Where Does Form 3922 Go On 1040

Where Does Form 3922 Go On 1040 - Keep the form for your records because you’ll need the information when you sell, assign, or. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Employee stock purchase plan (espp) the information below is provided to you in. Web to calculate the adjusted cost basis using your form 3922, you will use a range of dates when you got an option to buy the espp stocks. The irs doesn’t recognize income when you exercise an option under an. Web intuit help intuit form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 •. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,.

Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web to calculate the adjusted cost basis using your form 3922, you will use a range of dates when you got an option to buy the espp stocks. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Employee stock purchase plan (espp) the information below is provided to you in. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web intuit help intuit form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 •.

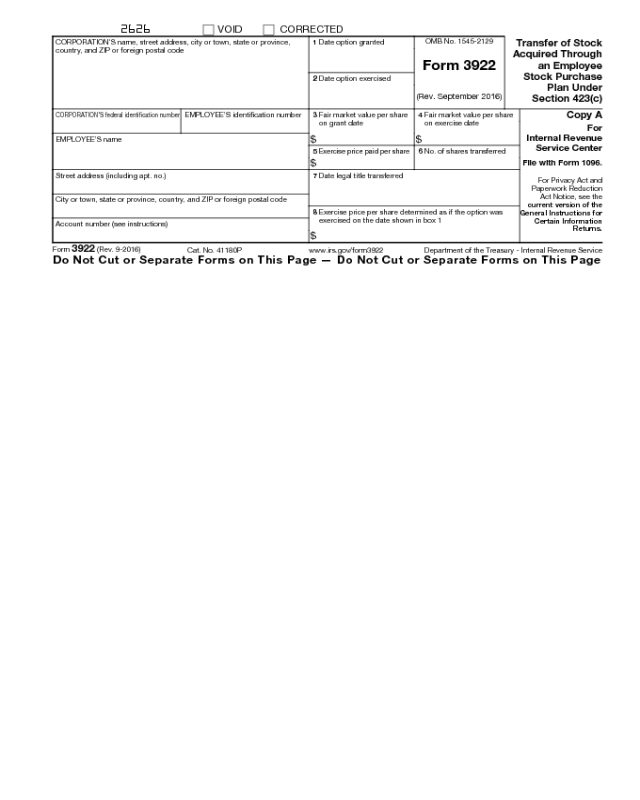

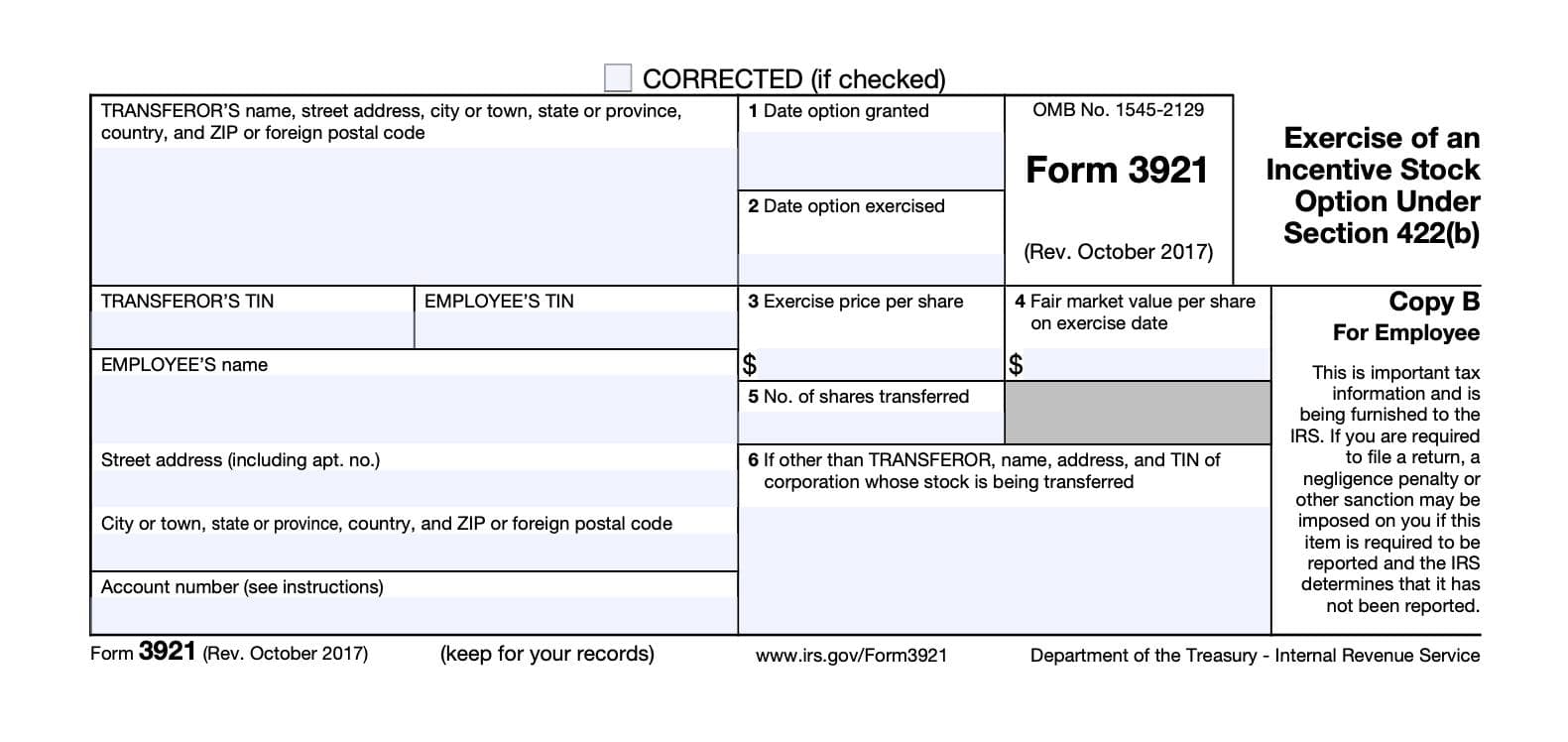

Web intuit help intuit form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 •. The irs doesn’t recognize income when you exercise an option under an. Web forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/ form3921 or irs.gov/form3922. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web the information on form 3922 will help determine your cost or other basis, as well as your holding period. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Web irs form 3922 is for informational purposes only and isn't entered into your return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Taxation is not stealing Dangerous Intersection

Web frequently asked questions relating to irs form 3922 for lowe’s companies inc. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Web to calculate the adjusted cost basis using your form 3922, you will use a range of dates.

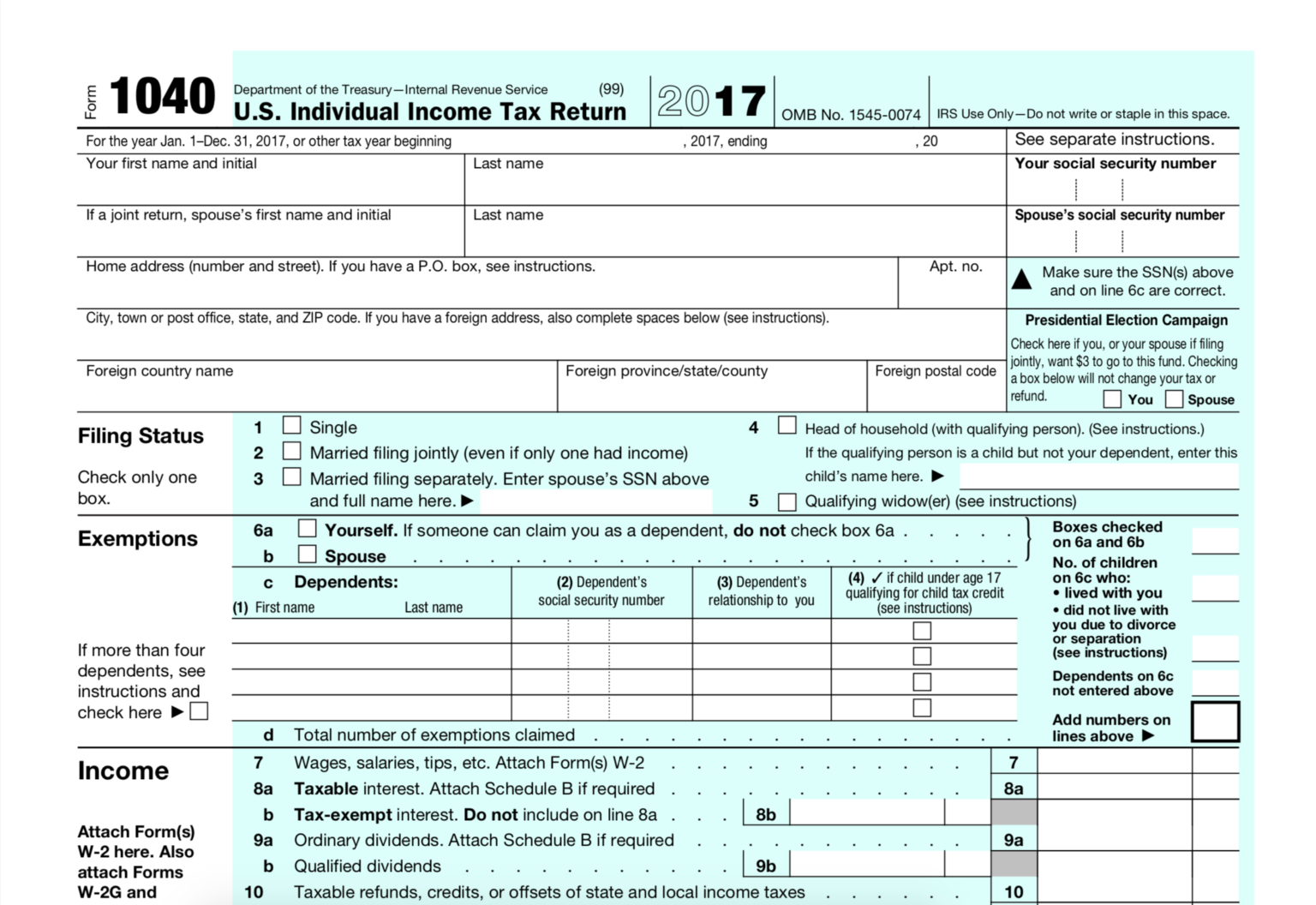

Obama S IRS Unveils New 1040 Tax Form International Liberty 1040 Form

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web intuit help intuit form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 •. Web information.

IRS Form 3922 Software 289 eFile 3922 Software

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web frequently asked questions relating to irs form 3922 for lowe’s companies inc. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Employee stock purchase.

Form 3922 Edit, Fill, Sign Online Handypdf

Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is.

IRS Form 3922

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Employee stock purchase plan (espp) the information below is provided to you in. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Transfer of.

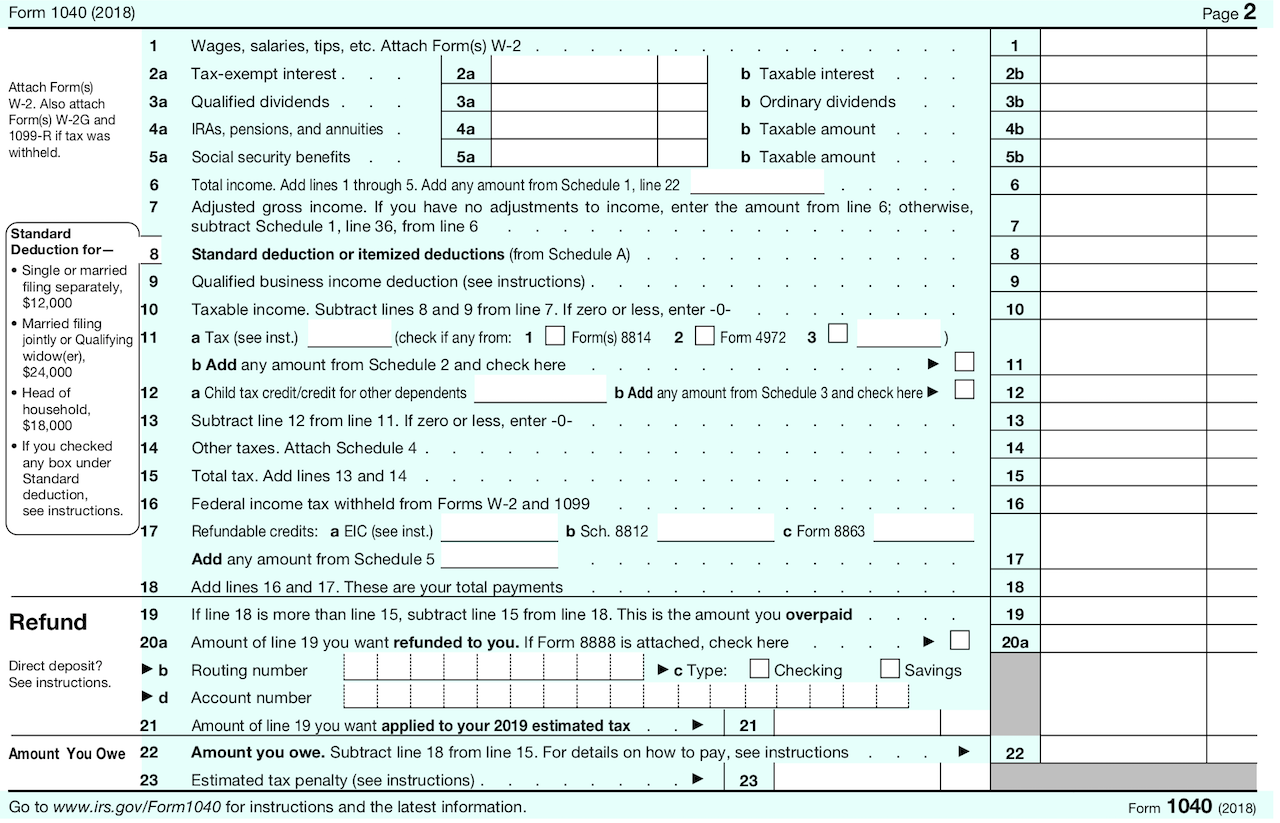

What Does A 1040 Form Look Like Seven Questions To Ask At 2021 Tax

Web irs form 3922 is for informational purposes only and isn't entered into your return. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web form 3922 is issued for employee stock options that you purchased but do not sell. Our experts can.

Point by point, why you should receive federal benefits and not have to

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Since you have not sold the stock, the holding period requirements have not been determined. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section.

Describes new Form 1040, Schedules & Tax Tables

Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Our experts can get your taxes done right. Employee stock purchase plan (espp) the information below is provided to you in. Web to calculate the adjusted cost basis using your form 3922, you will.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web the information on form 3922 will help determine your cost or other basis, as well as your holding period. Our experts can get your taxes done right. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Web form 3922 transfer of stock.

Form 3921 Everything you need to know

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Web to calculate the adjusted cost basis using your form 3922, you will.

Web If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan.

Employee stock purchase plan (espp) the information below is provided to you in. Since you have not sold the stock, the holding period requirements have not been determined. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Web form 3922 is issued for employee stock options that you purchased but do not sell.

Web Irs Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C) Is For Informational Purposes Only And Isn't Entered Into Your.

The irs doesn’t recognize income when you exercise an option under an. Web the information on form 3922 will help determine your cost or other basis, as well as your holding period. Web frequently asked questions relating to irs form 3922 for lowe’s companies inc. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax.

Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Copy A.

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Our experts can get your taxes done right.

Web Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C) Is For Informational Purposes Only And Isn't Entered Into Your Return.

Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web still need to file? Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/ form3921 or irs.gov/form3922.