Schedule M-3 Form 1120 Instructions

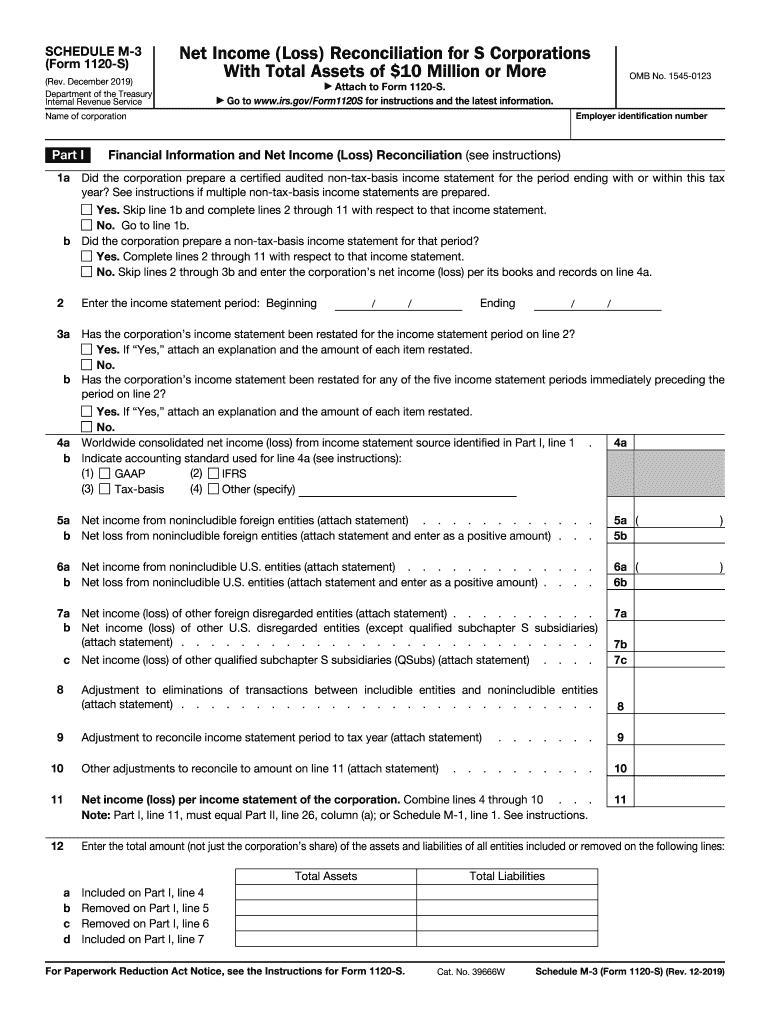

Schedule M-3 Form 1120 Instructions - “who must file any corporation required to file form 1120s. Corporation (or consolidated tax group, if applicable), as reported. Top 13mm (1⁄ 2) center sides. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Web revenue code unless otherwise noted. That reports on schedule l of form 1120s.

December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. “who must file any corporation required to file form 1120s. Top 13mm (1⁄ 2) center sides. That reports on schedule l of form 1120s. Corporation (or consolidated tax group, if applicable), as reported. Web revenue code unless otherwise noted.

Top 13mm (1⁄ 2) center sides. “who must file any corporation required to file form 1120s. Corporation (or consolidated tax group, if applicable), as reported. That reports on schedule l of form 1120s. Web revenue code unless otherwise noted. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of.

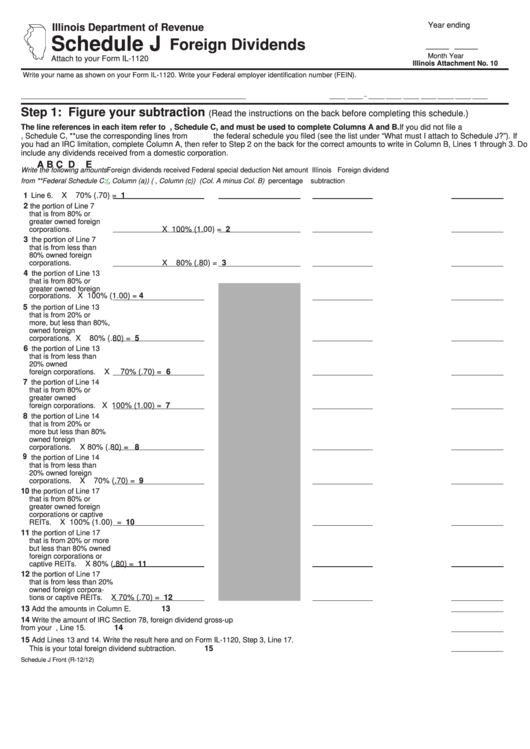

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. That reports on schedule l of form 1120s. Top 13mm (1⁄ 2) center sides. Corporation (or consolidated tax group, if applicable), as reported. Web revenue code unless otherwise noted.

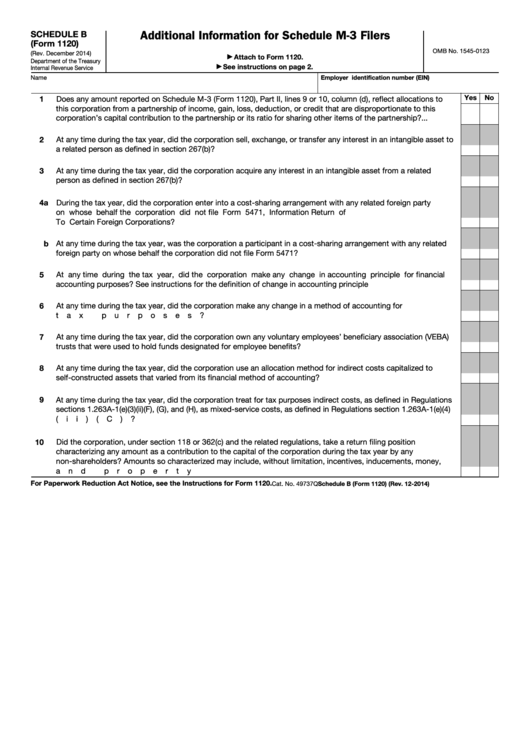

Fillable Form 1120 Additional Information For Schedule M3 Filers

That reports on schedule l of form 1120s. Top 13mm (1⁄ 2) center sides. Corporation (or consolidated tax group, if applicable), as reported. “who must file any corporation required to file form 1120s. Web revenue code unless otherwise noted.

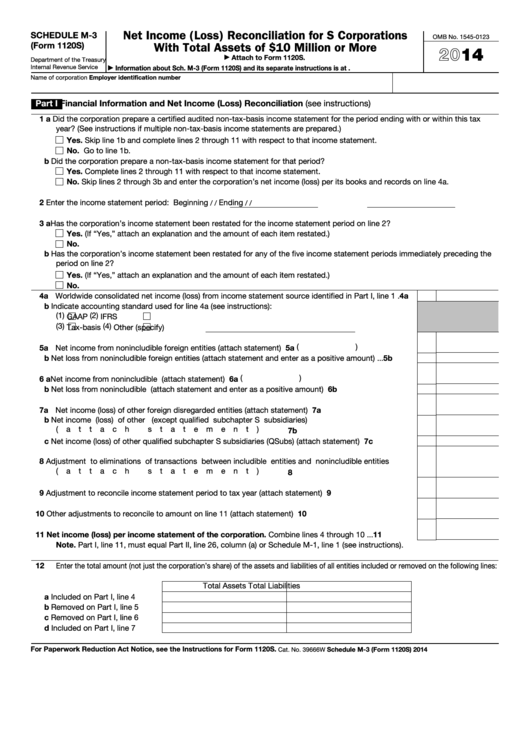

Fillable Schedule M3 (Form 1120s) Net (Loss) Reconciliation

Corporation (or consolidated tax group, if applicable), as reported. “who must file any corporation required to file form 1120s. Web revenue code unless otherwise noted. Top 13mm (1⁄ 2) center sides. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of.

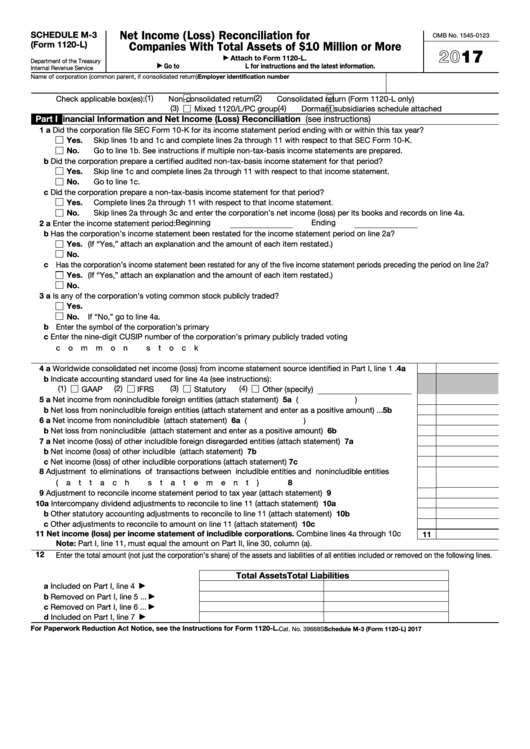

Fill Free fillable Form 1120L schedule m3 2019 PDF form

Corporation (or consolidated tax group, if applicable), as reported. “who must file any corporation required to file form 1120s. That reports on schedule l of form 1120s. Web revenue code unless otherwise noted. Top 13mm (1⁄ 2) center sides.

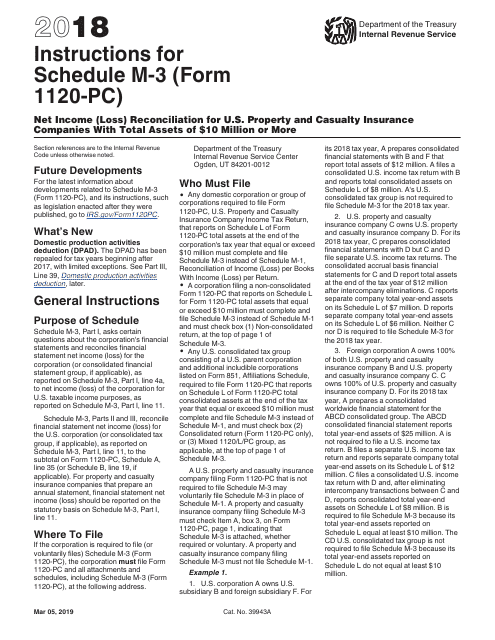

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

“who must file any corporation required to file form 1120s. That reports on schedule l of form 1120s. Corporation (or consolidated tax group, if applicable), as reported. Top 13mm (1⁄ 2) center sides. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of.

Form 1120F (Schedule M3) Net Reconciliation for Foreign

December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Top 13mm (1⁄ 2) center sides. That reports on schedule l of form 1120s. Corporation (or consolidated tax group, if applicable), as reported. “who must file any corporation required to file form 1120s.

Form 1120 (Schedule M3) Net Reconciliation for Corporations

December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Top 13mm (1⁄ 2) center sides. “who must file any corporation required to file form 1120s. Corporation (or consolidated tax group, if applicable), as reported. That reports on schedule l of form 1120s.

Fillable Schedule M3 (Form 1120L) Net (Loss) Reconciliation

“who must file any corporation required to file form 1120s. That reports on schedule l of form 1120s. Corporation (or consolidated tax group, if applicable), as reported. Web revenue code unless otherwise noted. Top 13mm (1⁄ 2) center sides.

Download Instructions for IRS Form 1120PC Schedule M3 Net

That reports on schedule l of form 1120s. Web revenue code unless otherwise noted. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. “who must file any corporation required to file form 1120s. Corporation (or consolidated tax group, if applicable), as reported.

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

Corporation (or consolidated tax group, if applicable), as reported. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Top 13mm (1⁄ 2) center sides. Web revenue code unless otherwise noted. That reports on schedule l of form 1120s.

Corporation (Or Consolidated Tax Group, If Applicable), As Reported.

Web revenue code unless otherwise noted. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. That reports on schedule l of form 1120s. Top 13mm (1⁄ 2) center sides.