Tax Form 8862 Turbotax

Tax Form 8862 Turbotax - You can create the form in turbotax. Answer the questions accordingly, and we’ll include form 8862 with your return. You must be a citizen of the united states, and must live in the u.s. Web tax tips & video homepage. How do i enter form. Terms and conditions may vary and are subject to change without notice. Information to claim earned income credit after disallowance video: File an extension in turbotax online before the deadline to avoid a late filing penalty. Web several standards must be met for you to claim the eic: More about the federal form 8862 tax credit

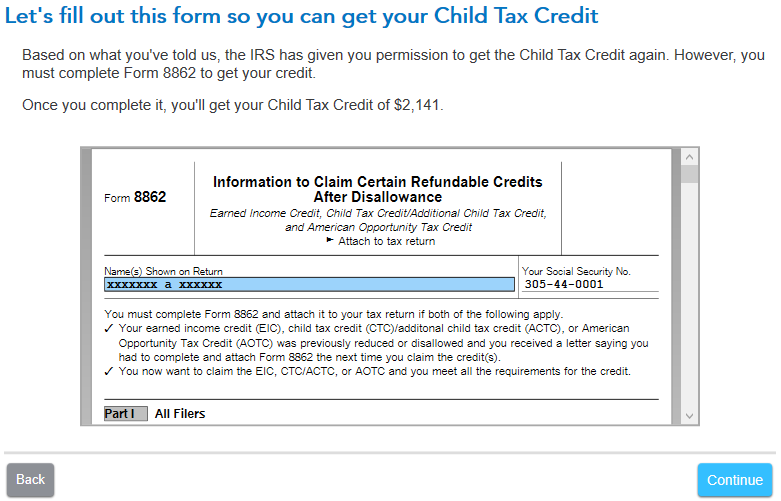

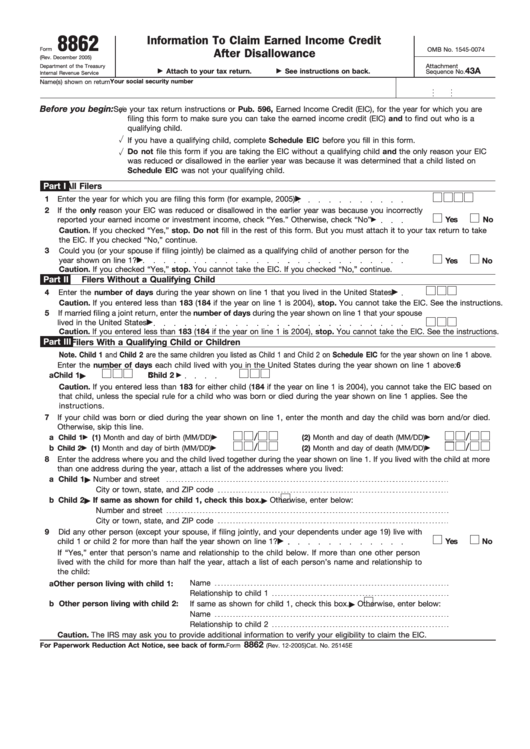

Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits Attach to your tax return. Turbotax deluxe online 1 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Terms and conditions may vary and are subject to change without notice. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. You can't be a qualifying child on another return. 596, earned income credit (eic), for the year for which you arefiling this form to make sure you can take the earned income credit (eic) and to find out who is aqualifying child. If you have a qualifying child, complete schedule eic before you fill in this form. Reconcile it with any advance payments of the premium tax. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned income tax credit (eitc), child tax credit, additional child tax credit, credit for other dependents, or american opportunity tax credit.

596, earned income credit (eic), for the year for which you arefiling this form to make sure you can take the earned income credit (eic) and to find out who is aqualifying child. Click here to view the turbotax article. Web taxpayers complete form 8862 and attach it to their tax return if: How do i clear and start over in turbotax online? You can create the form in turbotax. Turbotax deluxe online 1 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. File taxes with no income. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. More about the federal form 8862 tax credit Here's how to file form 8862 in turbotax.

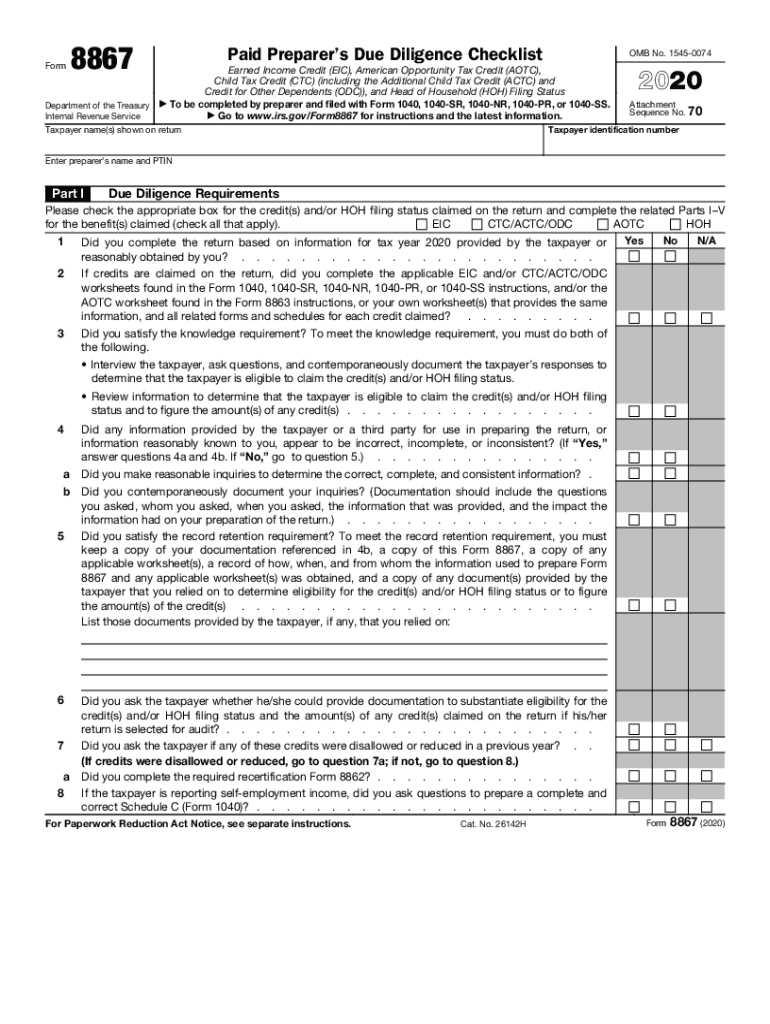

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

Information to claim certain credits after disallowance. File taxes with no income. How do i enter form. Click here to view the turbotax article. Information to claim earned income credit after disallowance video:

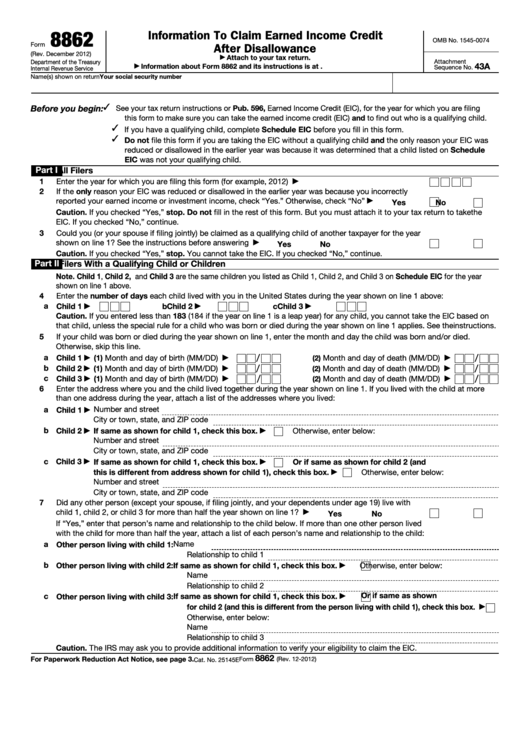

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

November 2018) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service. Married filing jointly vs separately. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Follow these steps to add it to your taxes.

Fillable Form 8862 Information To Claim Earned Credit After

Web taxpayers complete form 8862 and attach it to their tax return if: Web how do i file an irs extension (form 4868) in turbotax online? Web before you begin:usee your tax return instructions or pub. Married filing jointly vs separately. You can create the form in turbotax.

how do i add form 8862 TurboTax® Support

Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math or clerical error, you must include form 8862, information to claim certain credits after disallowance with your next tax return. You can't be a qualifying.

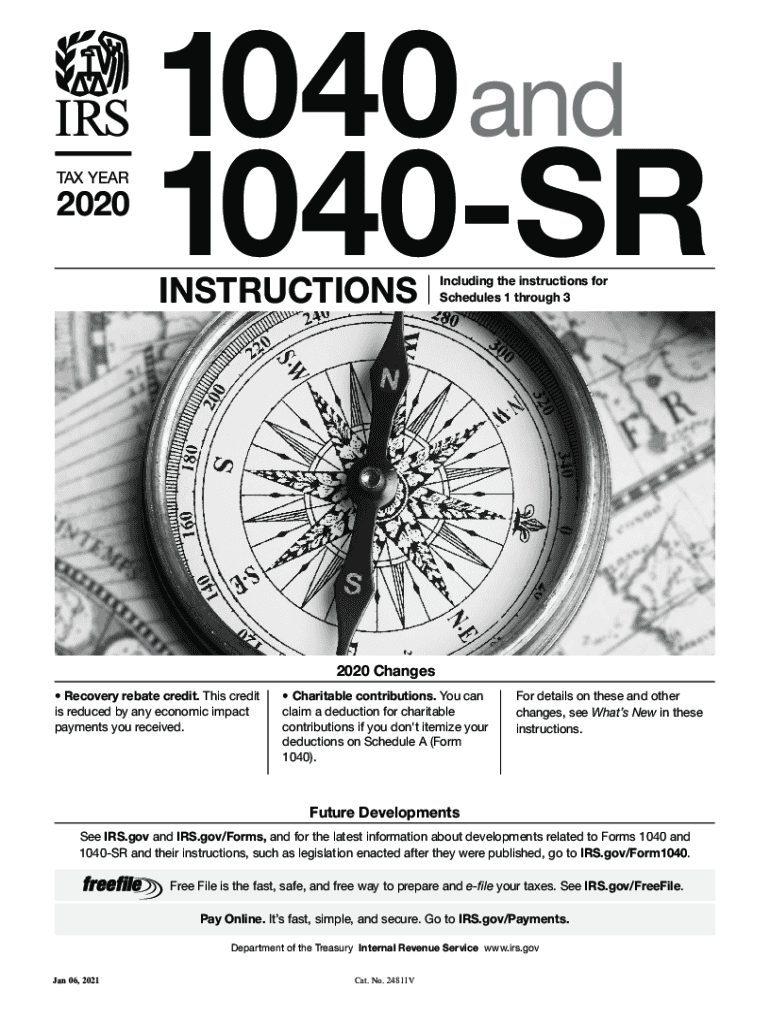

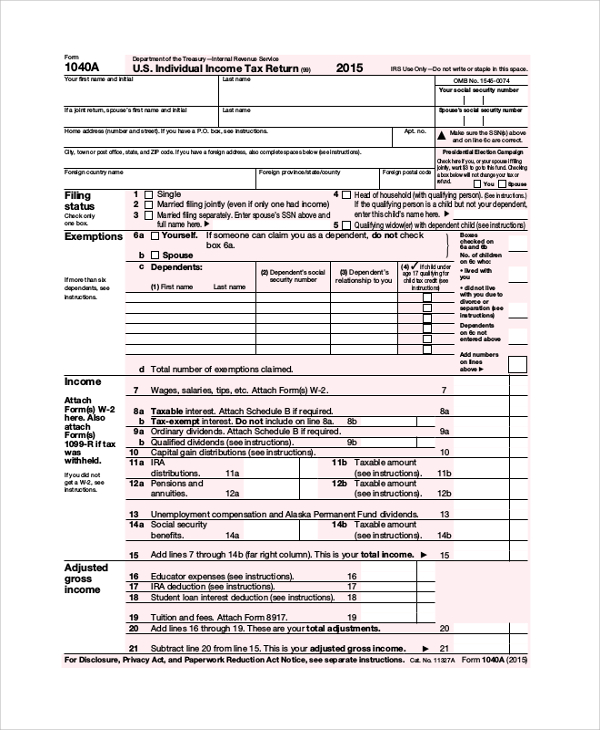

2020 Form IRS 1040 Instructions Fill Online, Printable, Fillable, Blank

You must be a citizen of the united states, and must live in the u.s. 596, earned income credit (eic), for the year for which you arefiling this form to make sure you can take the earned income credit (eic) and to find out who is aqualifying child. Web how do i file an irs extension (form 4868) in turbotax.

Form 8862Information to Claim Earned Credit for Disallowance

Web for the latest updates on coronavirus tax relief related to this page, check irs.gov/coronavirus. If you have a qualifying child, complete schedule eic before you fill in this form. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. You must complete form 8862 and attach it to your tax return.

Form 8862 Information To Claim Earned Credit After

Web tax tips & video homepage. The irs automatically provides filing and penalty relief to any taxpayer with an irs address of record located in the disaster area. You can't be a qualifying child on another return. Web before you begin:usee your tax return instructions or pub. Web taxpayers complete form 8862 and attach it to their tax return if:

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section references are to the internal revenue code.

turbotax tax treaty Fill Online, Printable, Fillable Blank form

For more answers to your questions, visit turbotax.com. Here's how to file form 8862 in turbotax. We can help you file form 8862. For turbotax live full service, your tax expert will amend your 2022 tax return for you through 11/15/2023. Once you complete the form, you’ll be able to claim the eic.

FREE 7+ Sample Tax Forms in PDF

Web for the latest updates on coronavirus tax relief related to this page, check irs.gov/coronavirus. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after 1996. For more than half of the year. We can help you file form 8862..

Web Before You Begin:usee Your Tax Return Instructions Or Pub.

Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). Savings and price comparison based on anticipated price increase. Easily fill out pdf blank, edit, and sign them. Web instructions for form 8862 (rev.

Earned Income Credit (Eic), Child Tax Credit (Ctc), Refundable Child Tax Credit (Rctc), Additional Child Tax Credit (Actc), Credit For Other Dependents (Odc), And American Opportunity Tax Credit (Aotc)

We can help you file form 8862. You can't be a qualifying child on another return. Guide to head of household. What is irs form 2441?

Web Federal — Information To Claim Earned Income Credit After Disallowance Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

December 2022) department of the treasury internal revenue service. Click here to view the turbotax article. Married filing jointly vs separately. Information to claim certain credits after disallowance.

You Must Have Earned Income For The Tax Year And A Valid Social Security Number (Ssn).

You can create the form in turbotax. File taxes with no income. Web taxpayers complete form 8862 and attach it to their tax return if: Web you do not need to file form 8862 in the year the credit was disallowed or reduced.