Tax Abatement Form Nevada

Tax Abatement Form Nevada - Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for: Contact the department holiday schedule public records request department of taxation. Web nevada department of business and industry division of industrial relations occupational safety and health administration. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Abatement of 50 percent of the 1.378%. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. _____ this section to be completed for residential properties only:

Web (fox5) by alexis fernandez published: Rate on quarterly wages exceeding $50,000. Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. 27, 2023 at 4:53 pm pdt las vegas, nev. 2022 projects 2021 projects 2020 projects previous projects statutes. Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web nevada from 2014 through 2019. Web to save time and money, submit a property tax cap claim form for your property in churchill county.

Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. What is the partial tax abatement or the. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web nevada department of business and industry division of industrial relations occupational safety and health administration. Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Rate on quarterly wages exceeding $50,000. 27, 2023 at 4:53 pm pdt las vegas, nev. Web to save time and money, submit a property tax cap claim form for your property in churchill county. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. Web renewable energy tax abatement application.

Form 843 Claim for Refund and Request for Abatement Definition

Rate on quarterly wages exceeding $50,000. _____ this section to be completed for residential properties only: Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for: Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web state of nevada tax abatements are.

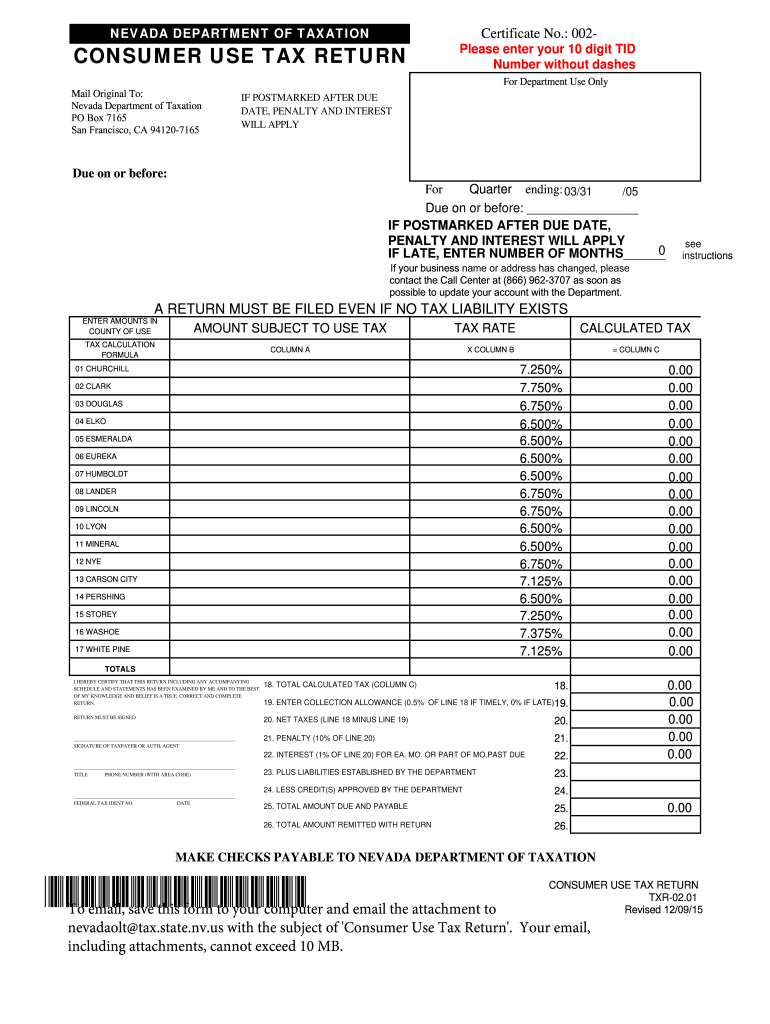

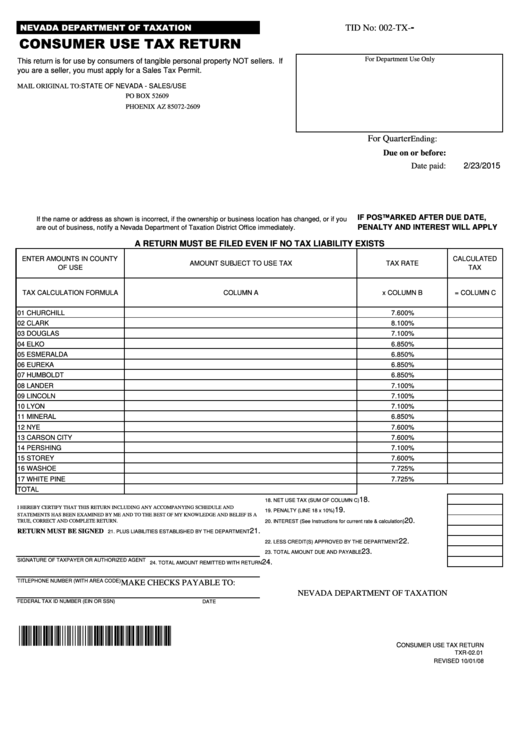

20152022 Form NV TXR02.01 Fill Online, Printable, Fillable, Blank

Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. _____ this section to be completed for residential properties only: Web (fox5) by alexis fernandez published: Contact the department holiday schedule public records request department of taxation. Web the state/goed offers standard tax abatements that include sales and use.

Nevada Redetermination Fill Out and Sign Printable PDF Template signNow

Personal property tax abatement of. 27, 2023 at 4:53 pm pdt las vegas, nev. Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Abatement of 50 percent of the 1.378%. Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax.

NYC 421a Tax Abatement What it is and how you can benefit from it?

Web (fox5) by alexis fernandez published: Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web state of nevada tax abatements are regulatory abatements, regulated by statute that sets criteria each company must meet in order to qualify for abatements.

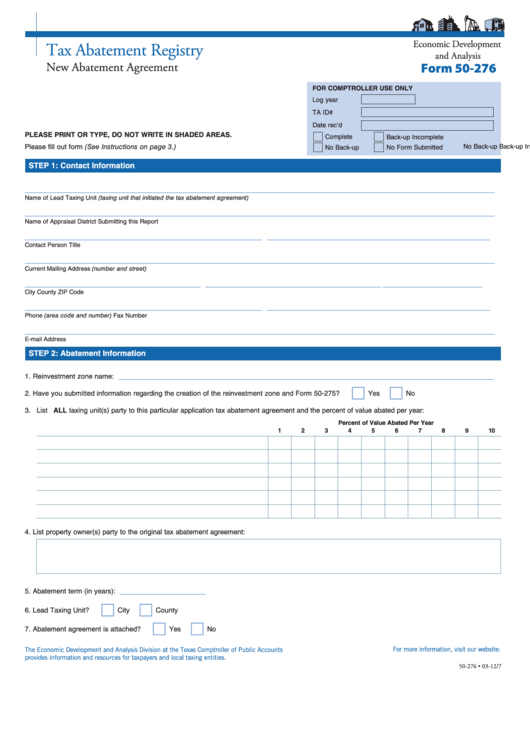

Fillable Form 50276 Tax Abatement Registry Texas Comptroller Of

27, 2023 at 4:53 pm pdt las vegas, nev. Personal property tax abatement of. Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web nevada from 2014 through 2019. Contact the department holiday schedule public records request department of taxation.

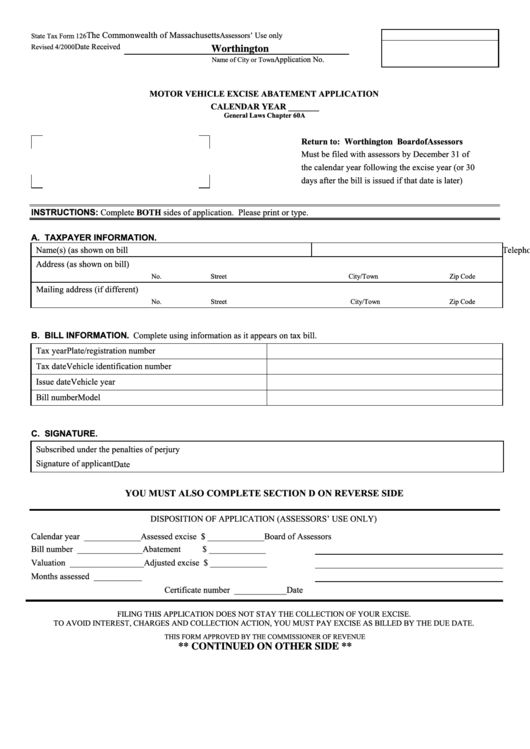

State Tax Form 126 Motor Vehicle Excise Abatement Application

Web (fox5) by alexis fernandez published: Rate on quarterly wages exceeding $50,000. Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of. Web of the.

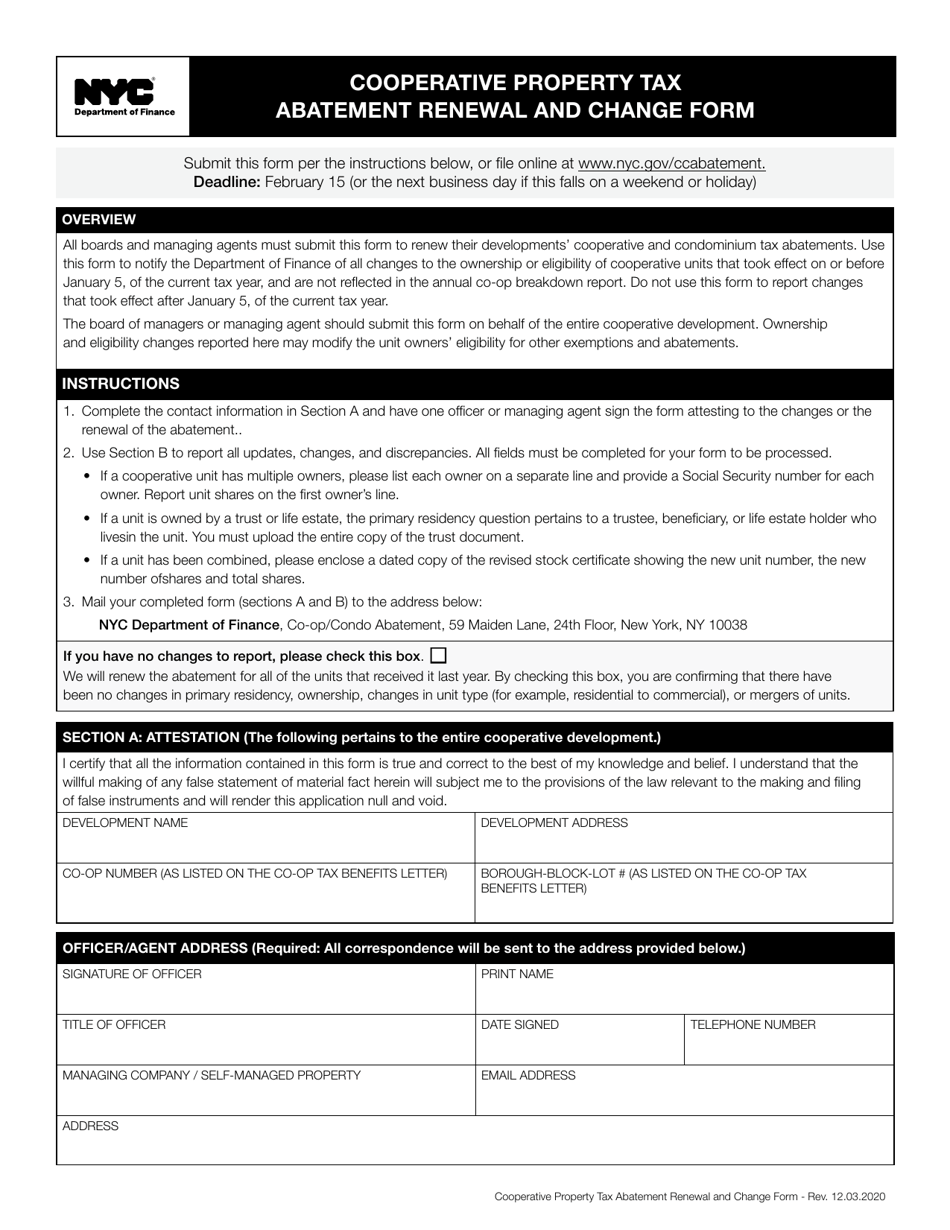

New York City Cooperative Property Tax Abatement Renewal and Change

Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web.

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web of the facilities granted a partial sales and use.

State Of Nevada Sales Tax Rates By County Literacy Ontario Central South

Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for: Web nevada department of business and industry division of industrial relations occupational safety and health administration..

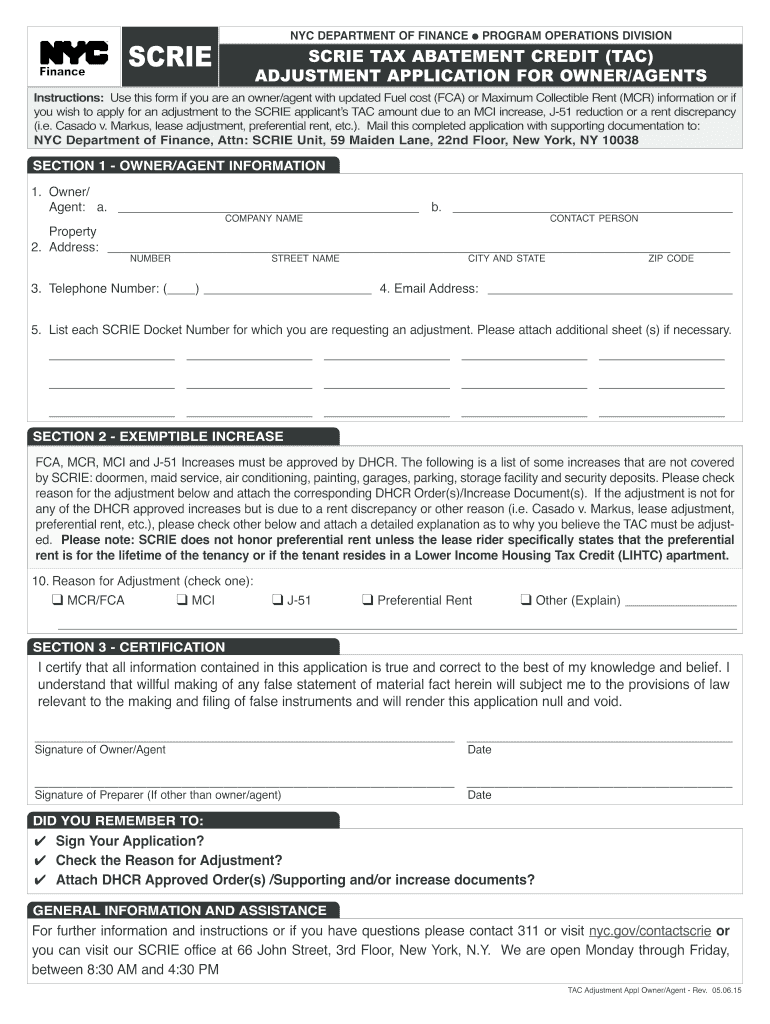

New York Tac Tax Abatement Fill Online, Printable, Fillable, Blank

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement.

Web Currently, Properties Qualifying As The Owner's Primary Residence Will Receive A 3% Tax Cap, All Other Properties Are Subject To The “Other” Tax Cap, Also Known As The “Commercial.

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web (fox5) by alexis fernandez published: _____ this section to be completed for residential properties only: Personal property tax abatement of.

Tax Abatements Are A Reduction Of Taxes Granted By A Government Entity To A Company For A Specific Period Of.

Web the state/goed offers standard tax abatements that include sales and use tax abatements on capital equipment purchases, abatements on personal property and. Rate on quarterly wages exceeding $50,000. Web renewable energy tax abatement application. Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for:

Web Abated Projects Goe Has Approved 54 Tax Abatement Applications Since The Program Began In 2010.

2022 projects 2021 projects 2020 projects previous projects statutes. Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. What is the partial tax abatement or the. Web nevada department of business and industry division of industrial relations occupational safety and health administration.

27, 2023 At 4:53 Pm Pdt Las Vegas, Nev.

Web nevada from 2014 through 2019. Contact the department holiday schedule public records request department of taxation. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)