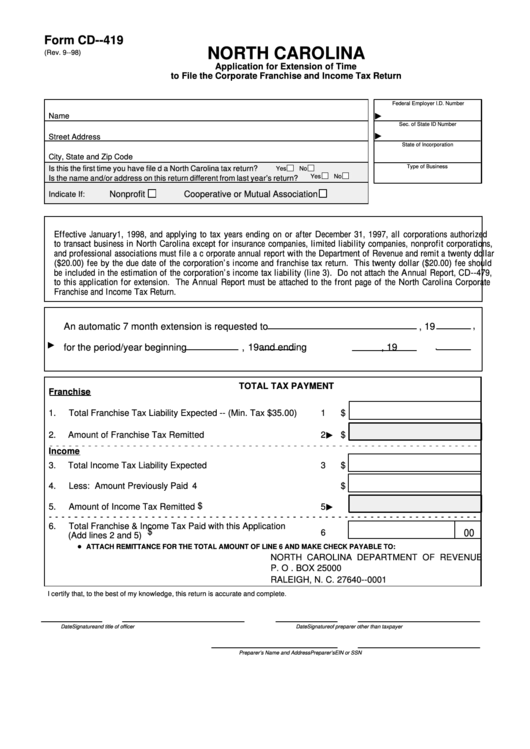

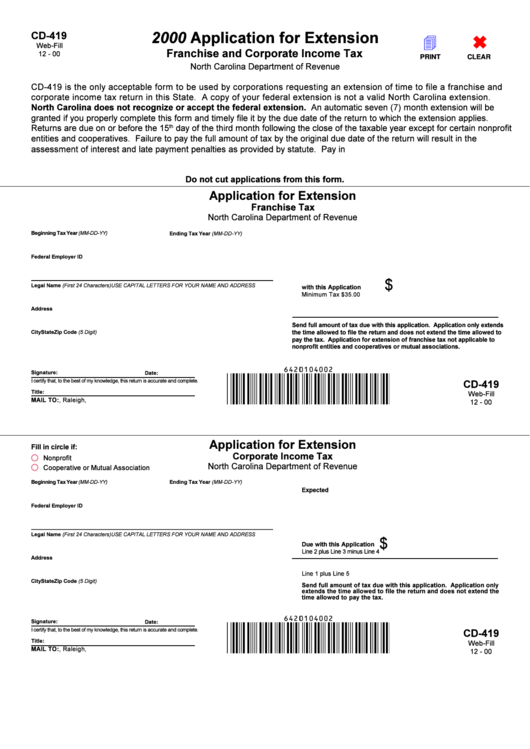

North Carolina Form Cd-419

North Carolina Form Cd-419 - Third party file and pay option: Web a taxpayer who is not granted an automatic extension to file a federal income tax return. Are you seeking a quick and convenient solution to. The irs and most states will. Web this document gives a brief summary of the tax law changes made by the 2018 general. The irs and most states. Web follow the simple instructions below:

Third party file and pay option: Web this document gives a brief summary of the tax law changes made by the 2018 general. Web a taxpayer who is not granted an automatic extension to file a federal income tax return. The irs and most states. Web follow the simple instructions below: Are you seeking a quick and convenient solution to. The irs and most states will.

The irs and most states. Web this document gives a brief summary of the tax law changes made by the 2018 general. The irs and most states will. Are you seeking a quick and convenient solution to. Web follow the simple instructions below: Third party file and pay option: Web a taxpayer who is not granted an automatic extension to file a federal income tax return.

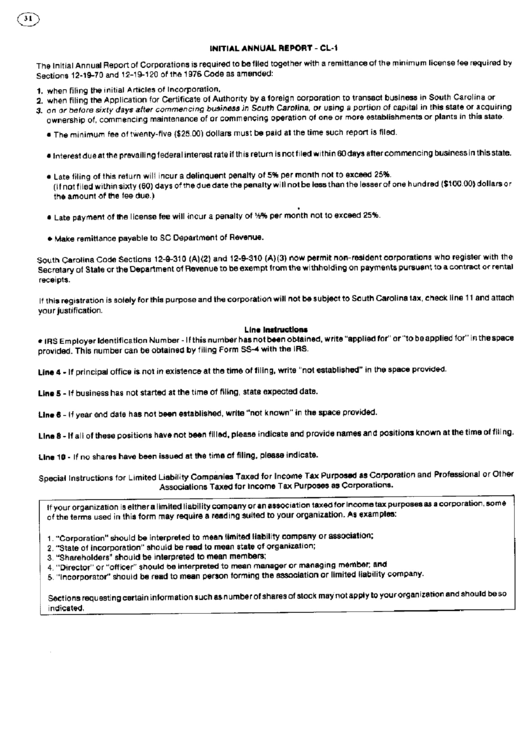

Instructions For Form Cl1 Initial Annual Report South Carolina

Web this document gives a brief summary of the tax law changes made by the 2018 general. The irs and most states will. Web follow the simple instructions below: Are you seeking a quick and convenient solution to. Web a taxpayer who is not granted an automatic extension to file a federal income tax return.

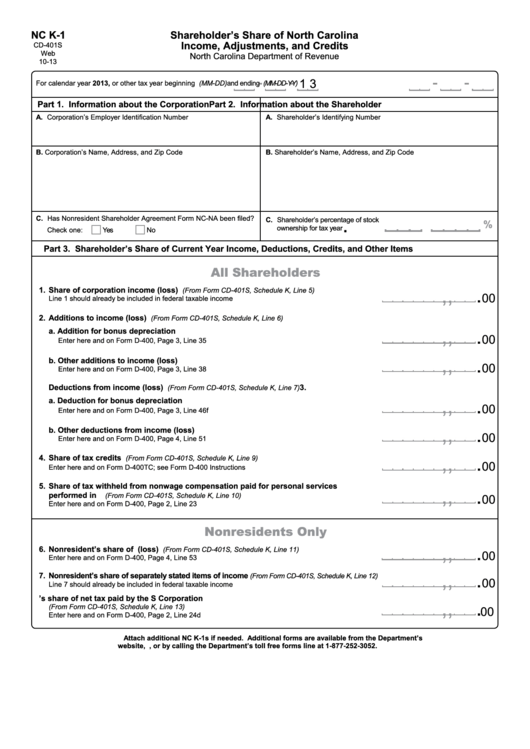

Form Nc K1 Shareholder'S Share Of North Carolina Adjustments

Web a taxpayer who is not granted an automatic extension to file a federal income tax return. Web this document gives a brief summary of the tax law changes made by the 2018 general. Web follow the simple instructions below: The irs and most states will. Third party file and pay option:

Fillable Form Cd419 Application For Extension Of Time To File The

Web follow the simple instructions below: The irs and most states. Web a taxpayer who is not granted an automatic extension to file a federal income tax return. Are you seeking a quick and convenient solution to. The irs and most states will.

North Carolina Form 2a11 T 20202022 Fill and Sign Printable Template

The irs and most states will. The irs and most states. Third party file and pay option: Web this document gives a brief summary of the tax law changes made by the 2018 general. Web a taxpayer who is not granted an automatic extension to file a federal income tax return.

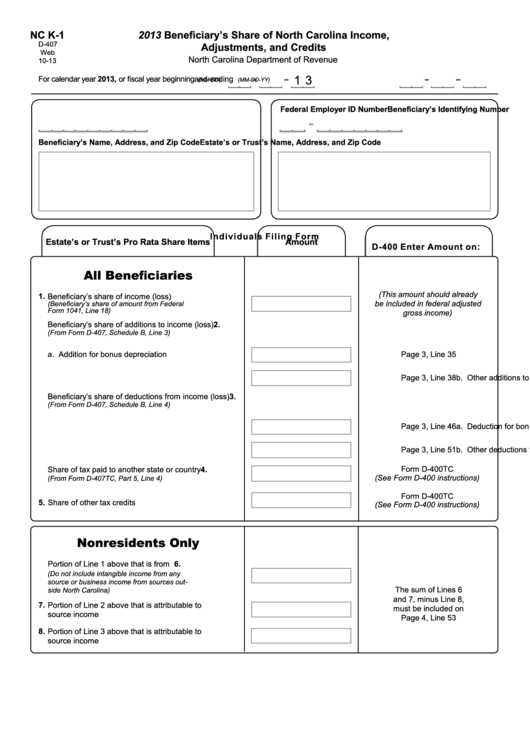

Form Nc K1 Beneficiary'S Share Of North Carolina Adjustments

The irs and most states will. Web this document gives a brief summary of the tax law changes made by the 2018 general. Third party file and pay option: Are you seeking a quick and convenient solution to. The irs and most states.

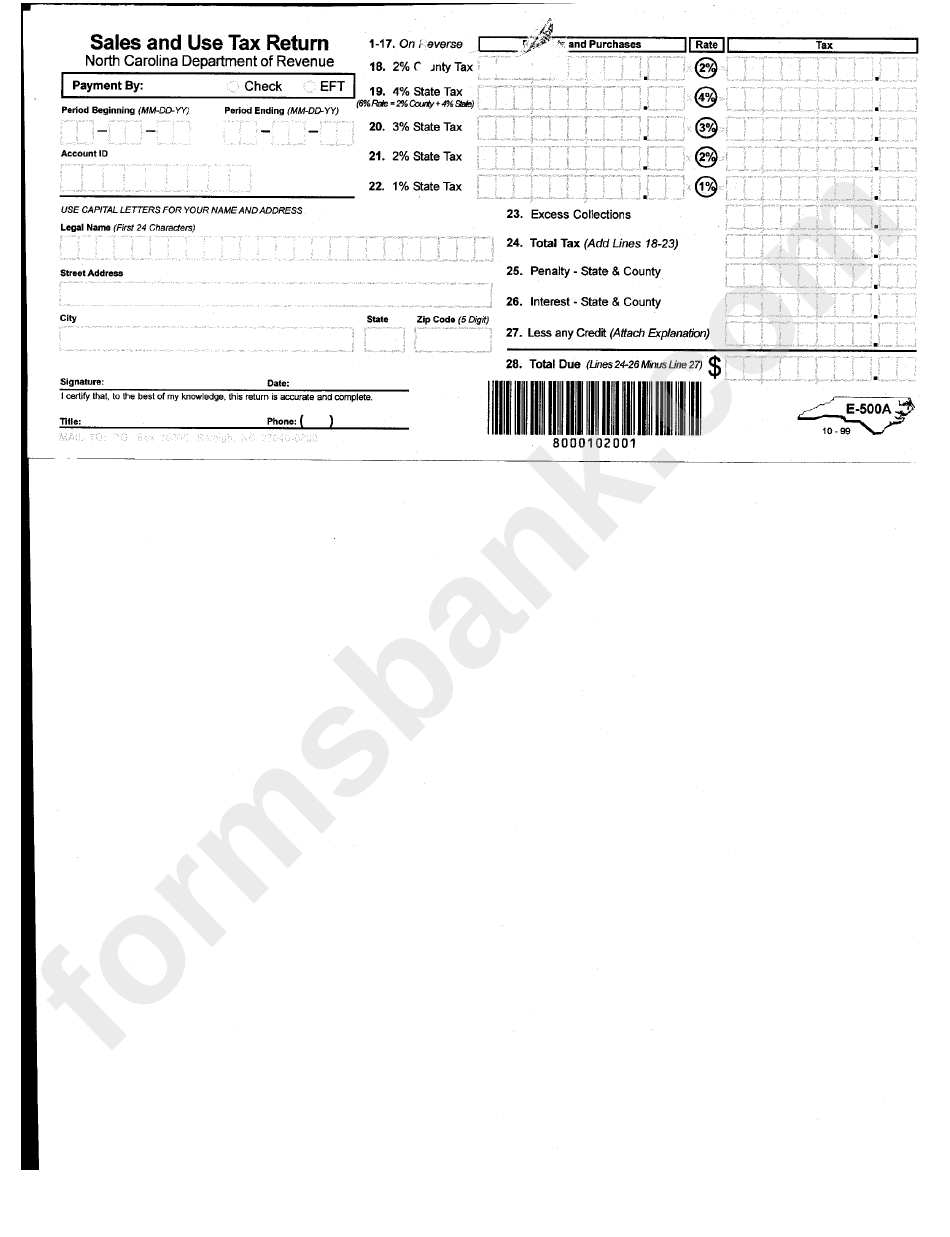

Form E500a Sales And Use Tax Return North Carolina Department Of

The irs and most states. Web this document gives a brief summary of the tax law changes made by the 2018 general. Are you seeking a quick and convenient solution to. Web a taxpayer who is not granted an automatic extension to file a federal income tax return. Web follow the simple instructions below:

Fillable Form Cd419 Application For Extension Franchise And

Web a taxpayer who is not granted an automatic extension to file a federal income tax return. The irs and most states will. Web follow the simple instructions below: Third party file and pay option: Are you seeking a quick and convenient solution to.

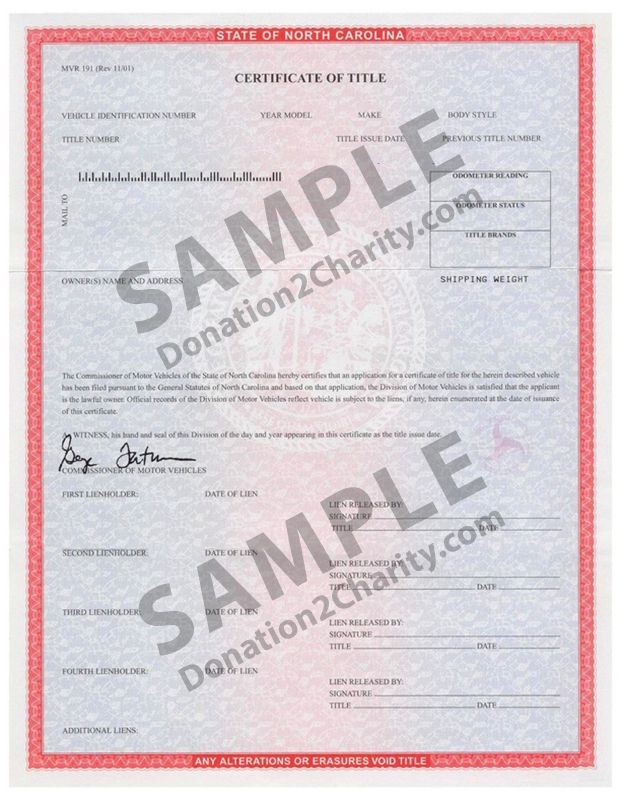

North Carolina Donation2Charity

The irs and most states. Third party file and pay option: The irs and most states will. Web follow the simple instructions below: Are you seeking a quick and convenient solution to.

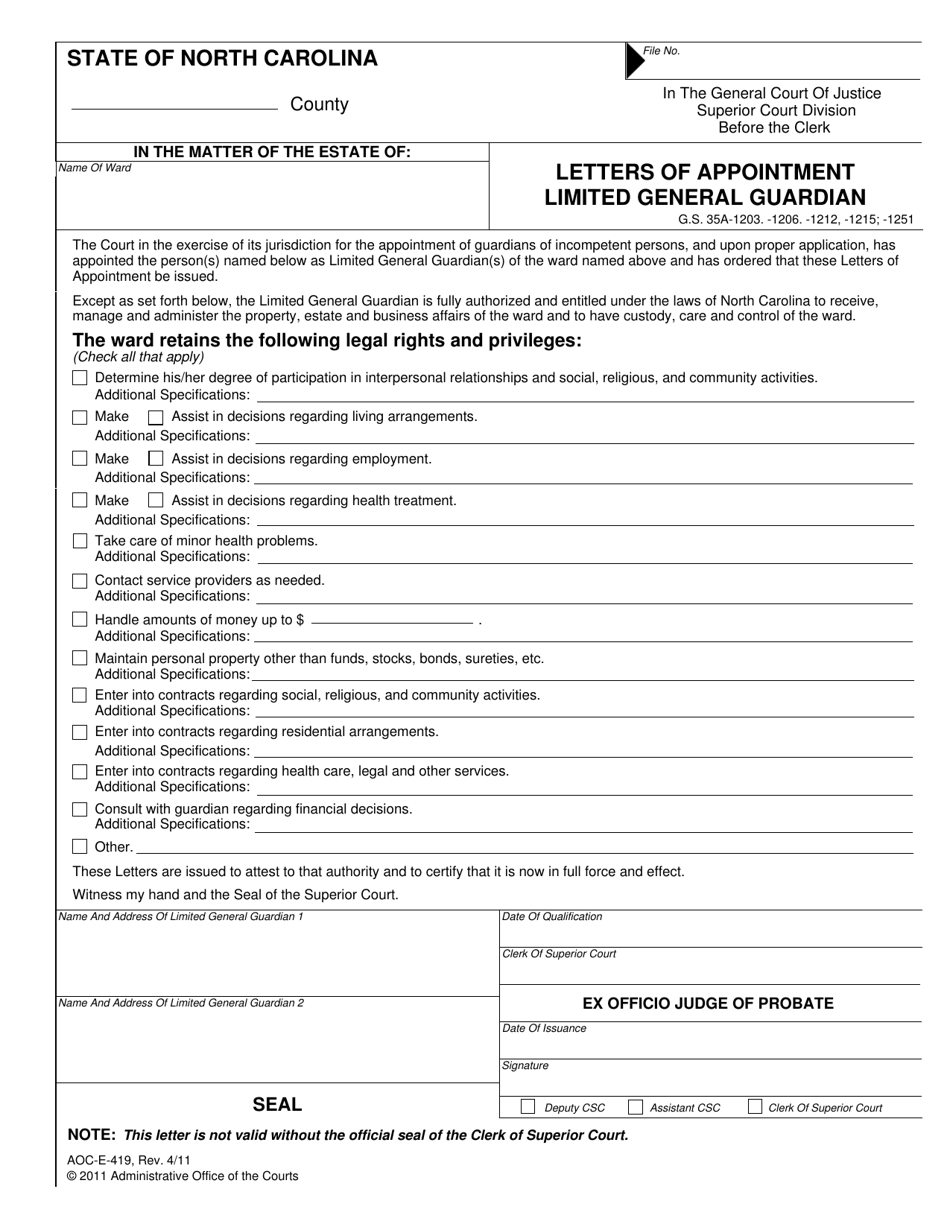

Form AOCE419 Download Fillable PDF or Fill Online Letters of

Are you seeking a quick and convenient solution to. The irs and most states will. Web a taxpayer who is not granted an automatic extension to file a federal income tax return. The irs and most states. Web this document gives a brief summary of the tax law changes made by the 2018 general.

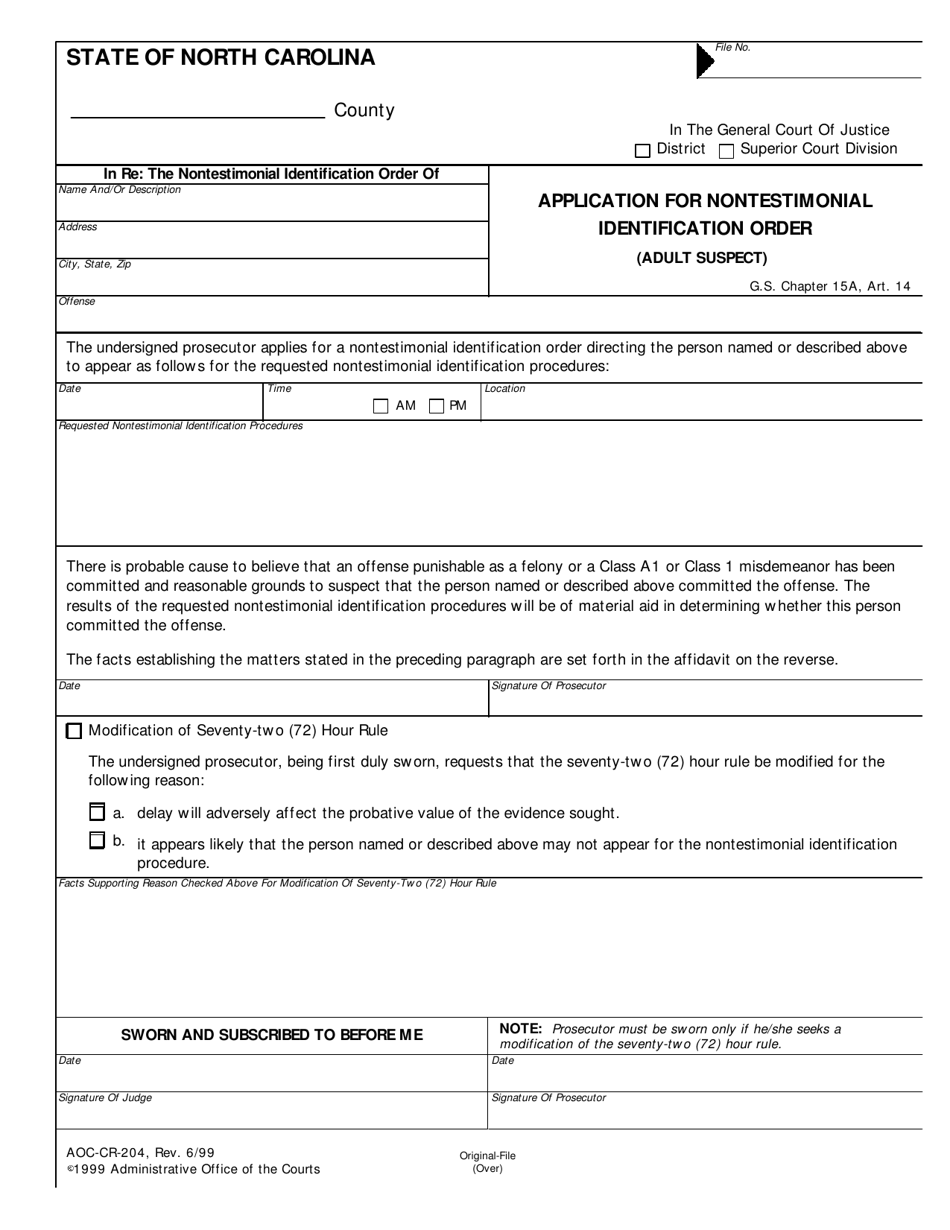

Form AOCCR204 Download Fillable PDF or Fill Online Application for

Web follow the simple instructions below: The irs and most states will. Third party file and pay option: Are you seeking a quick and convenient solution to. Web a taxpayer who is not granted an automatic extension to file a federal income tax return.

Web Follow The Simple Instructions Below:

The irs and most states. Are you seeking a quick and convenient solution to. The irs and most states will. Web this document gives a brief summary of the tax law changes made by the 2018 general.

Third Party File And Pay Option:

Web a taxpayer who is not granted an automatic extension to file a federal income tax return.