Lodging Tax Exemption Form Government Travelers Pdf

Lodging Tax Exemption Form Government Travelers Pdf - Web for hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new. Web taxes directly on the federal government. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. Sign up for dod dine smart traveler rewards® to earn points towards gifts cards when you dine at participating restaurants. Web gsa smartpay tax advantage travel accounts are new product offerings that combine an individually billed account (iba) and centrally billed account (cba),. Amount in excess of lodging amount allowed for the per diem locality unless previously. Web transient lodgings tax government exemption certificate (a completed certificate is required for a tax exemption.) guest name (please print): Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Hotels must be registered and licensed to do business in kansas city, missouri. Web employees of exempt entities traveling on official business can pay in any manner.

Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Submit a copy of this form and a copy of the proof of exemption with the hotel and lodging tax exemption report. Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Web exemption from tax may not be approved. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web tax guide for hotels. Web edit florida hotel tax exempt form pdf. Serving as the single focal. When a state exempts federal government travelers from taxes with the individually billed travel card, the exemption applies to just. Effortlessly add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from.

Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Web for hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new. Hotels must be registered and licensed to do business in kansas city, missouri. Web gsa smartpay tax advantage travel accounts are new product offerings that combine an individually billed account (iba) and centrally billed account (cba),. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web transient lodgings tax government exemption certificate (a completed certificate is required for a tax exemption.) guest name (please print): Serving as the single focal. Web edit florida hotel tax exempt form pdf. Amount in excess of lodging amount allowed for the per diem locality unless previously. Web tax guide for hotels.

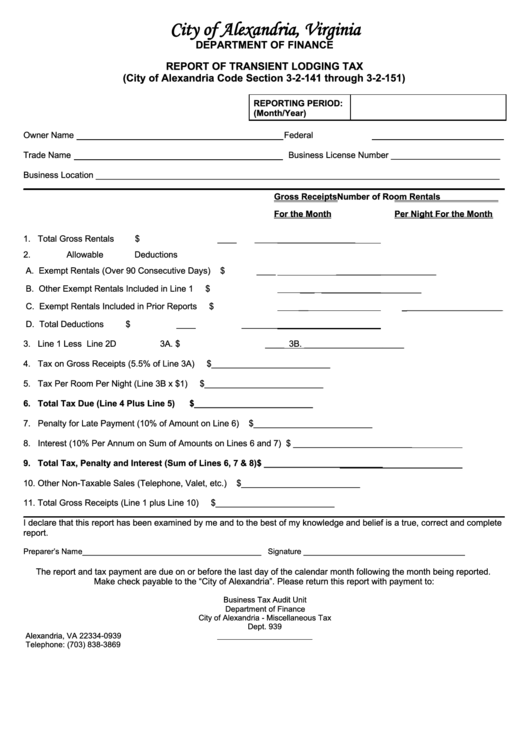

Fillable Report Of Transient Lodging Tax (city Of Alexandria, Virginia

Hotels must be registered and licensed to do business in kansas city, missouri. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Web this certificate is for use by employees of the united states government and the.

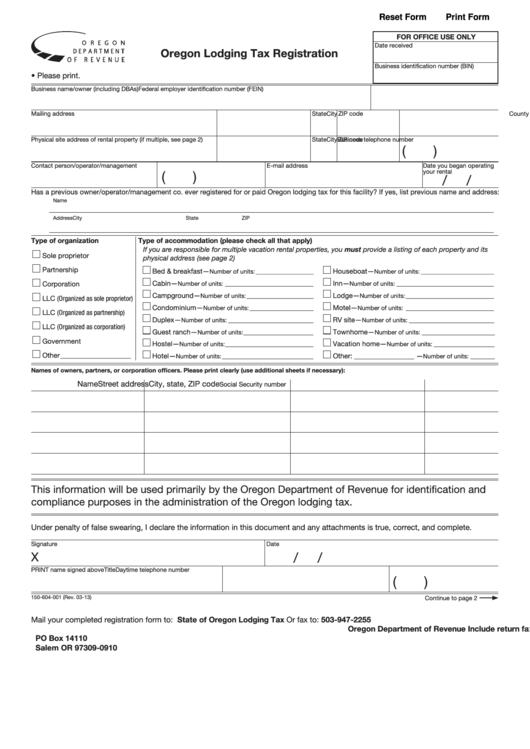

Fillable Form 150604001 State Of Oregon Lodging Tax Registration

Web transient lodgings tax government exemption certificate (a completed certificate is required for a tax exemption.) guest name (please print): When a state exempts federal government travelers from taxes with the individually billed travel card, the exemption applies to just. It is used to document employee eligibility for. Privately owned vehicle (pov) mileage. Web florida lodging tax exemption form government.

State lodging tax requirements

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Web edit florida hotel tax exempt form pdf. Web exemption from tax may not be approved. Sign up for dod dine smart traveler rewards® to earn points towards.

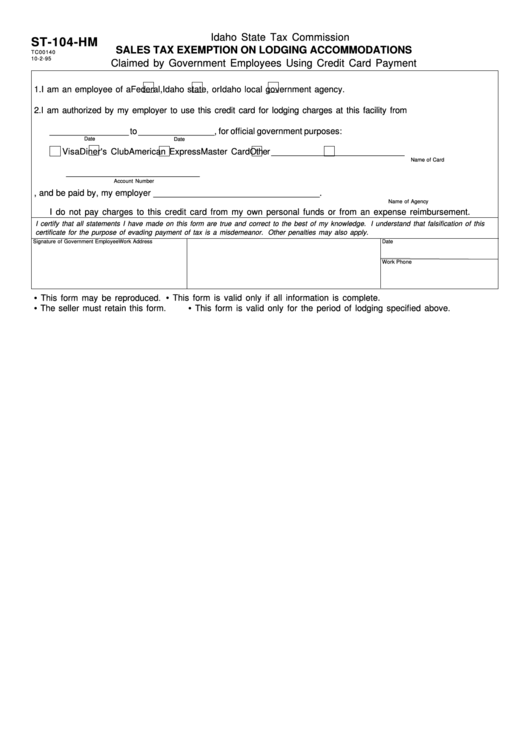

Fillable Form St104Hm Sales Tax Exemption On Lodging

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Effortlessly add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Web tax guide for hotels. Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Web taxes directly.

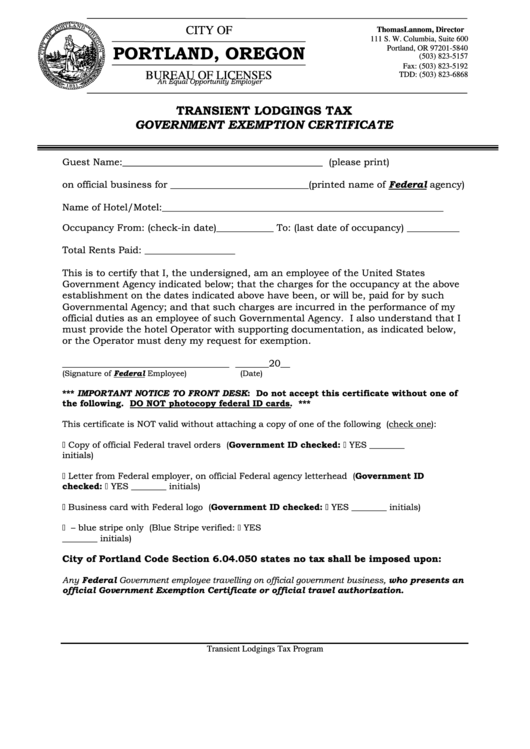

Transient Lodging Tax Government Exemption Certificate Form City Of

When a state exempts federal government travelers from taxes with the individually billed travel card, the exemption applies to just. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for. Web edit florida hotel tax exempt form pdf. Serving as.

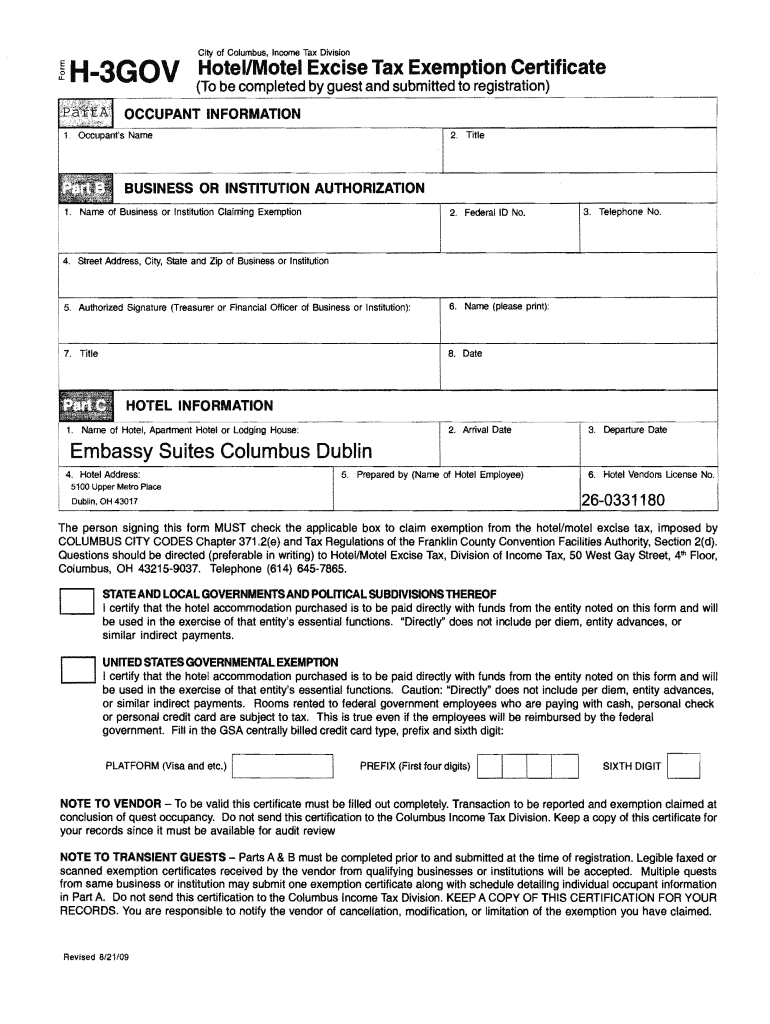

Ohio Tax Exempt Form 2022 Fill Out and Sign Printable PDF Template

Web edit florida hotel tax exempt form pdf. Serving as the single focal. Web florida lodging tax exemption form government travelers pdf. Web gsa smartpay tax advantage travel accounts are new product offerings that combine an individually billed account (iba) and centrally billed account (cba),. It is used to document employee eligibility for.

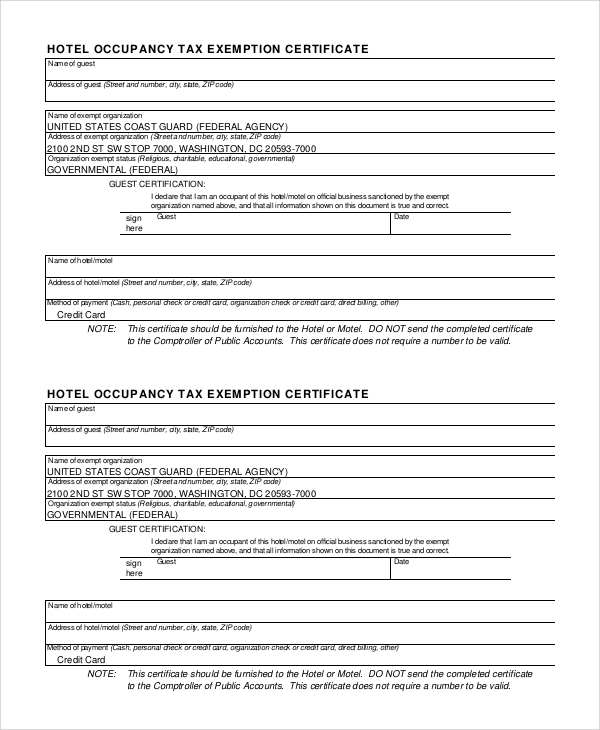

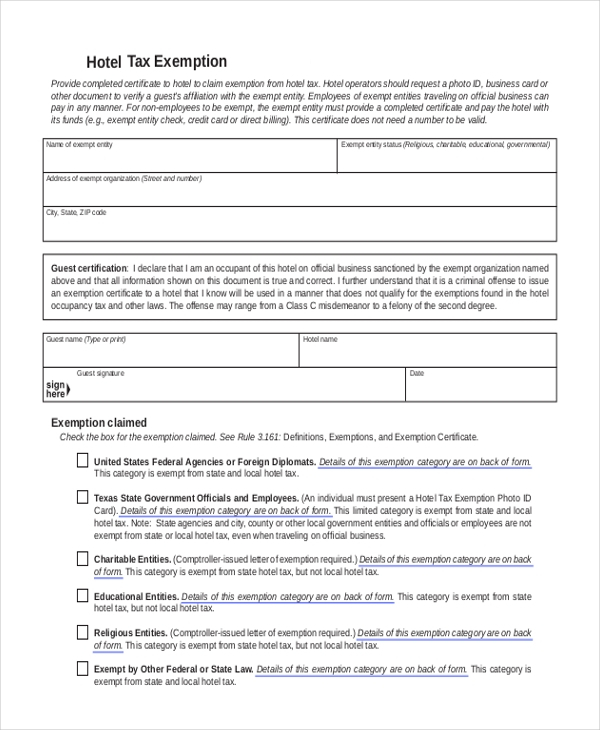

FREE 10+ Sample Tax Exemption Forms in PDF

Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Web taxes directly on the federal government. Submit a copy of this form and a copy of the proof of exemption with the hotel and lodging tax exemption report. Web tax guide for hotels. Web exemption from tax may not be approved.

TaxExempt Sales, Use and Lodging Certification Standardized as of Jan

Web tax guide for hotels. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. Web maximum lodging amount allowed for the per diem locality excluding lodging tax. It is used to document employee eligibility for. Check out how easy it is to complete and esign documents online.

Tax Exempt Form Florida Hotel

When a state exempts federal government travelers from taxes with the individually billed travel card, the exemption applies to just. Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. It is used to document employee eligibility.

Tax exempt form louisiana Fill out & sign online DocHub

Web for hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. Web exemption from tax may not be approved. Effortlessly add and.

Effortlessly Add And Highlight Text, Insert Pictures, Checkmarks, And Signs, Drop New Fillable Fields, And Rearrange Or Remove Pages From.

When a state exempts federal government travelers from taxes with the individually billed travel card, the exemption applies to just. Web edit florida hotel tax exempt form pdf. Web maximum lodging amount allowed for the per diem locality excluding lodging tax. Web florida lodging tax exemption form government travelers pdf.

Web Employees Of Exempt Entities Traveling On Official Business Can Pay In Any Manner.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Privately owned vehicle (pov) mileage reimbursement rates. Privately owned vehicle (pov) mileage. Web transient lodgings tax government exemption certificate (a completed certificate is required for a tax exemption.) guest name (please print):

Web Taxes Directly On The Federal Government.

Amount in excess of lodging amount allowed for the per diem locality unless previously. Web gsa smartpay tax advantage travel accounts are new product offerings that combine an individually billed account (iba) and centrally billed account (cba),. Web tax guide for hotels. Submit a copy of this form and a copy of the proof of exemption with the hotel and lodging tax exemption report.

Hotels Must Be Registered And Licensed To Do Business In Kansas City, Missouri.

Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Web exemption from tax may not be approved. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions.