Mississippi State Tax Form 2022

Mississippi State Tax Form 2022 - Web the mississippi sales tax holiday in 2023 only ran for two days. Web mississippi has a state income tax that ranges between 3% and 5%. Get ready for tax season deadlines by completing any required tax forms today. Web welcome to the mississippi department of revenue the department of revenue is the primary agency for collecting tax revenues that support state and local governments in. Be sure to verify that the form. Choose the correct version of the editable. Fiscal year returns must be filed no later than the 15th day of the 4th. Web you should file a mississippi income tax return if any of the following statements apply to you: You can download or print. Current mississippi income taxes can be prepared but.

Web you should file a mississippi income tax return if any of the following statements apply to you: You must file, online or through the mail, yearly by april 17. If a due date falls on a saturday, sunday, or legal holiday, the due date becomes the next business. Single individuals married individuals (jointly) head of family $6,000 $1,500 $12,000 dependents age 65 and over blindness. Web the mississippi sales tax holiday in 2023 only ran for two days. Web resident individual income tax return 2022 amended ssn spouse ssn 29 overpayment (if line 28 is more than line 24, subtract line 24 from line 28; Fiscal year returns must be filed no later than the 15th day of the 4th. Web item, sales tax is applied to the sale of the newly purchased item. Be sure to verify that the form. Mississippi state income tax forms for current and previous tax years.

Web instructions the personal exemptions allowed: Web welcome to the mississippi department of revenue the department of revenue is the primary agency for collecting tax revenues that support state and local governments in. If a due date falls on a saturday, sunday, or legal holiday, the due date becomes the next business. Mississippi state income tax forms for current and previous tax years. After the holiday, the customer. Web item, sales tax is applied to the sale of the newly purchased item. Single individuals married individuals (jointly) head of family $6,000 $1,500 $12,000 dependents age 65 and over blindness. If zero, skip to line 35) 30. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web resident individual income tax return 2022 amended ssn spouse ssn 29 overpayment (if line 28 is more than line 24, subtract line 24 from line 28;

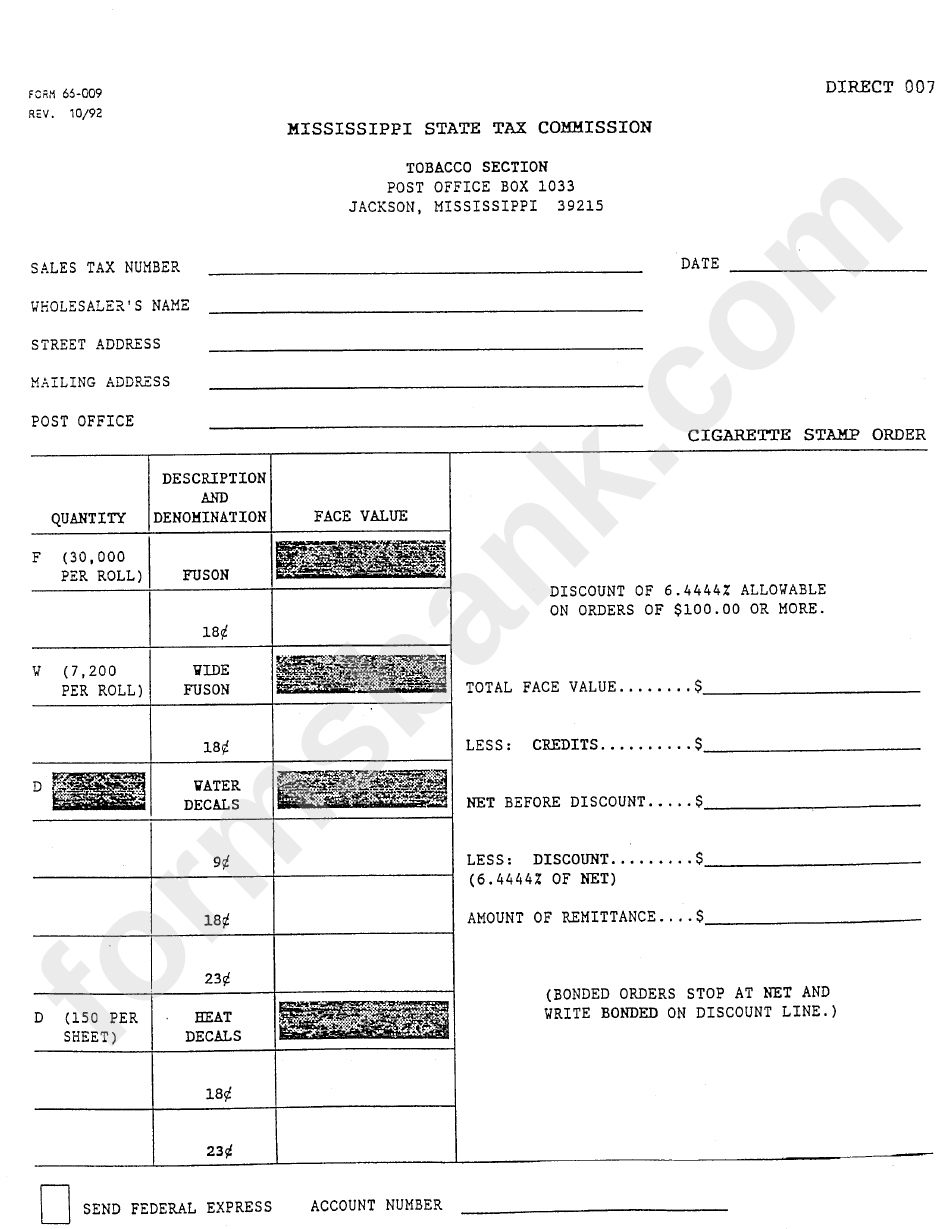

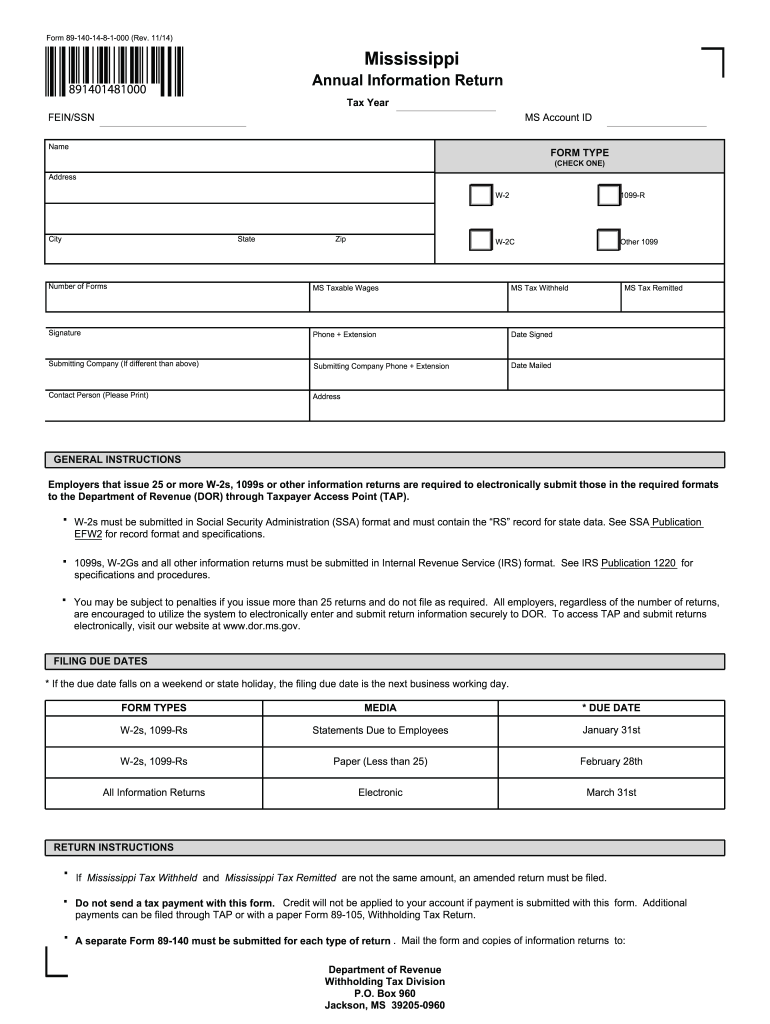

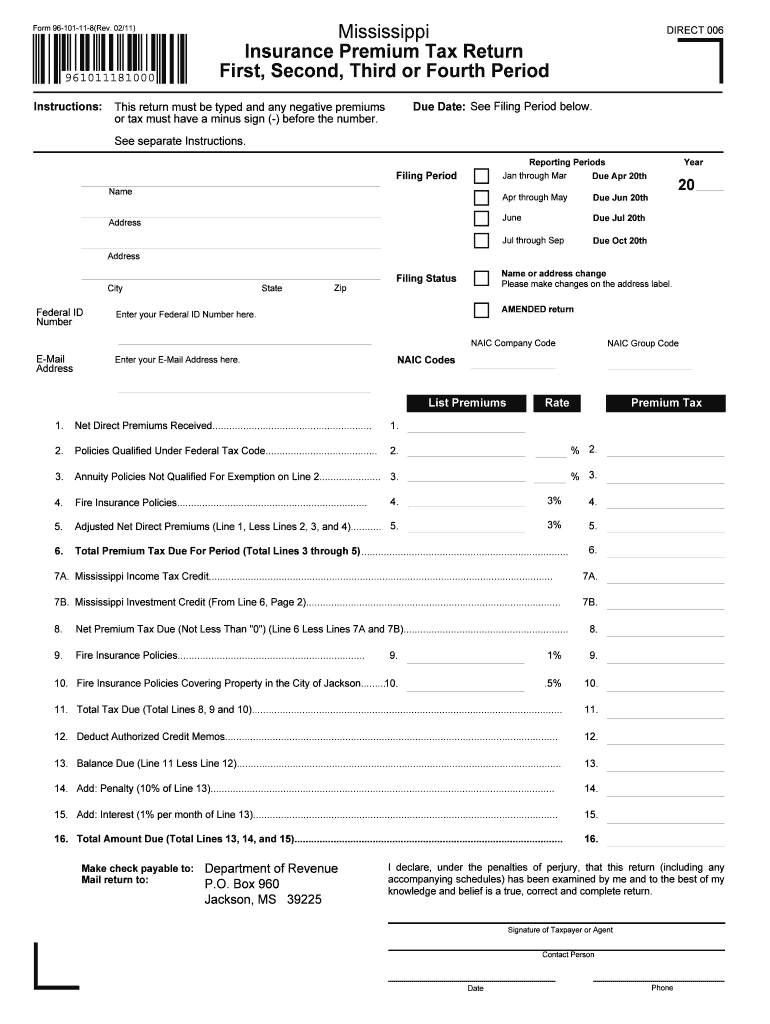

Form 66 009 Mississippi State Tax Commission Form printable pdf

Web you should file a mississippi income tax return if any of the following statements apply to you: You can download or print. Be sure to verify that the form. Web mississippi has a state income tax that ranges between 3% and 5%. Web the mississippi sales tax holiday in 2023 only ran for two days.

Mississippians have among the highest tax burdens Mississippi Center

Web item, sales tax is applied to the sale of the newly purchased item. Mississippi state income tax forms for current and previous tax years. After the holiday, the customer. If zero, skip to line 35) 30. Be sure to verify that the form.

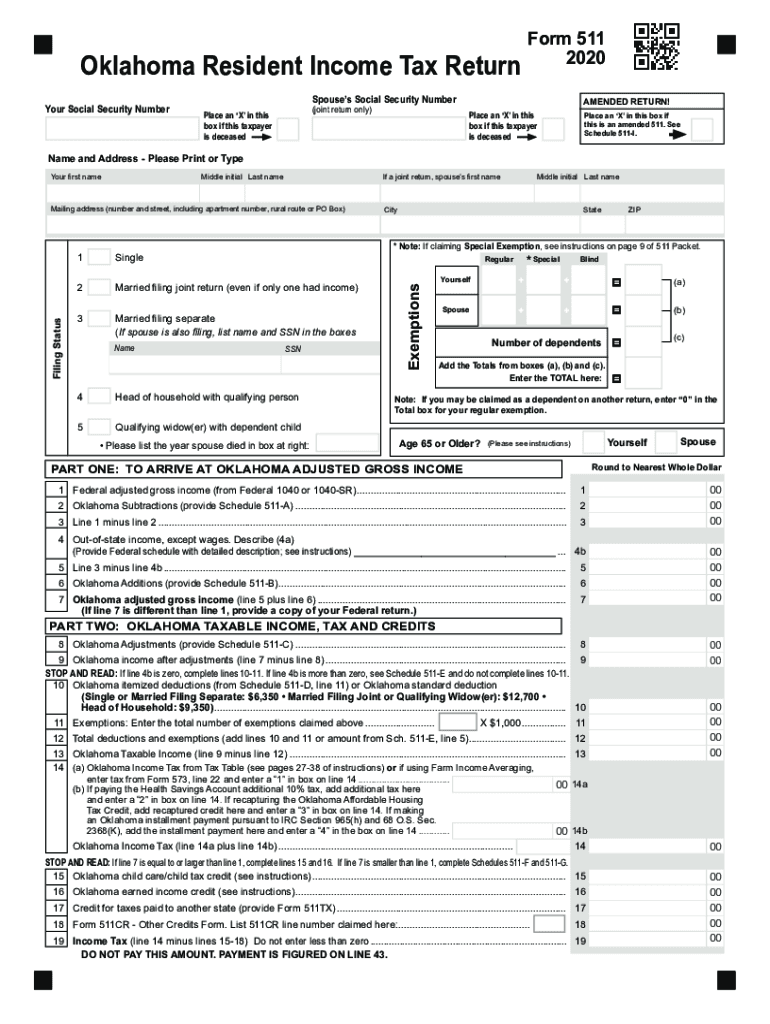

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

Web mississippi tax forms for 2022 and 2023. Web instructions the personal exemptions allowed: Fiscal year returns must be filed no later than the 15th day of the 4th. Web item, sales tax is applied to the sale of the newly purchased item. Get ready for tax season deadlines by completing any required tax forms today.

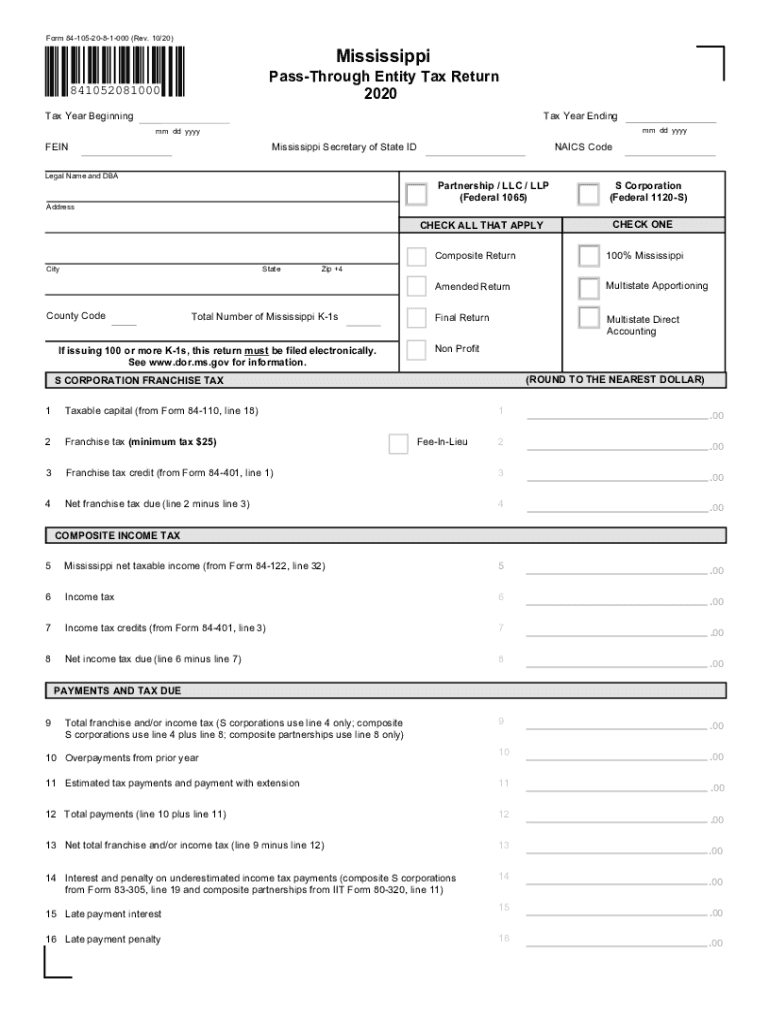

MS 84105 20202022 Fill out Tax Template Online US Legal Forms

Mississippi state income tax forms for current and previous tax years. Single individuals married individuals (jointly) head of family $6,000 $1,500 $12,000 dependents age 65 and over blindness. Web mississippi tax forms for 2022 and 2023. After the holiday, the customer. Web the mississippi sales tax holiday in 2023 only ran for two days.

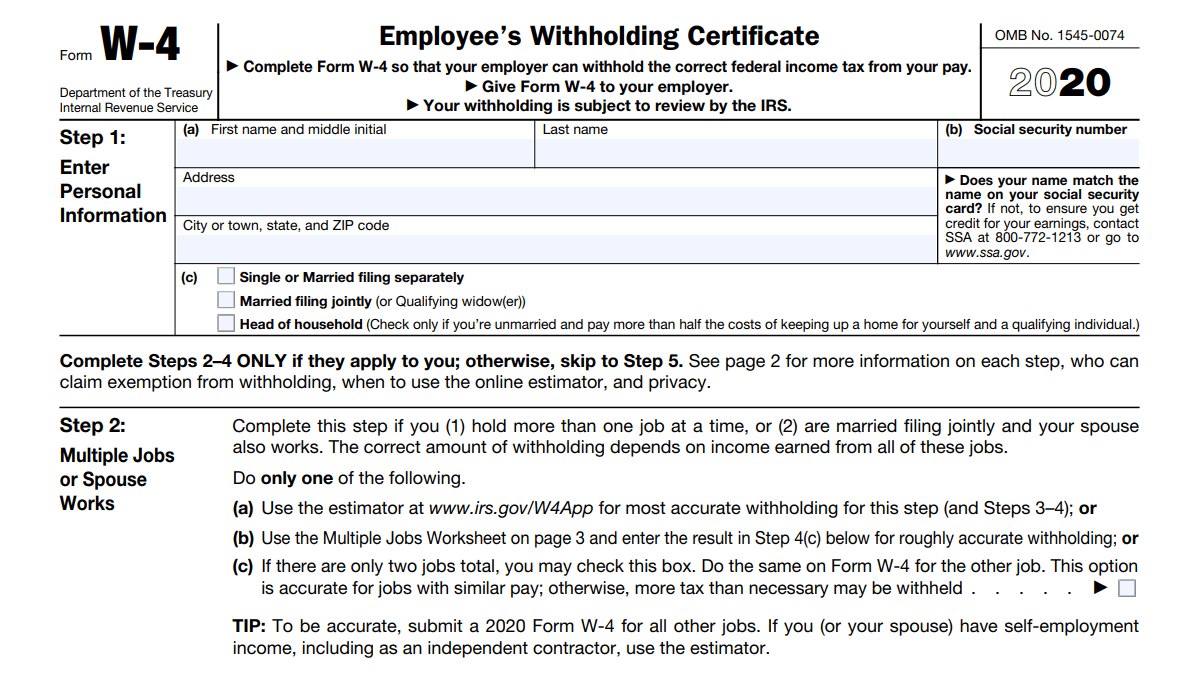

State Tax Withholding 2022 Gettrip24

For example, a customer purchases a $300.00 firearm during the msaw holiday. Web mississippi tax forms for 2022 and 2023. Current mississippi income taxes can be prepared but. Web you should file a mississippi income tax return if any of the following statements apply to you: Be sure to verify that the form.

Ms Printable W4 Forms 2021 2022 W4 Form

Mississippi state income tax forms for current and previous tax years. Web resident individual income tax return 2022 amended ssn spouse ssn 29 overpayment (if line 28 is more than line 24, subtract line 24 from line 28; Fiscal year returns must be filed no later than the 15th day of the 4th. Ad discover 2290 form due dates for.

Mississippi to end mailing of tax forms

Mississippi state income tax forms for current and previous tax years. Web mississippi has a state income tax that ranges between 3% and 5%. Web instructions the personal exemptions allowed: Current mississippi income taxes can be prepared but. Web item, sales tax is applied to the sale of the newly purchased item.

Mississippi State Withholding Form 2021 2022 W4 Form

Current mississippi income taxes can be prepared but. Web printable mississippi state tax forms fork the 2022 pay year want become based on income earned between january 1, 2022 through day 31, 2022. Web mississippi tax forms for 2022 and 2023. You can download or print. Single individuals married individuals (jointly) head of family $6,000 $1,500 $12,000 dependents age 65.

Mississippi State Tax Forms 20112022 Fill Out and Sign Printable PDF

If zero, skip to line 35) 30. Web welcome to the mississippi department of revenue the department of revenue is the primary agency for collecting tax revenues that support state and local governments in. (a) single individuals (b) married individuals (jointly) (c) head of family $6,000 $12,000 $9,500 dependents $1,500. Web the 2022 mississippi state income tax return forms for.

Will Mississippi get rid of state personal tax?

If a due date falls on a saturday, sunday, or legal holiday, the due date becomes the next business. Mississippi state income tax forms for current and previous tax years. Web item, sales tax is applied to the sale of the newly purchased item. You can download or print. Web withholding returns are due the 15th day of the month.

Mississippi State Income Tax Forms For Current And Previous Tax Years.

Web mississippi has a state income tax that ranges between 3% and 5%. Web you should file a mississippi income tax return if any of the following statements apply to you: Ad discover 2290 form due dates for heavy use vehicles placed into service. Fiscal year returns must be filed no later than the 15th day of the 4th.

You Can Download Or Print.

Web the mississippi sales tax holiday in 2023 only ran for two days. Web withholding returns are due the 15th day of the month following the period. Single individuals married individuals (jointly) head of family $6,000 $1,500 $12,000 dependents age 65 and over blindness. Web printable mississippi state tax forms fork the 2022 pay year want become based on income earned between january 1, 2022 through day 31, 2022.

Web Resident Individual Income Tax Return 2022 Amended Ssn Spouse Ssn 29 Overpayment (If Line 28 Is More Than Line 24, Subtract Line 24 From Line 28;

After the holiday, the customer. (a) single individuals (b) married individuals (jointly) (c) head of family $6,000 $12,000 $9,500 dependents $1,500. Web instructions the personal exemptions allowed: You must file, online or through the mail, yearly by april 17.

If A Due Date Falls On A Saturday, Sunday, Or Legal Holiday, The Due Date Becomes The Next Business.

Choose the correct version of the editable. Web item, sales tax is applied to the sale of the newly purchased item. Be sure to verify that the form. Get ready for tax season deadlines by completing any required tax forms today.