Ohio State Income Tax Extension Form

Ohio State Income Tax Extension Form - (no explanation required by the irs). Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. The ohio department of taxation provides a searchable repository of individual tax forms for. Web ohio income tax form requests welcome to the ohio department of taxation tax form request service information needed for requesting a tax form: Ohio automatically extends the deadline to oct. Web access the forms you need to file taxes or do business in ohio. The form gives a person or agency access to provide info about unemployment taxes. Web the ohio department of taxation will be offering extended hours for telephone assistance for ohio taxpayers filing individual and/or school district income tax returns. 10 what should i do if i filed my federal return using an ohio address, but. Pay all or some of your ohio income taxes online via:

Web 9 how can i get an extension to file my ohio individual and/or school district income tax returns? Ohio automatically extends the deadline to oct. Pay all or some of your ohio income taxes online via: Get 6 months automatic extension. The form gives a person or agency access to provide info about unemployment taxes. If you owe oh income taxes, you will either have to submit a oh tax return or. More information and registration can be found at. If you pay your state income. 10 what should i do if i filed my federal return using an ohio address, but. Web extended deadline with ohio tax extension:

Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. The ohio department of taxation provides a searchable repository of individual tax forms for. Web allows you to electronically make ohio individual income and school district income tax payments. Web download or print the 2022 ohio form it 40p (income tax payment voucher) for free from the ohio department of taxation. Ohio automatically extends the deadline to oct. Web the ohio department of taxation will be offering extended hours for telephone assistance for ohio taxpayers filing individual and/or school district income tax returns. Web you can make a state extension payment using ohio form it 40p (income tax payment voucher), or by going online to the ohio “epayment” portal:. This includes extension and estimated payments, original and amended. Get 6 months automatic extension. Web ohio filing due date:

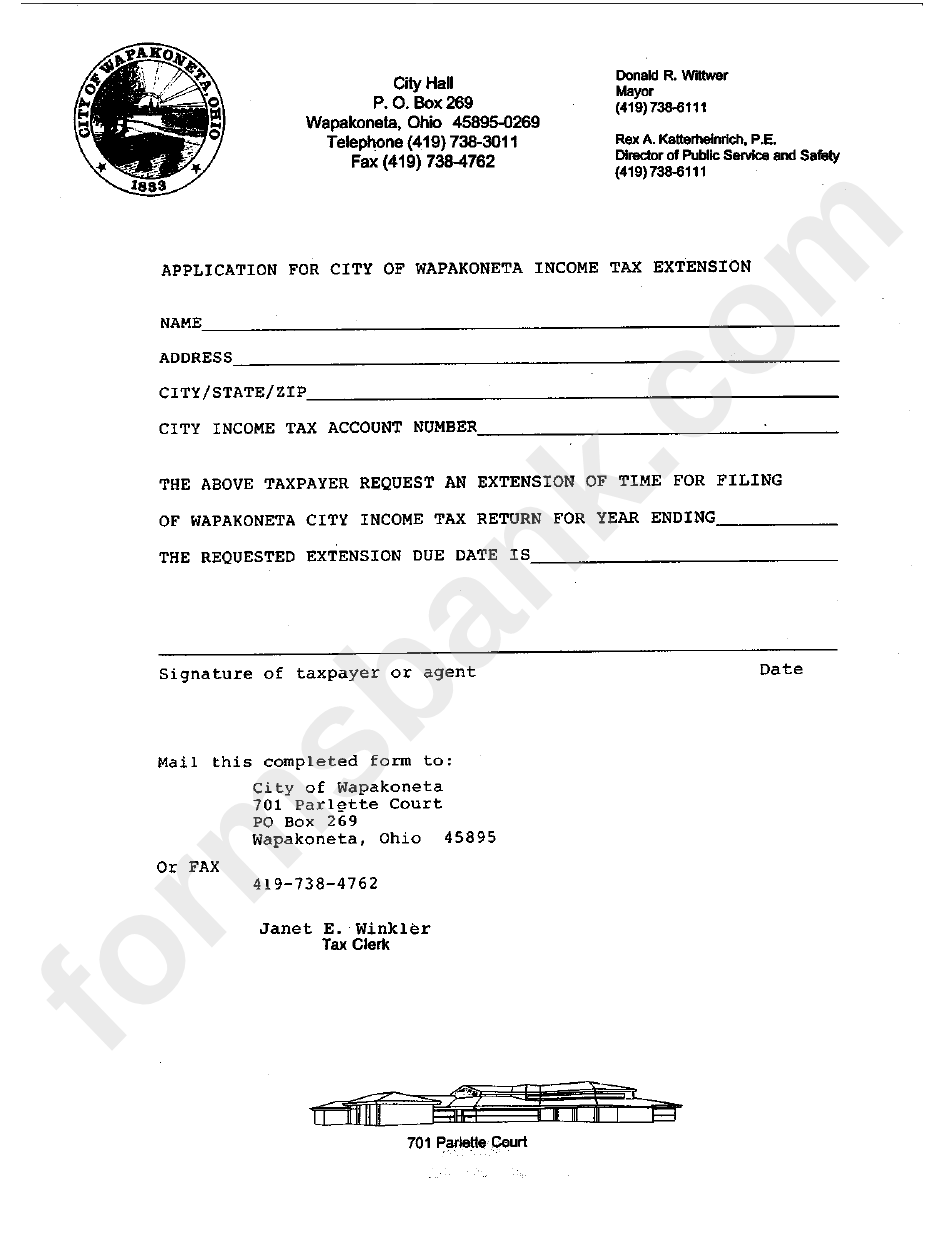

Application Form For City Of Tax Extension State Of

Web download or print the 2022 ohio form it 40p (income tax payment voucher) for free from the ohio department of taxation. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. Web ohio filing due date:.

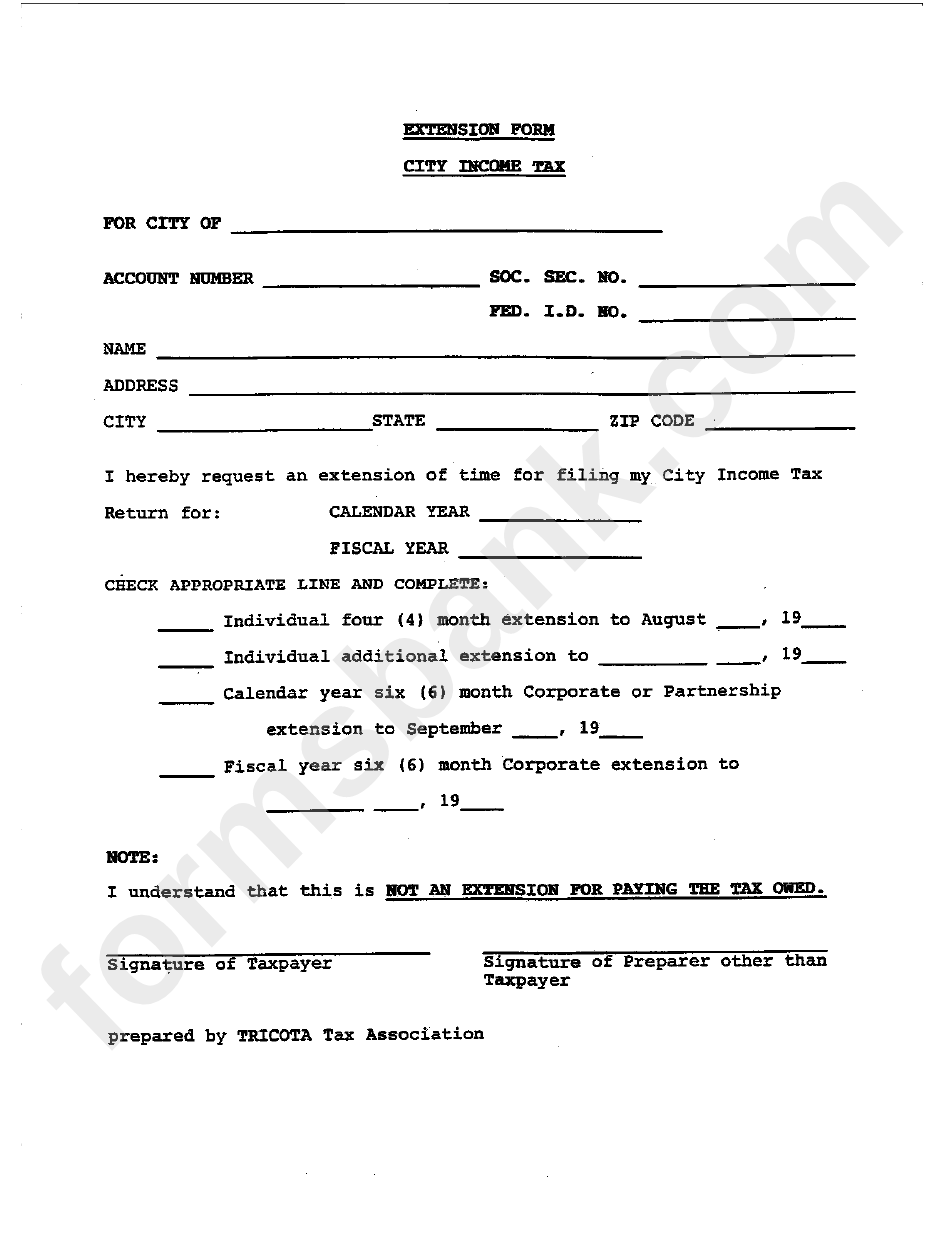

Extension Form Template City Tax printable pdf download

A copy of the irs form 4868 acts as any type of extension verification for the state of ohio. If you pay your state income. Web allows you to electronically make ohio individual income and school district income tax payments. The form gives a person or agency access to provide info about unemployment taxes. Web there is no separate extension.

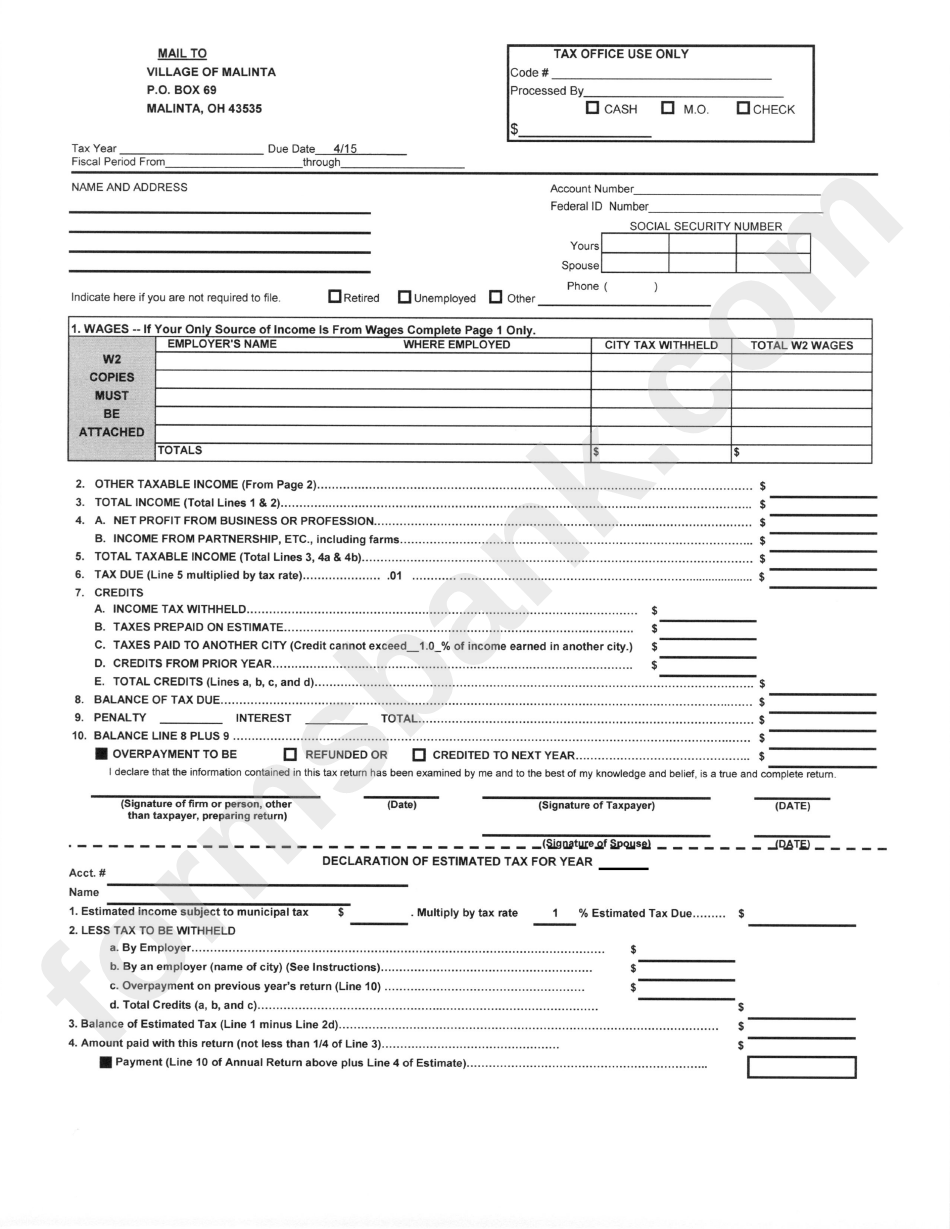

Ohio State Tax Forms Printable Printable World Holiday

Web ohio income tax form requests welcome to the ohio department of taxation tax form request service information needed for requesting a tax form: Ohio automatically extends the deadline to oct. Web extended deadline with ohio tax extension: (no explanation required by the irs). Web the ohio department of taxation will be offering extended hours for telephone assistance for ohio.

How Much Is Federal Tax In Ohio Tax Walls

Web the deadline for filing your ohio state income tax was april 18, 2023. If you pay your state income. 16, 2023, if your federal tax extension request. This includes extension and estimated payments, original and amended. Pay all or some of your ohio income taxes online via:

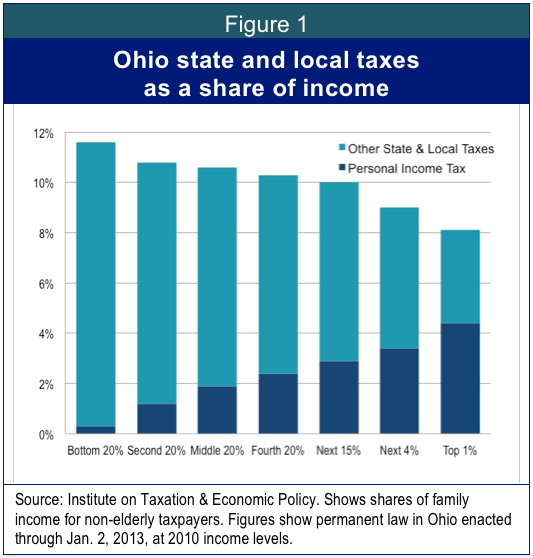

Ohio's state and local taxes hit poor and middle class much harder than

Web you can make a state extension payment using ohio form it 40p (income tax payment voucher), or by going online to the ohio “epayment” portal:. More information and registration can be found at. Web allows you to electronically make ohio individual income and school district income tax payments. 10 what should i do if i filed my federal return.

Down to the Wire Should You File For a Tax Extension?

Web the deadline for filing your ohio state income tax was april 18, 2023. (no explanation required by the irs). Web allows you to electronically make ohio individual income and school district income tax payments. The ohio department of taxation provides a searchable repository of individual tax forms for. Web the ohio department of taxation will be offering extended hours.

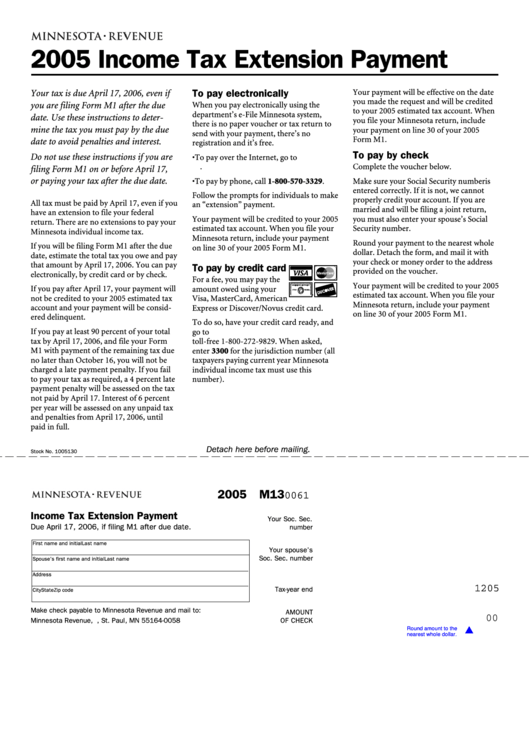

Fillable Form M13 Tax Extension Payment 2005 Minnesota

(no explanation required by the irs). Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. The ohio department of taxation provides a searchable repository of individual tax forms for. If you owe oh income taxes, you will either have to submit a oh tax return or..

Ohio Tax Filing Deadline

Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. More information and registration can be found at. Web the deadline for filing your ohio state income tax was april 18, 2023. Web the ohio department of taxation will be offering extended hours for telephone assistance for.

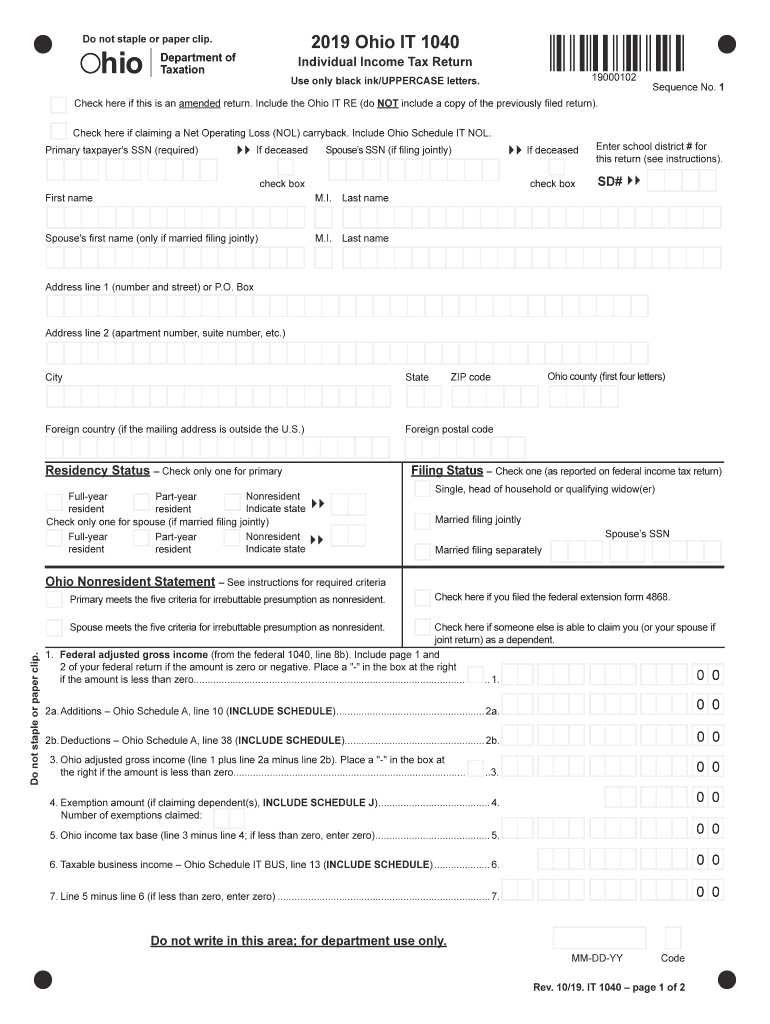

Printable State Of Ohio Tax Forms Printable Form 2022

The form gives a person or agency access to provide info about unemployment taxes. Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. If you pay your state income. This includes extension and estimated payments, original and amended. Web the deadline for filing your ohio state.

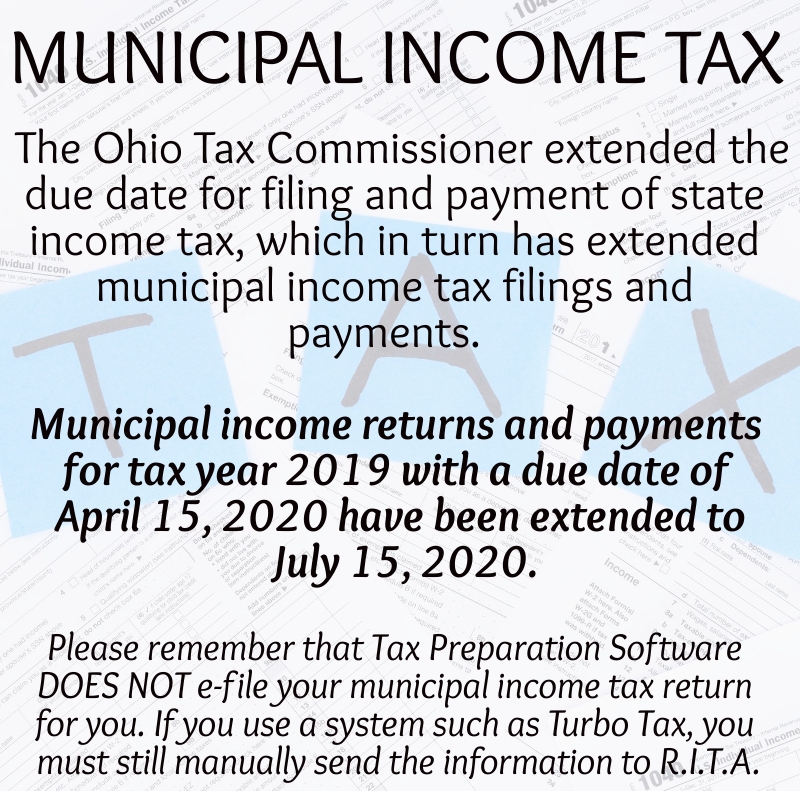

OH RITA 37 20202022 Fill out Tax Template Online US Legal Forms

Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. (no explanation required by the irs). Ohio does not have a separate extension request form. Get 6 months automatic extension. A copy of the irs form 4868 acts as any type of extension verification for the state.

Pay All Or Some Of Your Ohio Income Taxes Online Via:

Web allows you to electronically make ohio individual income and school district income tax payments. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. Ohio automatically extends the deadline to oct. The ohio department of taxation provides a searchable repository of individual tax forms for.

The Form Gives A Person Or Agency Access To Provide Info About Unemployment Taxes.

If you pay your state income. 16, 2023, if your federal tax extension request. Web 9 how can i get an extension to file my ohio individual and/or school district income tax returns? Web it 1040 es tax year:

Get 6 Months Automatic Extension.

A copy of the irs form 4868 acts as any type of extension verification for the state of ohio. Web ohio filing due date: Web download or print the 2022 ohio form it 40p (income tax payment voucher) for free from the ohio department of taxation. If you owe oh income taxes, you will either have to submit a oh tax return or.

Web There Is No Separate Extension Form For The State Of Ohio.

This includes extension and estimated payments, original and amended. (no explanation required by the irs). Web ohio income tax form requests welcome to the ohio department of taxation tax form request service information needed for requesting a tax form: Web ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation.