Tax Form 7203

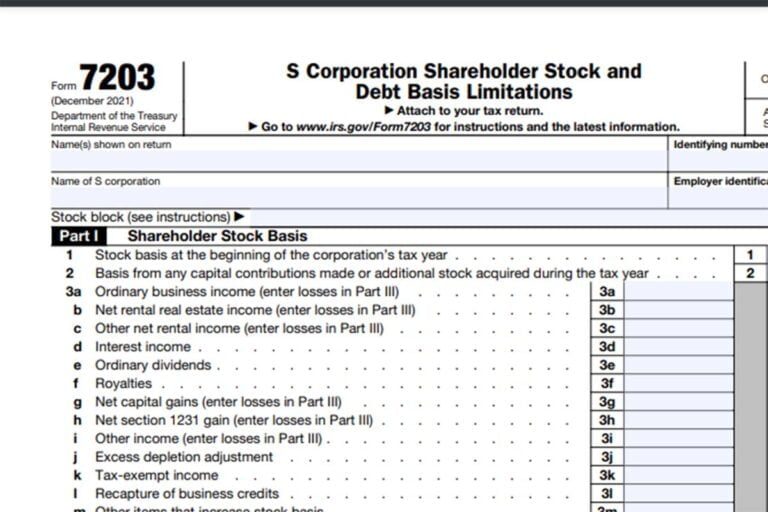

Tax Form 7203 - Web form 7203 is generated for a 1040 return when: Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Go to www.irs.gov/form7203 for instructions and the latest information. Distributions will also be reported on this form after the other basis components are included. If form 7203 is not populating, make sure at least one of the following is true: Web about form 7203, s corporation shareholder stock and debt basis limitations. Form 8582, passive activity loss limitations; Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. This form helps you calculate the adjusted basis of your stock and debt in the corporation. Web form 7203 is filed by s corporation shareholders who:

For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. This form helps you calculate the adjusted basis of your stock and debt in the corporation. Web form 7203 is generated for a 1040 return when: There are various restrictions on how much corporate losses you can write off on your tax return, and this form assists you in remaining compliant with those. The new form is required to be filed by an s corporation shareholder to report shareholder basis. And form 461, limitation on business losses. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 is filed by s corporation shareholders who: S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns.

Distributions will also be reported on this form after the other basis components are included. Web form 7203 is generated for a 1040 return when: Web form 7203 s corporation shareholder stock and debt basis limitations form 7203 (december 2021) department of the treasury internal revenue service s corporation shareholder stock and debt basis limitations attach to your tax return. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web form 7203 has three parts: Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. And form 461, limitation on business losses. Web about form 7203, s corporation shareholder stock and debt basis limitations. Go to www.irs.gov/form7203 for instructions and the latest information. There are various restrictions on how much corporate losses you can write off on your tax return, and this form assists you in remaining compliant with those.

IRS Proposes New Form 7203 for S Corporation Shareholders to Report

December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. And form 461, limitation on business losses. Web form 7203 is generated for a 1040 return when: The new form is required to be filed by an s corporation shareholder to report shareholder basis. Go to www.irs.gov/form7203 for instructions.

IRS Issues New Form 7203 for Farmers and Fishermen

Distributions will also be reported on this form after the other basis components are included. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. If form 7203 is not populating, make sure at least one of the following is true: Web form 7203 is filed by s corporation.

National Association of Tax Professionals Blog

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. If form 7203 is not populating, make sure at least one of the following is true: This form helps you calculate the adjusted basis of your stock and debt in the corporation. Web.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 8582, passive activity loss limitations; Web form 7203 has three parts: Distributions will also be reported on this form after the other basis components are included. And form 461, limitation on business losses. For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in.

National Association of Tax Professionals Blog

Web form 7203 is filed by s corporation shareholders who: The new form is required to be filed by an s corporation shareholder to report shareholder basis. And form 461, limitation on business losses. For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. Web form 7203 is used to calculate.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Form 8582, passive activity loss limitations; This form helps you calculate the adjusted basis of your stock and debt in the corporation. Distributions will also be reported on this form after the other basis components are included. Web form 7203.

Peerless Turbotax Profit And Loss Statement Cvp

Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. This form helps you calculate the adjusted basis of your stock and debt in the corporation. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits,.

Form7203PartI PBMares

Web form 7203 s corporation shareholder stock and debt basis limitations form 7203 (december 2021) department of the treasury internal revenue service s corporation shareholder stock and debt basis limitations attach to your tax return. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and.

More Basis Disclosures This Year for S corporation Shareholders Need

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. There are various restrictions on how much corporate losses you can write off on your tax return, and this form assists you in remaining compliant with those. S corporation shareholders use form 7203.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Form 8582, passive activity loss limitations; Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web form 7203 s corporation shareholder stock and debt basis limitations form 7203 (december 2021) department of the treasury internal revenue service s corporation shareholder stock and.

For Example, Your Deductible Loss Generally Can’t Be Greater Than The Cost Of Your Investment (Stock And Loans) In.

Web about form 7203, s corporation shareholder stock and debt basis limitations. Go to www.irs.gov/form7203 for instructions and the latest information. Web form 7203 is filed by s corporation shareholders who: Web form 7203 has three parts:

The New Form Is Required To Be Filed By An S Corporation Shareholder To Report Shareholder Basis.

And form 461, limitation on business losses. This form helps you calculate the adjusted basis of your stock and debt in the corporation. There are various restrictions on how much corporate losses you can write off on your tax return, and this form assists you in remaining compliant with those. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax.

Web Form 7203 Is Generated For A 1040 Return When:

Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Distributions will also be reported on this form after the other basis components are included. Form 8582, passive activity loss limitations; If form 7203 is not populating, make sure at least one of the following is true:

Web Form 7203 S Corporation Shareholder Stock And Debt Basis Limitations Form 7203 (December 2021) Department Of The Treasury Internal Revenue Service S Corporation Shareholder Stock And Debt Basis Limitations Attach To Your Tax Return.

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns.