2022 Form 1116

2022 Form 1116 - See schedule b (form 1116) and its instructions, and. This information should have been reported in prior years,. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. Form 1116 and its schedules are used by individuals, estates, and trusts to claim a credit for certain taxes paid or accrued during the taxable year to a foreign. Web october 25, 2022 resource center forms form 1116: Taxpayers are therefore reporting running balances of. It’s easy to handle when the total foreign taxes paid from. Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year.

See schedule b (form 1116) and its instructions, and. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Taxpayers are therefore reporting running balances of. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Parts ii and iii, to complete form 1116. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit.

Web form 1116 instructions for foreign tax credits: This information should have been reported in prior years,. Get ready for tax season deadlines by completing any required tax forms today. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web to avoid double taxation on americans living abroad, the irs gives them a choice: When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. It’s easy to handle when the total foreign taxes paid from. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 i noticed that there is a do not file notice on my 2021 form 1116. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022.

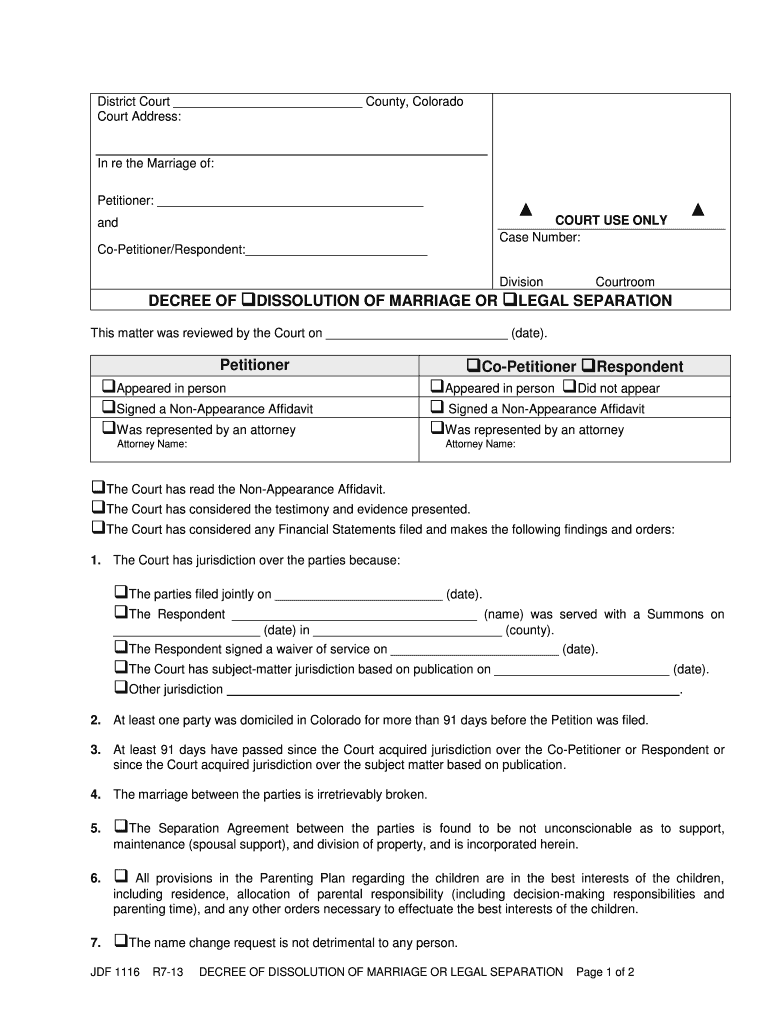

Jdf 1116 Fill Out and Sign Printable PDF Template signNow

This information should have been reported in prior years,. Does turbo tax have a timeline for fixing this issue? Web july 24, 2022: Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Form 1116 and its schedules are used by.

Puget Sound Solar LLC

This information should have been reported in prior years,. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. If all of your foreign tax is less than. Web to avoid double taxation on americans living abroad, the irs gives them.

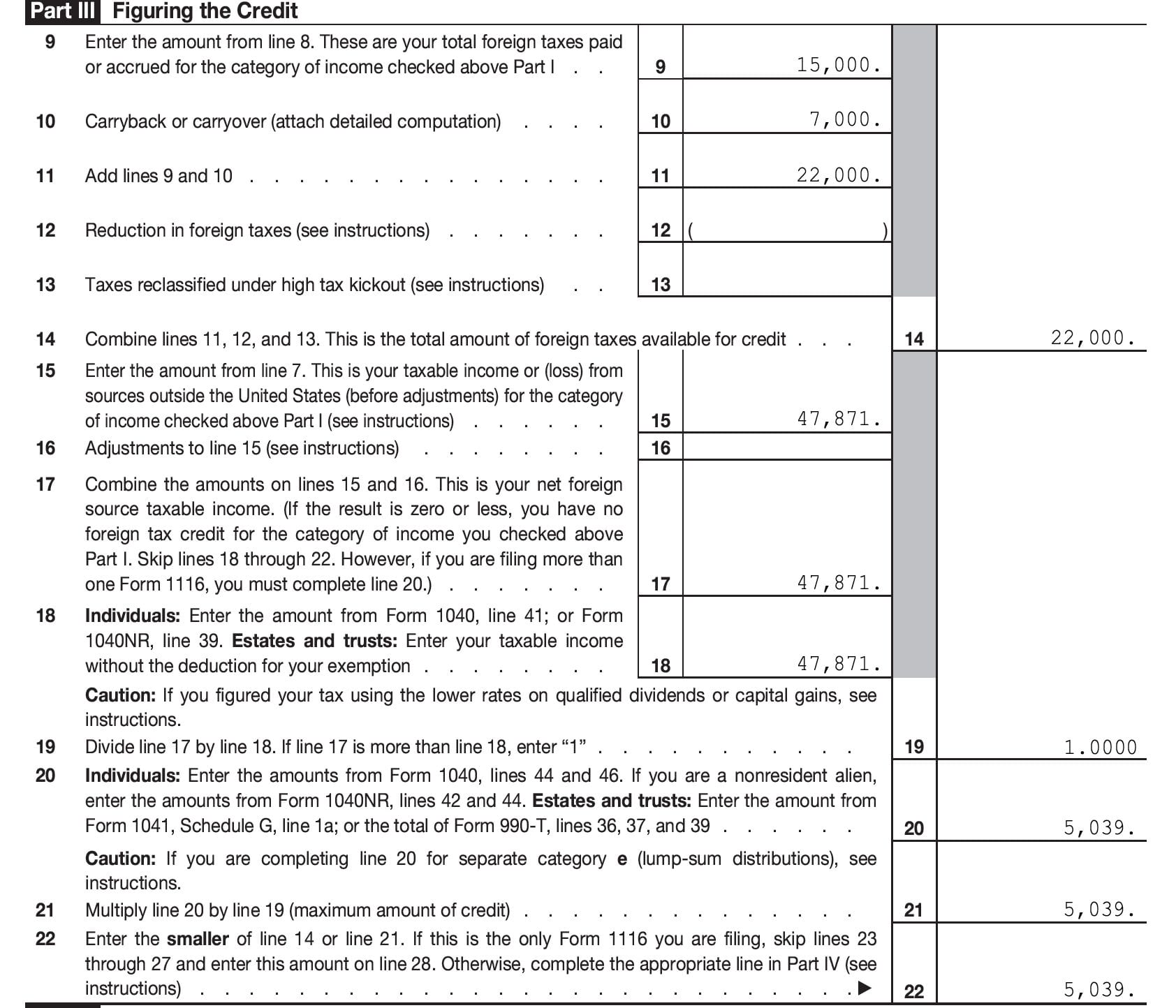

Foreign Tax Credit Form 1116 Explained Greenback —

This information should have been reported in prior years,. Web july 24, 2022: Get ready for tax season deadlines by completing any required tax forms today. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Web 2022 turbotax requiring form 1116 for foreign tax credit.

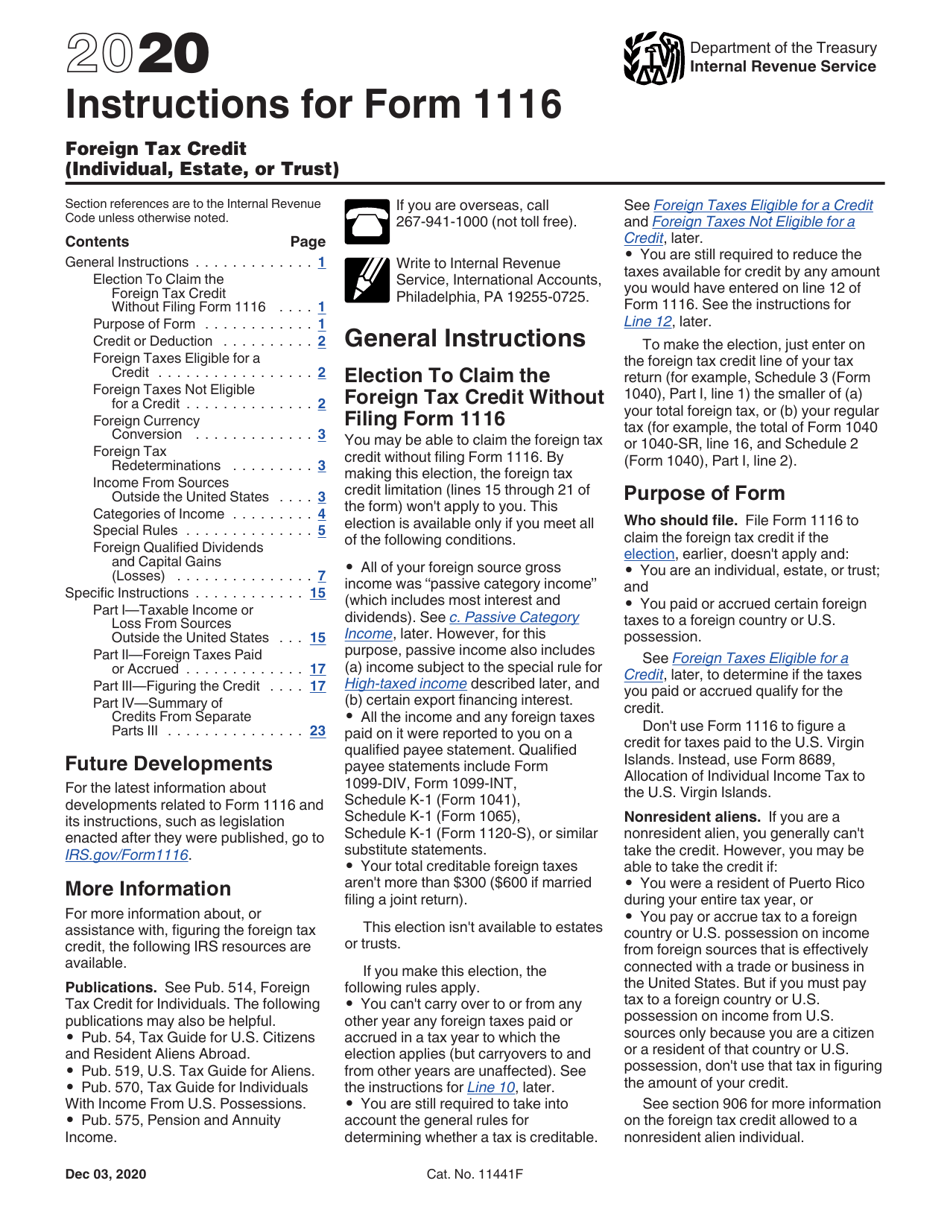

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

If all of your foreign tax is less than. Parts ii and iii, to complete form 1116. This information should have been reported in prior years,. Does turbo tax have a timeline for fixing this issue? Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a.

Eic Worksheet 2023 Fill online, Printable, Fillable Blank

Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. If all of your foreign tax is less than. Web form 1116 instructions for foreign tax credits: Web october 25, 2022 resource center forms form 1116: Taxpayers are therefore reporting running balances of.

IRS REGULATED 1096 FORMS PACKAGE OF 25 FORMS Amazon.ca Office Products

Web form 1116 instructions for foreign tax credits: Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web october 25, 2022 resource center forms form 1116: This information should have been reported in prior years,. Web there is a new schedule b (form 1116) which is used.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. When a us person individual earns foreign income abroad and pays foreign tax.

form 1116 Fill out & sign online DocHub

Does turbo tax have a timeline for fixing this issue? Complete, edit or print tax forms instantly. Web what is form 1116 and who needs to file it? Web october 25, 2022 resource center forms form 1116: Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Parts ii and iii, to complete form 1116. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. Web july 24, 2022: Complete, edit or print tax forms instantly. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Web schedule b (form 1116) is used to reconcile your.

Web There Is A New Schedule B (Form 1116) Which Is Used To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Taxpayers are therefore reporting running balances of. This information should have been reported in prior years,. Web form 1116 i noticed that there is a do not file notice on my 2021 form 1116. You must complete form 1116 in order to claim the foreign tax credit on your us tax return.

Web October 25, 2022 Resource Center Forms Form 1116:

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year. Web to avoid double taxation on americans living abroad, the irs gives them a choice: It’s easy to handle when the total foreign taxes paid from.

Claiming The Foreign Tax Credit At A Glance Find Out What Irs Form 1116 Is Used For And How To File It To Get.

Does turbo tax have a timeline for fixing this issue? Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Web form 1116 instructions for foreign tax credits:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Parts ii and iii, to complete form 1116. Complete, edit or print tax forms instantly. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit.