Michigan Withholding Form 2022

Michigan Withholding Form 2022 - If you fail or refuse to submit. This form is used by michigan residents who file an individual. Web up to $40 cash back fill michigan withholding form mi w4: Web we last updated michigan schedule w in february 2023 from the michigan department of treasury. Web filing deadlines all businesses are required to file an annual return each year. Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly or quarterly basis and. Get, create, make and sign michigan withholding form. Web income tax forms for the state of michigan. Web instructions included on form: Web welcome to michigan treasury online (mto)!

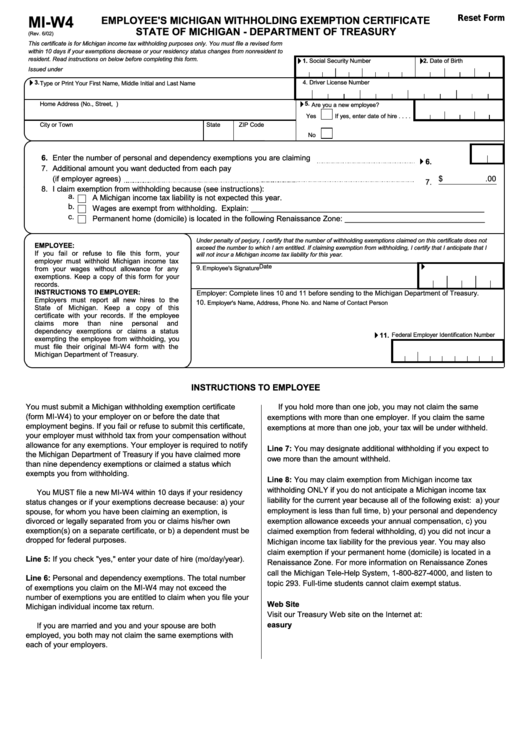

This form is for income earned in tax year 2022, with tax returns due in april. Mto is the michigan department of treasury's web portal to many business taxes. Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly or quarterly basis and. Once the form is completed, push finished. Web welcome to michigan treasury online (mto)! Get, create, make and sign michigan withholding form. Mto is free and provides secure 24/7 online access. Web common michigan income tax forms & instructions. Web michigan — employee's michigan withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. Treasury is committed to protecting.

Get, create, make and sign michigan withholding form. Once the form is completed, push finished. If you fail or refuse to submit. Michigan state tax employee's withholding. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Web instructions included on form: Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Treasury is committed to protecting. Web 2022 employer withholding tax.

2022 Ne State Tax Withholding Form

Treasury is committed to protecting. Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. If you fail or refuse to submit. This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Mto is the michigan department of treasury's web portal to.

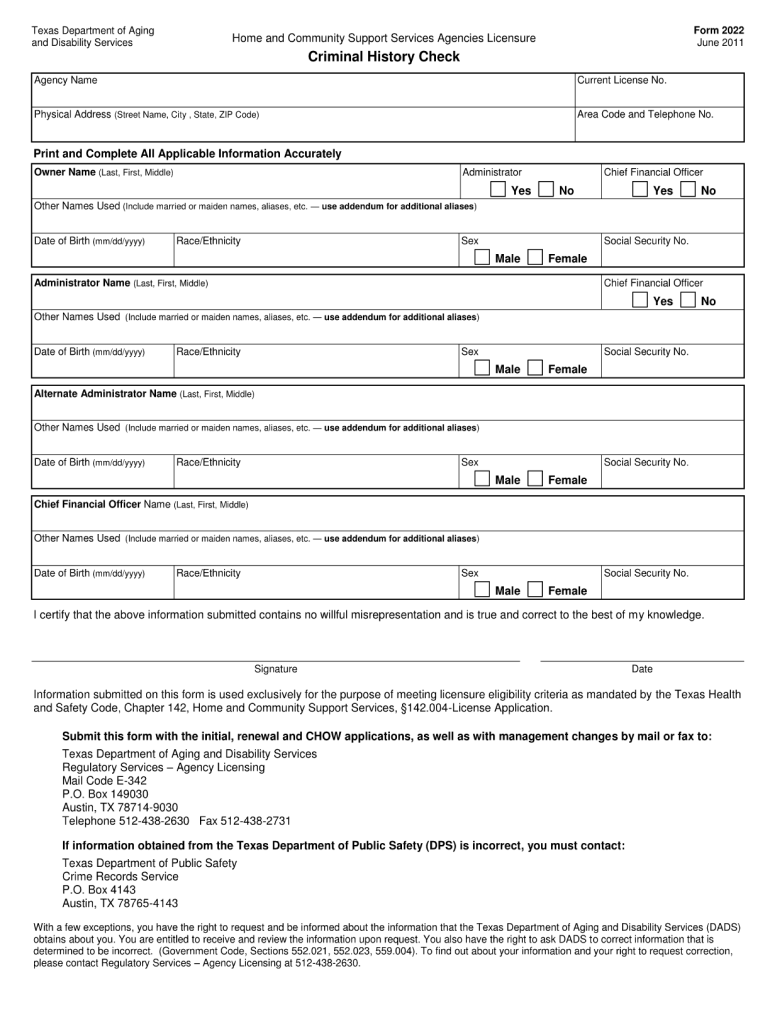

Mi 1040 Fill Out and Sign Printable PDF Template signNow

Web welcome to michigan treasury online (mto)! Web filing deadlines all businesses are required to file an annual return each year. Form popularity w4 treasury form. Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly or quarterly basis and. Complete, edit or print tax forms instantly.

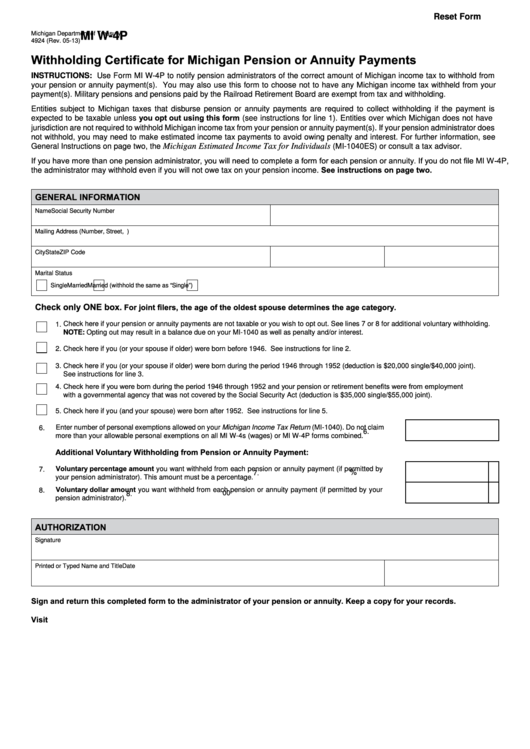

Fillable Form Mi W4p Withholding Certificate For Michigan Pension Or

This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Distribute the all set variety by. Web we last updated michigan schedule w in february 2023 from the michigan department of treasury. This form is used by michigan residents who file an individual. Web filing deadlines all businesses are required to.

2022 Michigan Withholding Tax Form

If you fail or refuse to submit. Distribute the all set variety by. This form is for income earned in tax year 2022, with tax returns due in april. Web instructions included on form: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which.

20202023 Form MI MIW4 Fill Online, Printable, Fillable, Blank pdfFiller

This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Form popularity w4 treasury form. Web welcome to michigan treasury online (mto)! If you fail or.

Michigan 2022 Annual Tax Withholding Form

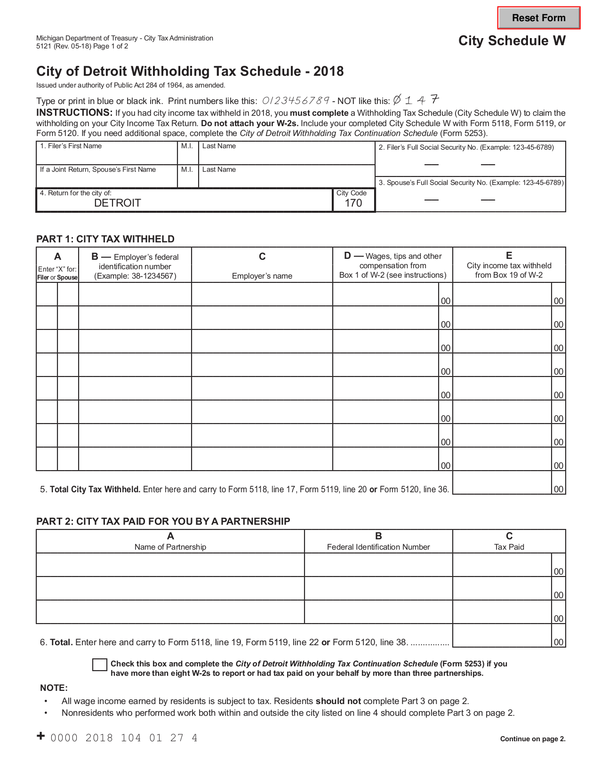

If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Treasury is committed to protecting. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated michigan schedule w in february 2023 from the michigan department.

Fillable Form MiW4 Employee'S Michigan Withholding Exemption

Complete, edit or print tax forms instantly. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Sales and other dispositions of capital assets: If you fail or refuse to submit. Treasury is committed to protecting.

Michigan Sales Tax And Withholding Form 2022

Treasury is committed to protecting. Mto is free and provides secure 24/7 online access. This form is for income earned in tax year 2022, with tax returns due in april. Distribute the all set variety by. If you fail or refuse to submit.

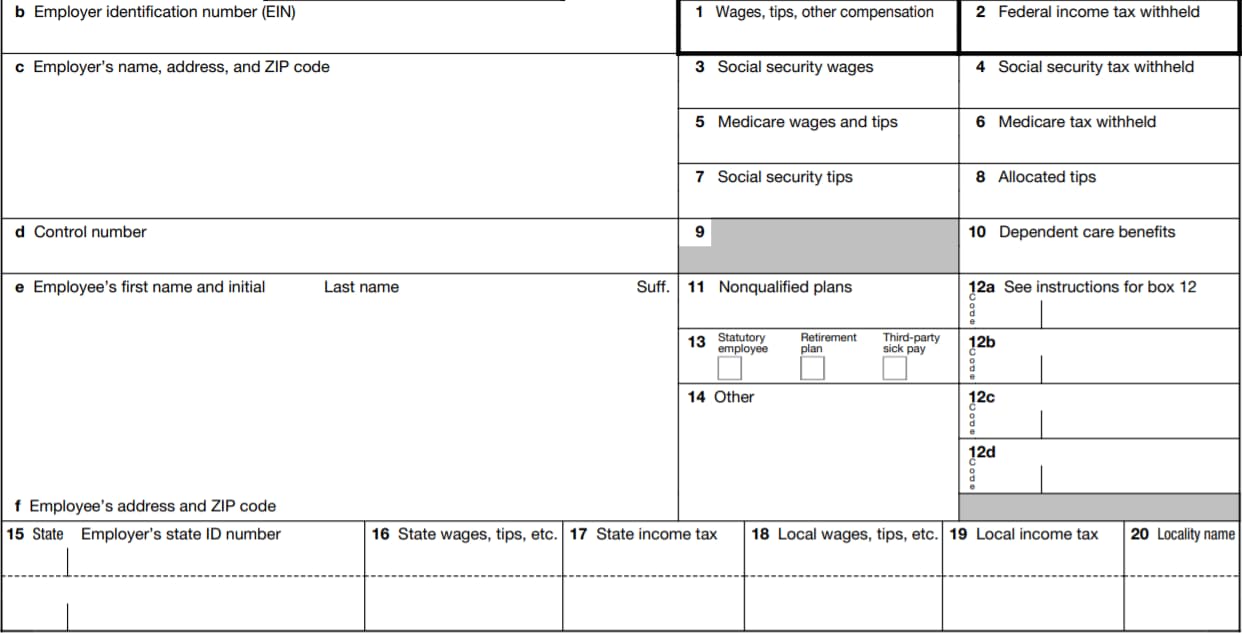

W2 Form 2022 Fillable PDF

Web 2022 employer withholding tax. Web common michigan income tax forms & instructions. Michigan state tax employee's withholding. Web michigan — employee's michigan withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. Web up to $40 cash back fill michigan withholding form mi w4:

Michigan Withholding Employee Form

Form popularity w4 treasury form. Web up to $40 cash back fill michigan withholding form mi w4: Complete, edit or print tax forms instantly. Sales and other dispositions of capital assets: This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of.

Complete, Edit Or Print Tax Forms Instantly.

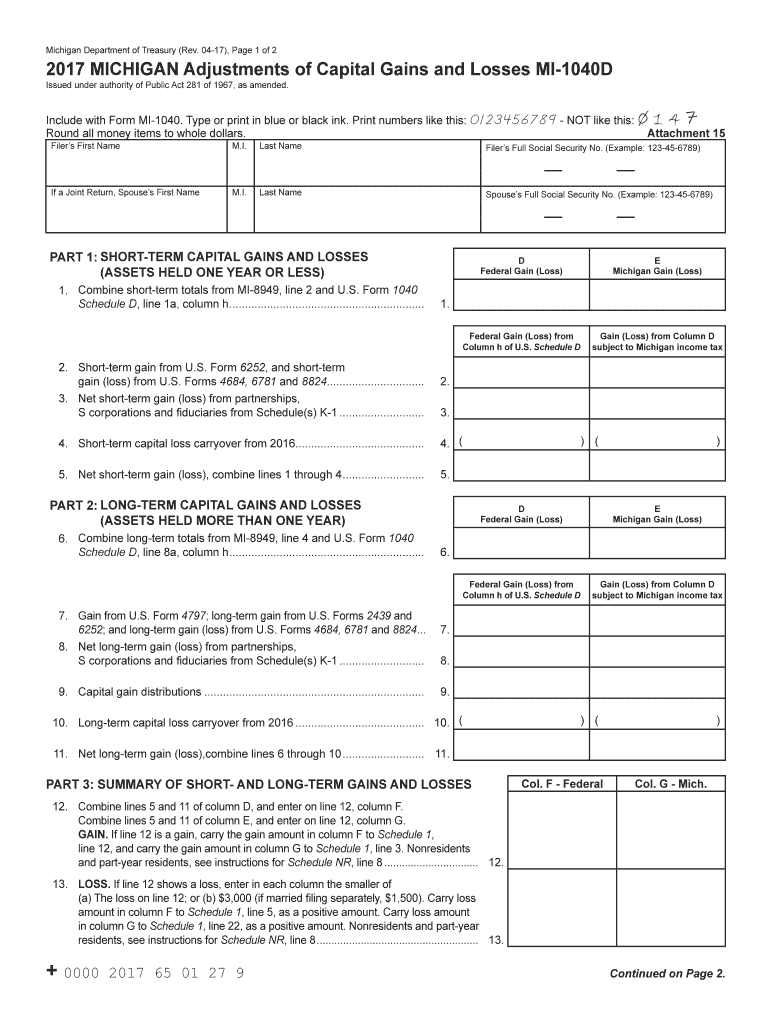

Sales and other dispositions of capital assets: Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Web income tax forms for the state of michigan. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument.

This Form Is Used By Michigan Residents Who File An Individual.

Web filing deadlines all businesses are required to file an annual return each year. Web 2022 employer withholding tax. If you fail or refuse to submit. Web michigan — employee's michigan withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser.

Mto Is The Michigan Department Of Treasury's Web Portal To Many Business Taxes.

Web we last updated michigan schedule w in february 2023 from the michigan department of treasury. Web common michigan income tax forms & instructions. Michigan state tax employee's withholding. Web up to $40 cash back fill michigan withholding form mi w4:

Web Welcome To Michigan Treasury Online (Mto)!

Treasury is committed to protecting. Complete if your company is making required withholding payments on behalf of your company’s employees on a monthly or quarterly basis and. Once the form is completed, push finished. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.