Maryland Form 511 Instructions 2022

Maryland Form 511 Instructions 2022 - State and local taxes based on income (trade/business, rental. Every other pte that is subject to maryland income tax law must file form 510. All other filers that aren't electing entities should file on the. Web ptes must file form 511. A pte that has credits in maryland and a pte that is a member of a pte. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web the newly released maryland administrative release no. Web the new form 511 is reserved for taxpayers electing to remit taxes on all members (electing entities). There has been an update to our previous news brief regarding the maryland form 511. Web ptes must file form 511.

Web ptes must file form 511. All other filers that aren't electing entities should file on the. State and local taxes based on income (trade/business, rental. A pte that has credits in maryland and a pte that is a member. Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials. Web the new form 511 is reserved for taxpayers electing to remit taxes on all members (electing entities). State and local taxes based on income. Web this affirms the instructions for 2023 maryland form 510/511d: Maryland state department of assessments and taxation, business services division business personal property. There has been an update to our previous news brief regarding the maryland form 511.

Web this affirms the instructions for 2023 maryland form 510/511d: Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials. Every other pte that is subject to maryland income tax law must file form 510. A pte that has credits in maryland and a pte that is a member of a pte. There has been an update to our previous news brief regarding the maryland form 511. Web the new form 511 is reserved for taxpayers electing to remit taxes on all members (electing entities). Web the newly released maryland administrative release no. A pte that has credits in maryland and a pte that is a member. Web ptes must file form 511. Every other pte that is subject to maryland income tax law must file form 510.

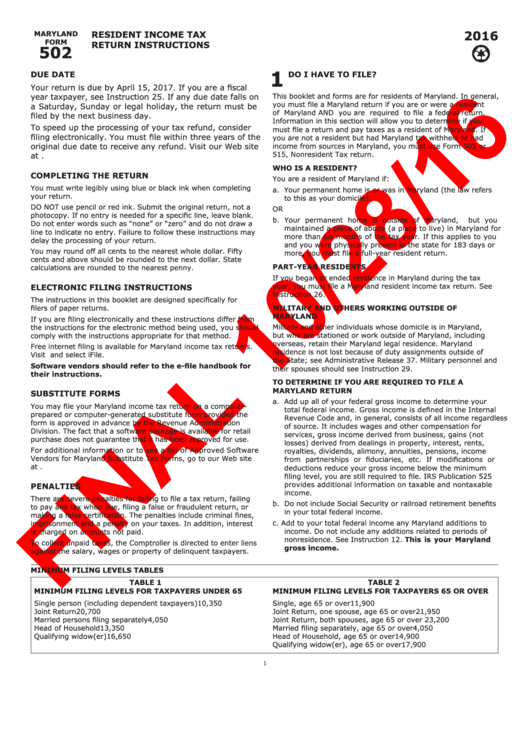

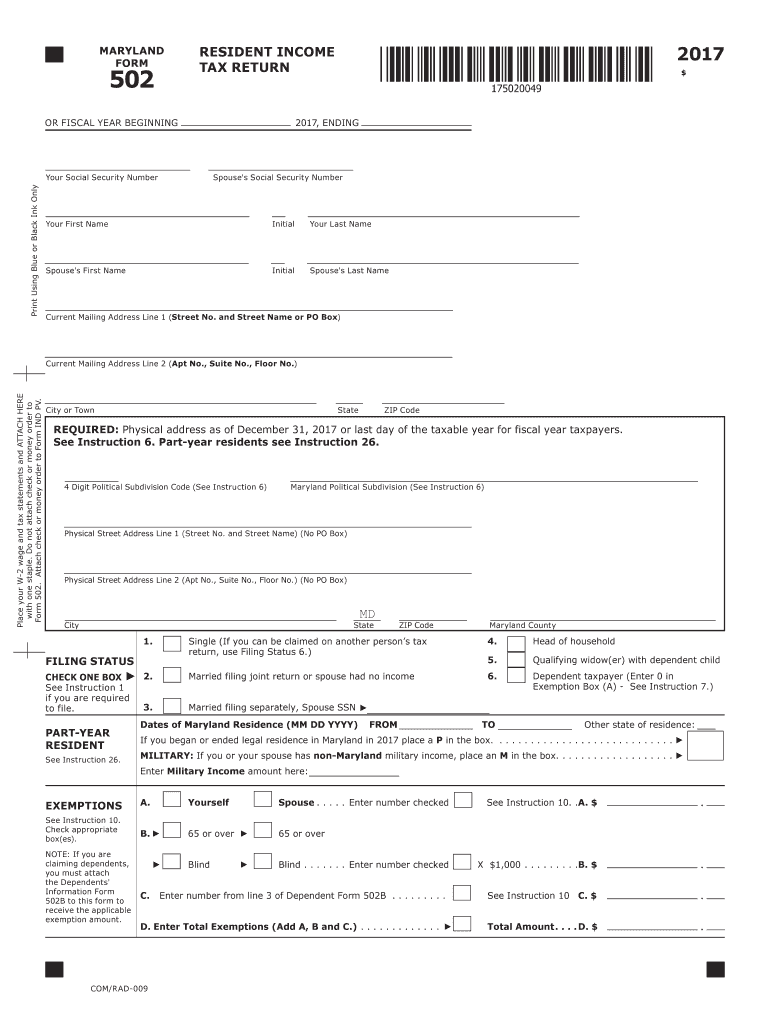

Instructions For Resident Tax Return (Maryland Form 502

Every other pte that is subject to maryland income tax law must file form 510. Every other pte that is subject to maryland income tax law must file form 510. Web this affirms the instructions for 2023 maryland form 510/511d: There has been an update to our previous news brief regarding the maryland form 511. Web ptes must file form.

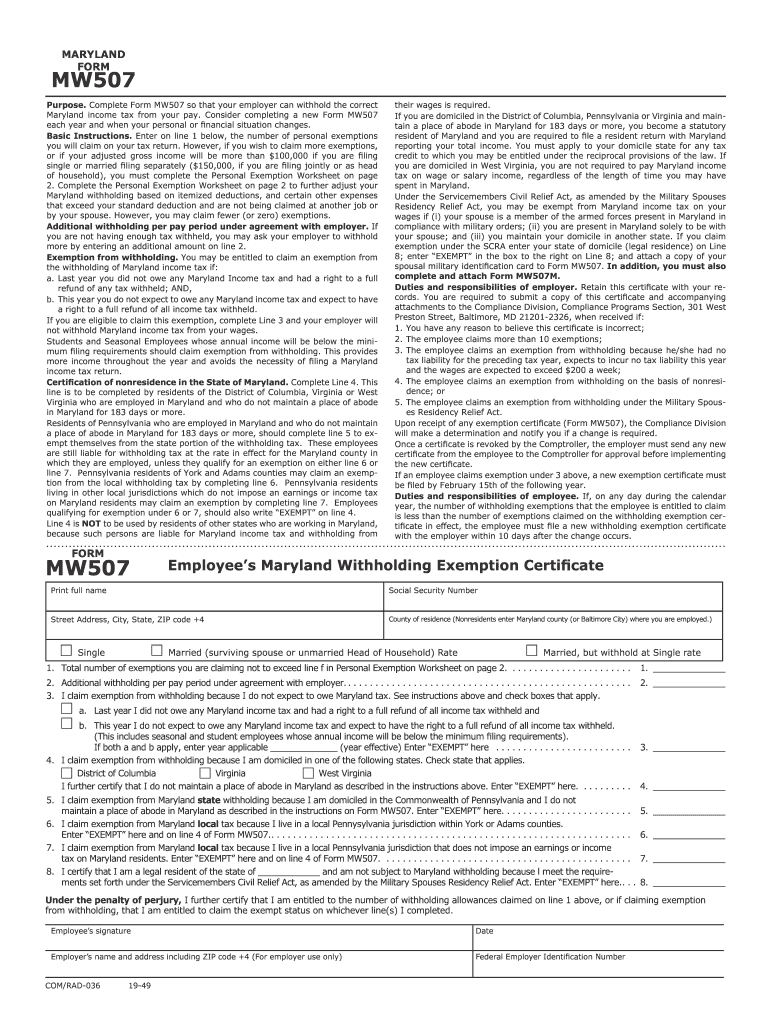

Md 507 Fill Out and Sign Printable PDF Template signNow

There has been an update to our previous news brief regarding the maryland form 511. Every other pte that is subject to maryland income tax law must file form 510. A pte that has credits in maryland and a pte that is a member. A pte that has credits in maryland and a pte that is a member of a.

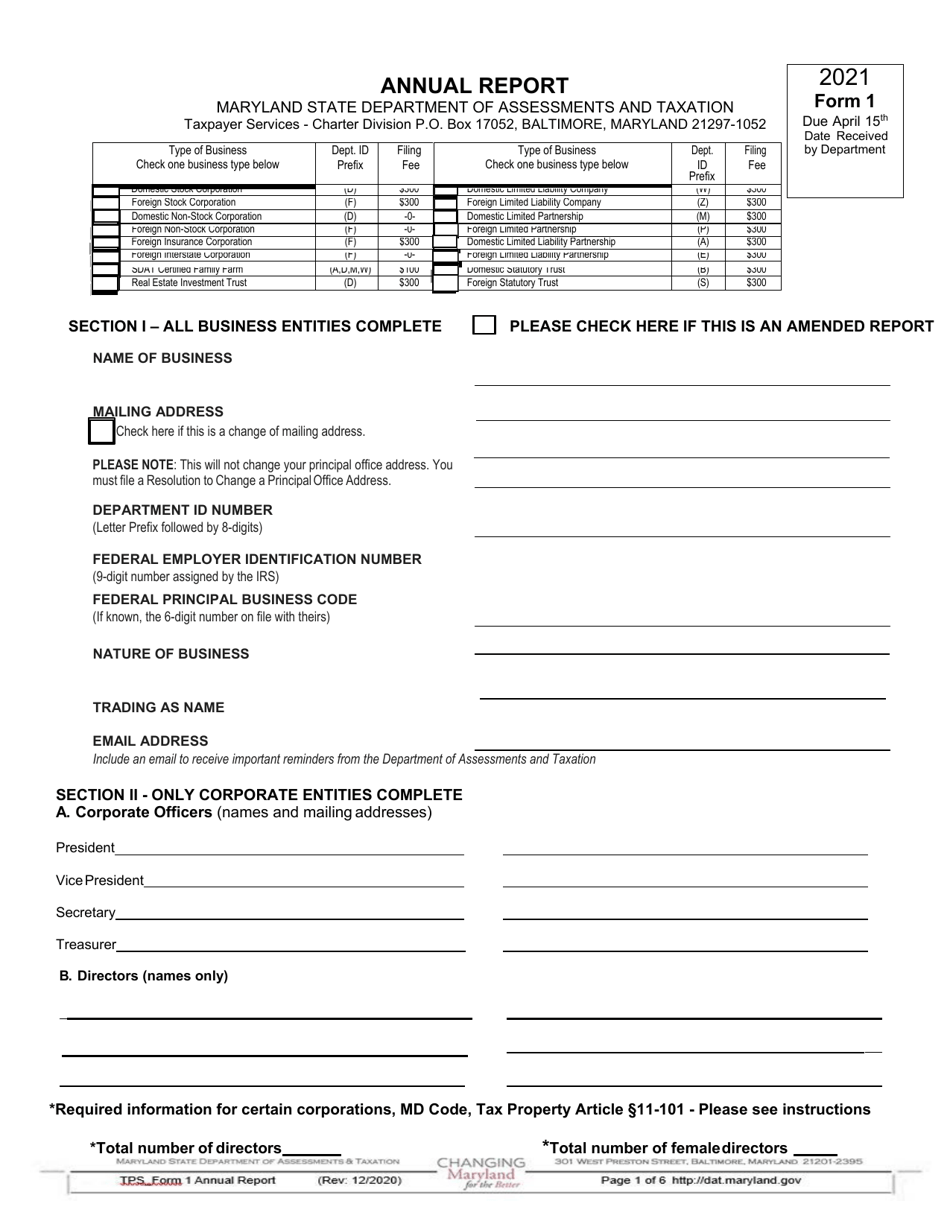

Form 1 Download Fillable PDF or Fill Online Annual Report 2021

Web this affirms the instructions for 2023 maryland form 510/511d: State and local taxes based on income (trade/business, rental. Web the newly released maryland administrative release no. A pte that has credits in maryland and a pte that is a member. Maryland state department of assessments and taxation, business services division business personal property.

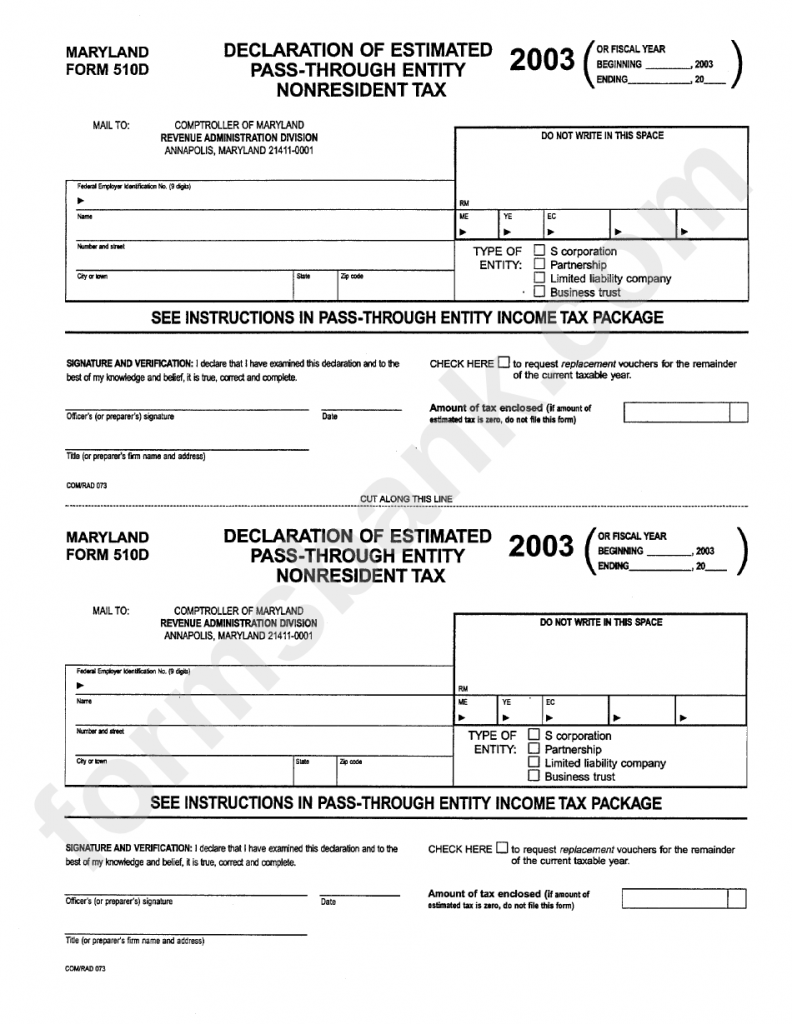

Maryland Printable Tax Forms Printable Form 2022

All other filers that aren't electing entities should file on the. Every other pte that is subject to maryland income tax law must file form 510. Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials. A pte that has credits in maryland and a pte that is.

Maryland form 511 Intuit Accountants Community

A pte that has credits in maryland and a pte that is a member of a pte. A pte that has credits in maryland and a pte that is a member. Web this affirms the instructions for 2023 maryland form 510/511d: Every other pte that is subject to maryland income tax law must file form 510. There has been an.

Download Maryland Form MW 507 for Free FormTemplate

All other filers that aren't electing entities should file on the. A pte that has credits in maryland and a pte that is a member of a pte. Web ptes must file form 511. Every other pte that is subject to maryland income tax law must file form 510. There has been an update to our previous news brief regarding.

New Form 511 May Extend Maryland PassThrough Entities’ Deadline I95

Every other pte that is subject to maryland income tax law must file form 510. Every other pte that is subject to maryland income tax law must file form 510. A pte that has credits in maryland and a pte that is a member of a pte. State and local taxes based on income (trade/business, rental. Maryland state department of.

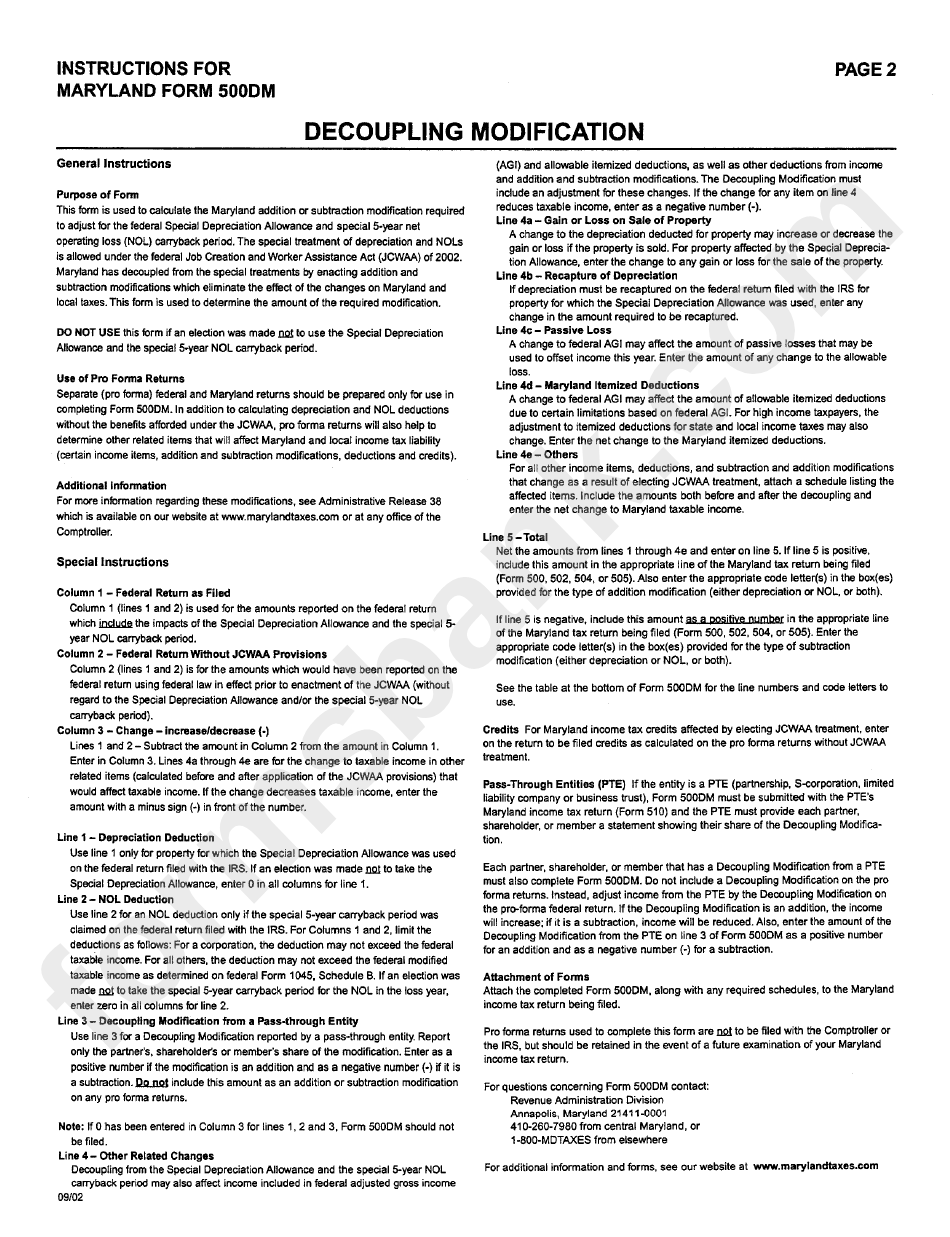

Instructions For Maryland Form 500dm printable pdf download

Maryland state department of assessments and taxation, business services division business personal property. Web the newly released maryland administrative release no. Every other pte that is subject to maryland income tax law must file form 510. State and local taxes based on income. State and local taxes based on income (trade/business, rental.

Maryland 502 Instructions 2017 Fill Out and Sign Printable PDF

Web the new form 511 is reserved for taxpayers electing to remit taxes on all members (electing entities). Web the newly released maryland administrative release no. Web to do business in the state of maryland, as of january 1. There has been an update to our previous news brief regarding the maryland form 511. A pte that has credits in.

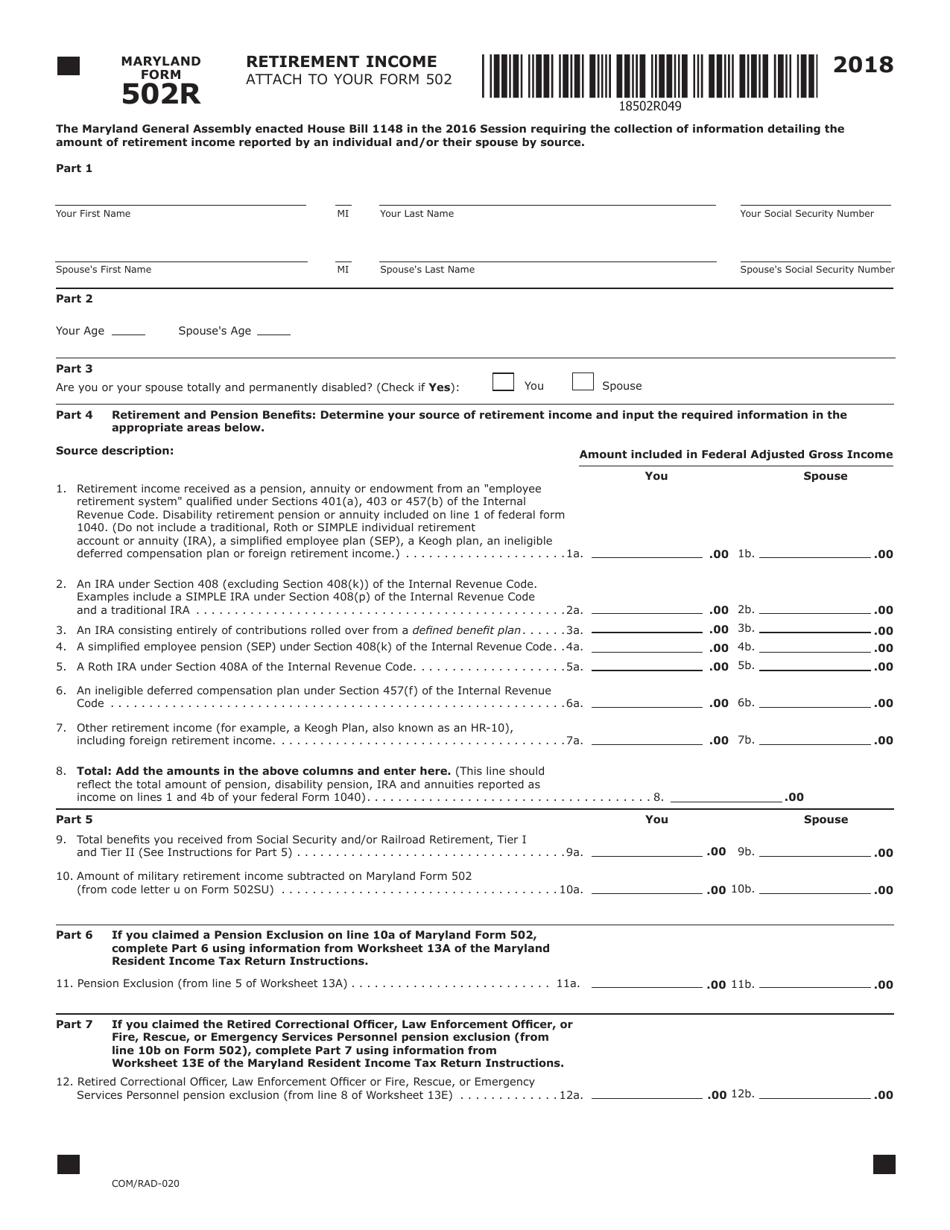

Form COM/RAD020 (Maryland Form 502R) Download Fillable PDF or Fill

Every other pte that is subject to maryland income tax law must file form 510. A pte that has credits in maryland and a pte that is a member of a pte. Web this affirms the instructions for 2023 maryland form 510/511d: Web the newly released maryland administrative release no. State and local taxes based on income.

Web This Week Several Members Of The Macpa State Tax Committee Met With The Maryland Comptroller’s Office Revenue Administration Division (Rad) Officials.

Web the new form 511 is reserved for taxpayers electing to remit taxes on all members (electing entities). State and local taxes based on income. Web to do business in the state of maryland, as of january 1. Web ptes must file form 511.

Maryland State Department Of Assessments And Taxation, Business Services Division Business Personal Property.

A pte that has credits in maryland and a pte that is a member. All other filers that aren't electing entities should file on the. Web this affirms the instructions for 2023 maryland form 510/511d: Every other pte that is subject to maryland income tax law must file form 510.

There Has Been An Update To Our Previous News Brief Regarding The Maryland Form 511.

6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. A pte that has credits in maryland and a pte that is a member of a pte. Every other pte that is subject to maryland income tax law must file form 510. Web ptes must file form 511.

Web The Newly Released Maryland Administrative Release No.

State and local taxes based on income (trade/business, rental.