Schedule B Form 990 Instructions

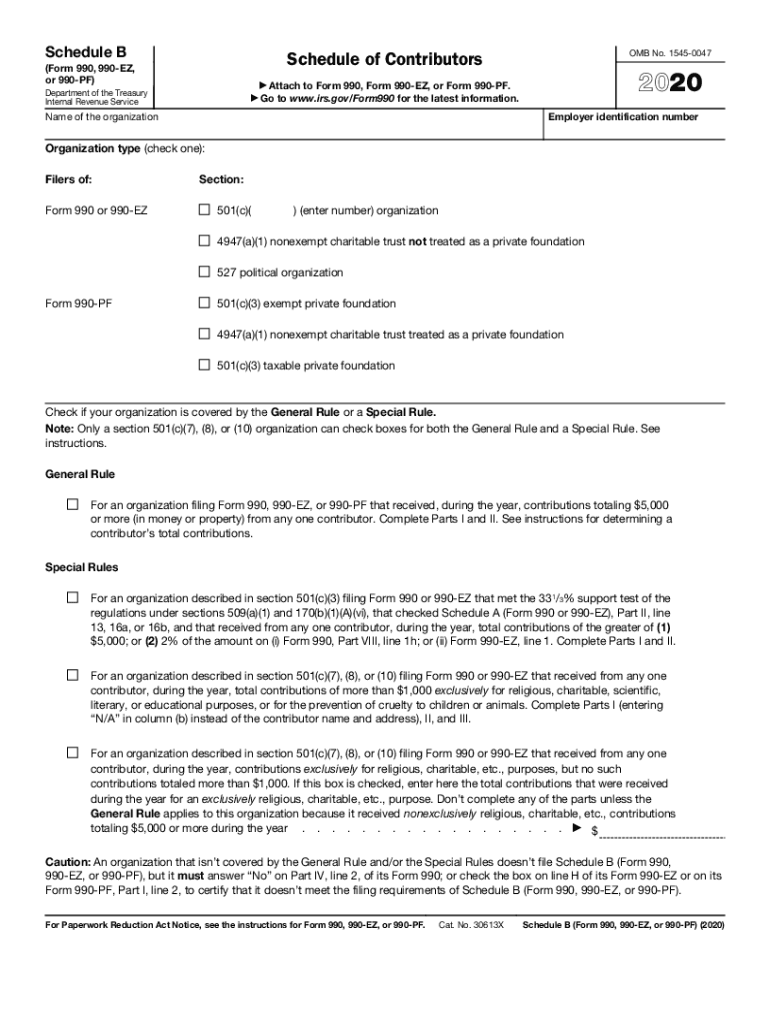

Schedule B Form 990 Instructions - (column (b) must equal form 990, part x, col. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. For other organizations that file. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: Under section 3101 of p. In general, first complete the core form, and then complete alphabetically. Web schedule b (form 990) department of the treasury internal revenue service schedule of. As such, up until recently, the state of california. Web see the schedule b instructions to determine the requirements for filing.

Web schedule b (form 990) department of the treasury internal revenue service schedule of. If you checked 12d of part i, complete sections a and d, and complete part v.). Under section 3101 of p. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Baa for paperwork reduction act notice, see the instructions for. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; As such, up until recently, the state of california. (column (b) must equal form 990, part x, col. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o.

Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear. States that do not require. Baa for paperwork reduction act notice, see the instructions for. Web see the schedule b instructions to determine the requirements for filing. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. (column (b) must equal form 990, part x, col. Under section 3101 of p. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web schedule b (form 990) department of the treasury internal revenue service schedule of.

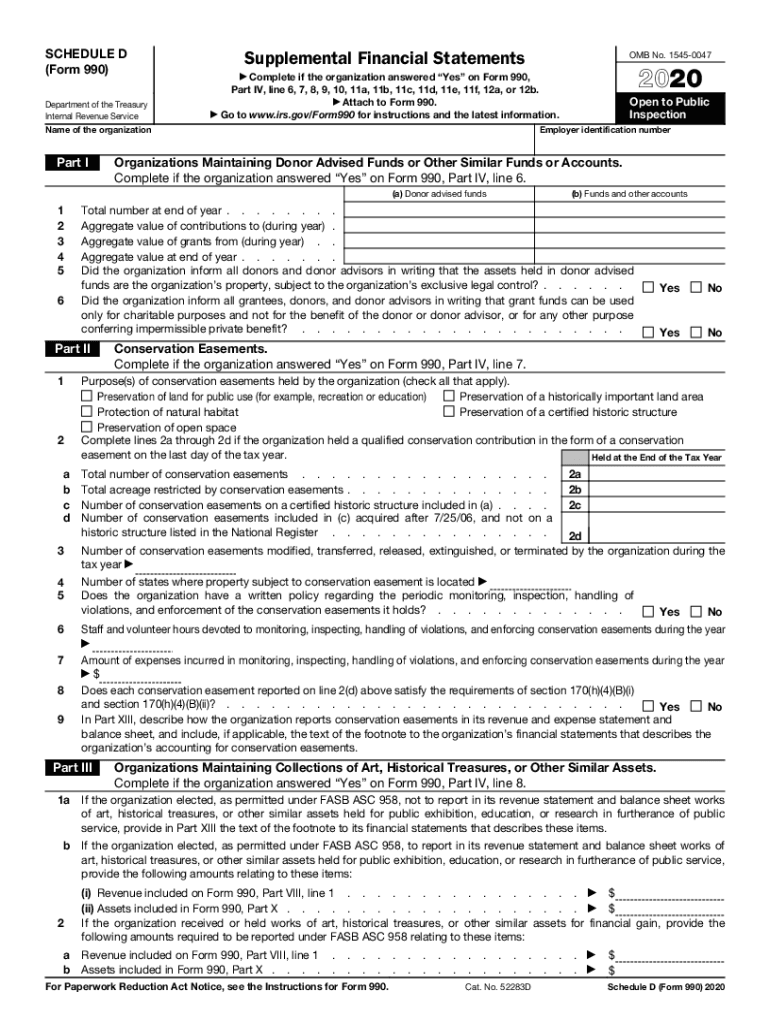

Schedule D Form 990 Supplemental Financial Statements Fill Out and

If you checked 12d of part i, complete sections a and d, and complete part v.). For other organizations that file. For other organizations that file. If the return is not required to file schedule b, one of the following lines will be marked no on the return. Web while the federal filing requirements are clear for schedule b, the.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web schedule b (form 990) department of the treasury internal revenue service schedule of. Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear. As such, up until recently, the state of california. In general, first complete the core form, and.

Form 990 (Schedule H) Hospitals (2014) Free Download

Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web the instructions to schedule b states that contributors include: Under section 3101 of p. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: Web an organization that isn’t covered by the general rule and/or the special rules.

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

Baa for paperwork reduction act notice, see the instructions for. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. (column (b) must equal form 990, part x, col. Web schedule b (form 990) department of the treasury internal revenue service schedule of. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4:

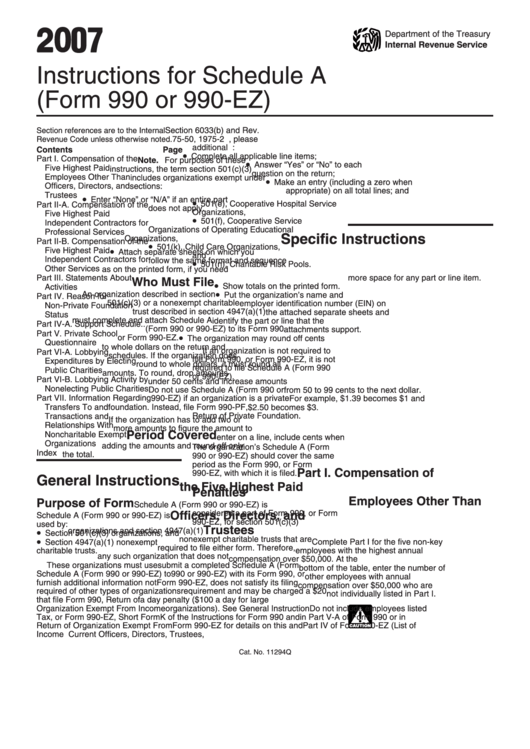

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. For other organizations that file. (column (b) must equal form 990, part x, col. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4:

form 990 schedule m instructions 2017 Fill Online, Printable

Web effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure requirements on form 990,. (column (b) must equal form 990, part x, col. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal. Corporation trust.

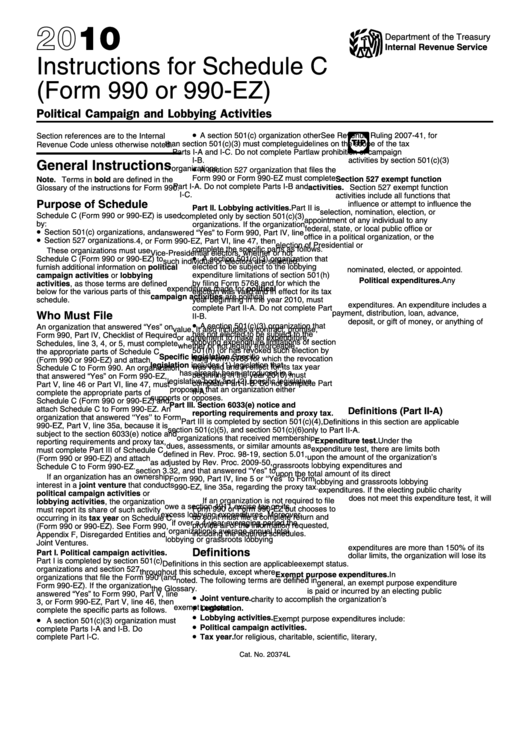

Instructions For Schedule C (Form 990 Or 990Ez) Political Campaign

Web schedule b (form 990) department of the treasury internal revenue service schedule of. In general, first complete the core form, and then complete alphabetically. Under section 3101 of p. Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear. States that do not require.

2010 Form 990 Schedule A Instructions

(column (b) must equal form 990, part x, col. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal. As such, up until recently, the state of california..

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Under section 3101 of p. Web the instructions to schedule b states that contributors include: If the return is not required to file schedule b, one of the following lines will be marked no on the return. Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. Web an organization that isn’t covered by the general rule and/or the special rules.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

In general, first complete the core form, and then complete alphabetically. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. Schedule o (form 990) 2022 name of the organization lha (form.

If The Return Is Not Required To File Schedule B, One Of The Following Lines Will Be Marked No On The Return.

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. If you checked 12d of part i, complete sections a and d, and complete part v.). As such, up until recently, the state of california.

For Other Organizations That File.

(column (b) must equal form 990, part x, col. Web see the schedule b instructions to determine the requirements for filing. Web schedule b (form 990) department of the treasury internal revenue service schedule of. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o.

Web Effective May 28, 2020, The Internal Revenue Service (Irs) Issued Final Treasury Regulations Addressing Donor Disclosure Requirements On Form 990,.

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Baa for paperwork reduction act notice, see the instructions for. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal.

States That Do Not Require.

Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Under section 3101 of p. In general, first complete the core form, and then complete alphabetically.