Form 8915-F 2023

Form 8915-F 2023 - Web updated january 13, 2023. Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: I went to the review section where i normally see the date listed for the form to be. In prior tax years, form 8915. If you received that information from refunds | internal revenue service then it means your refund has been approved and. Not sure why it's not showing up for yall. If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. (january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal. “include the remainder in the line 13 and/or line 24 totals, as applicable, of.

Guess we're having a repeat of last year? Not sure why it's not showing up for yall. If you received that information from refunds | internal revenue service then it means your refund has been approved and. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: This is such a pain in the tuchus. Department of the treasury internal. In prior tax years, form 8915. If you are using the. Web updated january 13, 2023.

I went to the review section where i normally see the date listed for the form to be. This is such a pain in the tuchus. If you received that information from refunds | internal revenue service then it means your refund has been approved and. Not sure why it's not showing up for yall. 2023) form instructions the irs has issued. The timing of your distributions and repayments will determine. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. (january 2022) qualified disaster retirement plan distributions and repayments. If you are using the. Department of the treasury internal.

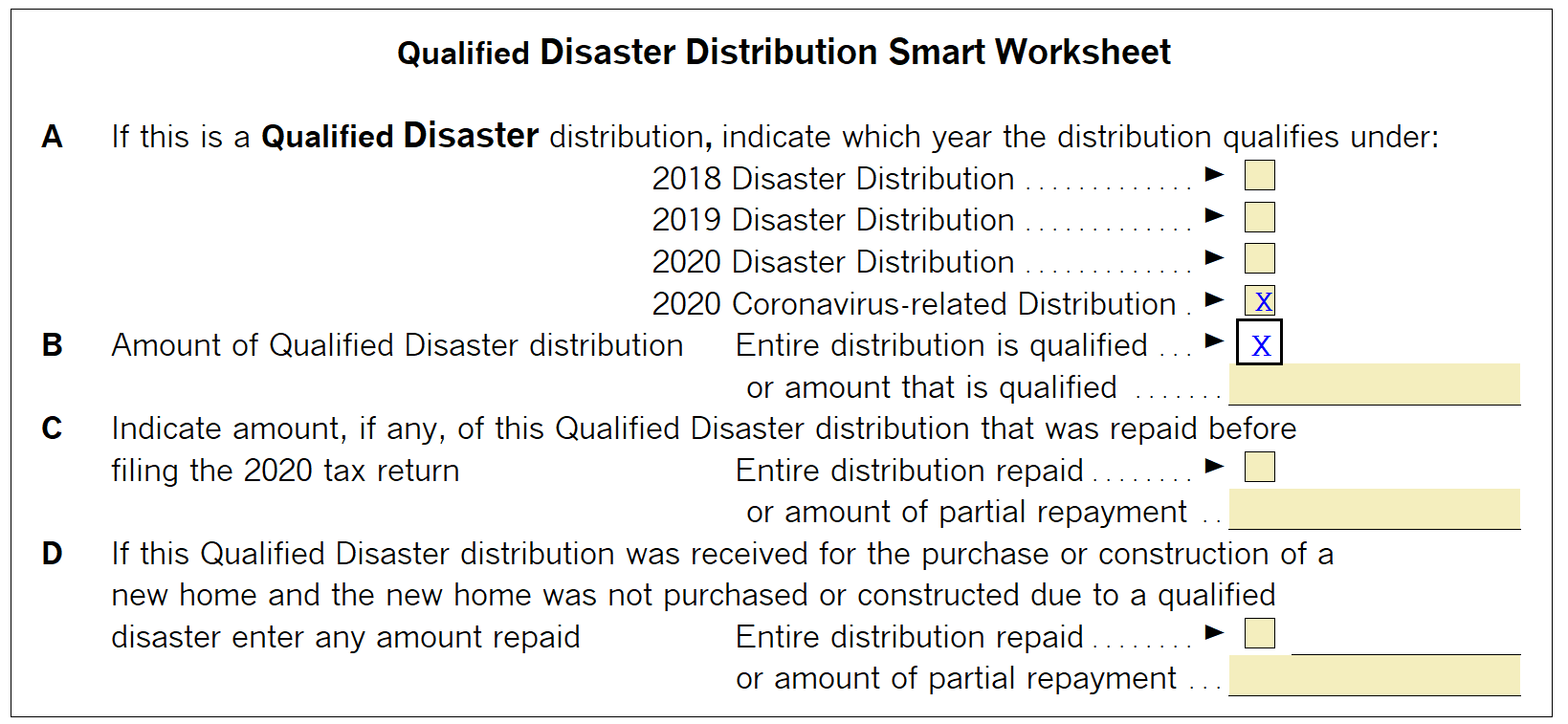

Generating Form 8915E in ProSeries Intuit Accountants Community

Department of the treasury internal. (january 2022) qualified disaster retirement plan distributions and repayments. The timing of your distributions and repayments will determine. Guess we're having a repeat of last year? “include the remainder in the line 13 and/or line 24 totals, as applicable, of.

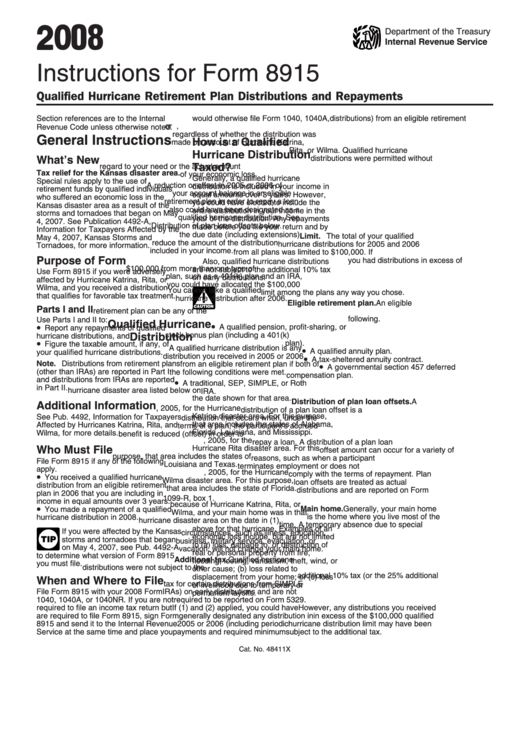

Instructions For Form 8915 2008 printable pdf download

If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. Department of the treasury internal. This is such a pain in the tuchus. I went to the review section where i normally see the date listed for the form to be. The timing of your distributions and repayments will determine.

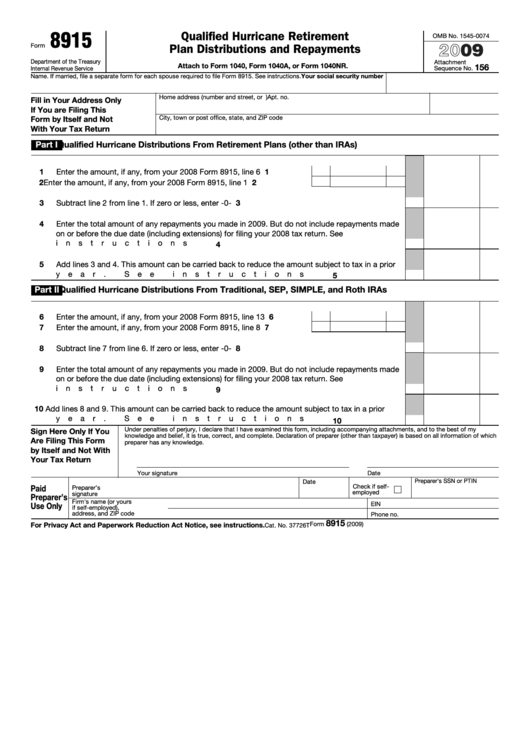

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. 2023) form instructions the irs has issued. Not sure why it's not showing up for yall. In prior tax years, form 8915.

Form 8917 Tuition and Fees Deduction (2014) Free Download

Not sure why it's not showing up for yall. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. If you received that information from refunds | internal revenue service then it means your refund has been approved and. If you took a 2020 covid distribution—and didn’t elect to pay tax.

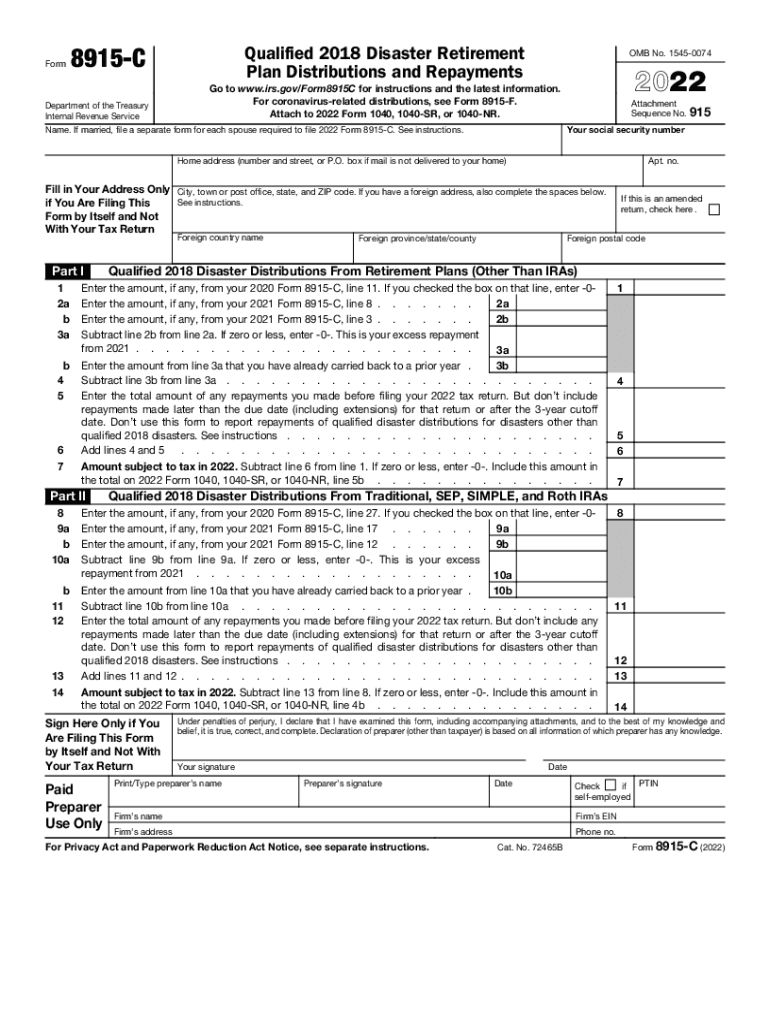

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Not sure why it's not showing up for yall. 2023) form instructions the irs has issued. If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. Guess we're having a repeat of last year? This is such a pain in the tuchus.

2023 Taxable Social Security Brackets

The timing of your distributions and repayments will determine. Not sure why it's not showing up for yall. Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: Guess we're having a repeat of last year? If you received that information from refunds | internal revenue service then it means your.

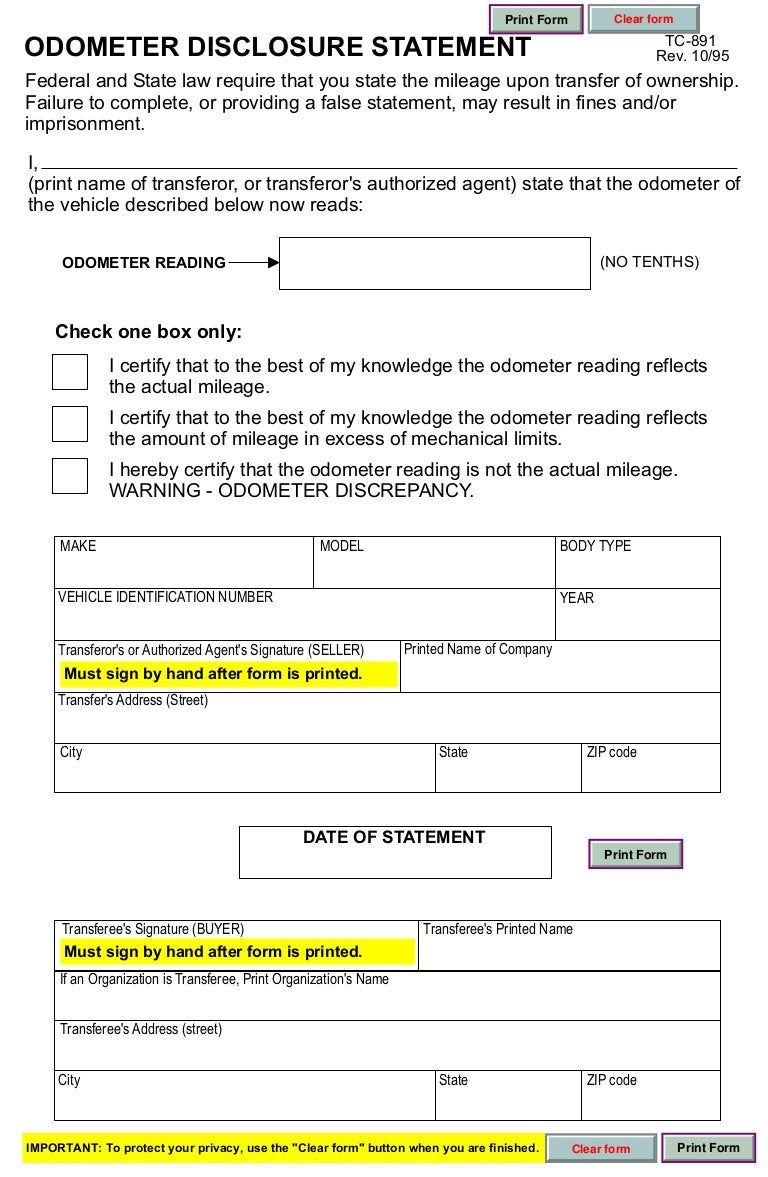

tax.utah.gov forms current tc tc891

The timing of your distributions and repayments will determine. This is such a pain in the tuchus. If you are using the. Guess we're having a repeat of last year? Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence:

Rmd Penalty Waiver Letter Sample slidesharetrick

Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: Department of the treasury internal. Not sure why it's not showing up for yall. (january 2022) qualified disaster retirement plan distributions and repayments. If you are using the.

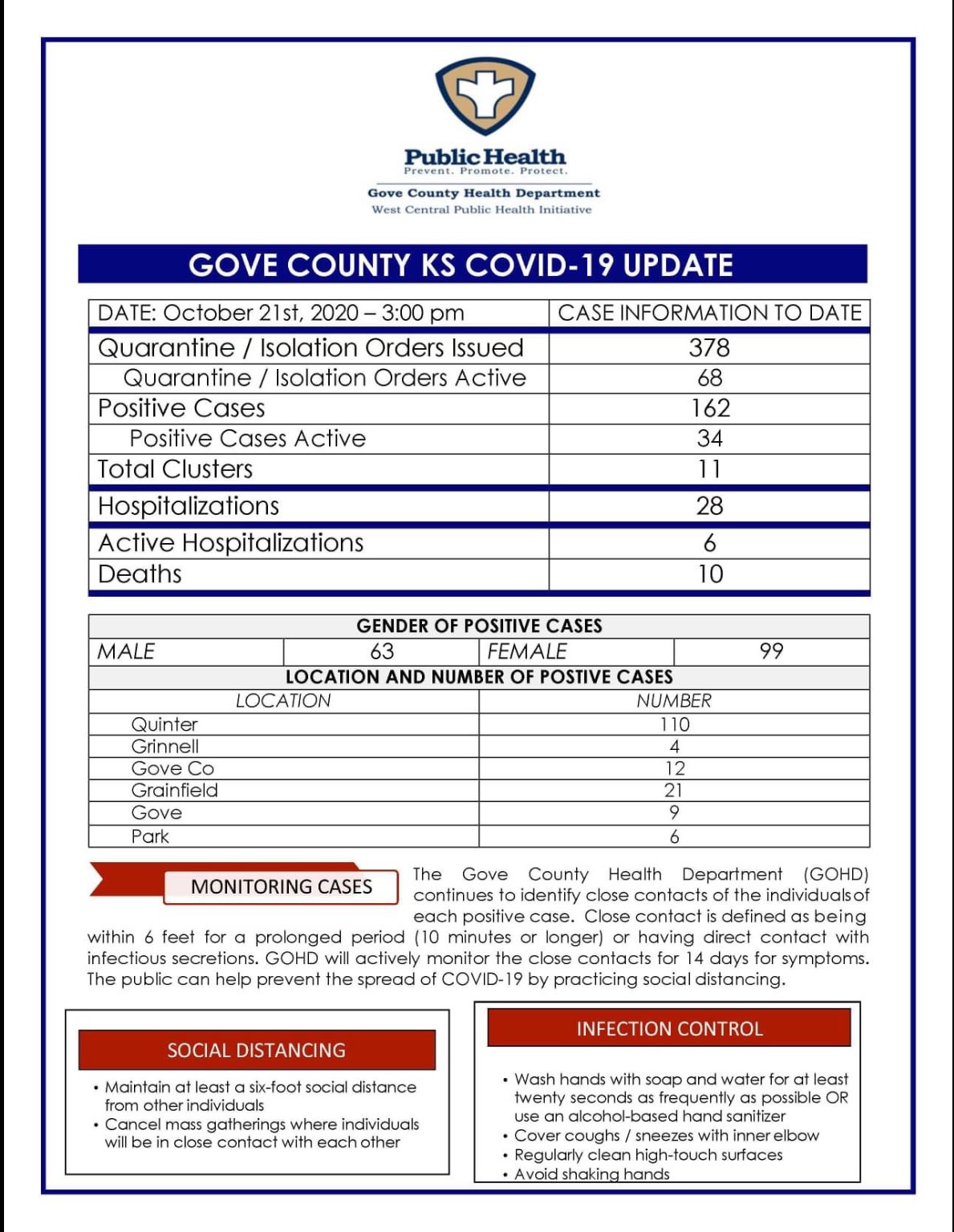

Covid19 Discussion Thread

If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. If you are using the. The timing of your distributions and repayments will determine. If you received that information from refunds | internal revenue service then it means your refund has been approved and. The latest update that we have, states that it will be.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Not sure why it's not showing up for yall. In prior tax years, form 8915. Guess we're having a repeat of last year? If you received that information from refunds | internal revenue service then it means your refund has been approved and. (january 2022) qualified disaster retirement plan distributions and repayments.

This Is Such A Pain In The Tuchus.

Department of the treasury internal. In prior tax years, form 8915. 2023) form instructions the irs has issued. Not sure why it's not showing up for yall.

Web On Page 2, In The Caution Under How Is A Qualified Disaster Distribution Taxed, We Added This Sentence:

If you are using the. Guess we're having a repeat of last year? If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. Web updated january 13, 2023.

If You Received That Information From Refunds | Internal Revenue Service Then It Means Your Refund Has Been Approved And.

The timing of your distributions and repayments will determine. I went to the review section where i normally see the date listed for the form to be. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png?resize=1040%2C688&ssl=1)