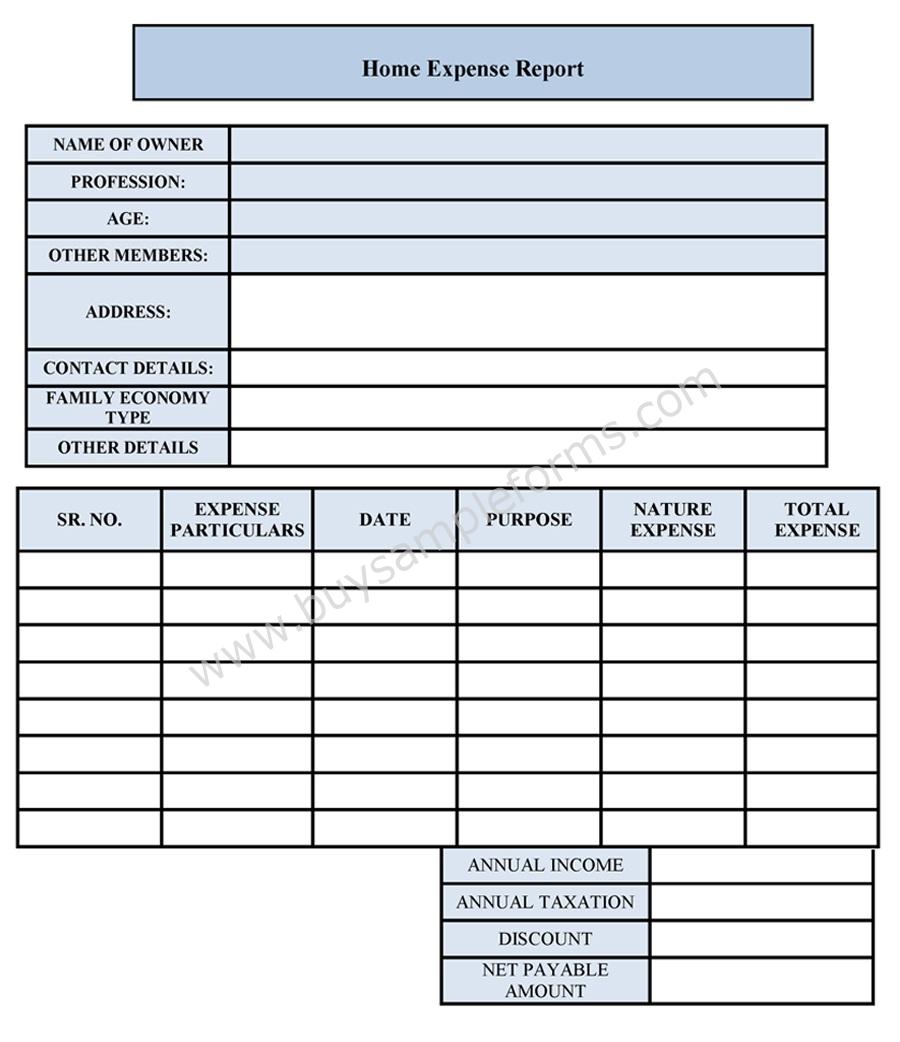

Home Expense Form Sample Forms

You must meet specific requirements to deduct expenses for the business use of your home. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction, use the simplified method worksheet and the daycare facility worksheet in your.

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

About publication 587, business use of your home (including use by daycare providers) |. The maximum value of the home office deduction using the simplified method is $1,500 per year. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the simplified method to.

14 best Restaurant Order Form Template images on Pinterest Order form

You must meet specific requirements to deduct expenses for the business use of your home. It includes special rules for daycare providers. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Use a separate form 8829 for each home you used for business during the year..

Nursing Home Application Form Fill Out and Sign Printable PDF

You must meet specific requirements to deduct expenses for the business use of your home. Standard $5 per square foot used to determine home business deduction: Use a separate form 8829 for each home you used for the business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form.

Chris Elsen's Web Development Blog New Feature Release Add or Update

Next, you can only deduct expenses for the portions of your home that are exclusively used for business. The simplified method allows a standard deduction of $5 per square foot of home used for business, with a maximum of 300 square feet. File only with schedule c (form 1040). Web allowable square footage of home use for business (not to.

Web A Portion Of Your Home May Qualify As Your Principal Place Of Business If You Use It For The Administrative Or Management Activities Of Your Trade Or Business And Have No Other Fixed Location Where You Conduct Substantial Administrative Or Management Activities For That Trade Or Business.

Web this publication explains how to figure and claim the deduction for business use of your home. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. The maximum value of the home office deduction using the simplified method is $1,500 per year. About publication 587, business use of your home (including use by daycare providers) |.

Use A Separate Form 8829 For Each Home You Used For Business During The Year.

Web allowable square footage of home use for business (not to exceed 300 square feet) percentage of home used for business: You can't work for four hours in your kitchen and deduct your new refrigerator, for instance. Use a separate form 8829 for each home you used for the business during the year. For instructions and the latest information.

Web Like Most Credits, There Are Requirements That A Home Office Must Meet In Order To Be Eligible To Claim The Home Office Deduction.

Next, you can only deduct expenses for the portions of your home that are exclusively used for business. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction, use the simplified method worksheet and the daycare facility worksheet in your instructions for schedule c for that business use. Web first, the area you use for work in your home must be your principal place of business.

You Must Meet Specific Requirements To Deduct Expenses For The Business Use Of Your Home.

The simplified method allows a standard deduction of $5 per square foot of home used for business, with a maximum of 300 square feet. Expenses for business use of your home. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. It includes special rules for daycare providers.