Nys Farm Tax Exempt Form

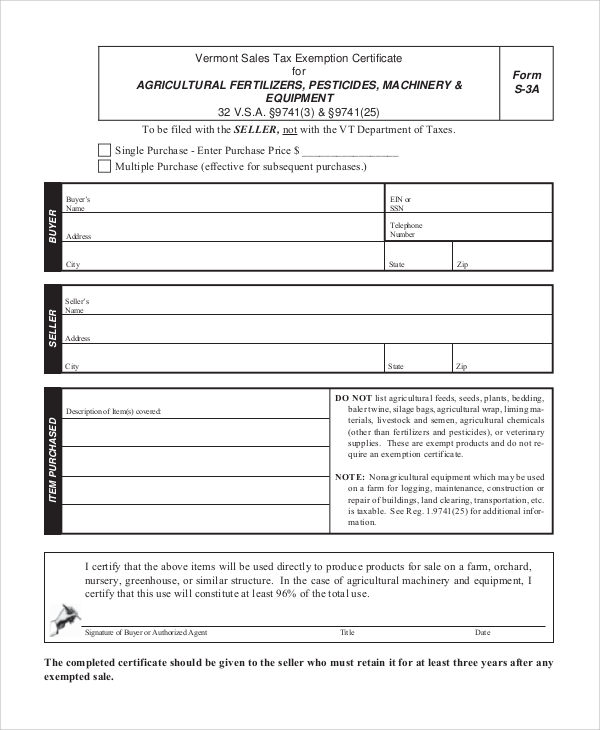

Nys Farm Tax Exempt Form - Web application for tax exemption of agricultural and horticultural buildings and structures: Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities: •in your possession within 90 days of the. Web consumed either in farm production or in a commercial horse boarding operation, or in both. How to use the certificate, You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. How to use an exemption certificate as a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and. Exemption certificate for the purchase of a racehorse: Complete all required entries on the form and give it to the seller.

Web farmer’s and commercial horse boarding operator's exemption certificate: As a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from liability for the tax if the certificate is valid. The certificate will be considered valid if it is: See below for special rules for purchases of motor fuel and diesel. Web application for tax exemption of agricultural and horticultural buildings and structures: Web farmers and commercial horse boarding operators may purchase certain items or services exempt from new york state and local sales and use taxes. Nys tax memo on exemptions for farmers and commercial horse boarding operations. •in your possession within 90 days of the. Web establish the right to the exemption. How to use an exemption certificate as a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller.

How to use the certificate, Web farmer’s and commercial horse boarding operator's exemption certificate: Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities: See below for special rules for purchases of motor fuel and diesel. You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. The certificate will be considered valid if it is: Exemption certificate for the purchase of a racehorse: Web application for tax exemption of agricultural and horticultural buildings and structures: Web establish the right to the exemption. •in your possession within 90 days of the.

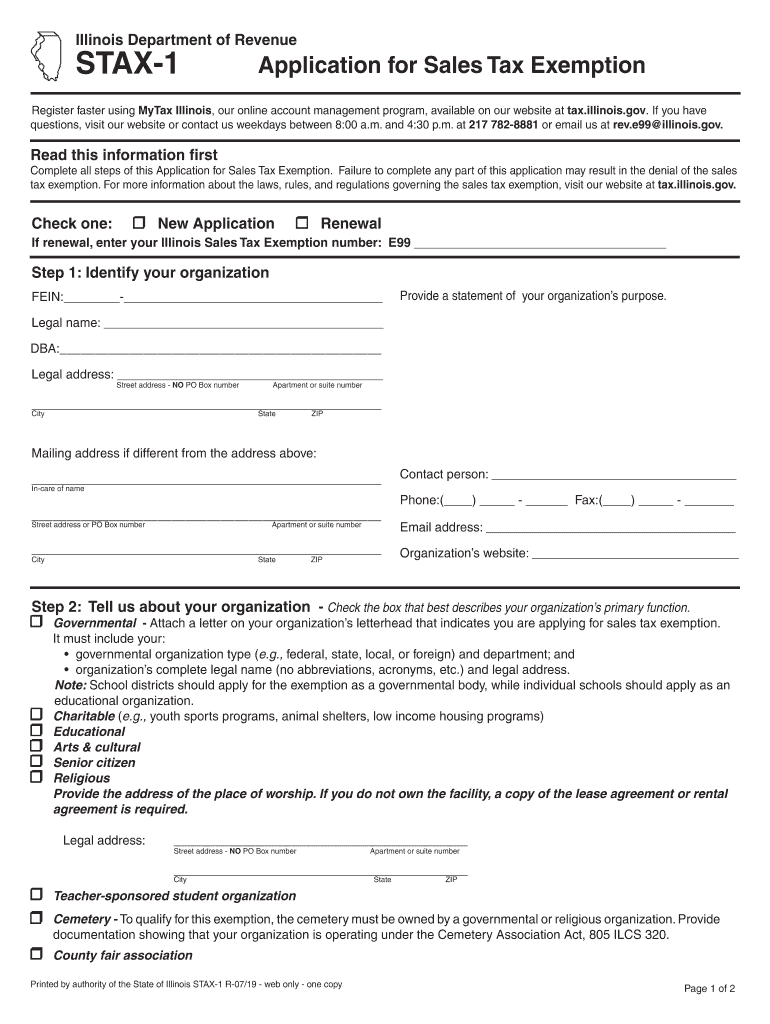

IL STAX1 2019 Fill out Tax Template Online US Legal Forms

Web exemption certificates of other states or countries are not valid to claim exemption from new york state and local sales and use tax. Web application for tax exemption of agricultural and horticultural buildings and structures: •in your possession within 90 days of the. Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk.

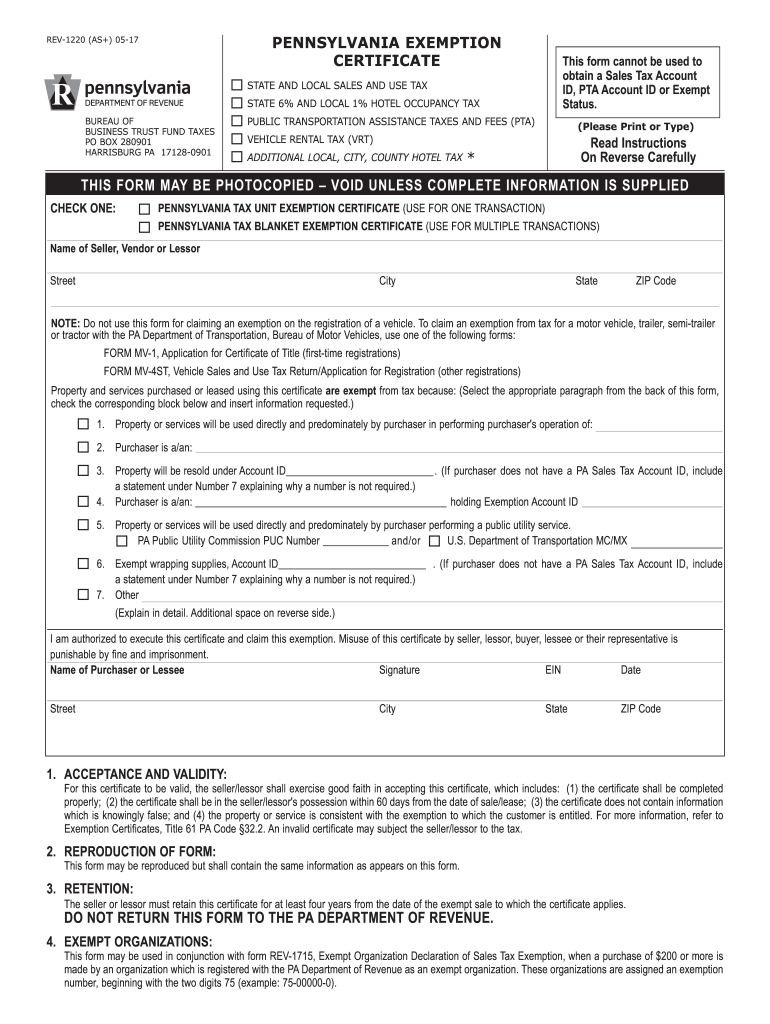

Resale Certificate Pa Fill Out and Sign Printable PDF Template signNow

How to use the certificate, Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and. Exemption certificate for the purchase of a racehorse: Web exemption certificates of other states or countries are not valid to claim exemption from new york state and local sales and use tax..

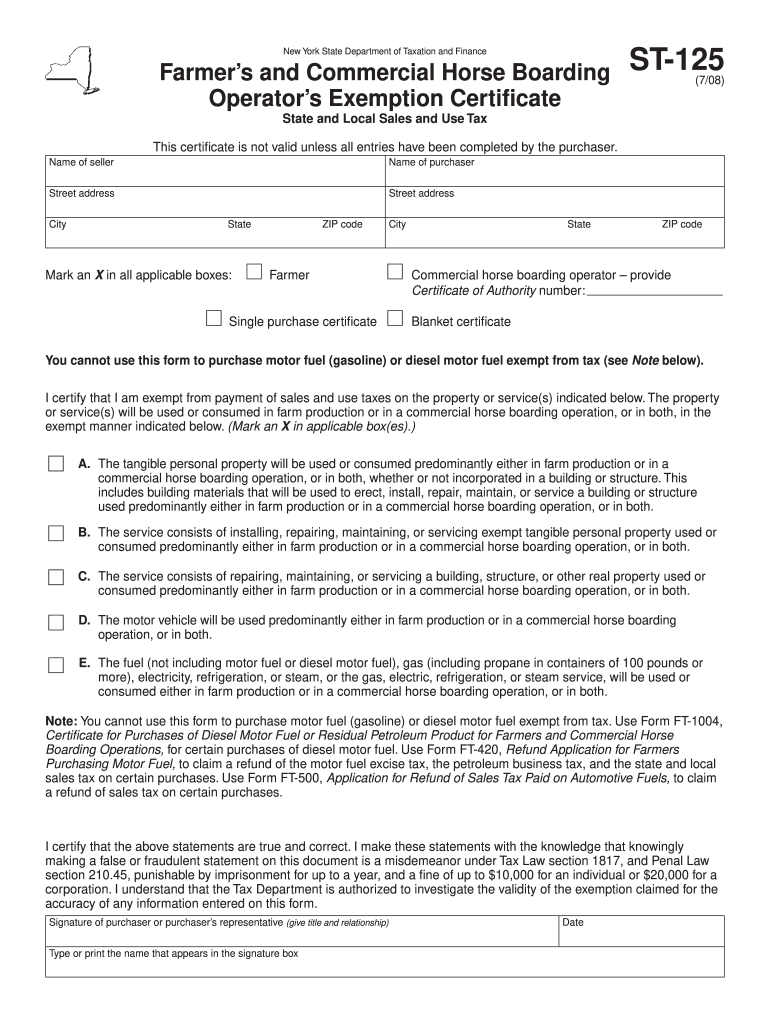

Nys St 125 Form Fill Out and Sign Printable PDF Template signNow

Web farmers and commercial horse boarding operators may purchase certain items or services exempt from new york state and local sales and use taxes. You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. How to use an exemption certificate as a purchaser, you must use the correct exemption certificate, and complete it.

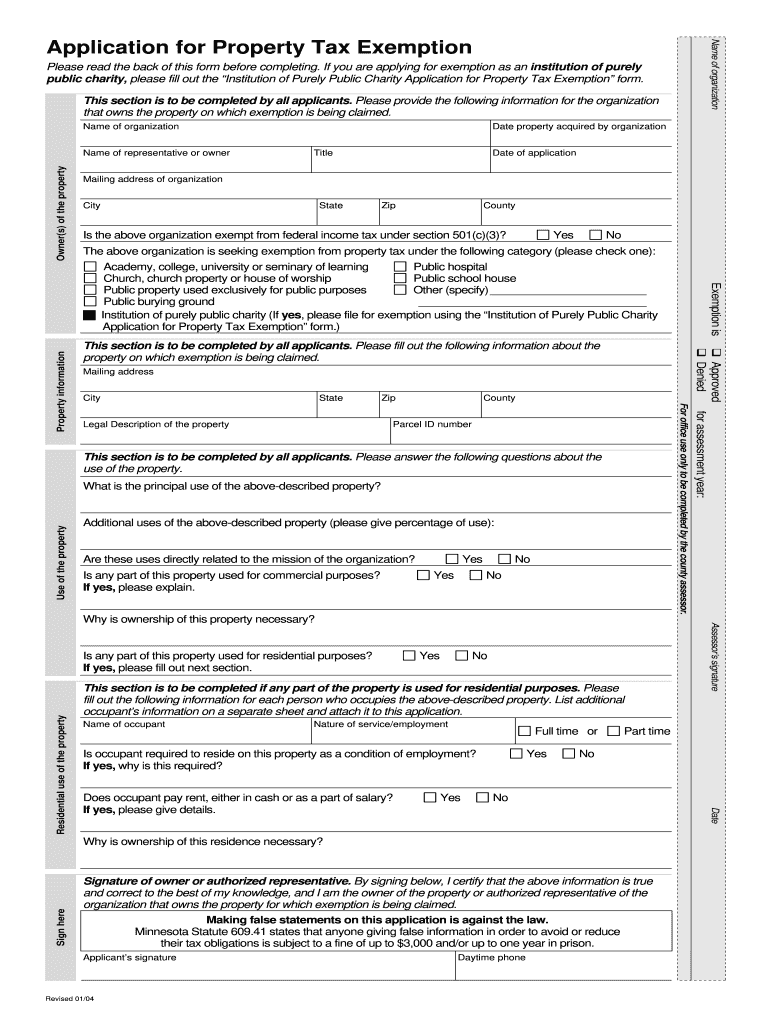

Property Tax Form Pdf Fill Out and Sign Printable PDF Template signNow

Web farmers and commercial horse boarding operators may purchase certain items or services exempt from new york state and local sales and use taxes. You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. Exemption certificate for the purchase of a racehorse: Application for tax exemption of farm silos, farm feed grain storage.

Farm Tax Exempt form Ny Lovely Tax Exemption form ]

Exemption certificate for the purchase of a racehorse: Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and. You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. See below for special rules for purchases of motor fuel and diesel..

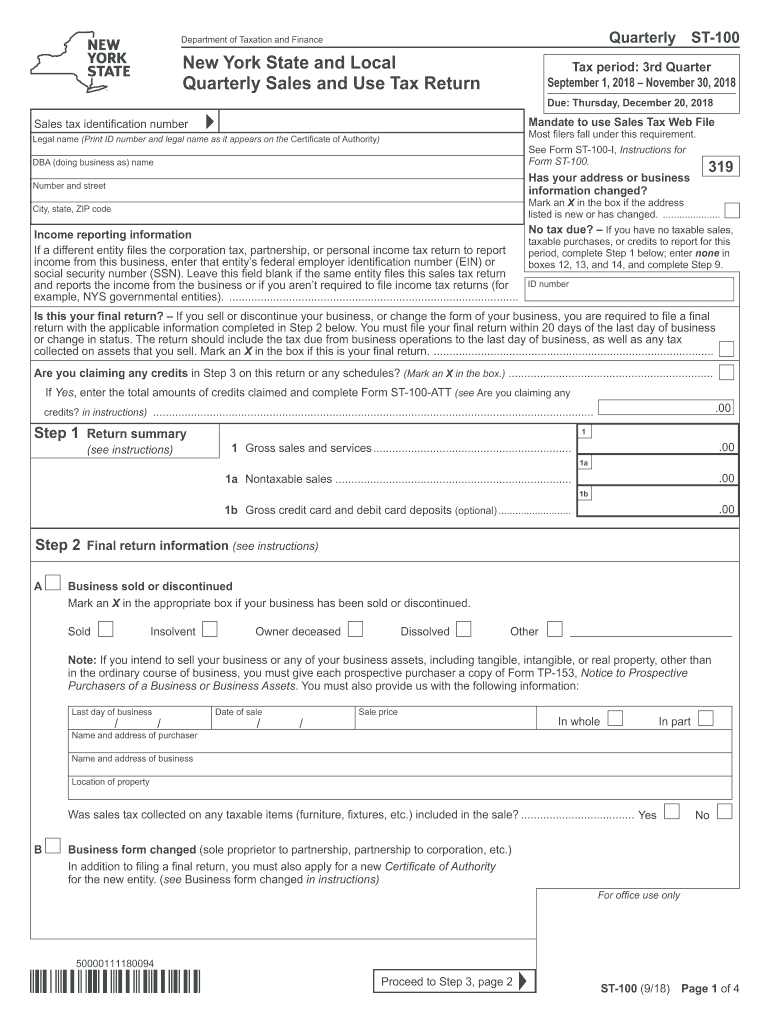

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities: How to use the certificate, Complete all required entries on the form and give it to the seller..

FREE 10+ Sample Tax Exemption Forms in PDF

The certificate will be considered valid if it is: Web farmer’s and commercial horse boarding operator's exemption certificate: How to use an exemption certificate as a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. Web consumed either in farm production or in a commercial horse boarding operation, or in both..

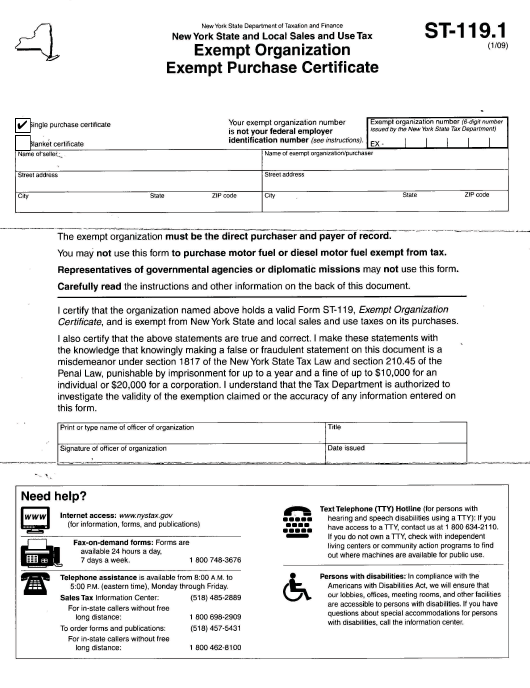

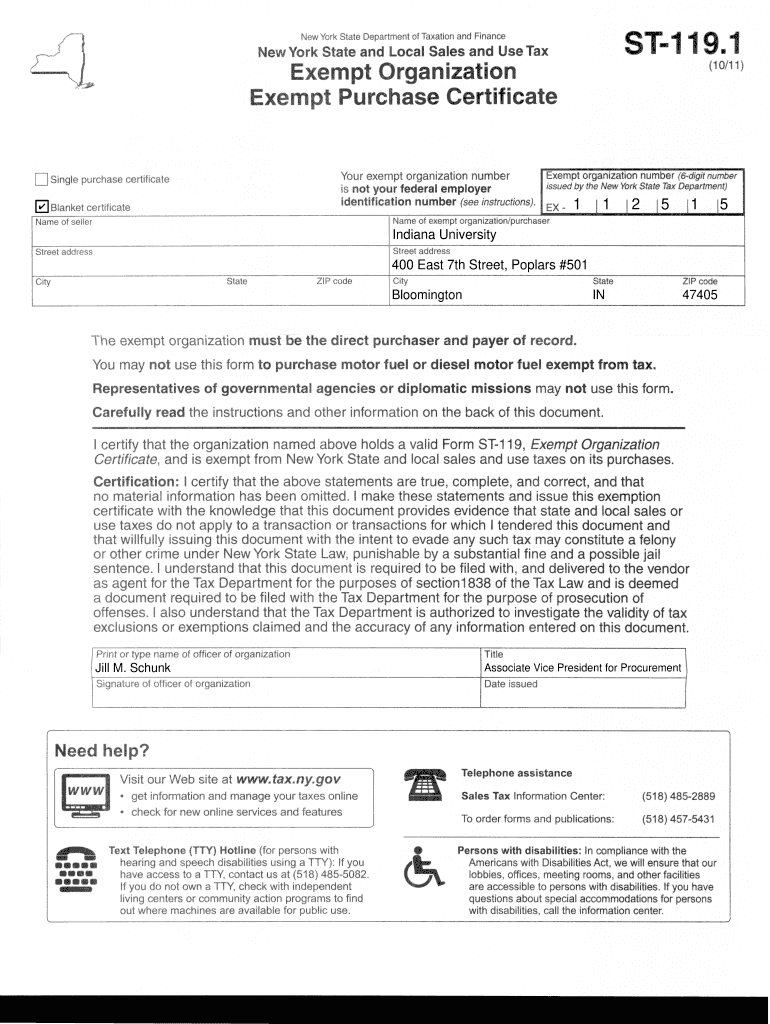

1981 Form NY DTF ST119.1 Fill Online, Printable, Fillable, Blank

The certificate will be considered valid if it is: Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and. Web application for tax exemption of agricultural and horticultural buildings and structures: Web establish the right to the exemption. How to use the certificate,

Agricultural Tax Exempt Form Nys

As a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from liability for the tax if the certificate is valid. Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities: Nys tax memo on.

St 119 1 Fill Out and Sign Printable PDF Template signNow

•in your possession within 90 days of the. Web establish the right to the exemption. Complete all required entries on the form and give it to the seller. Web consumed either in farm production or in a commercial horse boarding operation, or in both. As a new york state registered vendor, you may accept an exemption certificate in lieu of.

•In Your Possession Within 90 Days Of The.

Web establish the right to the exemption. How to use an exemption certificate as a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. The certificate will be considered valid if it is: Complete all required entries on the form and give it to the seller.

See Below For Special Rules For Purchases Of Motor Fuel And Diesel.

How to use the certificate, Nys tax memo on exemptions for farmers and commercial horse boarding operations. Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities: Web consumed either in farm production or in a commercial horse boarding operation, or in both.

Web Application For Tax Exemption Of Agricultural And Horticultural Buildings And Structures:

Web farmer’s and commercial horse boarding operator's exemption certificate: Web exemption certificates of other states or countries are not valid to claim exemption from new york state and local sales and use tax. You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax. Exemption certificate for the purchase of a racehorse:

Web Farmers And Commercial Horse Boarding Operators May Purchase Certain Items Or Services Exempt From New York State And Local Sales And Use Taxes.

Application for tax exemption of farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and. As a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from liability for the tax if the certificate is valid.

![Farm Tax Exempt form Ny Lovely Tax Exemption form ]](https://www.flaminke.com/wp-content/uploads/2018/09/farm-tax-exempt-form-ny-lovely-tax-exemption-form-of-farm-tax-exempt-form-ny.jpg)