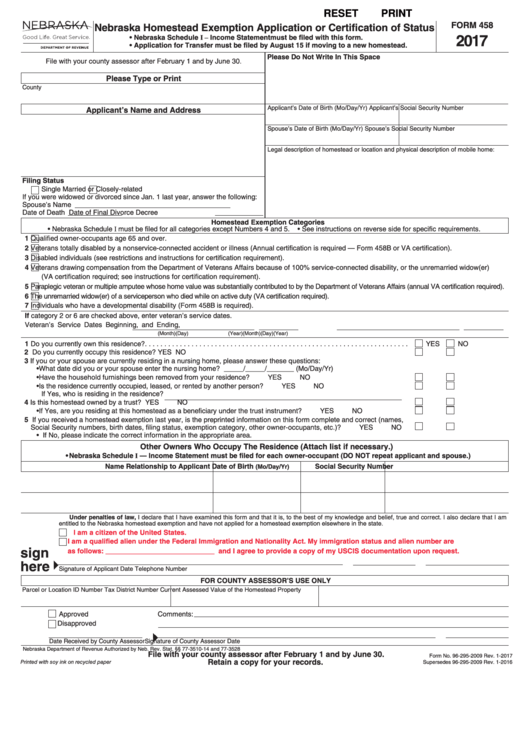

Nebraska Form 458

Nebraska Form 458 - Tach this schedule to the 2018 nebraska. Web where can i find information about the homestead exemption? Department of revenue homestead exemption information and forms (pdf format) homestead exemption. Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458. File 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. Web nebraska homestead exemption application or certification of status, form 458 for filing after february 1, 2013, and by july 1, 2013. Web the nebraska homestead exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in nebraska who occupy a home, used as their. Retain a copy for your records. Web property if you need an application, or have questions, you may contact our office at: Web if you move from one homestead in nebraska to a new homestead in nebraska that is acquired between january 1 and august 15 of the year for which the transfer is.

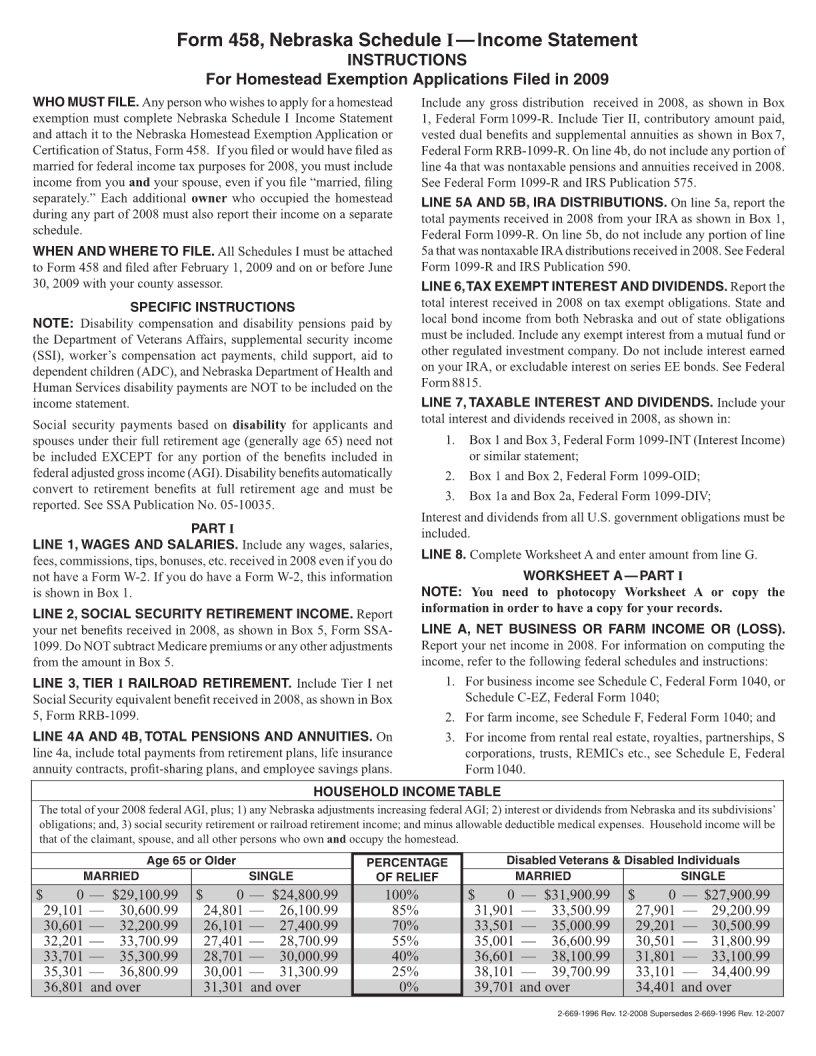

Web property owners are reminded to file their nebraska homestead exemption application or certification, form 458, with their local county assessor before june 30. Web nebraska homestead exemption application good life. Retain a copy for your records. Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458. 2) interest or dividends from nebraska and its subdivisions’ obligations; File 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. Web where can i find information about the homestead exemption? Web the nebraska homestead exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in nebraska who occupy a home, used as their. Web file 2021 form 458 and all schedules with your county assessor after february 1, 2021 and on or before june 30, 2021. Web instructions for homestead exemption applications filed in 2000 who must file.

Nebraska schedule i — income statement must be filed with this form except for categories 4 and 5. Web property owners are reminded to file their nebraska homestead exemption application or certification, form 458, with their local county assessor before june 30. Web where can i find information about the homestead exemption? Retain a copy for your records. Web nebraska homestead exemption application or certification of status, form 458 for filing after february 1, 2013, and by july 1, 2013. Retain a copy for your records. Web instructions for homestead exemption applications filed in 2000 who must file. Web the nebraska homestead exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in nebraska who occupy a home, used as their. Web the total of your 2009 federal agi, plus; Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458.

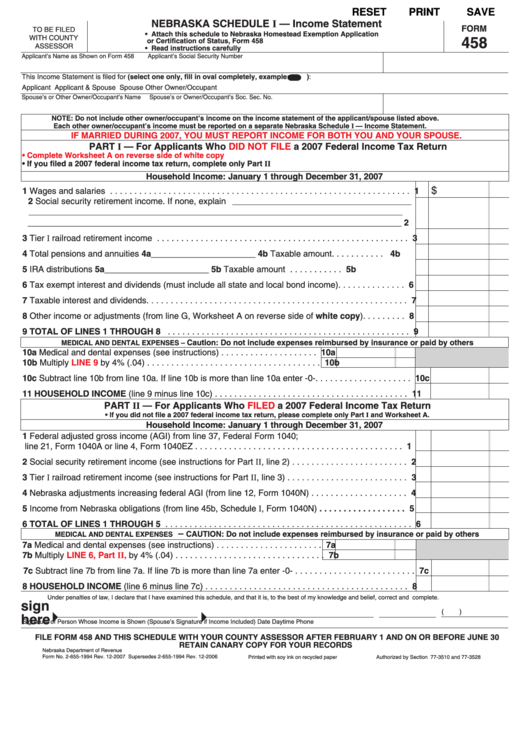

Fillable Form 458 Nebraska Schedule I Statement 2007

Web the nebraska department of revenue, property assessment division (dor) reminds property owners that the nebraska homestead exemption application,. Tach this schedule to the. Retain a copy for your records. Web nebraska homestead exemption application or certification of status, form 458 for filing after february 1, 2013, and by july 1, 2013. Any person who wishes to apply for a.

Retirees in These 15 States Can Save With These Tax Tips GOBankingRates

Retain a copy for your records. Web property if you need an application, or have questions, you may contact our office at: Web nebraska schedule i — income statement. Web the nebraska department of revenue, property assessment division (dor) reminds property owners that the nebraska homestead exemption application,. 1) any nebraska adjustments increasing federal agi;

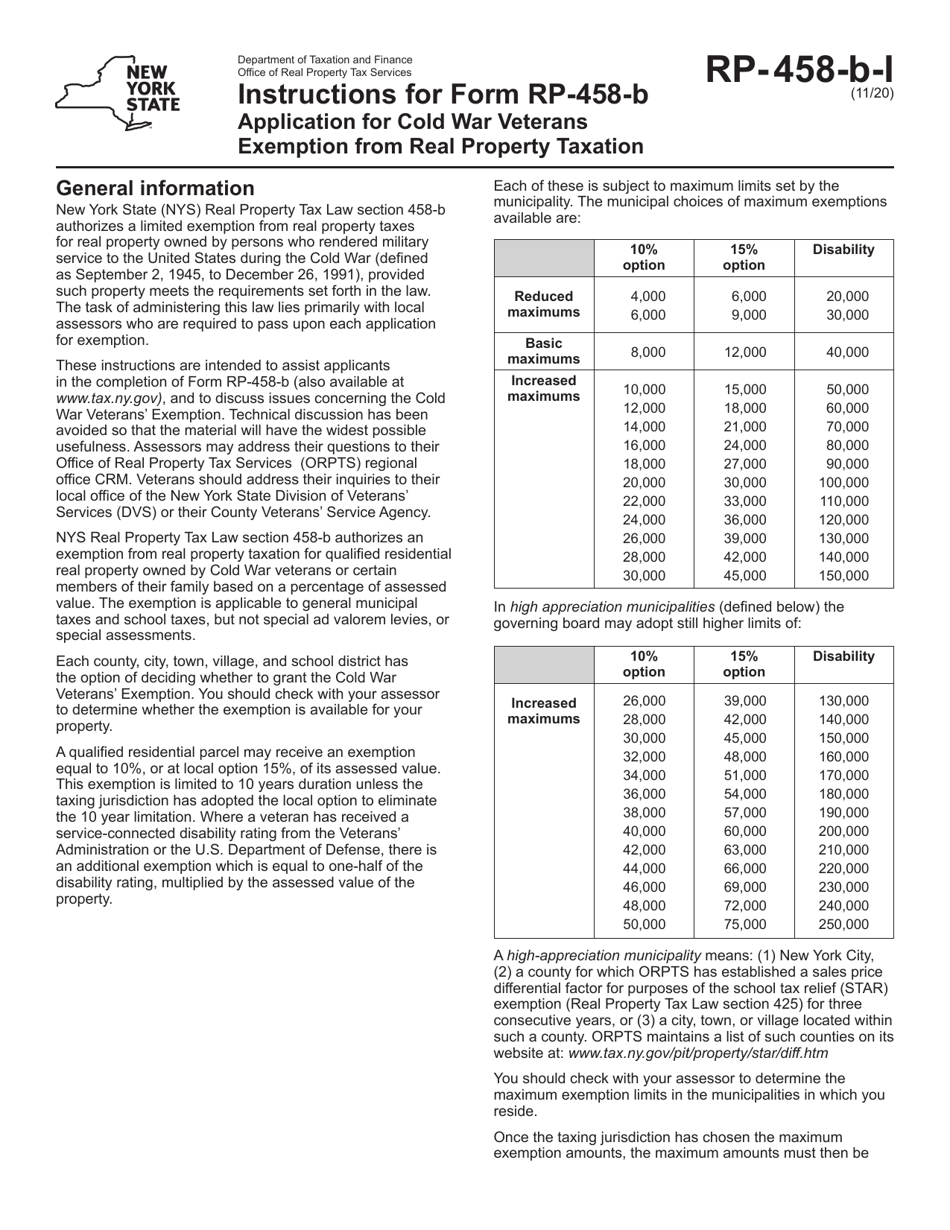

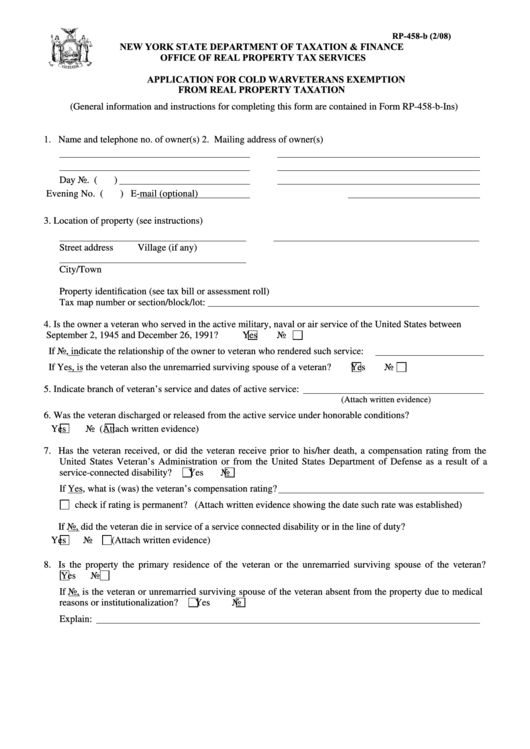

Download Instructions for Form RP458B Application for Cold War

Web file form 458 and all schedules with your county assessor after february 1 and by june 30. Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458. Web instructions for homestead exemption applications filed in 2000 who must file. Web file 2021 form 458 and all schedules.

Benco Dental Exemption Certificate Information Benco Dental

Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458. Web property if you need an application, or have questions, you may contact our office at: Retain a copy for your records. Web property owners are reminded to file their nebraska homestead exemption application or certification, form 458,.

Ne Form 458 ≡ Fill Out Printable PDF Forms Online

Retain a copy for your records. Retain a copy for your records. File 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. 1) any nebraska adjustments increasing federal agi; Web property owners are reminded to file their nebraska homestead exemption application or certification, form 458, with their local.

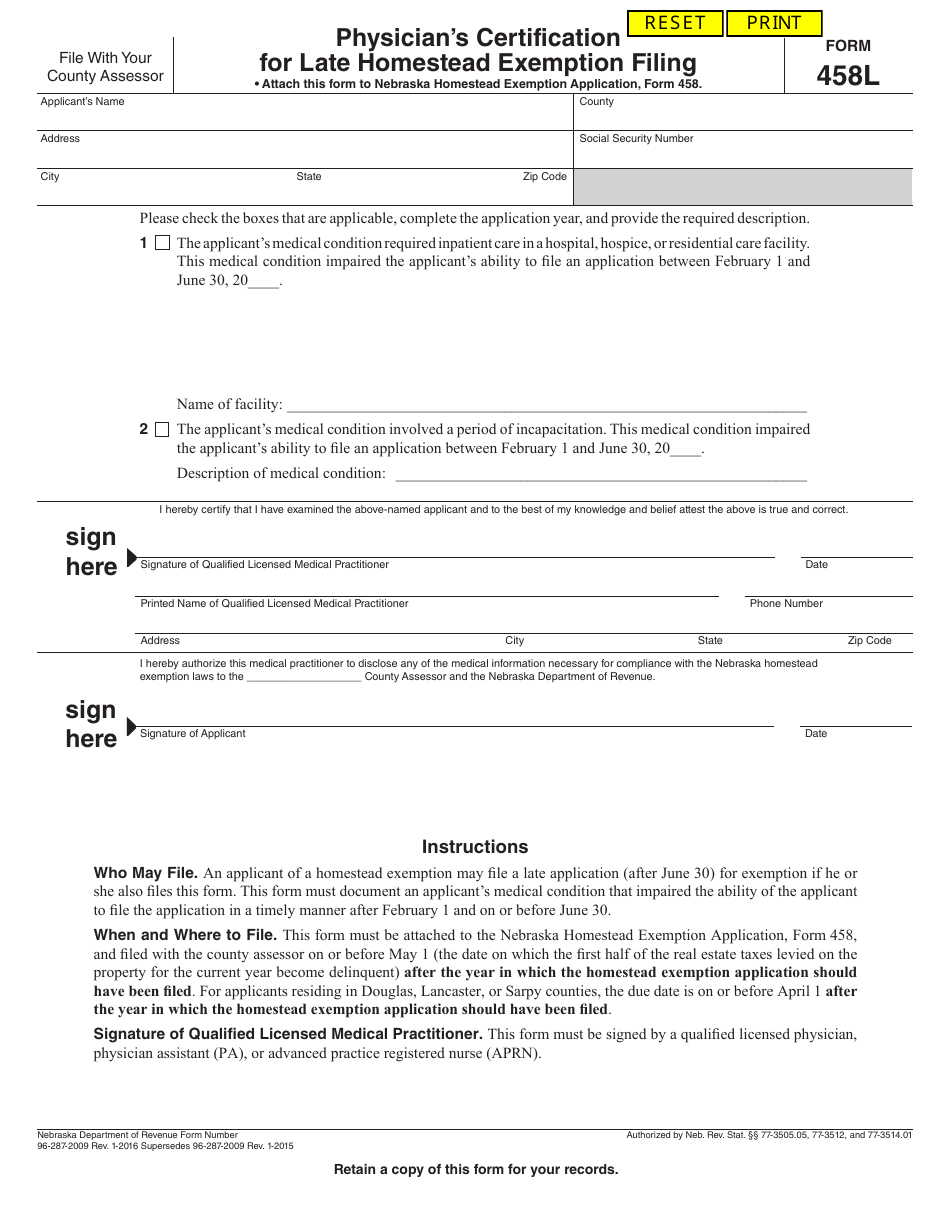

Form 458L Download Fillable PDF or Fill Online Physician's

Tach this schedule to the. • attach this schedule to the 2016 nebraska homestead. 2) interest or dividends from nebraska and its subdivisions’ obligations; Department of revenue homestead exemption information and forms (pdf format) homestead exemption. Web this form is to be attached to and filed with the nebraska homestead exemption application or certification of status, form 458.

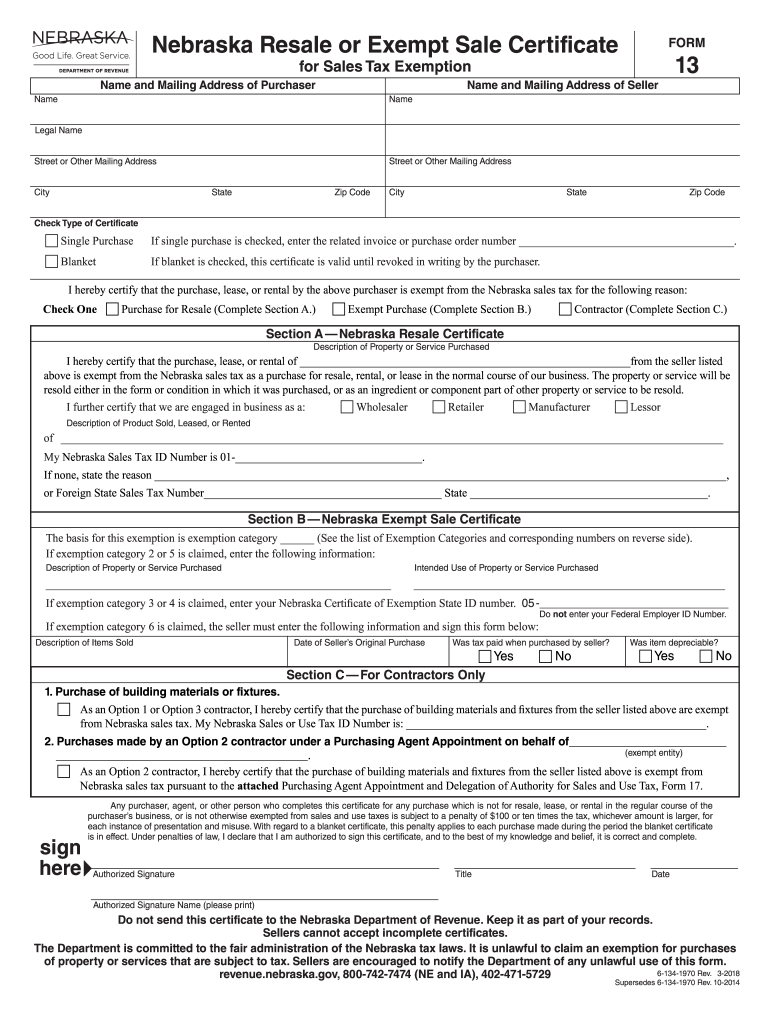

Nebraska Form 13 Fill Out and Sign Printable PDF Template signNow

Web file 2018 form 458 and all schedules with your county assessor after february 1, 2018 and by july 2, 2018. Tach this schedule to the. Web the nebraska department of revenue, property assessment division (dor) reminds property owners that the nebraska homestead exemption application,. Web property if you need an application, or have questions, you may contact our office.

Fillable Form Rp458B Application For Cold War Veterans Exemption

Tach this schedule to the. Web nebraska homestead exemption application or certification of status, form 458 for filing after february 1, 2013, and by july 1, 2013. Web nebraska schedule i — income statement. Retain a copy for your records. Web if you move from one homestead in nebraska to a new homestead in nebraska that is acquired between january.

Fillable Form 458 Nebraska Homestead Exemption Application Or

File 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. Web file 2021 form 458 and all schedules with your county assessor after february 1, 2021 and on or before june 30, 2021. Web property if you need an application, or have questions, you may contact our office.

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

Tach this schedule to the. Tach this schedule to the 2018 nebraska. • attach this schedule to the 2016 nebraska homestead. 2) interest or dividends from nebraska and its subdivisions’ obligations; Any person who wishes to apply for a homestead exemption must complete the.

Web This Form Is To Be Attached To And Filed With The Nebraska Homestead Exemption Application Or Certification Of Status, Form 458.

Web where can i find information about the homestead exemption? Any person who wishes to apply for a homestead exemption must complete the. File 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. Web file 2018 form 458 and all schedules with your county assessor after february 1, 2018 and by july 2, 2018.

1) Any Nebraska Adjustments Increasing Federal Agi;

Web instructions for homestead exemption applications filed in 2000 who must file. Web the total of your 2009 federal agi, plus; Retain a copy for your records. Nebraska schedule i — income statement must be filed with this form except for categories 4 and 5.

Department Of Revenue Homestead Exemption Information And Forms (Pdf Format) Homestead Exemption.

2) interest or dividends from nebraska and its subdivisions’ obligations; Web file form 458 and all schedules with your county assessor after february 1 and by june 30. Retain a copy for your records. • attach this schedule to the 2016 nebraska homestead.

Retain A Copy For Your Records.

Tach this schedule to the 2018 nebraska. Web the nebraska department of revenue, property assessment division (dor) reminds property owners that the nebraska homestead exemption application,. Web property owners are reminded to file their nebraska homestead exemption application or certification, form 458, with their local county assessor before june 30. Web property if you need an application, or have questions, you may contact our office at: