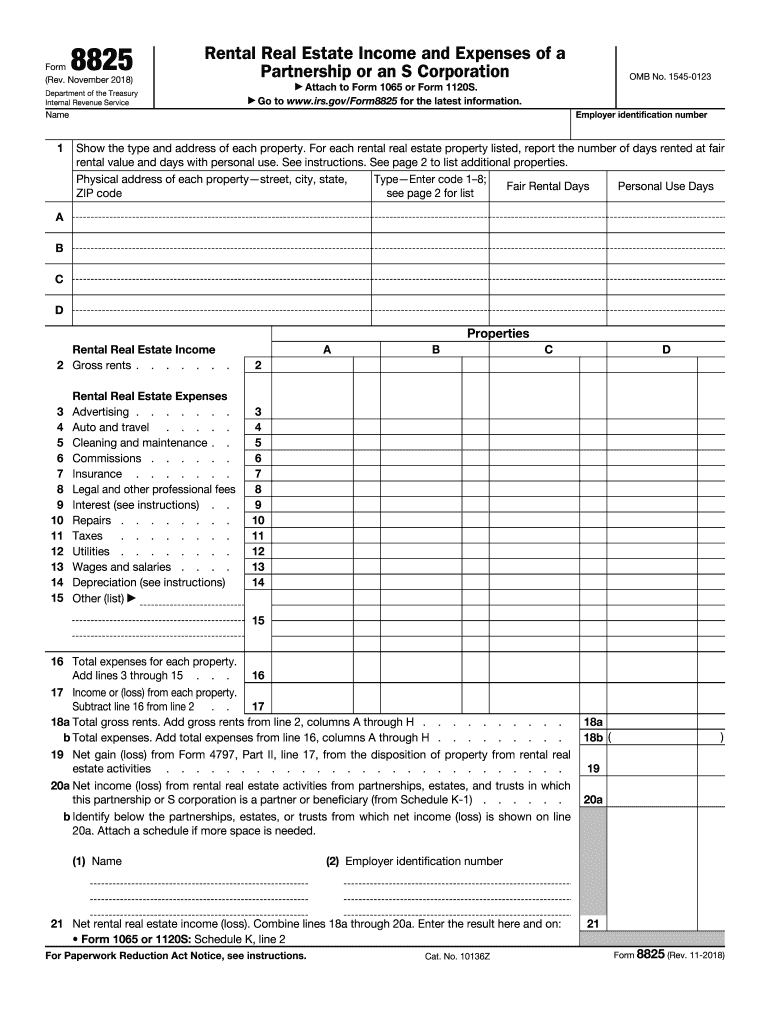

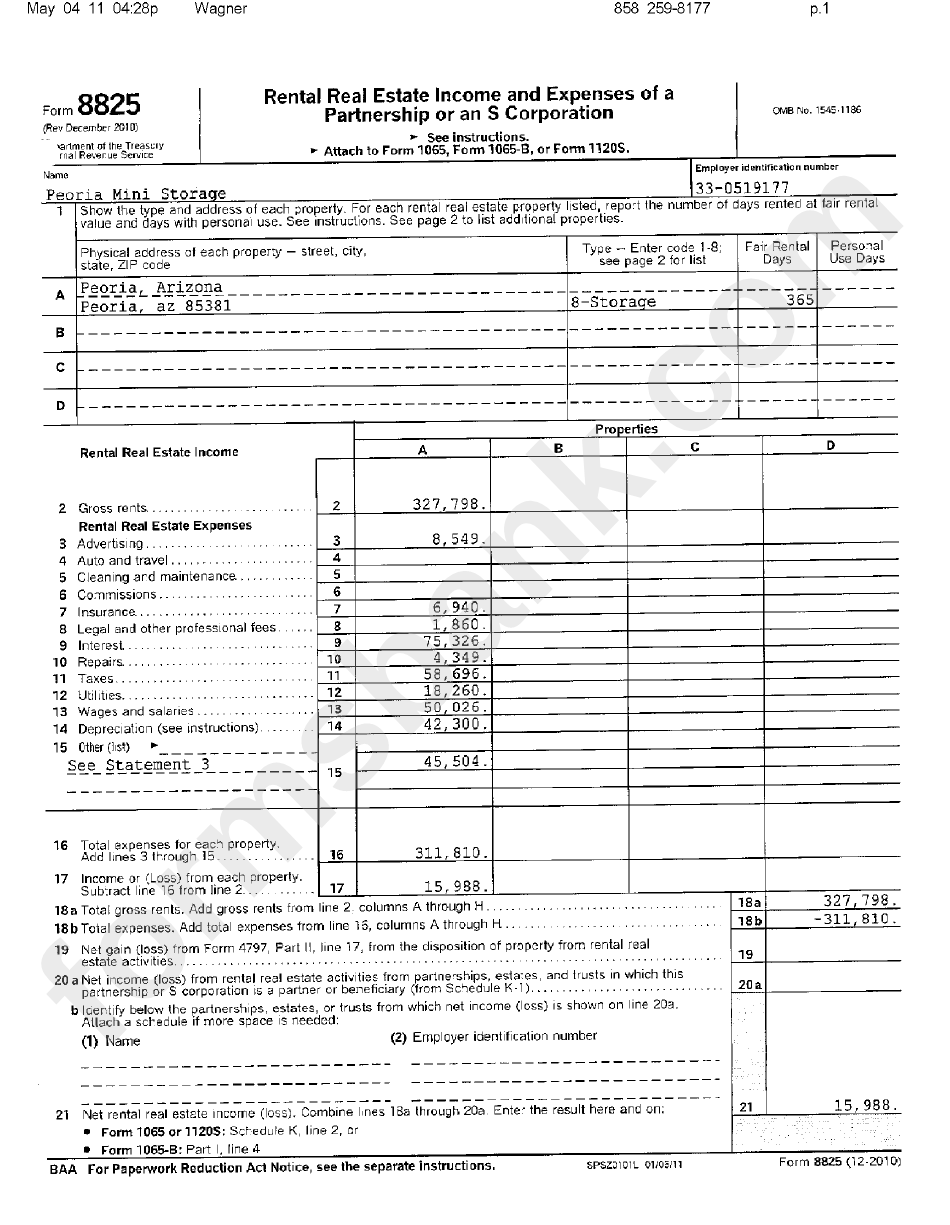

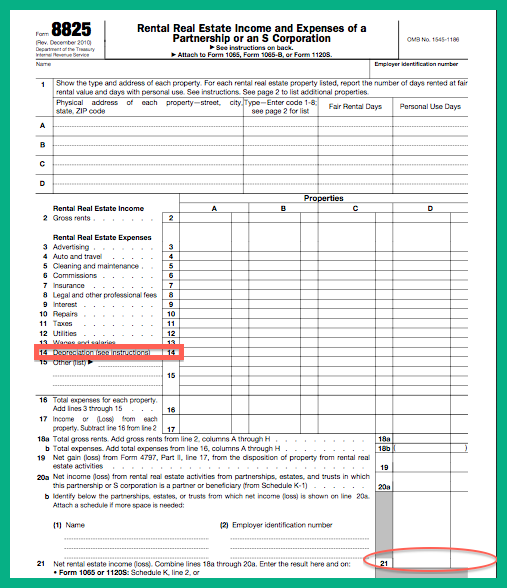

Tax Form 8825

Tax Form 8825 - All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. November 2018) department of the treasury internal revenue service. Form 8825 is used to report income and deductible expenses from rental real estate activities. You will need this form to complete the data. Rental real estate income and expenses of a partnership or an s corporation. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Go to www.irs.gov/form8825 for the latest information. Then it flows through to the owner’s return.

In plain english, it is the company version of the schedule e rental real estate form we often see. Go to www.irs.gov/form8825 for the latest information. In that case, you will need to include the income and expenses of each property on the form. Rental real estate income and expenses of a partnership or an s corporation. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Attach to form 1065 or form 1120s. If you are reporting partnership. Web form 8825 reports the rental income of partnerships or s corporations in the united states. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided.

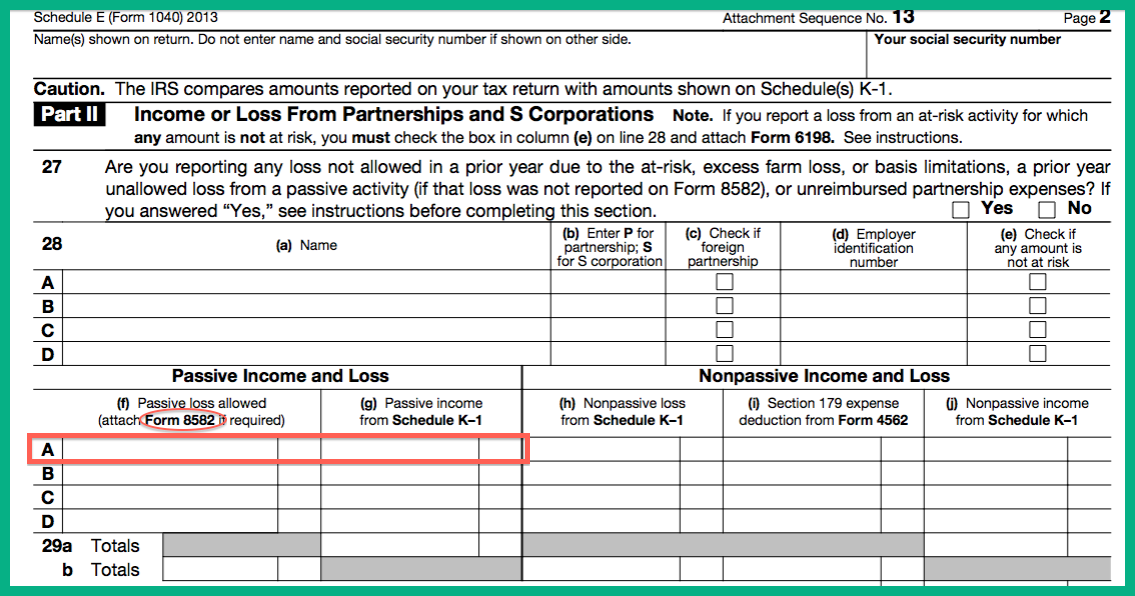

Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. November 2018) department of the treasury internal revenue service. If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Rental real estate income and expenses of a partnership or an s corporation. You will need this form to complete the data. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. In that case, you will need to include the income and expenses of each property on the form. In plain english, it is the company version of the schedule e rental real estate form we often see.

20182022 Form IRS 8825 Fill Online, Printable, Fillable, Blank pdfFiller

Go to www.irs.gov/form8825 for the latest information. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. Web an 8825 form is officially.

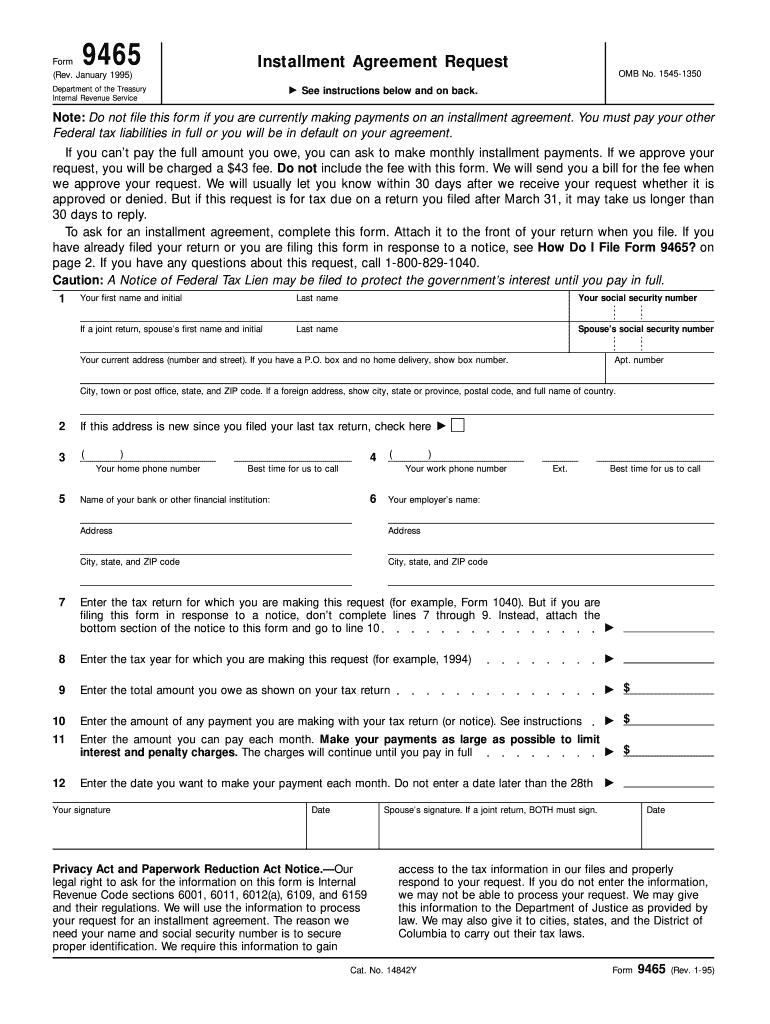

Form 9465 Installment Agreement Request Fill Out and Sign Printable

In that case, you will need to include the income and expenses of each property on the form. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Rental real estate income and expenses of a partnership or an s corporation. Form 8825 is used to.

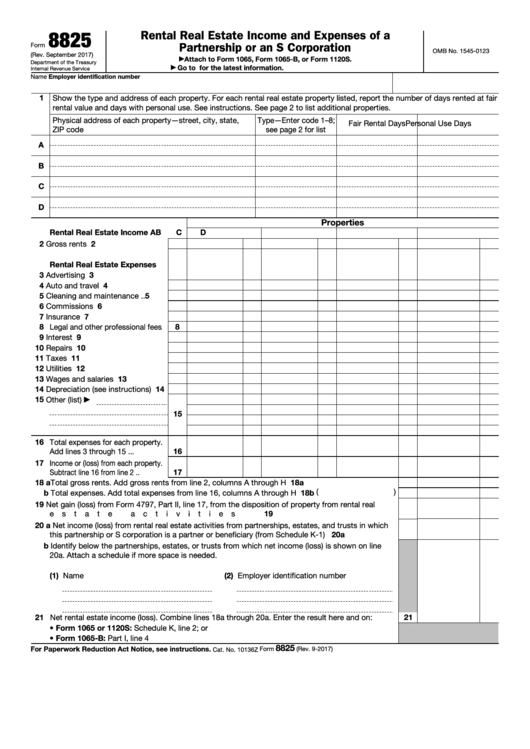

Top 6 Form 8825 Templates free to download in PDF format

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Form 8825 is used to report income and deductible expenses from rental real estate activities. Web the 8825 is the real estate form and.

Form 8805 Foreign Partner's Information Statement of Section 1446 Wi…

In that case, you will need to include the income and expenses of each property on the form. Go to www.irs.gov/form8825 for the latest information. You will need this form to complete the data. Attach to form 1065 or form 1120s. If the owner is an individual, their share goes to schedule e, page two line 28 column f or.

Fill Free fillable Form 8825 Rental Real Estate and Expenses

In plain english, it is the company version of the schedule e rental real estate form we often see. November 2018) department of the treasury internal revenue service. If you are reporting partnership. Go to www.irs.gov/form8825 for the latest information. You will need this form to complete the data.

Linda Keith CPA » All about the 8825

Web form 8825 reports the rental income of partnerships or s corporations in the united states. In plain english, it is the company version of the schedule e rental real estate form we often see. November 2018) department of the treasury internal revenue service. Web the 8825 is the real estate form and it flows to the schedule k instead.

Form 8825 Rental Real Estate And Expenses Of A printable pdf

If you are reporting partnership. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Go to www.irs.gov/form8825 for the latest information. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. Web.

How To Add Airbnb on Your Tax Return VacationLord

All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. You.

Linda Keith CPA » All about the 8825

Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. In plain english, it is the company version of the schedule e rental real estate form we often see. Web an 8825 form is officially called a rental real estate income.

Rental Real Estate Income And Expenses Of A Partnership Or An S Corporation.

Form 8825 is used to report income and deductible expenses from rental real estate activities. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Then it flows through to the owner’s return. Web form 8825 reports the rental income of partnerships or s corporations in the united states.

November 2018) Rental Real Estate Income And Expenses Of A Partnership Or An S Corporation Department Of The Treasury Internal Revenue Service Employer Identification Number Name 1 Omb No.

Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form8825 for the latest information.

If You Are Reporting Partnership.

Attach to form 1065 or form 1120s. If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. In plain english, it is the company version of the schedule e rental real estate form we often see. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income.

Web An 8825 Form Is Officially Called A Rental Real Estate Income And Expenses Of A Partnership Or An S Corp.

In that case, you will need to include the income and expenses of each property on the form. November 2018) department of the treasury internal revenue service. You will need this form to complete the data.