Weak Form Emh

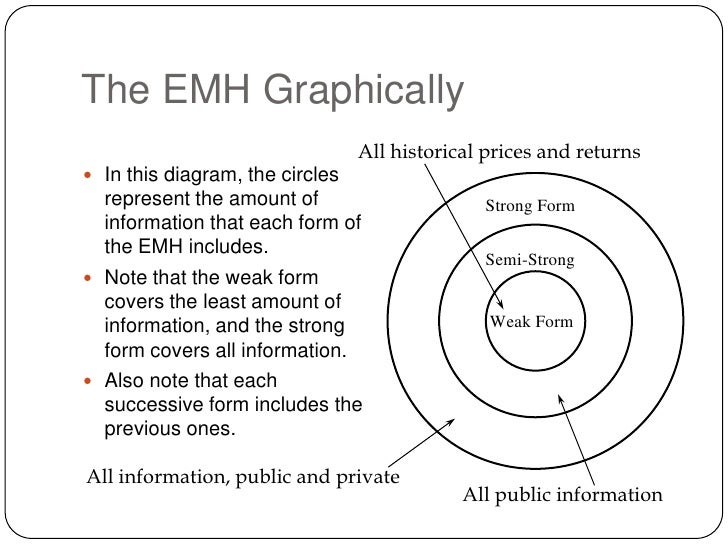

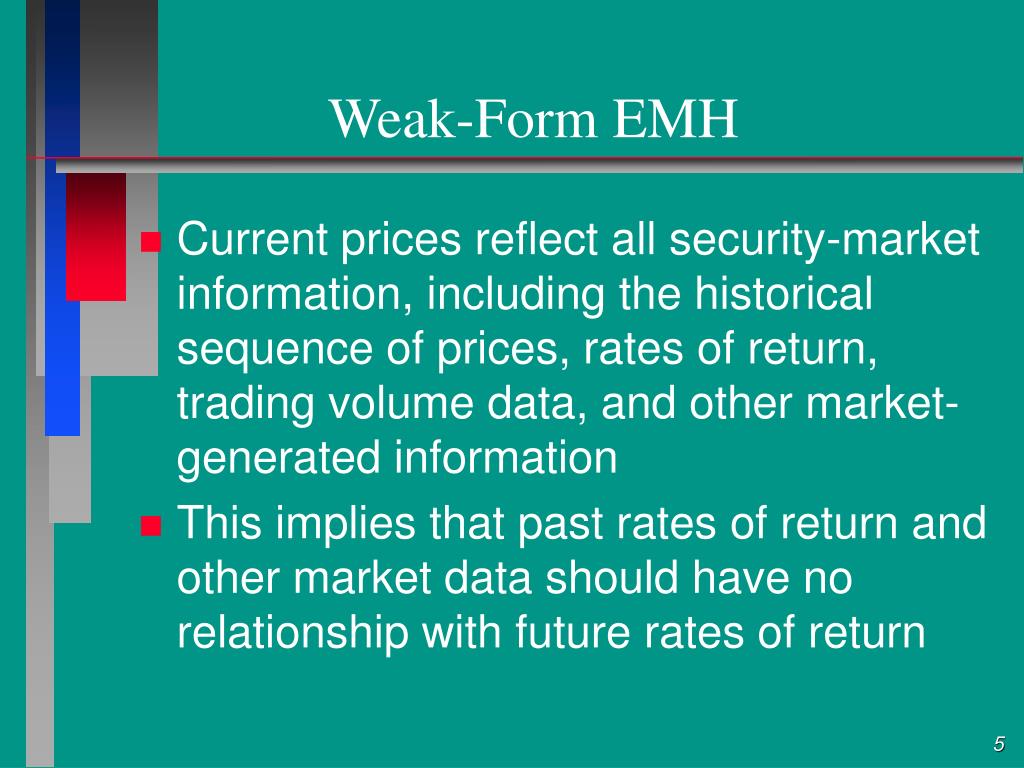

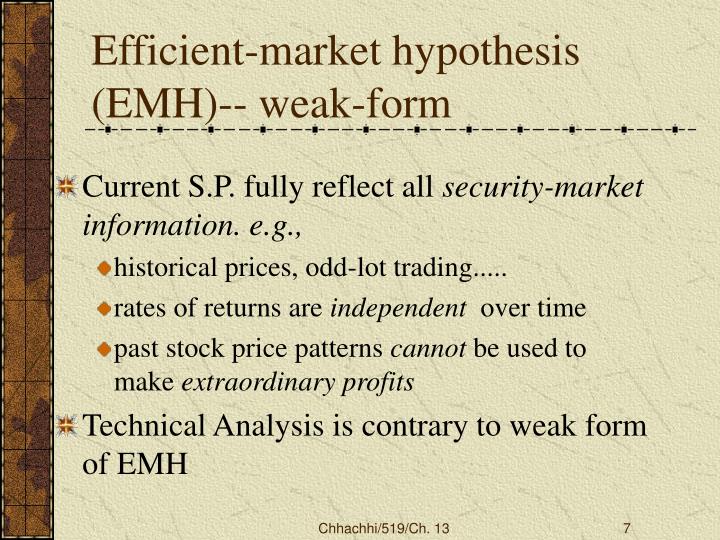

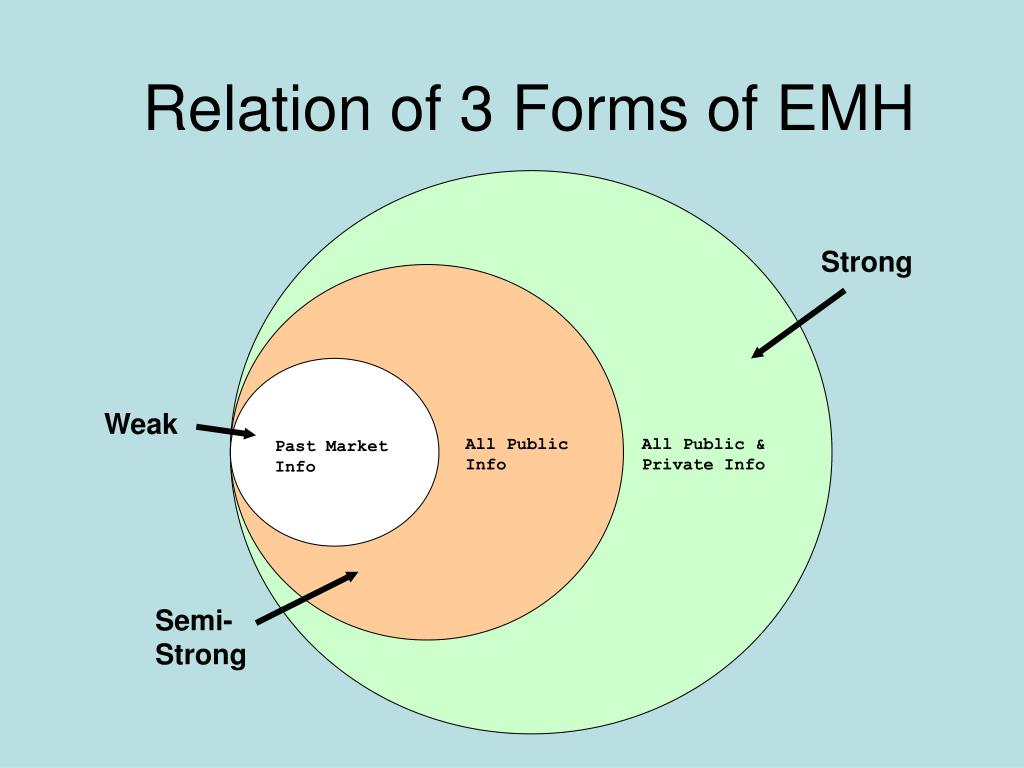

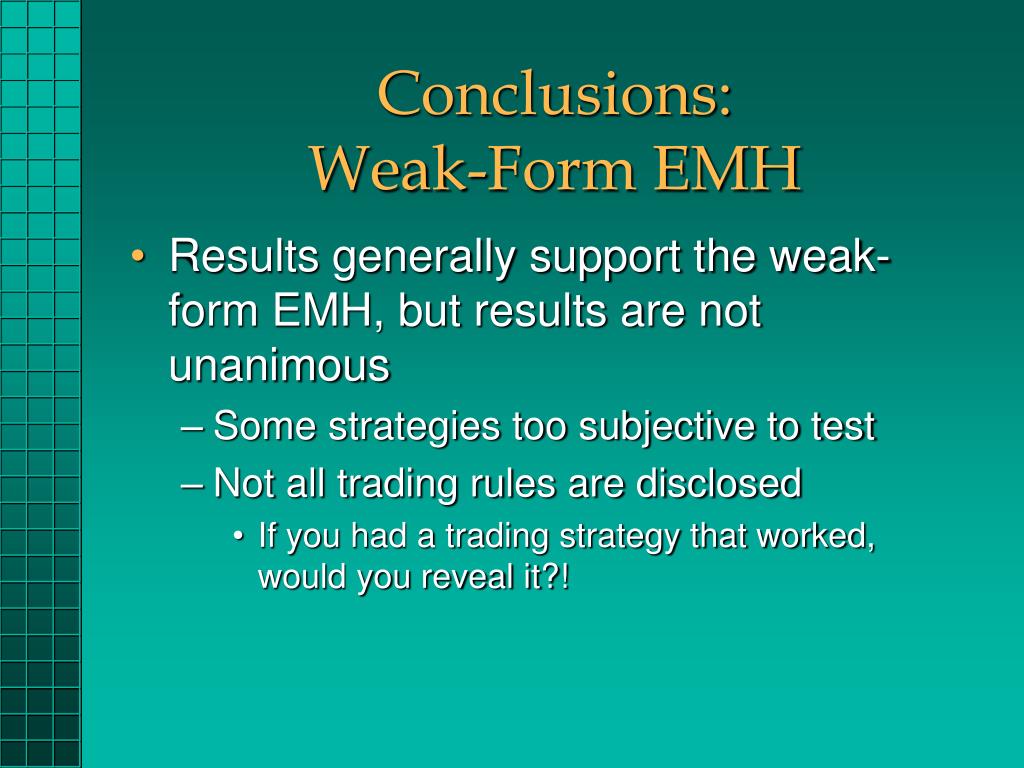

Weak Form Emh - It additionally assumes that past information regarding price, volume, and returns is independent of future prices. All public and private information, inclusive of insider information, is reflected in market prices. The weak form of market efficiency is the weakest form of this hypothesis model. Web weak form emh: Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form emh suggests that all past information is priced into securities. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Key takeaways weak form efficiency states that past prices, historical values, and. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term.

Key takeaways weak form efficiency states that past prices, historical values, and. All past information like historical trading prices and volume data is reflected in the market prices. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). All publicly available information is reflected in the current market prices. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Web weak form emh: The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. There are three beliefs or views: Weak form emh suggests that all past information is priced into securities.

It additionally assumes that past information regarding price, volume, and returns is independent of future prices. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: All publicly available information is reflected in the current market prices. The weak form of market efficiency is the weakest form of this hypothesis model. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web weak form emh: Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. All public and private information, inclusive of insider information, is reflected in market prices. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term.

What does Warren Buffett tell me about EMH on his winning bet?

Weak form emh suggests that all past information is priced into securities. All past information like historical trading prices and volume data is reflected in the market prices. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. All public.

Efficient market hypothesis

Key takeaways weak form efficiency states that past prices, historical values, and. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). There are three beliefs or views: Web the market capitalization of.

Efficient market hypothesis

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. There are three beliefs or views: Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh)..

PPT Efficient Market Theory PowerPoint Presentation, free download

All past information like historical trading prices and volume data is reflected in the market prices. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). There are three beliefs or views: Fundamental analysis.

Weak Form of EMH (T39) YouTube

All publicly available information is reflected in the current market prices. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). All past information like historical trading prices and volume data is reflected.

Weak form efficiency indian stock markets make money with meghan system

The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. It additionally assumes that past information regarding price, volume, and returns is independent of future prices. Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). All publicly available information is reflected in.

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

It additionally assumes that past information regarding price, volume, and returns is independent of future prices. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that.

What is the Efficient Market Hypothesis (EMH)? IG Bank Switzerland

Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: There are three beliefs or views: The weak form of the emh assumes that the prices of securities reflect.

CHAPTER 8 Stocks and Their Valuation n n

Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: All publicly available information is reflected in the current market prices. Web weak form emh: Weak form emh suggests that all past information is priced into securities. Web the market capitalization of emerging market economies.

PPT Chapter 10 PowerPoint Presentation, free download ID395356

All publicly available information is reflected in the current market prices. Weak form emh suggests that all past information is priced into securities. All public and private information, inclusive of insider information, is reflected in market prices. All past information like historical trading prices and volume data is reflected in the market prices. It additionally assumes that past information regarding.

All Public And Private Information, Inclusive Of Insider Information, Is Reflected In Market Prices.

Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web weak form emh:

The Weak Form Of Market Efficiency Is The Weakest Form Of This Hypothesis Model.

All past information like historical trading prices and volume data is reflected in the market prices. It additionally assumes that past information regarding price, volume, and returns is independent of future prices. Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). Key takeaways weak form efficiency states that past prices, historical values, and.

All Publicly Available Information Is Reflected In The Current Market Prices.

The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. There are three beliefs or views: Weak form emh suggests that all past information is priced into securities. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available.