Texas Sales Tax Calendar

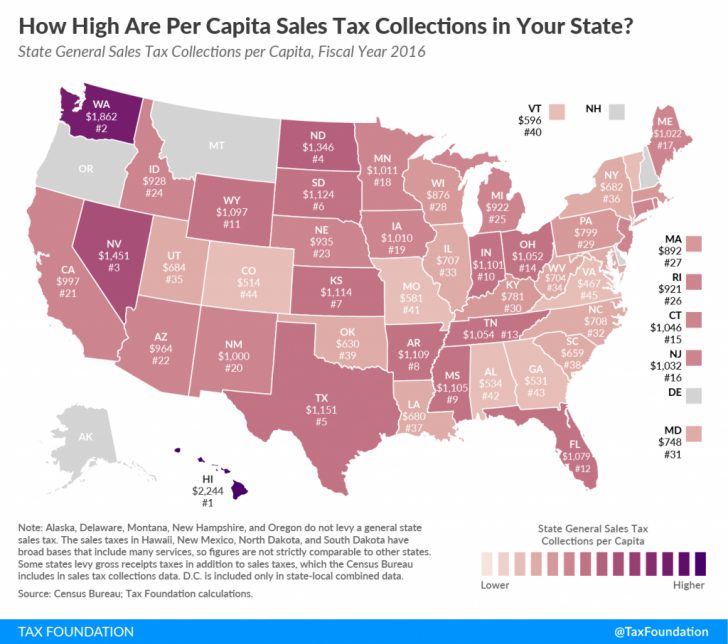

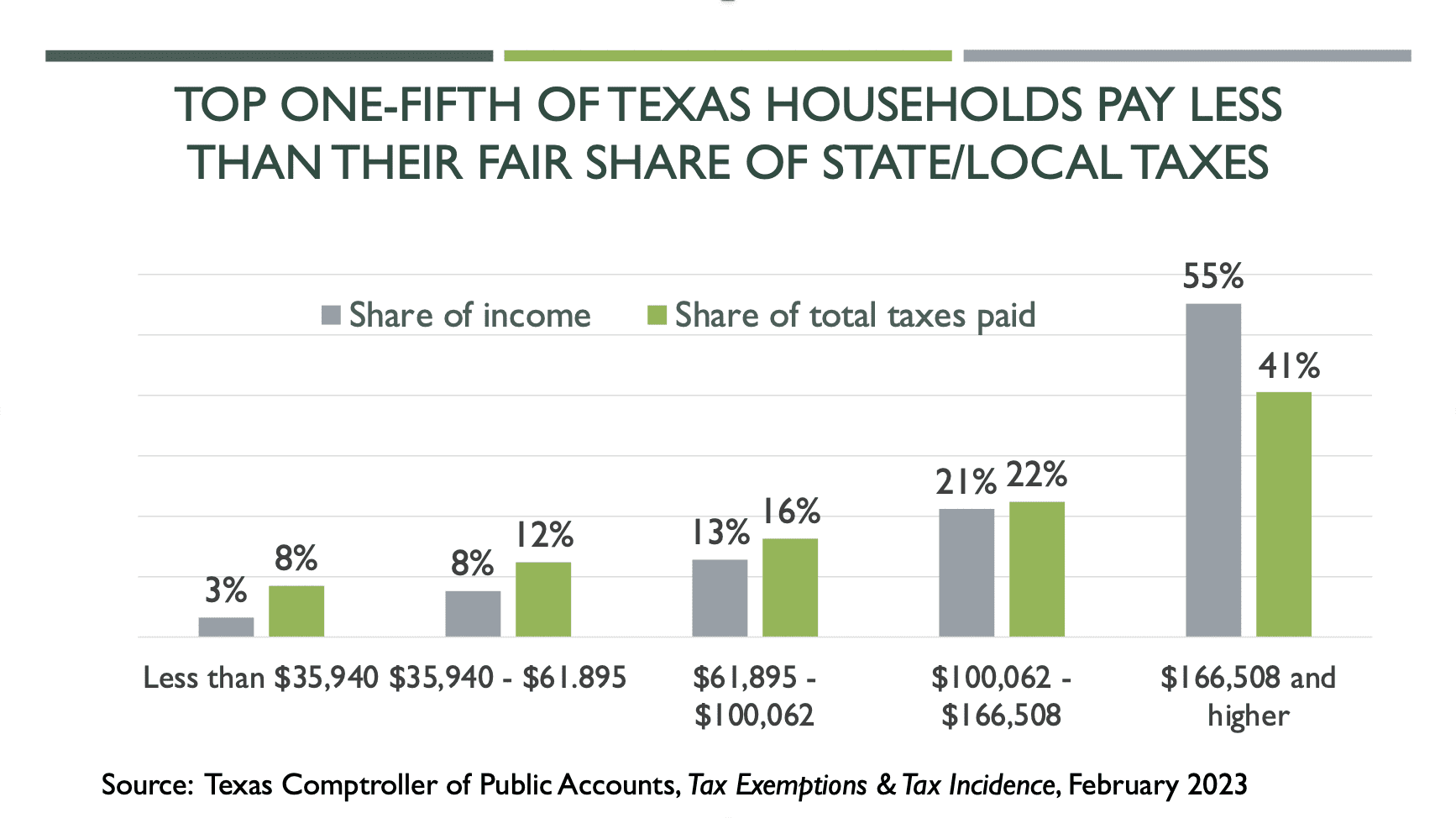

Texas Sales Tax Calendar - If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. Web in 2024, the texas sales tax holidays will be held on the following dates: List of sales tax holidays. How to file and pay sales tax in texas in 2024. Web 2024 reporting due dates for taxes, fees and reports. Web do i need to be collecting texas sales tax? Depending on the volume of sales taxes you. However, these rates increase to 8.25% in almost every texas jurisdiction as cities, counties, special districts, and transit authorities can each impose up to a 2% sales tax. State sales tax rate table. Contact the department of revenue.

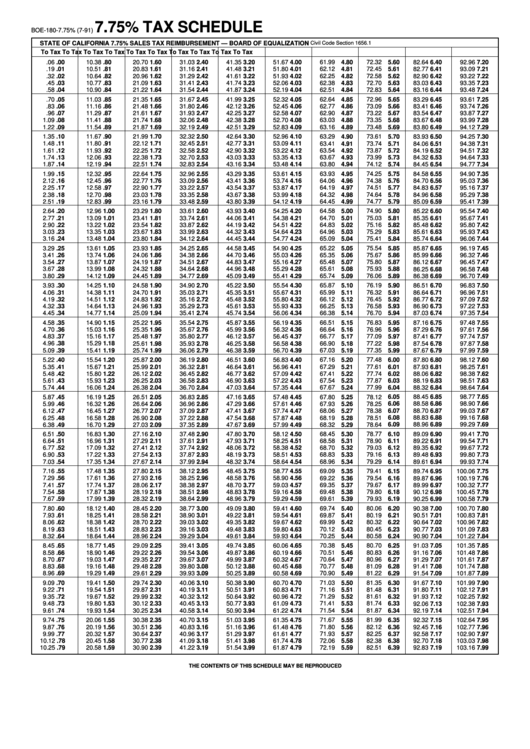

As a business operating in texas, it’s important to know the specific sales tax rate for the areas you operate in. Web the texas sales tax rate is 6.25% statewide. Web a sales tax holiday is an annual event during which the texas comptroller of public. How to file and pay sales tax in texas in 2024. There are two types of sales tax designations in texas: Web texas important tax dates. Franchise tax is a privilege tax on taxable entities doing business in texas. Calculate how much sales tax you owe; When it comes time to file sales tax in texas you must do three things: Do you need to collect and remit sales tax in texas?

How to file and pay sales tax in texas in 2024. Franchise tax is a privilege tax on taxable entities doing business in texas. Web a sales tax holiday is an annual event during which the texas comptroller of public. Web our free online guide for business owners covers texas sales tax registration,. Top where to file your texas sales tax return: Your business's sales tax return must be filed by the 20th of the month following reporting period. There are two types of sales tax designations in texas: State sales tax rate table. Texas' sales tax by the numbers: In the tabs below, discover new map and.

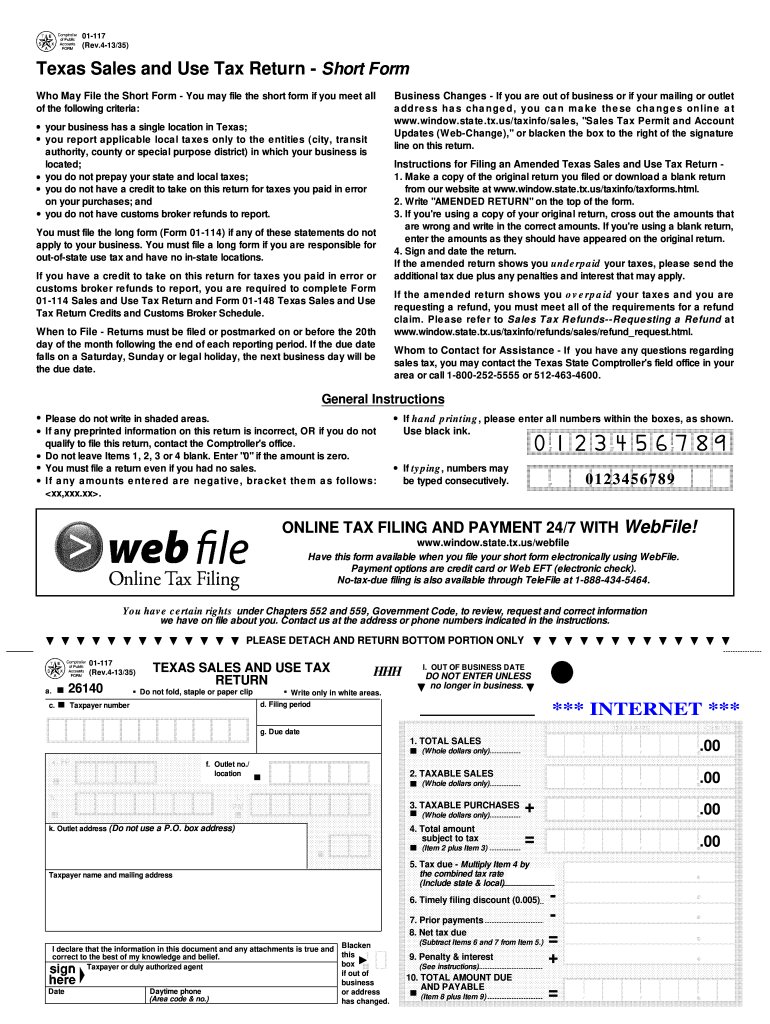

TX Sales Tax Return Monthly Form Denver City & County Fill out Tax

Do you need to collect and remit sales tax in texas? There are two types of sales tax designations in texas: If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. As a business operating in texas, it’s important to know the specific sales tax rate for the areas you.

Texas State Sales Tax 2024 Kathe Maurine

Web texas important tax dates. Do you need to collect and remit sales tax in texas? Web a sales tax holiday is an annual event during which the texas comptroller of public. File a sales tax return. Depending on the volume of sales taxes you.

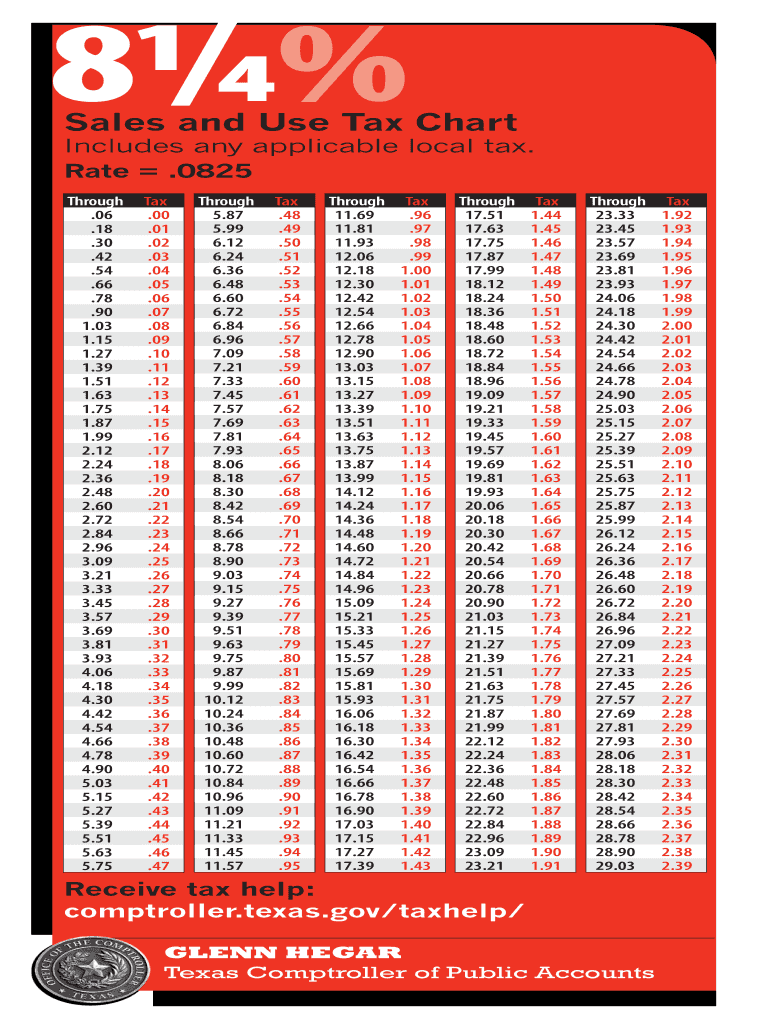

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. Web texas important tax dates. In the tabs below, discover new map and. There are two types of sales tax designations in texas: Local tax can’t exceed 2%, which.

Sales Tax Calculator 2024 Texas Chere Deeanne

Web 2024 reporting due dates for taxes, fees and reports. Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. Web in 2024, the texas sales tax holidays will be held on the following dates: As a business operating in texas, it’s important to know the specific sales tax rate for the areas you operate.

Who Pays Texas Taxes? (2023) Every Texan

Web do i need to be collecting texas sales tax? Franchise tax is a privilege tax on taxable entities doing business in texas. Web in 2024, the texas sales tax holidays will be held on the following dates: When it comes time to file sales tax in texas you must do three things: File a sales tax return.

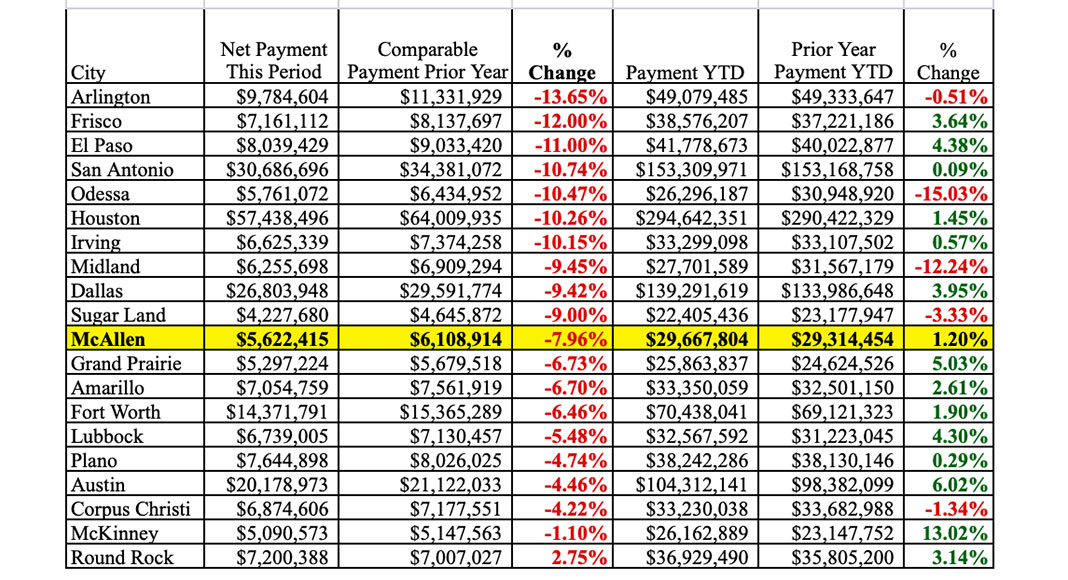

May 2020 Sales Tax Info Texas Border Business

Web texas important tax dates. Web welcome to the new sales tax rate locator. Web 2024 reporting due dates for taxes, fees and reports. List of sales tax holidays. Web businesses that cross the texas economic nexus threshold must register.

Texas Sales Tax Chart

As a business operating in texas, it’s important to know the specific sales tax rate for the areas you operate in. Web do i need to be collecting texas sales tax? Web calendar of texas sales tax filing dates. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. Depending.

Texas Sales Use Tax 20192024 Form Fill Out and Sign Printable PDF

Local tax can’t exceed 2%, which. Sales tax on cars & vehicles. When it comes time to file sales tax in texas you must do three things: Contact the department of revenue. Web texas sales tax returns are always due the 20th of the month following the reporting period.

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF

For applicable taxes, quarterly reports are due in april, july, october and january. When it comes time to file sales tax in texas you must do three things: Filing your texas sales tax returns online Your business's sales tax return must be filed by the 20th of the month following reporting period. Web calendar of texas sales tax filing dates.

Ultimate Texas Sales Tax Guide Zamp

Your business's sales tax return must be filed by the 20th of the month following reporting period. How to file and pay sales tax in texas in 2024. However, these rates increase to 8.25% in almost every texas jurisdiction as cities, counties, special districts, and transit authorities can each impose up to a 2% sales tax. Contact the department of.

Your Business's Sales Tax Return Must Be Filed By The 20Th Of The Month Following Reporting Period.

Web the state sales tax in texas is 6.25%. When it comes time to file sales tax in texas you must do three things: Web welcome to the new sales tax rate locator. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and.

Web Texas Sales And Use Tax Faqs About Prepayment Discounts, Extensions And Amendments.

Contact the department of revenue. Web 2024 reporting due dates for taxes, fees and reports. As a business operating in texas, it’s important to know the specific sales tax rate for the areas you operate in. Web the state sales tax rate in texas is currently 6.25%.

Depending On The Volume Of Sales Taxes You.

Web businesses that cross the texas economic nexus threshold must register. Web the sales tax rate for texas sales is 6.25 percent for 2022. Filing your texas sales tax returns online List of sales tax holidays.

Web A Sales Tax Holiday Is An Annual Event During Which The Texas Comptroller Of Public.

Franchise tax is a privilege tax on taxable entities doing business in texas. Sales tax on cars & vehicles. Top where to file your texas sales tax return: There are two types of sales tax designations in texas: