Turbo Tax Form 5329

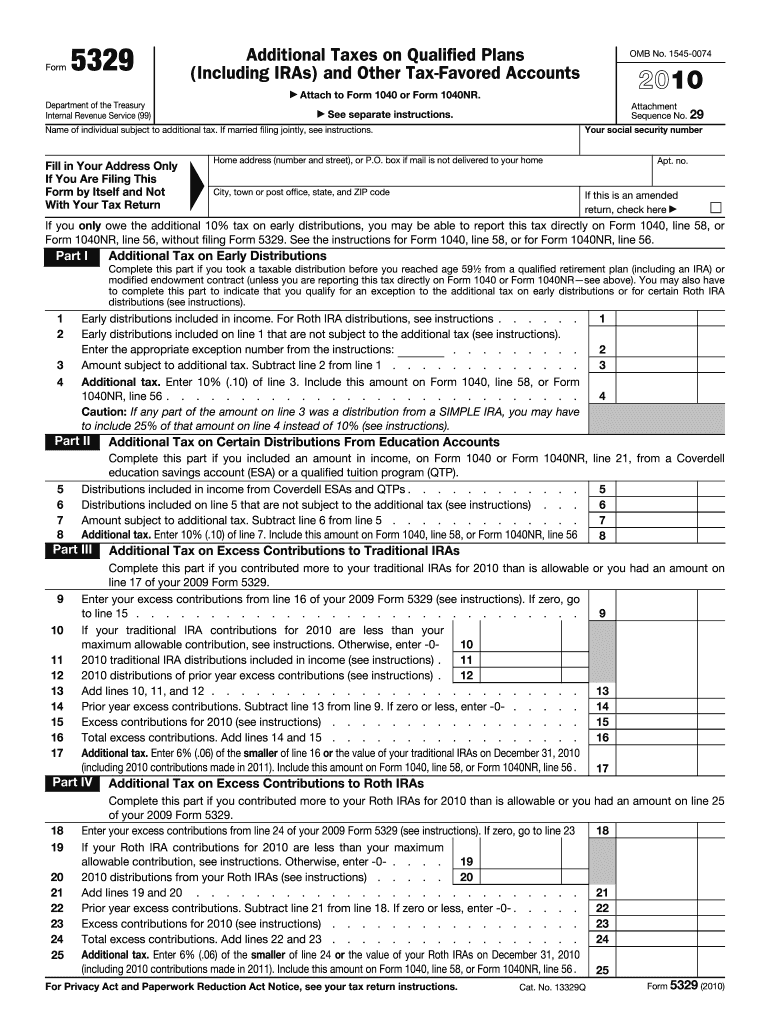

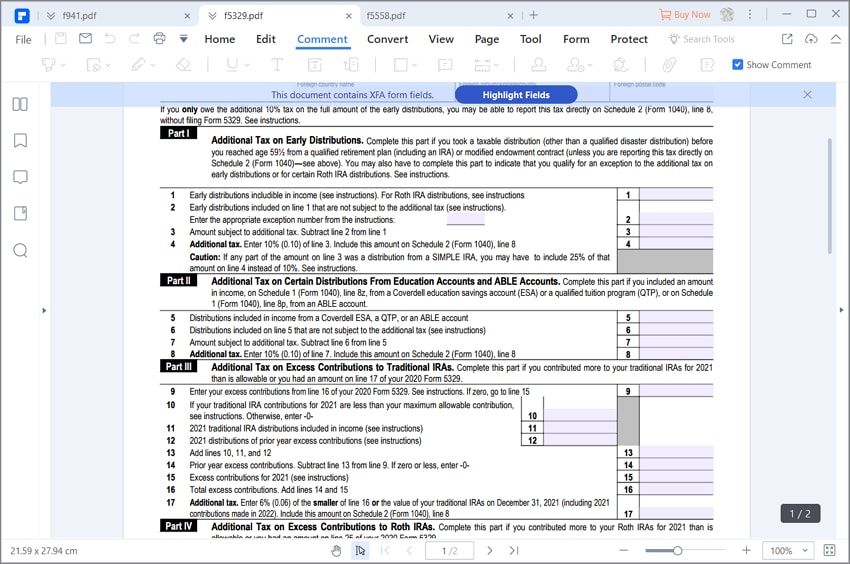

Turbo Tax Form 5329 - Easily sort by irs forms to find the product that best fits your tax situation. If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. You may need this form in three situations: Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. The form reports additional taxes on qualified plans. Web march 7, 2023 7:11 pm. Web yes, you can get form 5329 from turbotax. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. However, you may have to print and mail your tax return.please read below for details.the action required depends on.

Failing to take required minimum distributions we'll go into each of these three areas in more detail. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. At least it can be done on turbotax premier cd/download version. Web march 7, 2023 7:11 pm. Easily sort by irs forms to find the product that best fits your tax situation. If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web yes, you can get form 5329 from turbotax. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web what is irs form 5329?

Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. At least it can be done on turbotax premier cd/download version. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Easily sort by irs forms to find the product that best fits your tax situation. However, you may have to print and mail your tax return.please read below for details.the action required depends on. Failing to take required minimum distributions we'll go into each of these three areas in more detail. Web what is irs form 5329? If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas.

IRS Form 5329 Instructions How To File Retirement Plan Tax Form IRS

However, you may have to print and mail your tax return.please read below for details.the action required depends on. At least it can be done on turbotax premier cd/download version. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Web what is irs form 5329? Failing to take required minimum distributions.

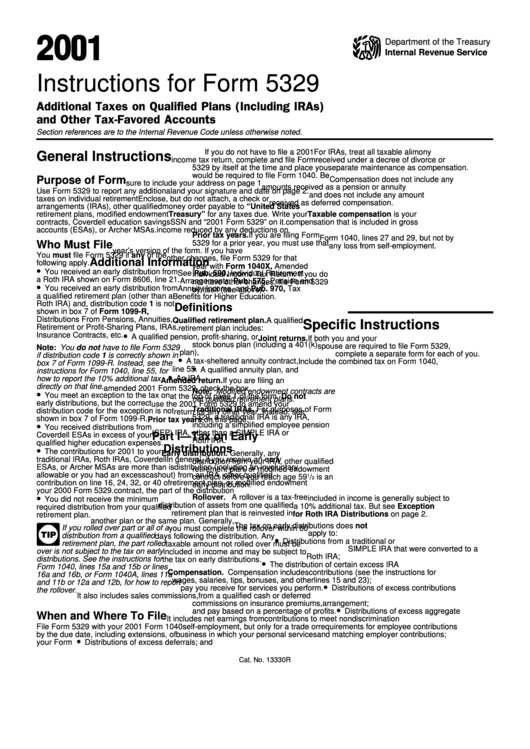

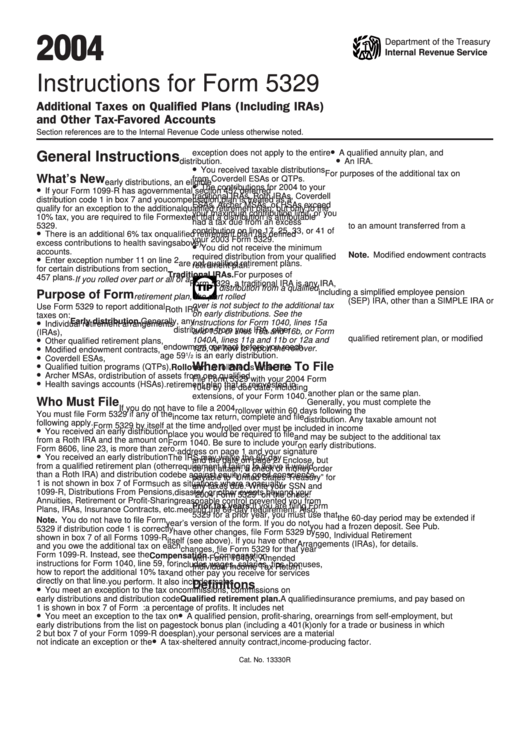

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Web what is irs form 5329? Web march 7, 2023 7:11 pm. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web yes, you can get form 5329 from turbotax.

How to Fill in IRS Form 5329

If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. Web what is irs form 5329? However, you may have to print and mail your tax return.please read below for details.the action required depends on. Web on september 7, 2022, you withdrew $800, the entire balance.

Tax Lien Irs Tax Lien Phone Number

The form reports additional taxes on qualified plans. However, you may have to print and mail your tax return.please read below for details.the action required depends on. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts.

1099R Coding Change

If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Failing to take required minimum distributions we'll go into each of these three areas in more detail. Easily.

How to file form 2290 Electronically For the Tax Year 20212022 by Form

If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. The form reports additional taxes on qualified plans. Web yes, you can get form 5329 from turbotax. Web what is irs form 5329? You must file form 5329 for 2020 and 2021 to pay the additional.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

Failing to take required minimum distributions we'll go into each of these three areas in more detail. However, you may have to print and mail your tax return.please read below for details.the action required depends on. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Easily sort by irs forms to.

Form 5329 Instructions & Exception Information for IRS Form 5329

Failing to take required minimum distributions we'll go into each of these three areas in more detail. If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas,.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. The form reports additional taxes on qualified plans. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329. Web march.

5329 Form Fill Out and Sign Printable PDF Template signNow

Easily sort by irs forms to find the product that best fits your tax situation. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Web march 7, 2023 7:11 pm. Web if you enter an early withdraw from a retirement account, the program should generate a.

You Must File Form 5329 For 2020 And 2021 To Pay The Additional Taxes For Those Years.

At least it can be done on turbotax premier cd/download version. Web march 7, 2023 7:11 pm. The form reports additional taxes on qualified plans. Web if you enter an early withdraw from a retirement account, the program should generate a form 5329.

Web Form 5329 Must Be Filed By Taxpayers With Retirement Plans Or Education Savings Accounts Who Owe An Early Distribution Or Another Penalty.

Web yes, you can get form 5329 from turbotax. Web what is irs form 5329? You may need this form in three situations: Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas.

Easily Sort By Irs Forms To Find The Product That Best Fits Your Tax Situation.

Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. If you're amending a prior year return and using turbotax desktop, go to forms at the upper right to access form 5329, under 'forms. February 2021) department of the treasury internal. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.

Failing To Take Required Minimum Distributions We'll Go Into Each Of These Three Areas In More Detail.

However, you may have to print and mail your tax return.please read below for details.the action required depends on.

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-CFI-IRS-Form-5329.png)