Where To Send Form 944

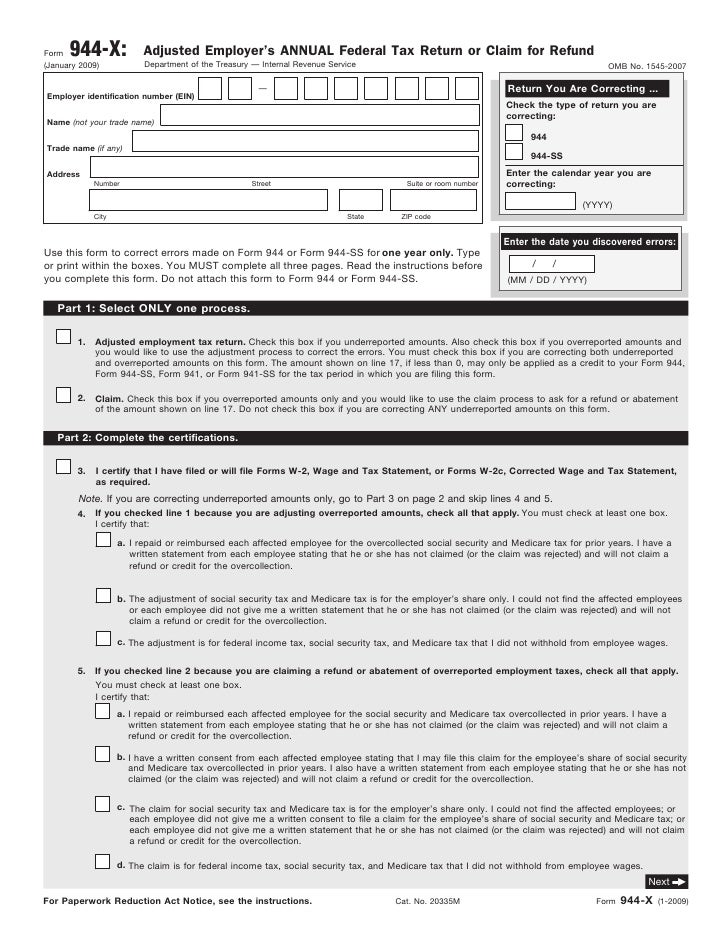

Where To Send Form 944 - Web additionally, if you have not received an irs notification that you’re eligible to complete form 944, but you believe your employment tax liability meets the. That means employers eligible to file form 944 are only required to complete and submit it once per year. Web published on june 13, 2023. Web follow the easy steps of filing form 944 electronically with taxbandits: Form 944 allows small employers. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. The 940 is an annual federal tax form used to report wages subject to and taxes paid for. Web are you one of them? Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be eligible to switch to form 944. You can complete it online, download a copy, or you can print out a copy from the website.

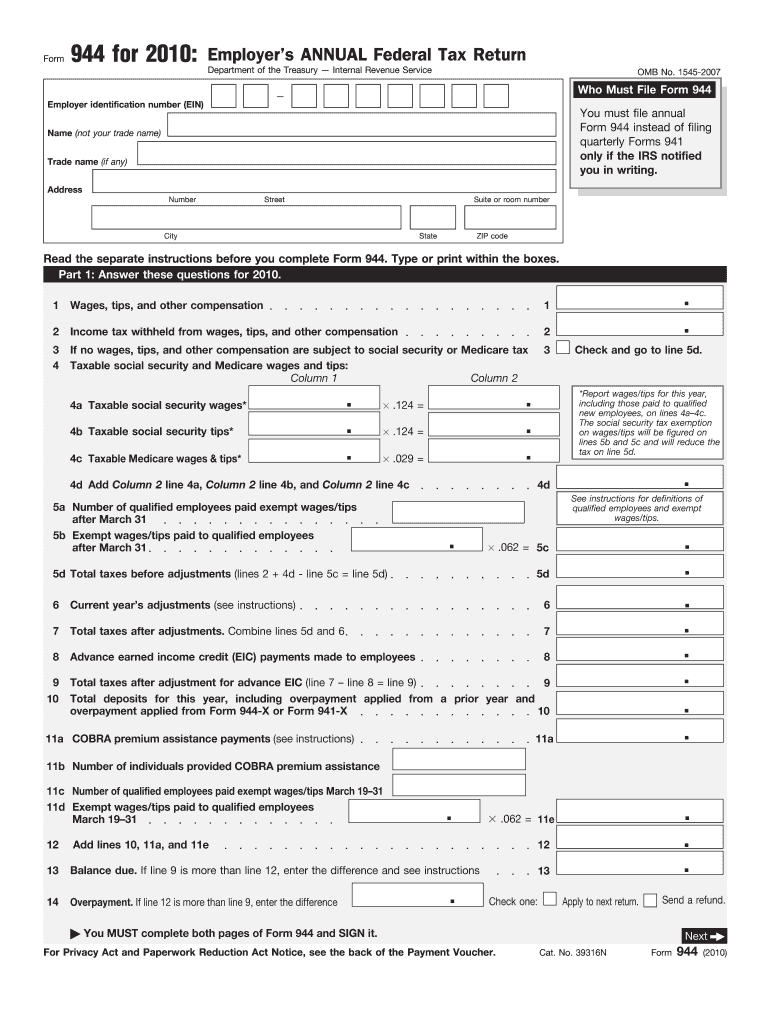

That means employers eligible to file form 944 are only required to complete and submit it once per year. Web hand write the business's federal employer identification number (ein) on the first page of their notice. Form 944, employer’s annual federal tax return, reports federal income. Web to find out where to send your form 944 check the irs website, as it is based on the location of your business. Web irs form 944 is an annual filing. If you have more than one notice of discrepancy, send each. Web where to get form 944 form 944 is available on the irs website. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. For the vast majority of these. Web additionally, if you have not received an irs notification that you’re eligible to complete form 944, but you believe your employment tax liability meets the.

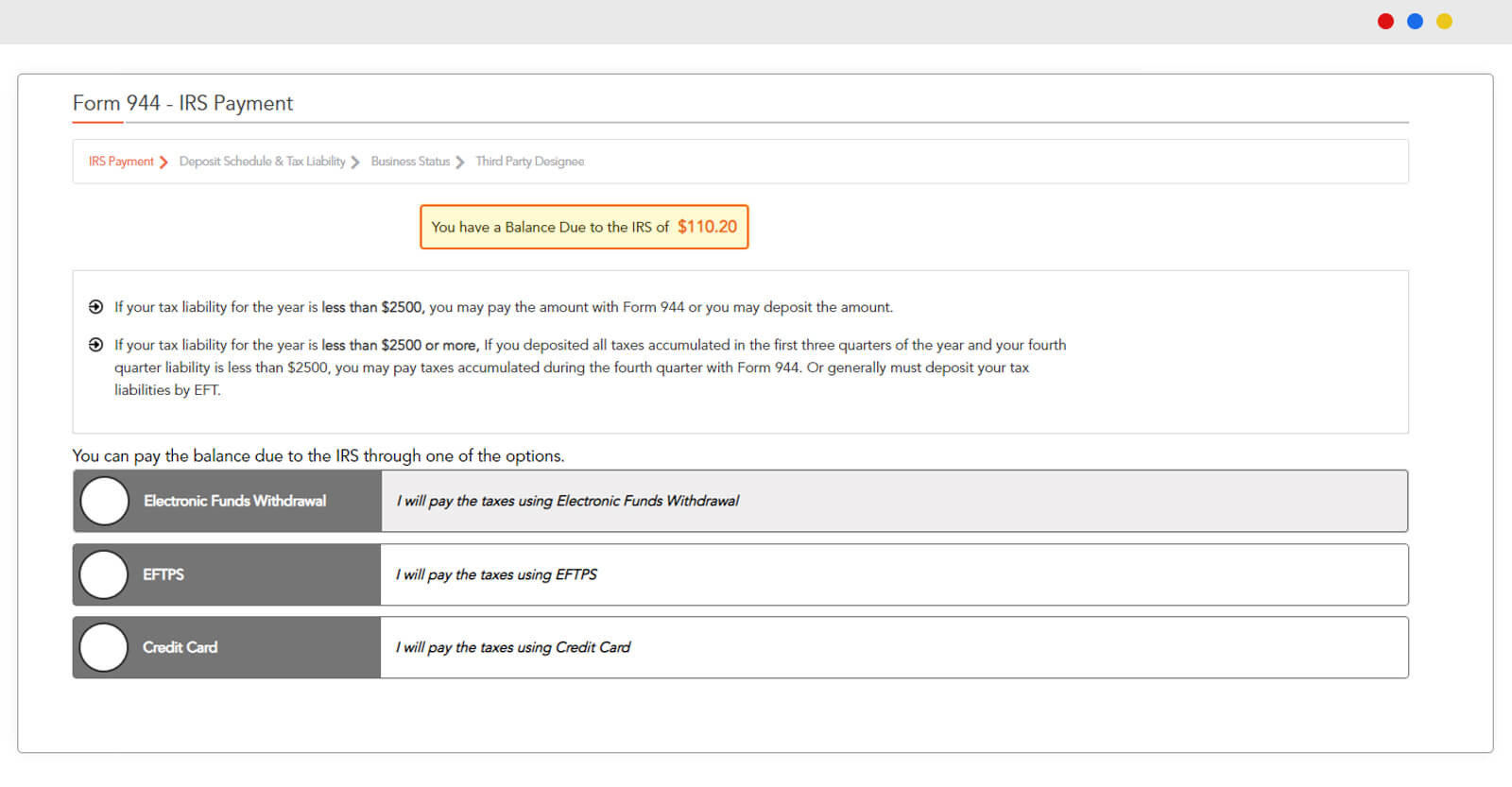

If you have more than one notice of discrepancy, send each. If you're a small business owner, you may have received a notification from the internal revenue service (irs) stating that you must file. Web to find out where to send your form 944 check the irs website, as it is based on the location of your business. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web are you one of them? Form 944, employer’s annual federal tax return, reports federal income. For the vast majority of these. Web follow the easy steps of filing form 944 electronically with taxbandits: Enter form 944 details step 2: However, if you made deposits on time in full payment of the.

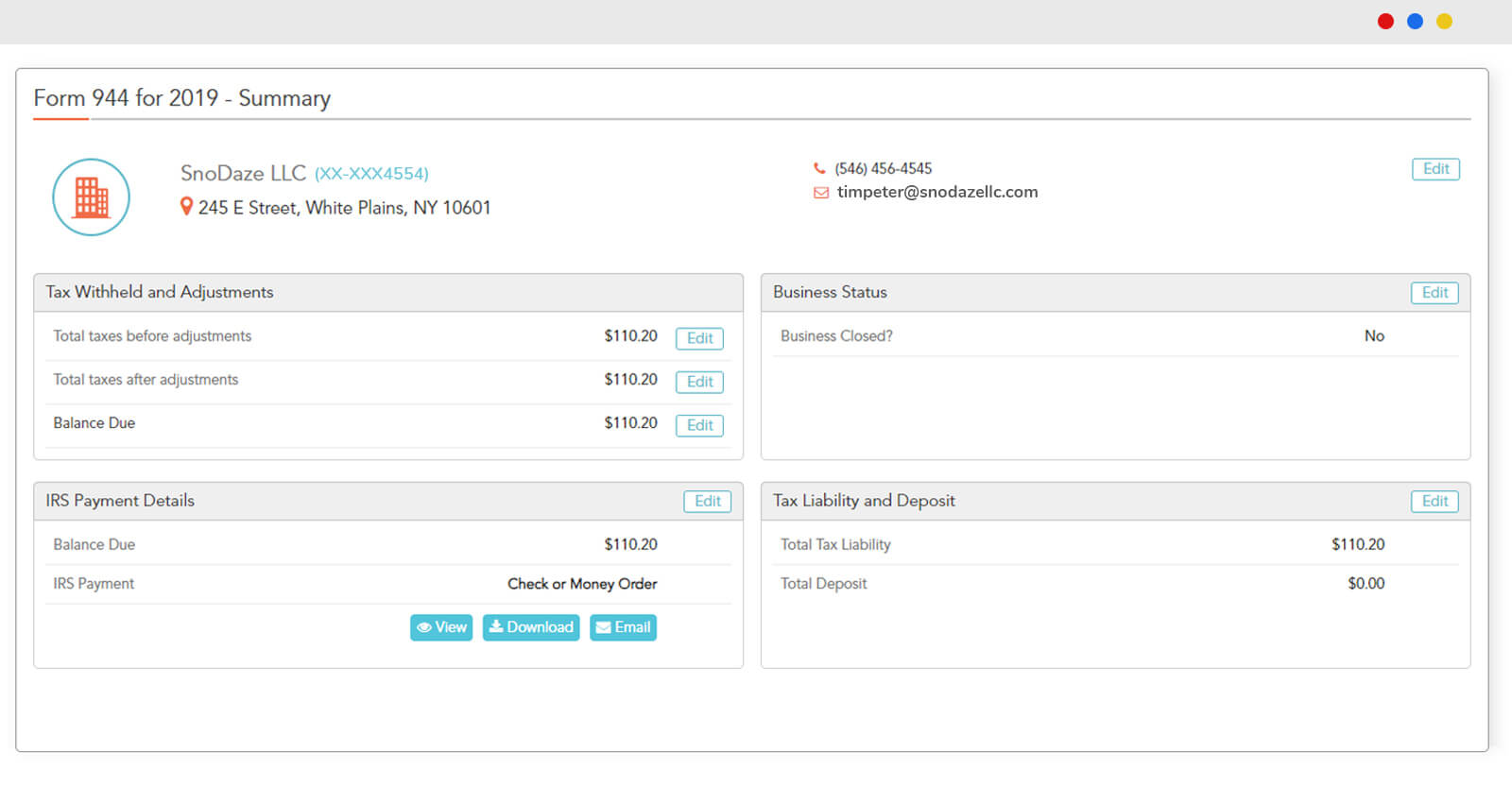

File Form 944 Online EFile 944 Form 944 for 2021

The 940 is an annual federal tax form used to report wages subject to and taxes paid for. If you're a small business owner, you may have received a notification from the internal revenue service (irs) stating that you must file. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how.

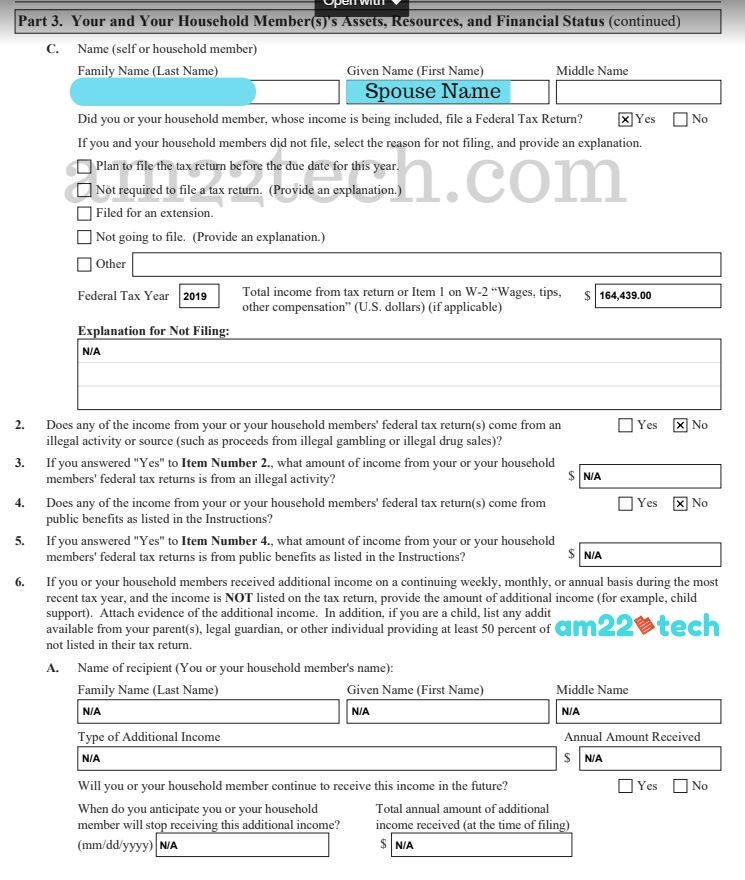

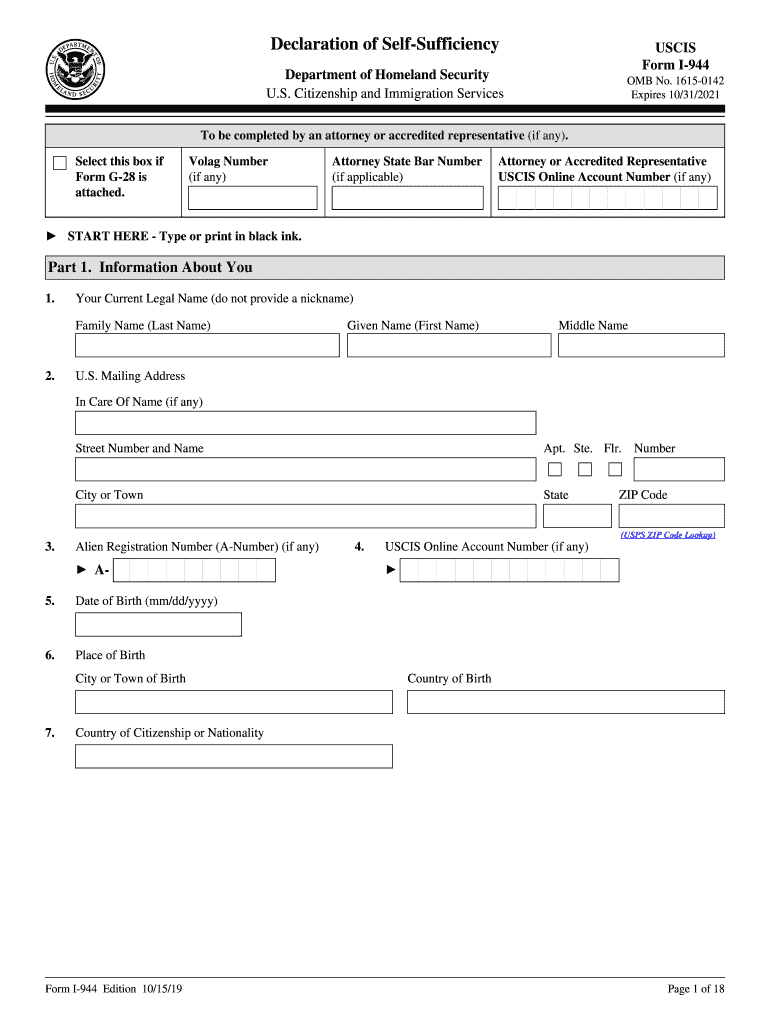

Sweet Beginning USA Form I944 Declaration of SelfSufficiency In the

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web follow the easy steps of filing form 944 electronically with taxbandits: Web irs form 944 is an annual filing. Form 944, employer’s annual federal tax return, reports federal income. Web form 944 is due by january 31st every.

Form i944 Self Sufficiency US Green Card (Documents Required) USA

Form 944, employer’s annual federal tax return, reports federal income. Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be eligible to switch to form 944. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and.

How to Fill out Form I944 ( Declaration of SelfSufficiency ) for AOS

However, if you made deposits on time in full payment of the. Web where to get form 944 form 944 is available on the irs website. That means employers eligible to file form 944 are only required to complete and submit it once per year. Web form 944 is due by january 31st every year, regardless of the filing.

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

Web form 940 is required for businesses who are subject to federal unemployment (futa). Review the summary form 944; If you have more than one notice of discrepancy, send each. Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be eligible to.

What Is Form 944 What Is Federal Form 944 For Employers How To

Web hand write the business's federal employer identification number (ein) on the first page of their notice. Web where to get form 944 form 944 is available on the irs website. Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be.

How To Fill Out Form I944 StepByStep Instructions [2021]

Web additionally, if you have not received an irs notification that you’re eligible to complete form 944, but you believe your employment tax liability meets the. However, if you made deposits on time in full payment of the. Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for.

File Form 944 Online EFile 944 Form 944 for 2021

However, if you made deposits on time in full payment of the. Web to find out where to send your form 944 check the irs website, as it is based on the location of your business. Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax.

Form 944 Fill Out and Sign Printable PDF Template signNow

Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be eligible to switch to form 944. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Form.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Employers in american samoa, guam, the commonwealth of the northern mariana islands, the u.s. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. You can complete it online, download a copy, or you can print out a copy from the website. That means employers eligible to file form.

Web Form 944 Is Due By January 31St Every Year, Regardless Of The Filing Method (Paper Or Electronic Filing).

Web published on june 13, 2023. If you're a small business owner, you may have received a notification from the internal revenue service (irs) stating that you must file. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. That means employers eligible to file form 944 are only required to complete and submit it once per year.

If So, You Need To Learn How To Fill Out Form 944.

Web hand write the business's federal employer identification number (ein) on the first page of their notice. Web are you one of them? However, if you made deposits on time in full payment of the. Web additionally, if you have not received an irs notification that you’re eligible to complete form 944, but you believe your employment tax liability meets the.

You Can Complete It Online, Download A Copy, Or You Can Print Out A Copy From The Website.

Web if you're an employer required to file a form 941 but estimate your tax liability will be $1,000 or less for the tax year, you may be eligible to switch to form 944. Web follow the easy steps of filing form 944 electronically with taxbandits: Employers in american samoa, guam, the commonwealth of the northern mariana islands, the u.s. Form 944 allows small employers.

Web Irs Form 944 Is An Annual Filing.

For the vast majority of these. Web where to get form 944 form 944 is available on the irs website. If you have more than one notice of discrepancy, send each. Form 944, employer’s annual federal tax return, reports federal income.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)