Nys Estimated Tax Form

Nys Estimated Tax Form - Web select a tax year. Payments due april 18, june 15, september 15, 2023, and january 16, 2024. You may be required to make estimated tax payments to new. See important information for nyc residents. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. The balance of estimated tax is due as follows: Web estimated income tax payment voucher for fiduciaries; Are first met during the taxable year: Be sure to verify that the form you are downloading is for the correct. Web if the requirements for filing estimated payments file the form on or before the:

Web purpose of this package. If you would like to make an estimated income tax payment, you can make your payment. Payments due april 15, june 15, september 15, 2021, and january 18, 2022. Payments due april 18, june 15, september 15, 2023, and january 16,. Web estimated income tax payment voucher for fiduciaries; The balance of estimated tax is due as follows: Web if the requirements for filing estimated payments file the form on or before the: Web new york state income tax forms for tax year 2022 (jan. Single head of household married filing joint married filing separately surviving spouse. Payments due april 18, june 15, september 15, 2023, and january 16, 2024.

Web estimated income tax payment voucher for fiduciaries; Details on how to only prepare and. Web if the requirements for filing estimated payments file the form on or before the: What is this form for? Are first met during the taxable year: See important information for nyc residents. Payments due april 18, june 15, september 15, 2023, and january 16,. Payments due april 15, june 15, september 15, 2021, and january 18, 2022. The balance of estimated tax is due as follows: You may make estimated tax.

2017 Nys Estimated Tax Instructions

Web new york state gives you five options. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. The balance of estimated tax is due as follows: Single head of household married filing.

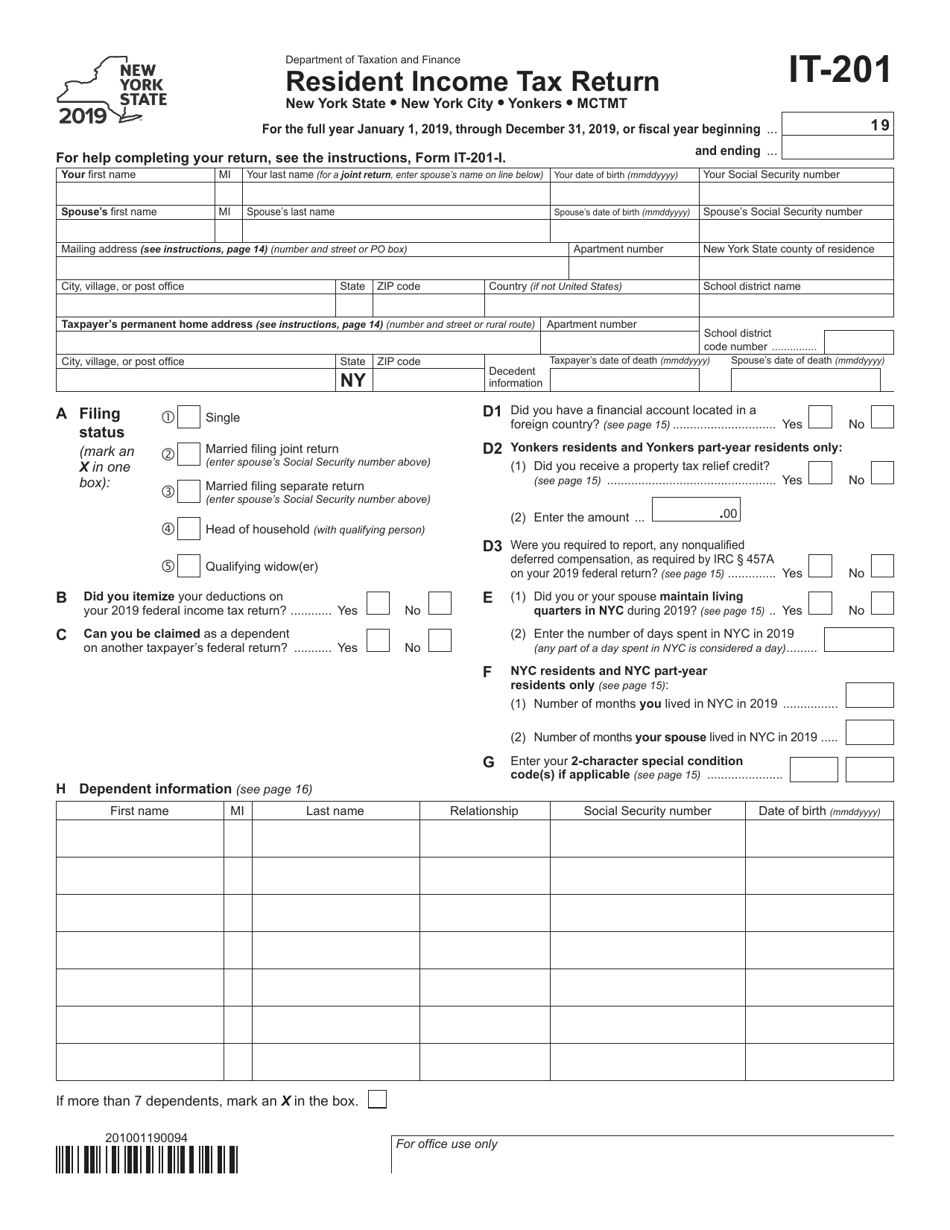

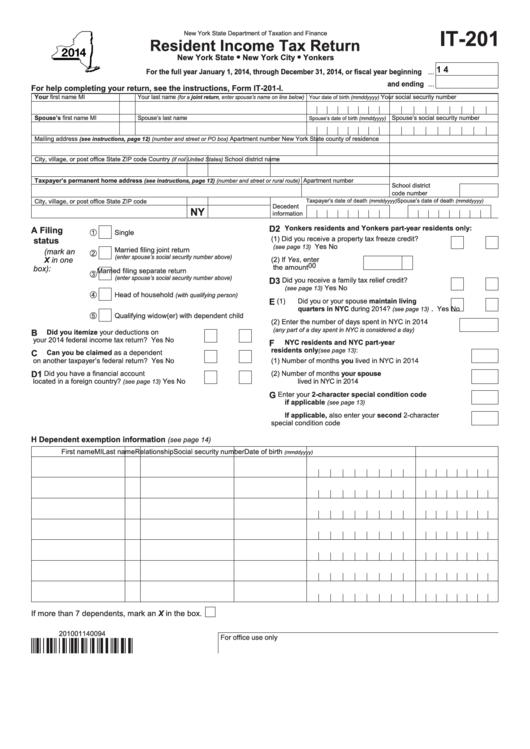

Form IT201 Download Fillable PDF or Fill Online Resident Tax

Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. Web when figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. You may be required to make estimated.

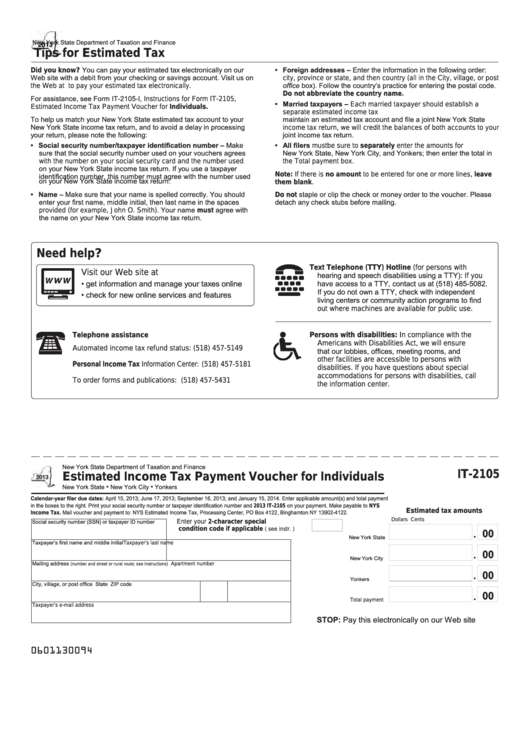

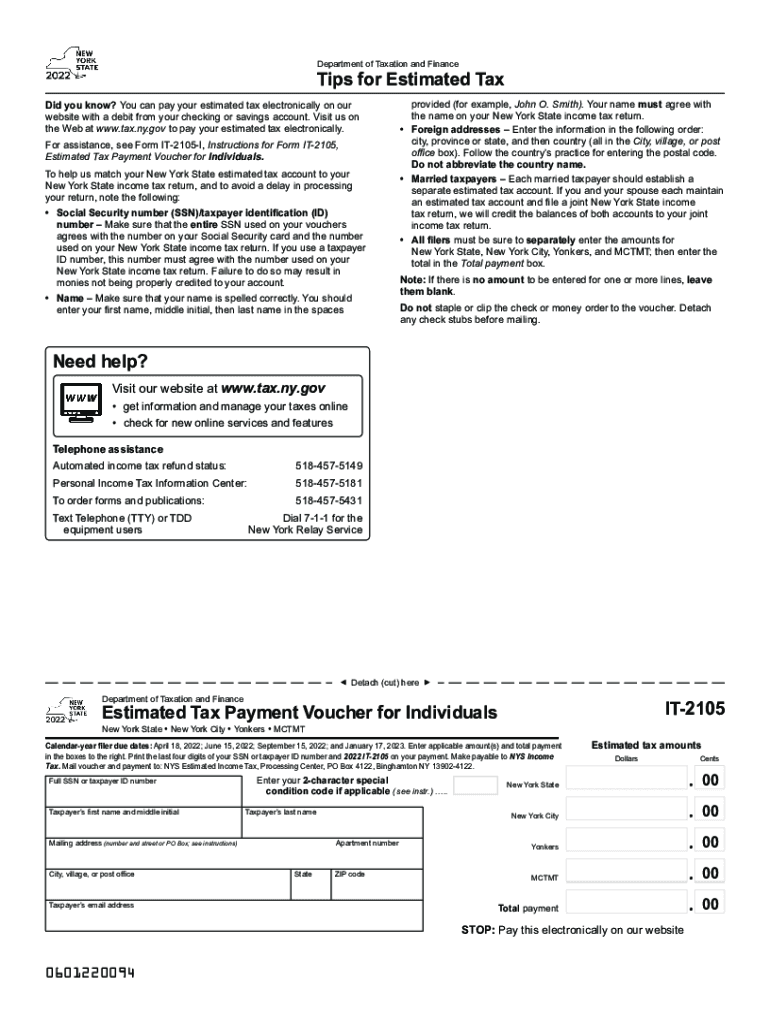

Fillable Form It2105 Estimated Tax Payment Voucher For

Payments due april 15, june 15, september 15, 2021, and january 18, 2022. Payments due april 18, june 15, september 15, 2023, and january 16, 2024. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web new york state income tax forms for tax year 2022 (jan. You may be required.

Tax Withholding Estimator New Job QATAX

Payments due april 18, june 15, september 15, 2023, and january 16,. Web purpose of this package. The balance of estimated tax is due as follows: Web estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. Web new york state income tax forms for tax year 2022 (jan.

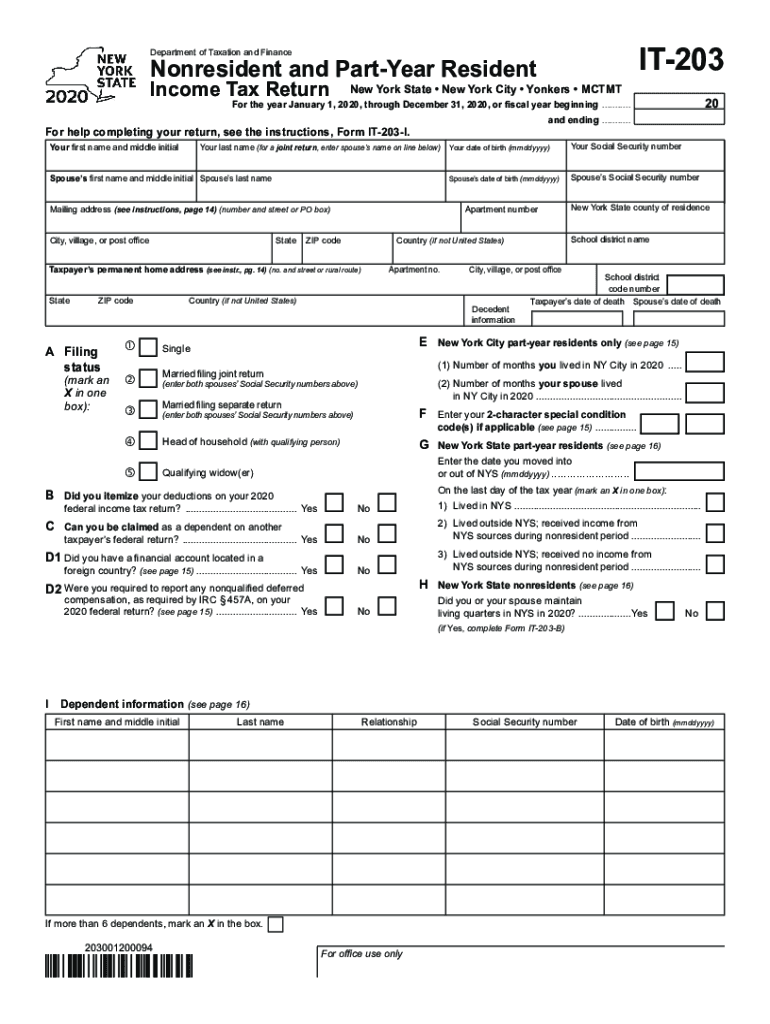

2020 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Payments due april 18, june 15, september 15, 2023, and january 16,. Payments due april 18, june 15, september 15, 2022, and january 17, 2023. Web select a tax year. Be sure to verify that the form you are downloading is for the correct. If you would like to make an estimated income tax payment, you can make your payment.

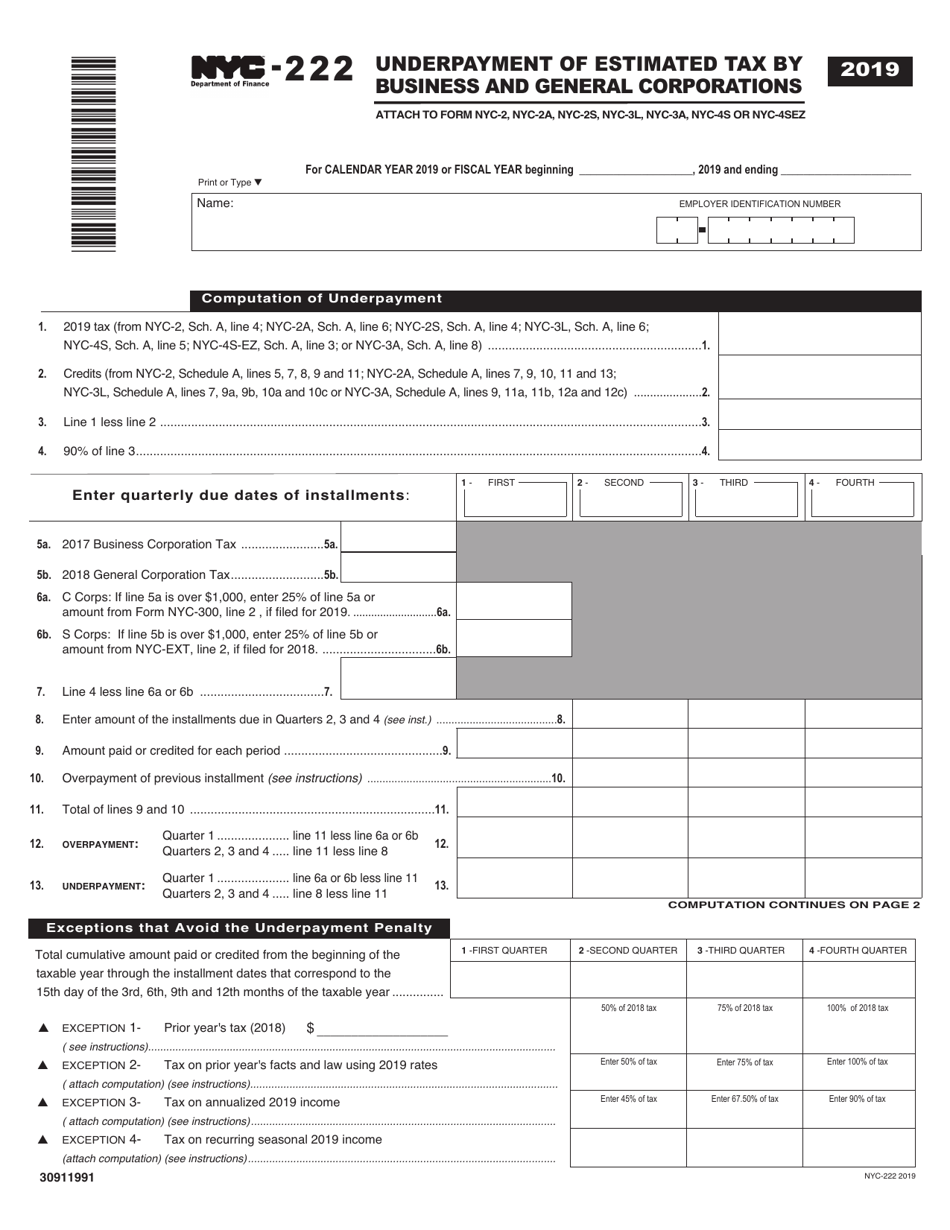

Form NYC222 Download Printable PDF or Fill Online Underpayment of

Payments due april 18, june 15, september 15, 2022, and january 17, 2023. See important information for nyc residents. Web estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. The balance of estimated tax is due as follows: You may make estimated tax.

2022 Form NY IT2105 Fill Online, Printable, Fillable, Blank pdfFiller

Four of these options are based on a percentage of tax from both the prior year and the current year. Web new york state income tax forms for tax year 2022 (jan. You may be required to make estimated tax payments to new. Use your prior year's federal. Payments due april 18, june 15, september 15, 2023, and january 16,.

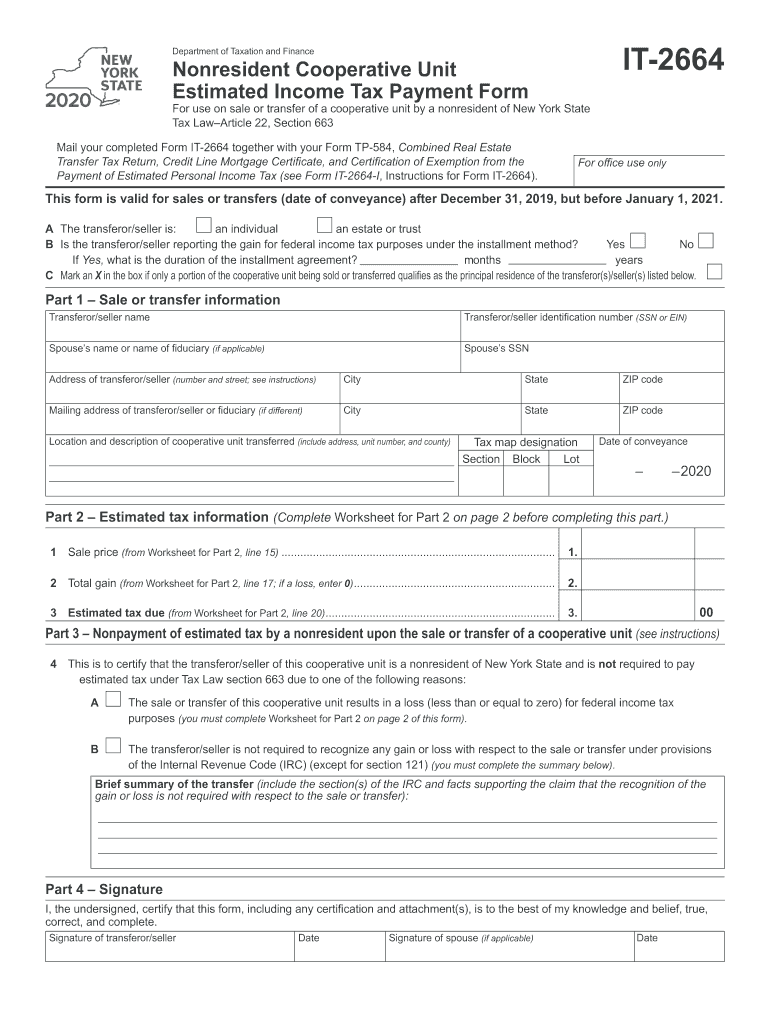

2020 Form NY DTF IT2664 Fill Online, Printable, Fillable, Blank

Web new york state gives you five options. What is this form for? See important information for nyc residents. Details on how to only prepare and. Web select a tax year.

Estimated Tax Payment Worksheet 2023

What is this form for? Are first met during the taxable year: Web if the requirements for filing estimated payments file the form on or before the: Payments due april 18, june 15, september 15, 2022, and january 17, 2023. Payments due april 18, june 15, september 15, 2023, and january 16, 2024.

Fillable Form It201 2014 Resident Tax Return New York State

The balance of estimated tax is due as follows: Web when figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Web new york state income tax forms for tax year 2022 (jan. See important information for nyc residents. Web if the requirements.

Four Of These Options Are Based On A Percentage Of Tax From Both The Prior Year And The Current Year.

Payments due april 15, june 15, september 15, 2021, and january 18, 2022. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. Be sure to verify that the form you are downloading is for the correct. Payments due april 18, june 15, september 15, 2022, and january 17, 2023.

Are First Met During The Taxable Year:

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web purpose of this package. See important information for nyc residents. If you would like to make an estimated income tax payment, you can make your payment.

See Important Information For Nyc Residents.

You may make estimated tax. Payments due april 18, june 15, september 15, 2023, and january 16, 2024. Web new york state income tax forms for tax year 2022 (jan. Use your prior year's federal.

Web If The Requirements For Filing Estimated Payments File The Form On Or Before The:

Payments due april 18, june 15, september 15, 2023, and january 16,. Web when figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Web estimated income tax payment voucher for fiduciaries; The balance of estimated tax is due as follows: