Non Profit Extension Form

Non Profit Extension Form - For instance, an extension on the filing date for forms 990,. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. There are two types of extensions that can be obtained with form 8868: Ad we stay up to date on any state changes so that you don’t need to. Ad we stay up to date on any state changes so that you don’t need to. Web to get this extension from the irs, nonprofits must file form 8868 and pay any taxes due by the original date. Web to obtain a sales and use tax exemption for a missouri nonprofit corporations, you must submit the following to the missouri department of revenue: Thus, for a calendar year. Web to be eligible for the automatic extension, a nonprofit organization must file form 8868 before the original due date of their tax return. *file from any device for an extension of up to 6 months.

Cogency global takes state compliance and related requirements off your plate. By filing form 8868, you. For instance, an extension on the filing date for forms 990,. *file from any device for an extension of up to 6 months. Ad we stay up to date on any state changes so that you don’t need to. Web file form 8868 by the due date of the original nonprofit tax forms for which you are requesting an extension. Thus, for a calendar year. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. Irs has now merged the automatic and not.

Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. *file from any device for an extension of up to 6 months. Web file form 8868 by the due date of the original nonprofit tax forms for which you are requesting an extension. For instance, an extension on the filing date for forms 990,. There are two types of extensions that can be obtained with form 8868: File your nonprofit tax extension form 8868. Web to obtain a sales and use tax exemption for a missouri nonprofit corporations, you must submit the following to the missouri department of revenue: Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and. By filing form 8868, you. This form must be sent separately from the return.

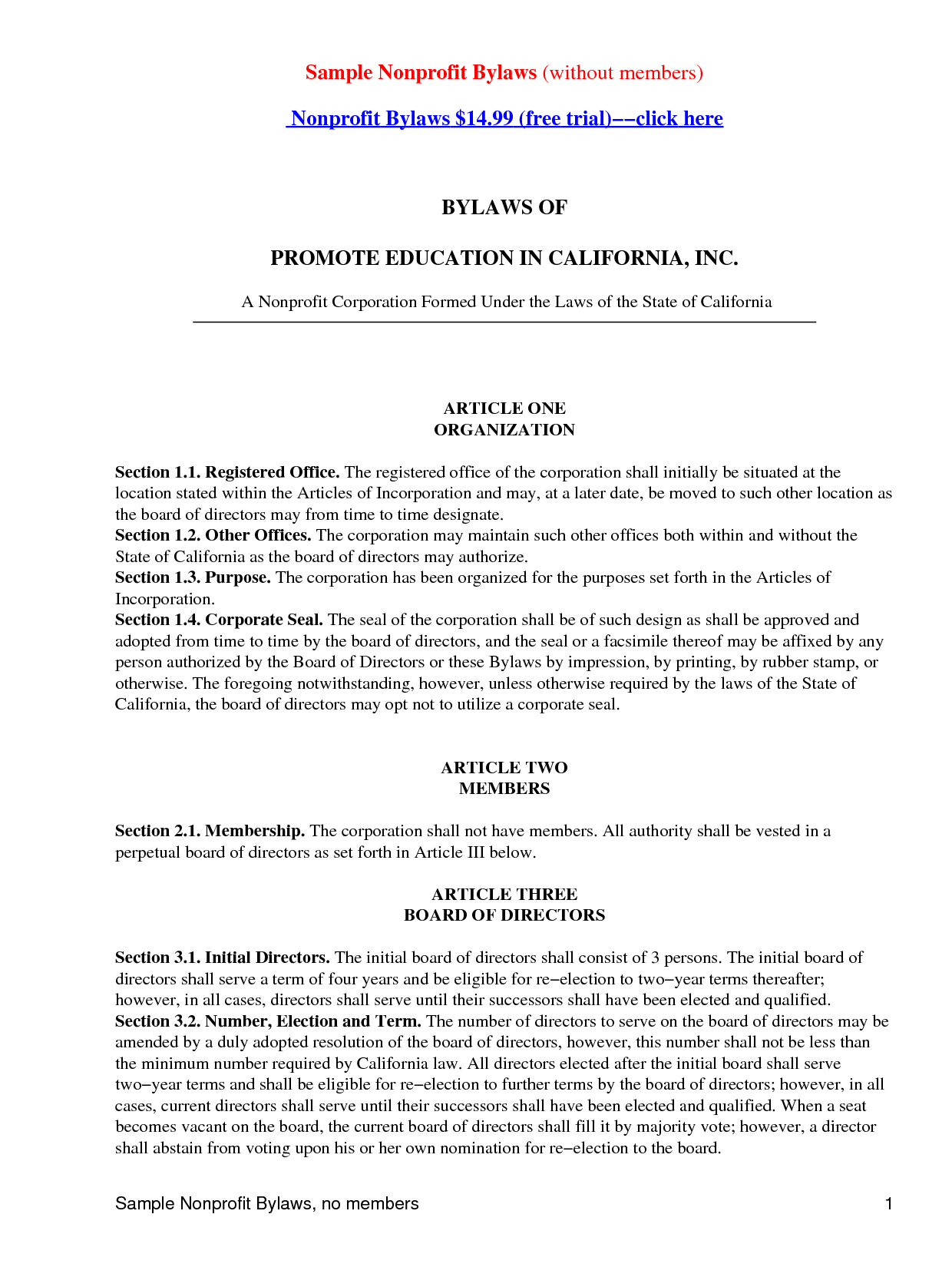

Sample Bylaws and Templates Printable Templates

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. Web to obtain a sales and.

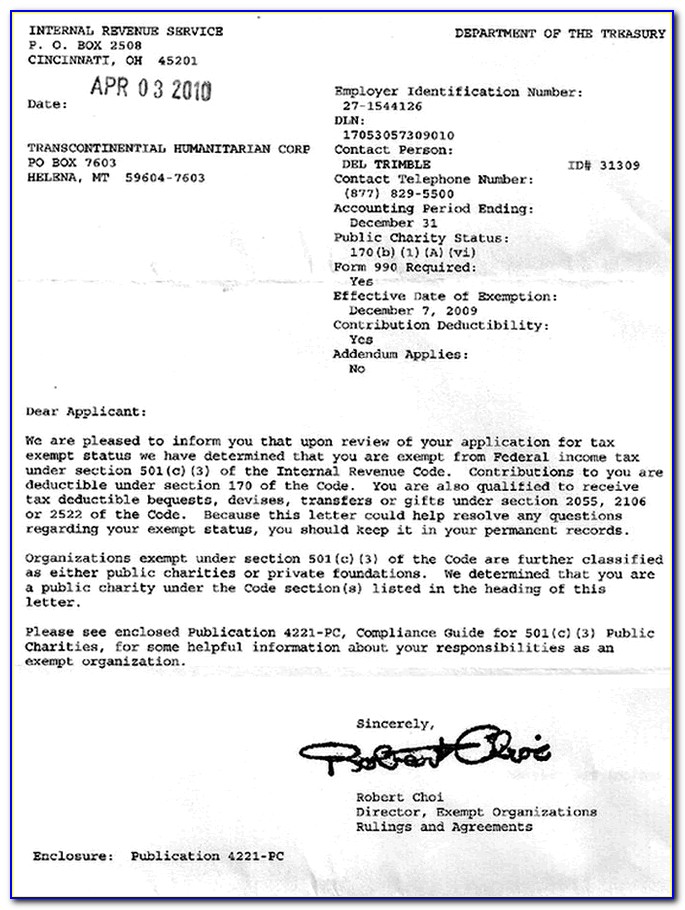

IRS Extension Form 8868 of Time To File an Non Profit or Exempt

Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and. Ad we stay up to date on any state changes so that you don’t need to. Web information about form 8868, application for extension of time to file an exempt organization return, including recent.

Form 990 Non Profit Salaries Universal Network

*file from any device for an extension of up to 6 months. Cogency global takes state compliance and related requirements off your plate. Web to obtain a sales and use tax exemption for a missouri nonprofit corporations, you must submit the following to the missouri department of revenue: Web to get this extension from the irs, nonprofits must file form.

990 Form For Non Profits Irs Universal Network

Cogency global takes state compliance and related requirements off your plate. Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. Web to get this extension from the irs, nonprofits must file form 8868 and pay any taxes due.

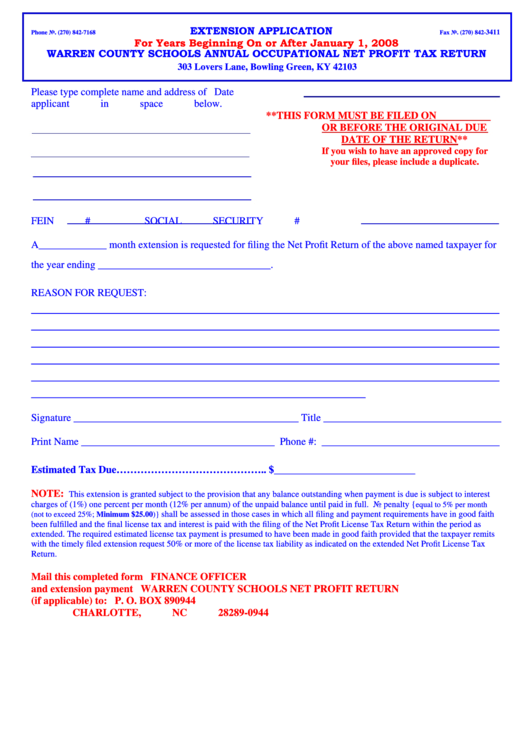

Fillable Extension Application Form Warren County Schools Annual

By filing form 8868, you. Your organization is not suspended on the original due date. Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and. File your nonprofit tax extension form 8868. Web to obtain a sales and use tax exemption for a missouri.

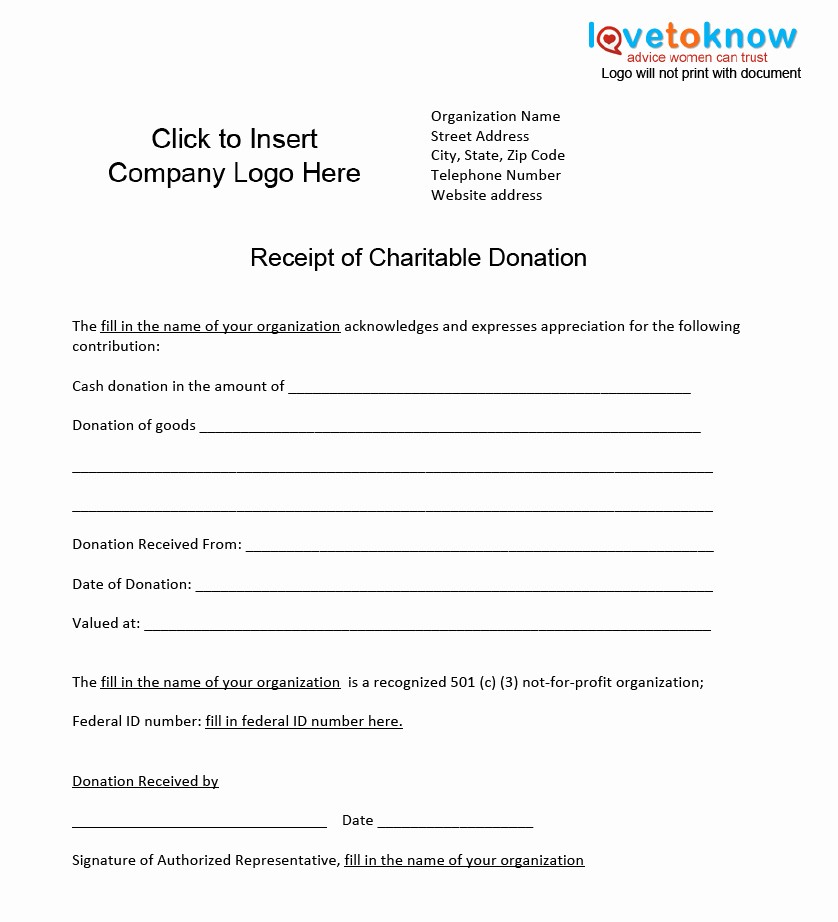

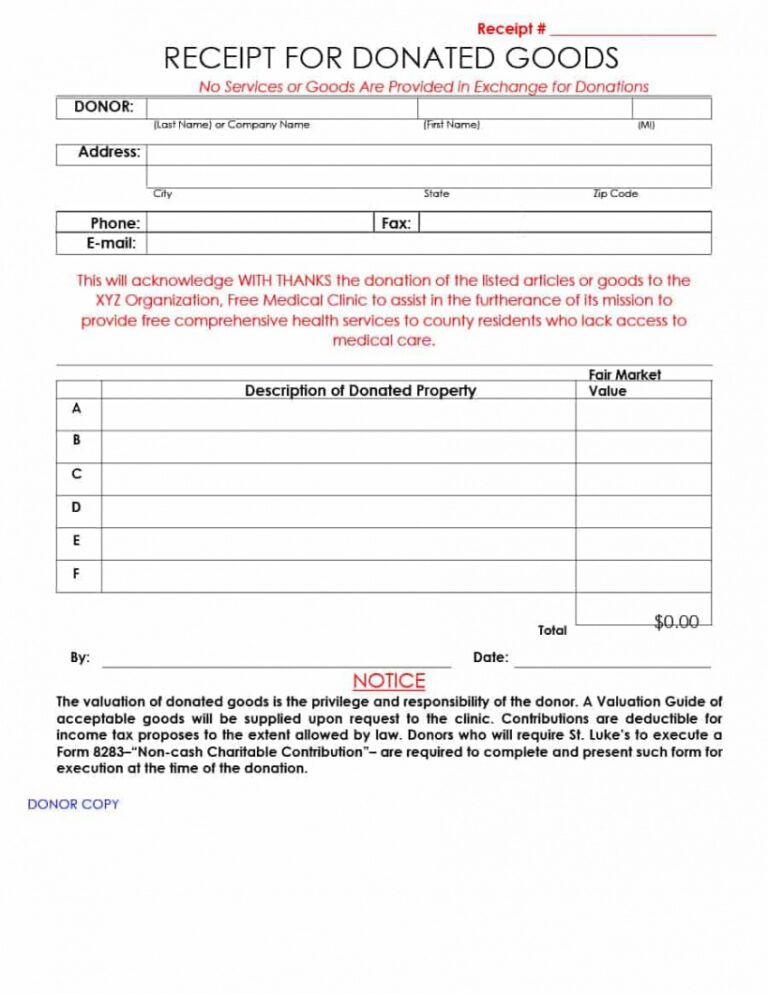

50 Non Profit Donation Receipt form Template

Your organization is not suspended on the original due date. Web to get this extension from the irs, nonprofits must file form 8868 and pay any taxes due by the original date. Cogency global takes state compliance and related requirements off your plate. Web to obtain a sales and use tax exemption for a missouri nonprofit corporations, you must submit.

Non Profit Template Database

Cogency global takes state compliance and related requirements off your plate. Web file form 8868 by the due date of the original nonprofit tax forms for which you are requesting an extension. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Web public service loan forgiveness,.

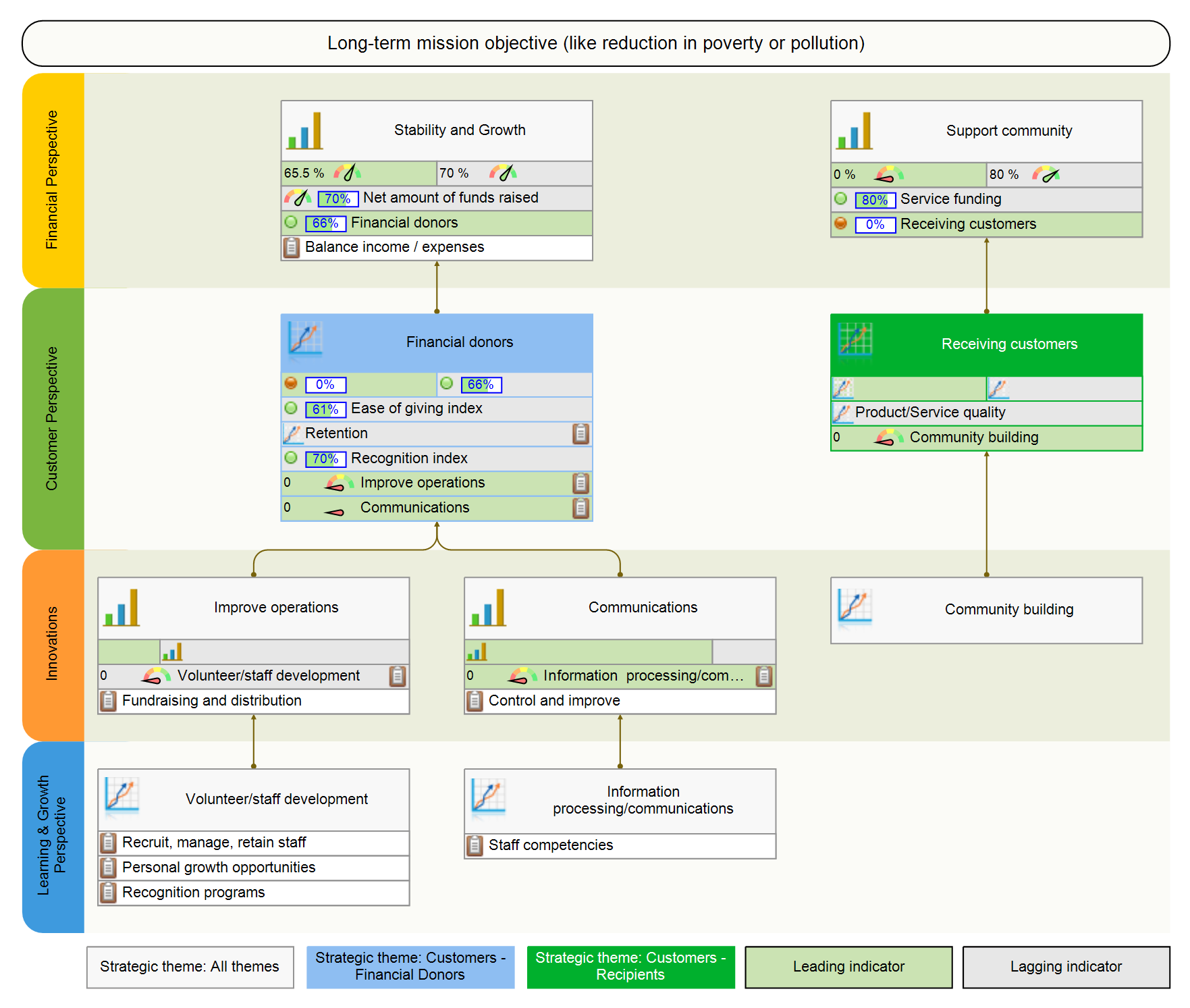

Example of Nonprofit Balanced Scorecard with 14 KPIs

This form must be sent separately from the return. For instance, an extension on the filing date for forms 990,. Cogency global takes state compliance and related requirements off your plate. Ad we stay up to date on any state changes so that you don’t need to. Web if your nonprofit organization has a deadline of may 16 to file.

Non Profit Donation Form Template Excel Sample Minasinternational

Cogency global takes state compliance and related requirements off your plate. Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. Web file form 8868 by the due date of the original nonprofit tax forms for which you are.

Form a Nonprofit Corporation YouTube

This form must be sent separately from the return. Cogency global takes state compliance and related requirements off your plate. Web to be eligible for the automatic extension, a nonprofit organization must file form 8868 before the original due date of their tax return. Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for.

Web To Get This Extension From The Irs, Nonprofits Must File Form 8868 And Pay Any Taxes Due By The Original Date.

Web if your nonprofit organization has a deadline of may 16 to file form 990, they can opt for an irs extension by making use of the irs extension form 8868. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Ad we stay up to date on any state changes so that you don’t need to. Cogency global takes state compliance and related requirements off your plate.

Web To Obtain A Sales And Use Tax Exemption For A Missouri Nonprofit Corporations, You Must Submit The Following To The Missouri Department Of Revenue:

*file from any device for an extension of up to 6 months. Web to be eligible for the automatic extension, a nonprofit organization must file form 8868 before the original due date of their tax return. Specifically, the filing and tax payment deadlines for irs. By filing form 8868, you.

Irs Has Now Merged The Automatic And Not.

Your organization is not suspended on the original due date. Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and. This form must be sent separately from the return. Web file form 8868 by the due date of the original nonprofit tax forms for which you are requesting an extension.

Cogency Global Takes State Compliance And Related Requirements Off Your Plate.

There are two types of extensions that can be obtained with form 8868: File your nonprofit tax extension form 8868. Thus, for a calendar year. Ad we stay up to date on any state changes so that you don’t need to.