Weak Form Efficiency

Weak Form Efficiency - The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. It also holds that stock price movements. This hypothesis suggests that price changes in securities are independent and identically distributed. Web what is weak form market efficiency? Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. In other words, linear models and technical analyses may be clueless for predicting future returns. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Advocates of weak form efficiency believe all. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'.

Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. In other words, linear models and technical analyses may be clueless for predicting future returns. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Thus, past prices cannot predict future prices. In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Advocates of weak form efficiency believe all. It also holds that stock price movements.

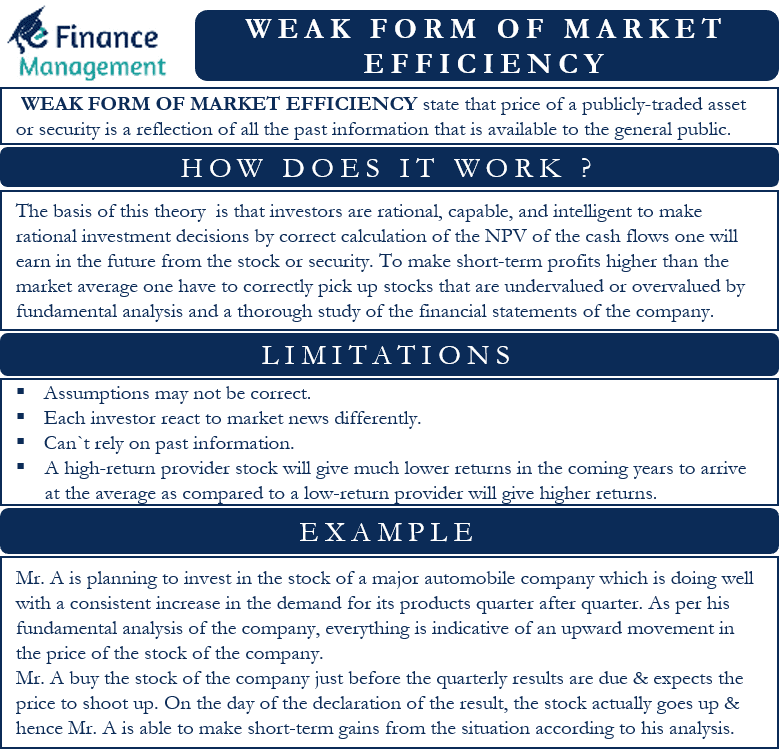

Advocates of weak form efficiency believe all. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. In other words, linear models and technical analyses may be clueless for predicting future returns. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Web weak form efficiency. They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. Web what is weak form market efficiency? It also holds that stock price movements.

Weak Form Efficiency Tests by Bj??rn Schubert (English) Paperback Book

Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web weak form efficiency. The efficient market hypothesis concerns the extent to.

(PDF) Testing the WeakForm Efficiency of the Stock Market Pakistan as

Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. Web what is weak form market efficiency? In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements..

(PDF) Testing weak form efficiency in the South African market

Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Advocates of weak form efficiency believe all. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. Web what is weak form market efficiency?.

(PDF) WeakForm Efficiency of Foreign Exchange Market in the

They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Advocates of weak form efficiency believe all. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form market efficiency,.

Weak Form of Market Efficiency Meaning, Usage, Limitations

It also holds that stock price movements. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'. In.

(PDF) The Weakform Efficiency of Chinese Stock Markets Thin Trading

Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Web weak form efficiency. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built.

(PDF) A Test of Weak Form Efficiency for the Botswana Stock Exchange

They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. Weak form market efficiency, also known as.

(PDF) Testing the weakform efficiency in African stock markets

Advocates of weak form efficiency believe all. This hypothesis suggests that price changes in securities are independent and identically distributed. They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Web the weak form efficiency is one of the three types of.

Weak form efficiency indian stock markets and with it work at home

They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'. Thus, past prices cannot.

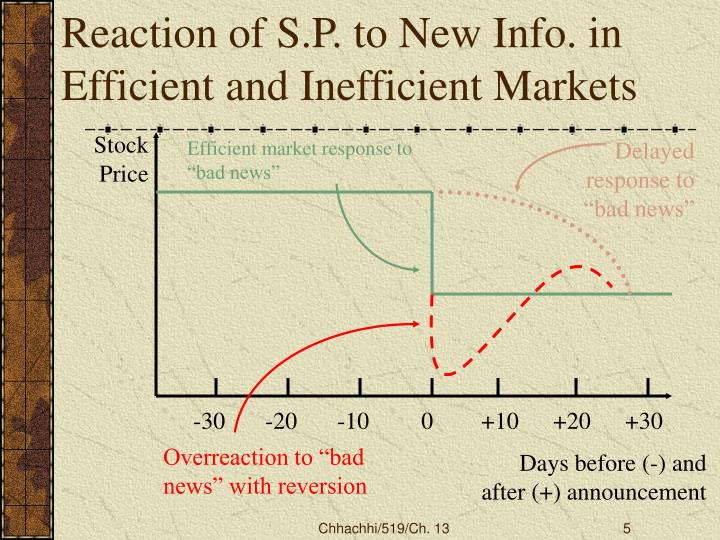

PPT CHAPTER ONE PowerPoint Presentation, free download ID1960979

This hypothesis suggests that price changes in securities are independent and identically distributed. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. In other words, linear models and technical analyses may be clueless for predicting future returns. Web what is weak form market efficiency? Advocates of weak form.

They Make Rational Investment Decisions By Correct Calculation Of The Net Present Values Of The Cash Flows One Will Earn In The Future From The Stock Or Security.

Web what is weak form market efficiency? Web weak form efficiency. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. This hypothesis suggests that price changes in securities are independent and identically distributed.

Web The Weak Form Efficiency Is One Of The Three Types Of The Efficient Market Hypothesis (Emh) As Defined By Eugene Fama In 1970.

Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. It also holds that stock price movements. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements.

Web Advocates For The Weak Form Efficiency Theory Believe That If The Fundamental Analysis Is Used, Undervalued And Overvalued Stocks Can Be Determined, And Investors Can Research Companies'.

Thus, past prices cannot predict future prices. Advocates of weak form efficiency believe all. In other words, linear models and technical analyses may be clueless for predicting future returns. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.