Ss4 Form Sample

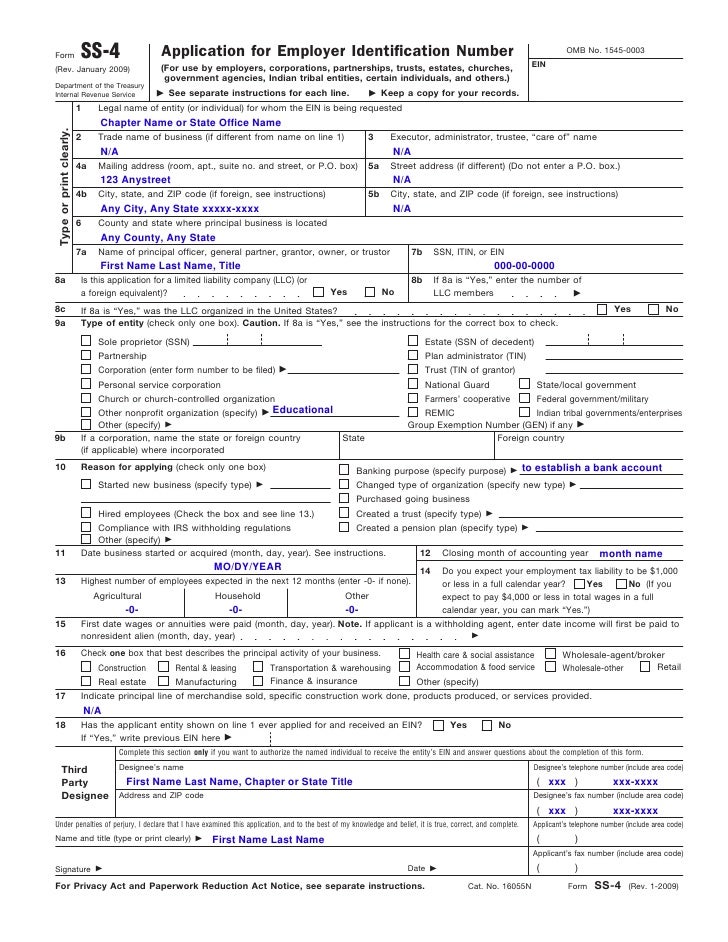

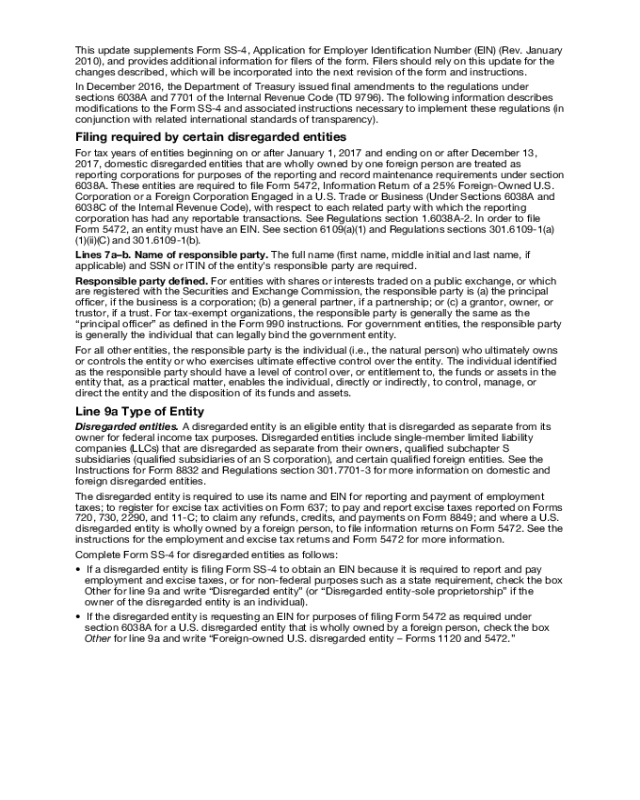

Ss4 Form Sample - Enter c/o mcfi fiscal agent. Also, see do i need an ein? Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein. Web primary business activity, products and services (i.e. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Get your online template and fill it in using progressive features. Web how to fill out and sign ss 4 letter sample online? The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id.

An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. Legal name of entity (or individual) for whom the ein is being requested. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? On this fein form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying. Federal tax reporting opening a business bank account The information you provide on this form will establish your business tax account. If approved, the irs will then issue an employer identification number (ein) that the business will use with their. Enjoy smart fillable fields and interactivity. Web primary business activity, products and services (i.e. Enter legal name of entity (or individual) for whom the ein is being requested;

Get your online template and fill it in using progressive features. February 2006) government agencies, indian tribal entities, certain individuals, and others.) department of The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id. An ein is required for several reasons, including: What are examples of ss4 letter? Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). Web primary business activity, products and services (i.e. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? What it is and how to find yours you can get the form online or. The information you provide on this form will establish your business tax account.

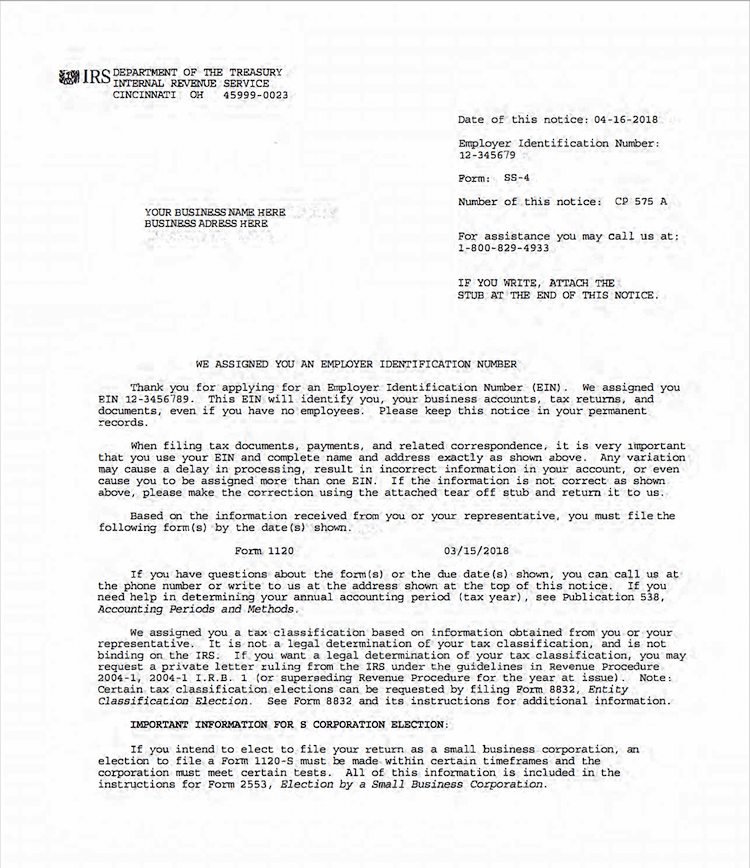

SS4 EIN Registration Letter ASAP Help Center

What it is and how to find yours you can get the form online or. An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. Make sure your business name is spelled correctly and that it looks the same on this line as it appears on your articles of incorporation or official business.

Irs Ss4 Form

Some of the circumstances under which a new number may be required are as follows: December 2019) department of the treasury internal revenue service. This is where you put your official business name. An ein is required for several reasons, including: The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file.

Instructions for the Form SS4 Limited Liability Company Irs Tax Forms

When completed, this form is submitted to the irs. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Legal name of entity (or individual) for whom the ein is being requested. This includes obtaining an employer identification number (ein) from the irs. Federal.

Sample EIN SS4 Application Form 2009

An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? December 2019) department of the treasury internal revenue service. Application for employer identification number (for use by.

Form ss4 Employer identification number, Online application, Business

Web primary business activity, products and services (i.e. Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). This is where you put your official business name. Web if you already have an ein, and the organization (entity) or ownership of your business changes, you may need.

denisewy's blog Decreased tax withholding rate on royalties for NonUS

December 2019) department of the treasury internal revenue service. When completed, this form is submitted to the irs. Enter c/o mcfi fiscal agent. Federal tax reporting opening a business bank account On this fein form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying.

How to Get A Copy Of Your Form SS4 Letter Excel Capital

Enjoy smart fillable fields and interactivity. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? An ein is required for several reasons, including: Federal tax reporting opening a business bank account February 2006) government agencies, indian tribal entities, certain individuals, and others.) department of

Form ss4 Edit, Fill, Sign Online Handypdf

Legal name of entity (or individual) for whom the ein is being requested. Federal tax reporting opening a business bank account The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id. An ein is required for.

Ss4 Irs Form amulette

Also, see do i need an ein? If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein. What it is and how to find yours you can get the form online or. The information you provide on this form will establish your business tax account. Web if.

Form SS4 Example Demo YouTube

What are examples of ss4 letter? Enter c/o mcfi fiscal agent. Some of the circumstances under which a new number may be required are as follows: Get your online template and fill it in using progressive features. Legal name of entity (or individual) for whom the ein is being requested.

Enter Legal Name Of Entity (Or Individual) For Whom The Ein Is Being Requested;

Make sure your business name is spelled correctly and that it looks the same on this line as it appears on your articles of incorporation or official business formation documents. If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein. February 2006) government agencies, indian tribal entities, certain individuals, and others.) department of The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id.

Federal Tax Reporting Opening A Business Bank Account

Legal name of entity (or individual) for whom the ein is being requested. If approved, the irs will then issue an employer identification number (ein) that the business will use with their. Enter c/o mcfi fiscal agent. Web primary business activity, products and services (i.e.

Web If You Already Have An Ein, And The Organization (Entity) Or Ownership Of Your Business Changes, You May Need To Apply For A New Number.

Get your online template and fill it in using progressive features. An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. On this fein form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying. This is where you put your official business name.

An Ein Is Your Business’s Taxpayer Identification Number (Tin) And Is Assigned To You For Business Purposes Only.

An ein is required for several reasons, including: Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? Enjoy smart fillable fields and interactivity. Enter title as hhcsr (home healthcare service recipient).