Tax Form 8959

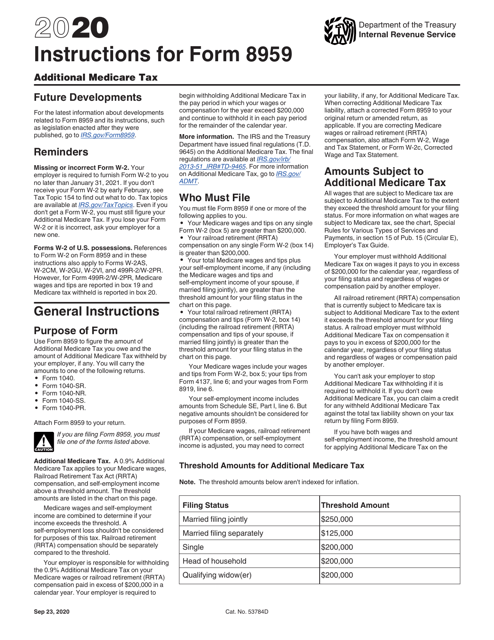

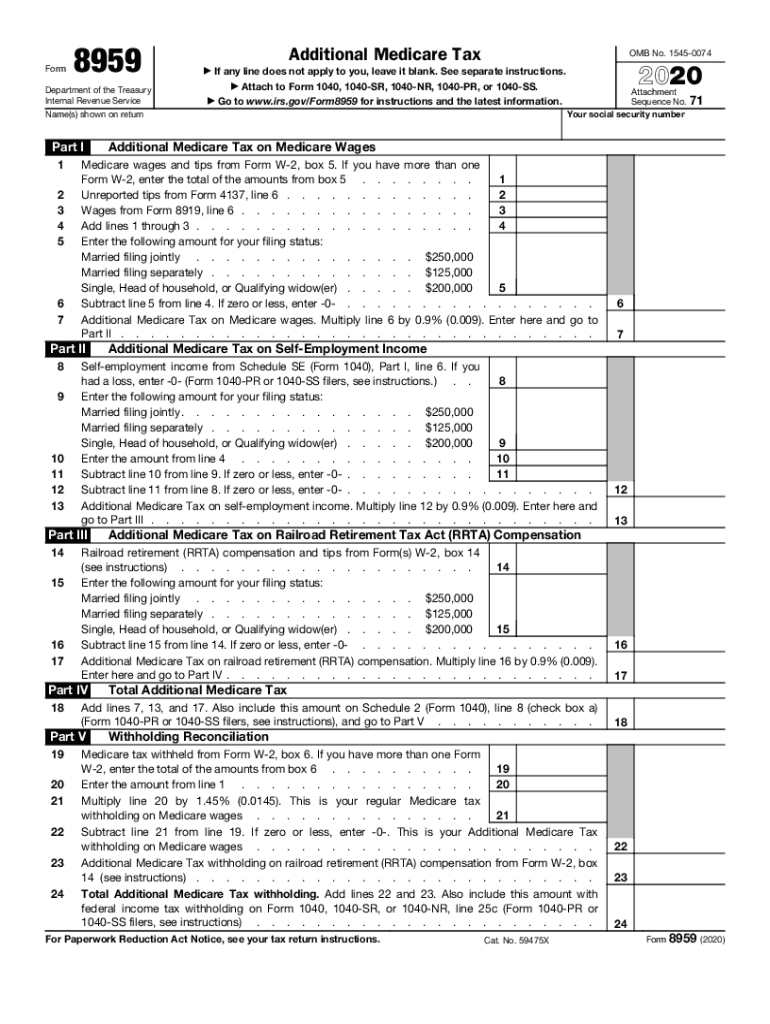

Tax Form 8959 - File your form 2290 online & efile with the irs. Then just send it to the irs! Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. 63rd st.) using cash, check or credit card. You will carry the amounts to. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. 12th st.) or at the water services department (4800 e. File your taxes for free. Threshold amounts for additional medicare tax. Use this form to figure the.

Modify the pdf form template to get a document required in your city. Then just send it to the irs! File your taxes for free. 63rd st.) using cash, check or credit card. Sign in to your account. File your form 2290 today avoid the rush. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web what is form 8959? Web water bills can be paid online or in person at city hall (414 e.

Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web water bills can be paid online or in person at city hall (414 e. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web level 1 why is turbotax telling me i need to file form 8959 when i am below the income threshold? You will carry the amounts to. If filing jointly, you’ll need to add medicare wages,. Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. Web what is form 8959?

Forms Needed To File Self Employment Employment Form

Use this form to figure the. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Get irs approved instant schedule 1 copy. You will carry the amounts to.

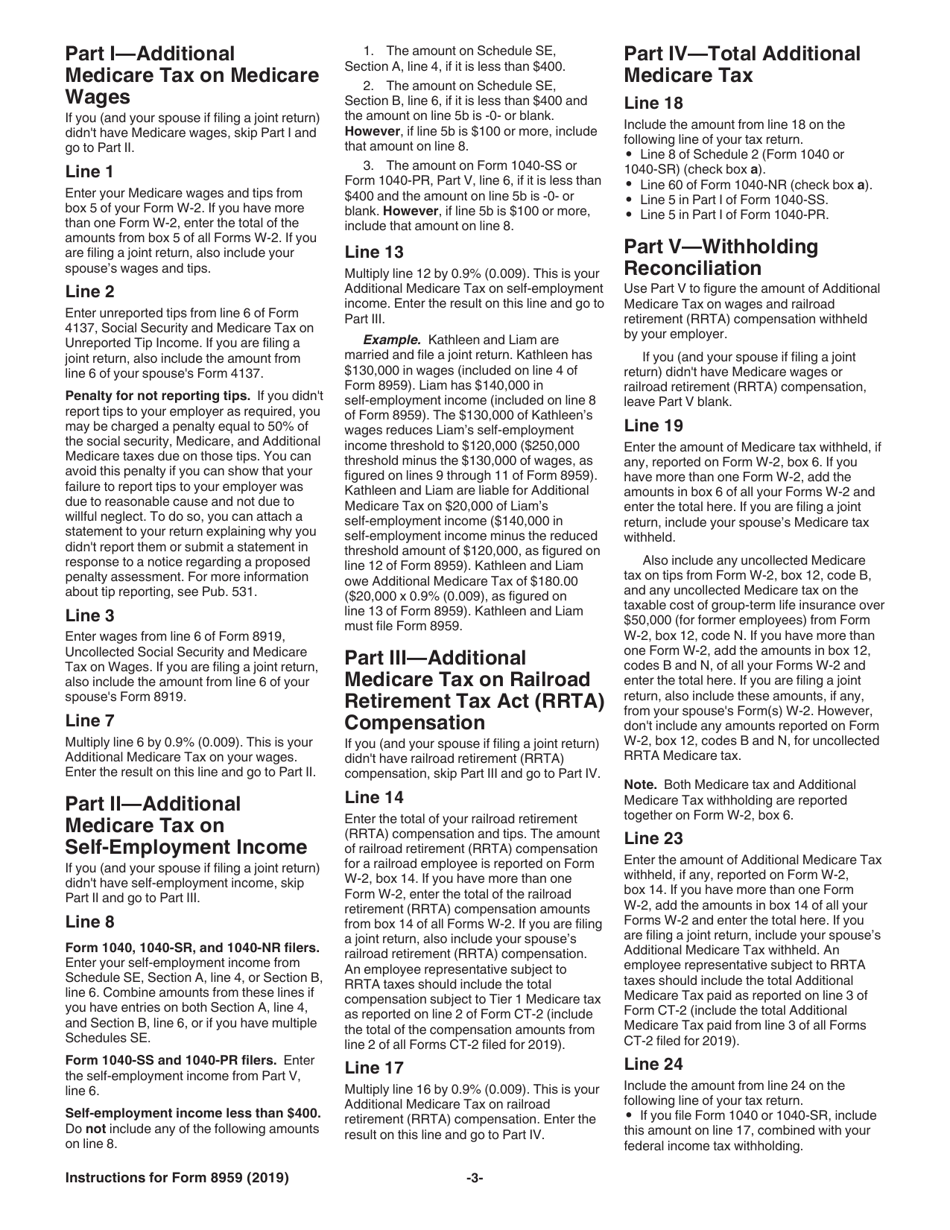

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

If filing jointly, you’ll need to add medicare wages,. Form 8959, additional medicare tax, is used to figure the additional 0.9% percent. File your form 2290 today avoid the rush. Web how can we help you? Web what is form 8959?

Form 8959 Additional Medicare Tax (2014) Free Download

Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Modify the pdf form template to get a document required in your city. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any..

2014 federal form 8962 instructions

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Then just send it to the irs! Web who must pay the additional medicare taxes how to complete and file irs form 8959 where to find this tax form let’s start by.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Form 8959, additional medicare tax, is used to figure the additional 0.9% percent. Solved•by turbotax•869•updated january 13, 2023. Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. 12th st.) or at the water.

What Is Form 8959 Additional Medicare Tax TurboTax Tax Tips & Videos

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web water bills can be paid online or in person at city hall (414 e. Web who must pay the additional medicare taxes how to complete and file irs form 8959 where.

Form 8959 Fill Out and Sign Printable PDF Template signNow

Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. Threshold amounts for additional medicare tax. If filing jointly, you’ll need to add medicare wages,. Then just send it to the irs! Web what.

1099 Misc Fillable Form Free amulette

Web instructions for form 8959: Sign in to your account. Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. Web what is form 8959? 12th st.) or at the water services department (4800.

Form 8959 Additional Medicare Tax (2014) Free Download

Web level 1 why is turbotax telling me i need to file form 8959 when i am below the income threshold? Use this form to figure the. Threshold amounts for additional medicare tax. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web medicare tax has.

Web How Can We Help You?

Use this form to figure the. Web who must pay the additional medicare taxes how to complete and file irs form 8959 where to find this tax form let’s start by walking through this tax form, step. Web water bills can be paid online or in person at city hall (414 e. Starting in tax year 2022 the qualified widow (er) filing status has been renamed to.

Ad Don't Leave It To The Last Minute.

You will carry the amounts to. Form 8959, additional medicare tax, is used to figure the additional 0.9% percent. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Modify the pdf form template to get a document required in your city.

File Your Taxes For Free.

Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. Solved•by turbotax•869•updated january 13, 2023. File your form 2290 today avoid the rush.

Ad Download Or Email Irs 8959 & More Fillable Forms, Register And Subscribe Now!

Web instructions for form 8959: Sign in to your account. Get irs approved instant schedule 1 copy. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all.