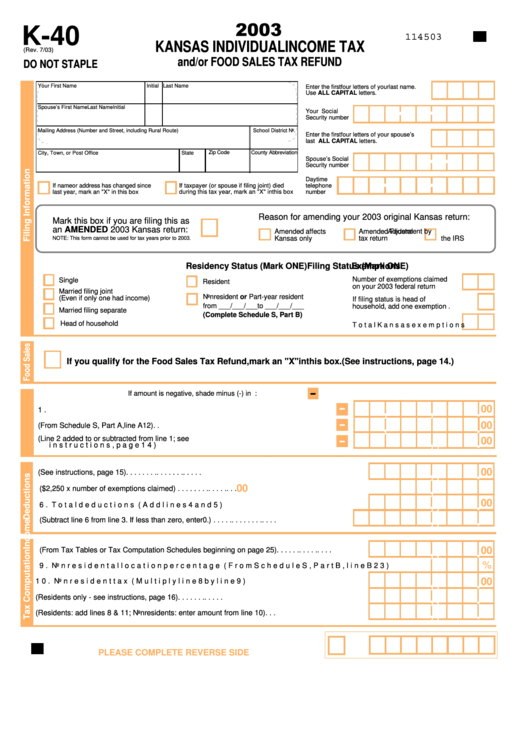

K40 Tax Form 2022

K40 Tax Form 2022 - Web irs income tax forms, schedules and publications for tax year 2022: You do not qualify for this credit. Web your current in come tax return (form 1040, line 6d). Web to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web yes if you answered “no” to a, b and c, stop here; Person filing form 8865, any required statements to qualify for the. 1) your kansas income tax balance due, after. Quarterly payroll and excise tax returns normally due on may 1. Enter the amount of total income reported on your current income tax return (form 1040, line 22). You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it.

Enter the amount of money you remitted to the kansas department of revenue with your original. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. If you answered “yes” to a, b, or c, enter your federal adjusted gross income from line 1 of. Web irs income tax forms, schedules and publications for tax year 2022: Nonresident alien income tax return. 1) your kansas income tax balance due, after. Figure your tax on line 3 by using the. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Enter the amount of total income reported on your current income tax return (form 1040, line 22).

Irs use only—do not write or. Use any tax tables, worksheets, or schedules in the 2021 instructions for. You do not qualify for this credit. If you answered “yes” to a, b, or c, enter your federal adjusted gross income from line 1 of. Web if you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the marketplace for 2022 and advance payments of the premium tax. Web irs income tax forms, schedules and publications for tax year 2022: Person filing form 8865, any required statements to qualify for the. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web yes if you answered “no” to a, b and c, stop here; Nonresident alien income tax return.

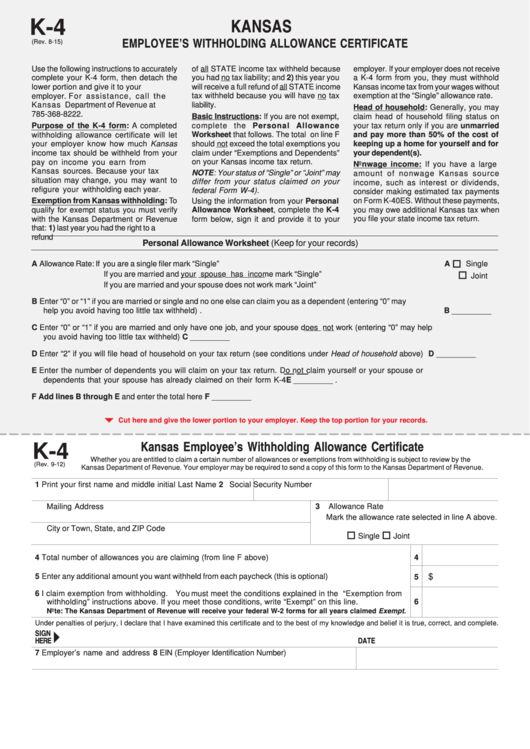

What Is Withholding Tax IRS Improves Online Tax Withholding

You do not qualify for this credit. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web if you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the marketplace for 2022 and advance payments of the premium tax. 1) your kansas income tax balance due, after..

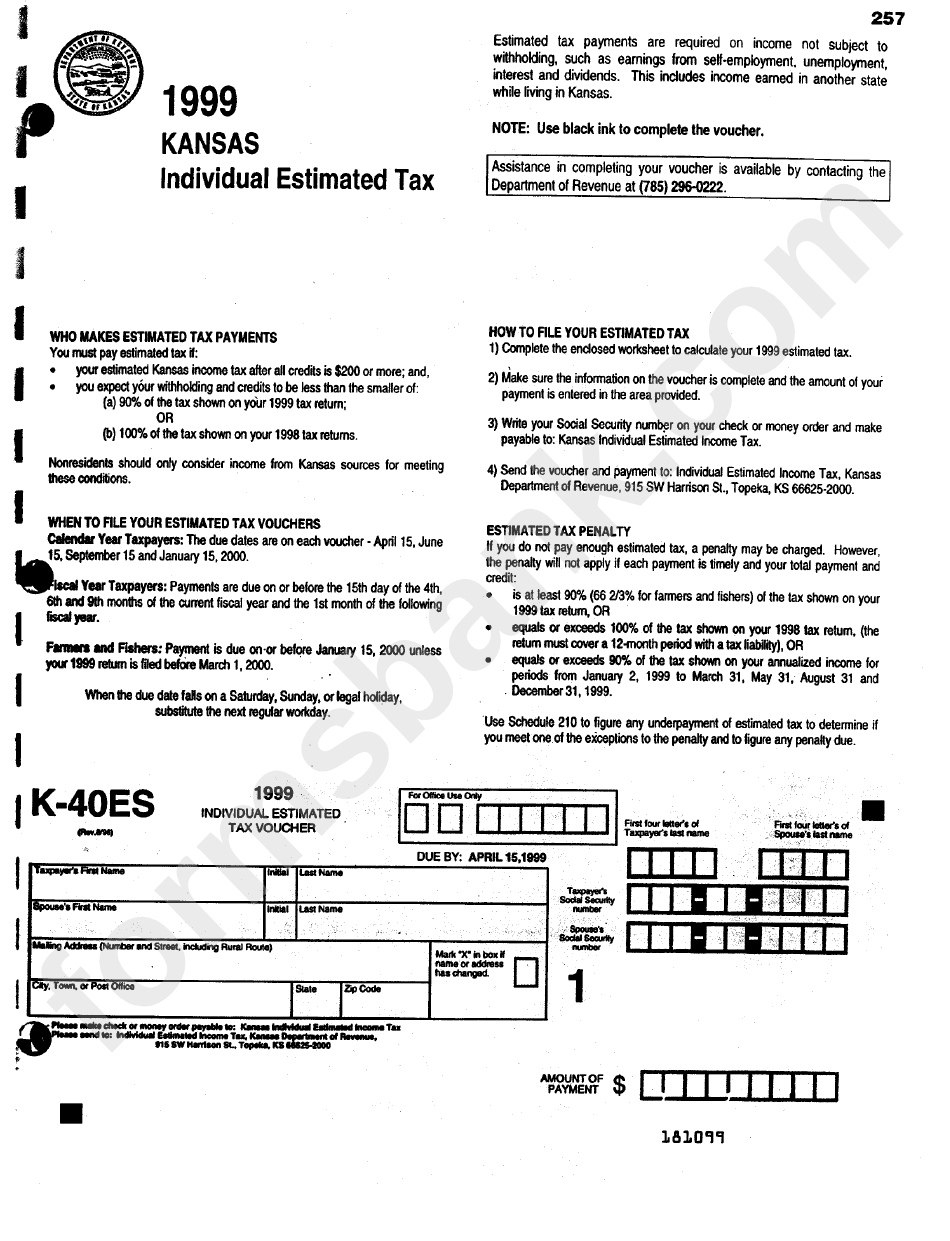

Fillable Form K40es Individual Estimated Tax Kansas Department Of

1) your kansas income tax balance due, after. Figure your tax on line 3 by using the. Web your current in come tax return (form 1040, line 6d). Web to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or.

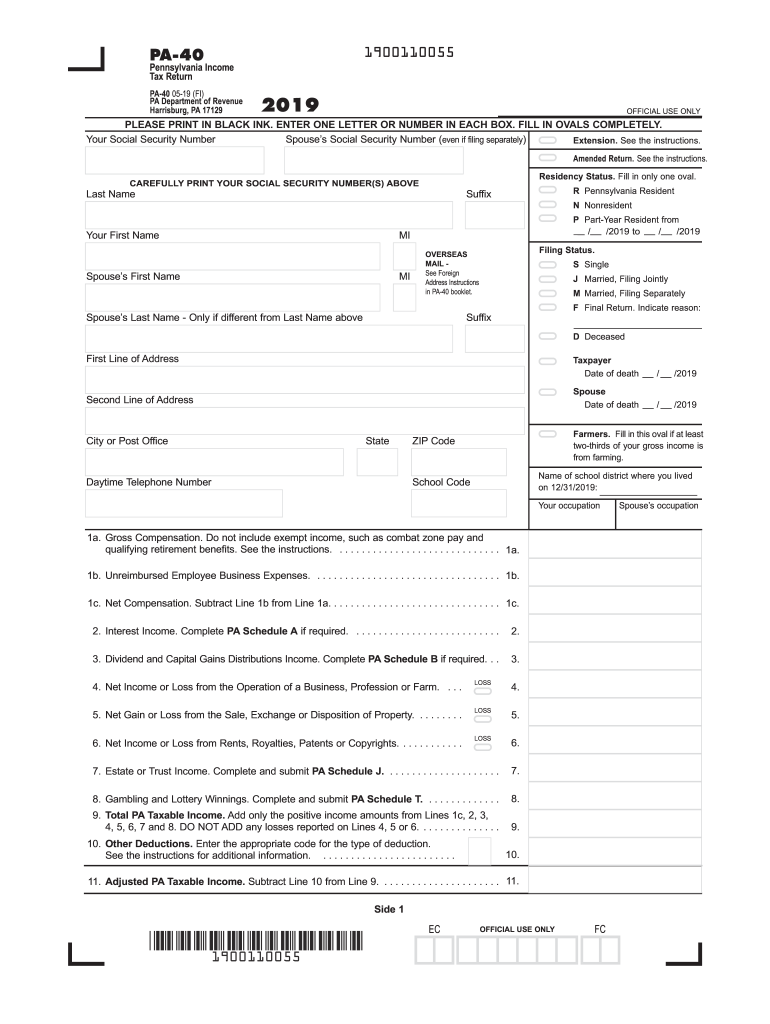

2019 Form PA DoR PA40 Fill Online, Printable, Fillable, Blank pdfFiller

Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web yes if you answered “no” to a, b and c, stop here; Individual.

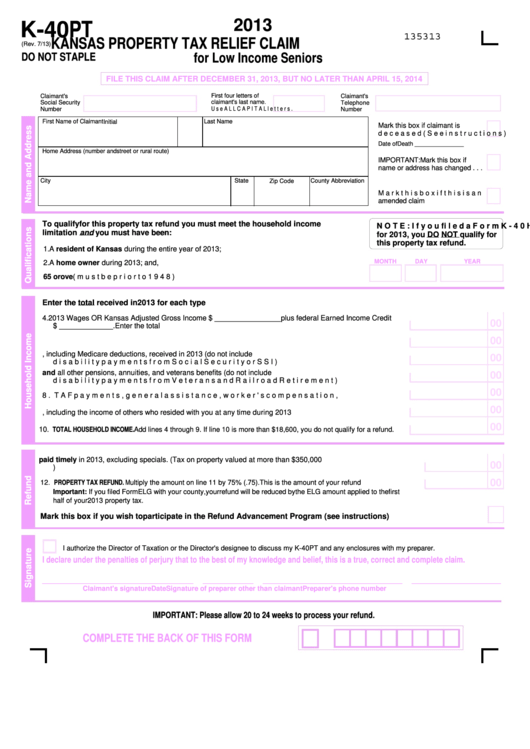

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Irs use only—do not write or. Enter the amount of money you remitted to the kansas department of revenue with your original. 1) your kansas income tax balance due, after. Web irs income tax forms, schedules and publications for tax year 2022: Use any tax tables, worksheets, or schedules in the 2021 instructions for.

LG K40S Price in Tanzania

You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Web yes if you answered “no” to a, b and c, stop here; 1) your kansas income tax balance due, after. Quarterly payroll and excise tax returns normally due on may 1. Use any tax tables, worksheets, or schedules in the 2021 instructions.

2020 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

Use any tax tables, worksheets, or schedules in the 2021 instructions for. Irs use only—do not write or. You do not qualify for this credit. Figure your tax on line 3 by using the. Nonresident alien income tax return.

LG K40 Price in Bangladesh 2022, Full Specs & Review MobileDokan

Individual income tax return 2022 department of the treasury—internal revenue service omb no. Person filing form 8865, any required statements to qualify for the. Figure your tax on line 3 by using the. Web irs income tax forms, schedules and publications for tax year 2022: Web yes if you answered “no” to a, b and c, stop here;

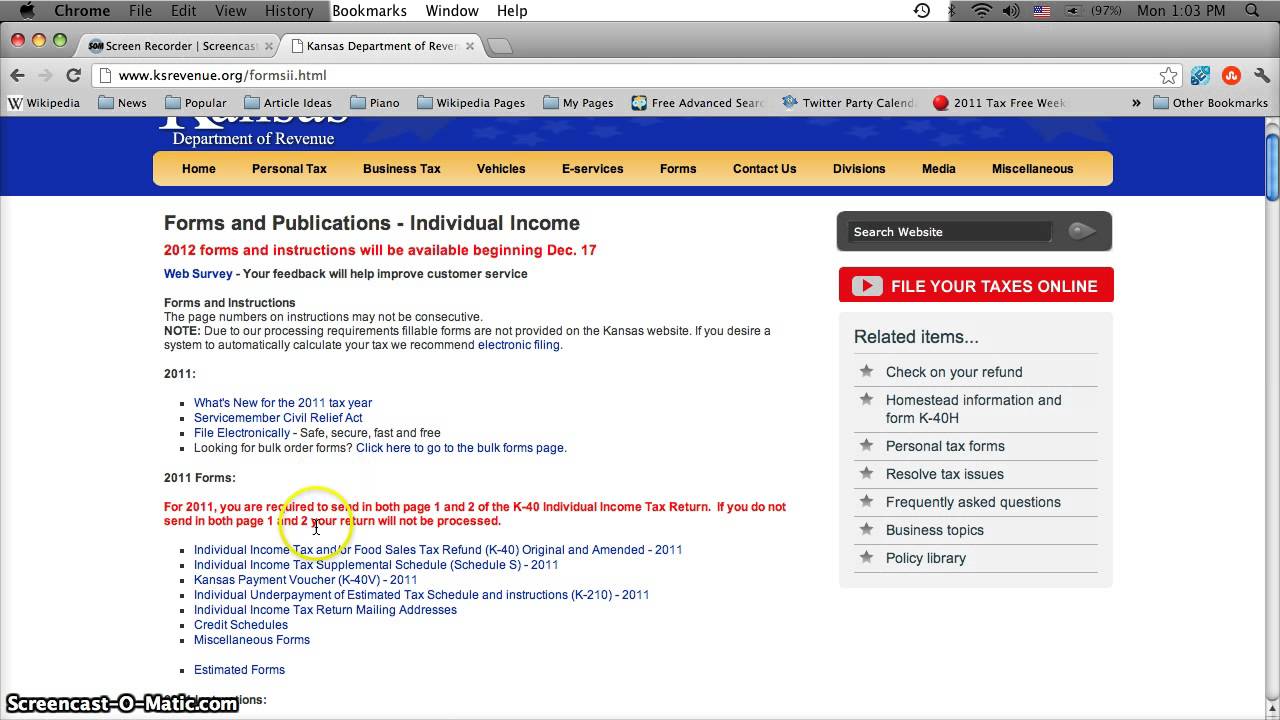

Kansas Printable Tax Forms 2012 Individual K40 Tax Forms

Web irs income tax forms, schedules and publications for tax year 2022: Irs use only—do not write or. 1) your kansas income tax balance due, after. Use any tax tables, worksheets, or schedules in the 2021 instructions for. Web yes if you answered “no” to a, b and c, stop here;

Xiaomi Redmi K40 mobiles arena

Web your current in come tax return (form 1040, line 6d). Enter the amount of total income reported on your current income tax return (form 1040, line 22). Figure your tax on line 3 by using the. 2022 tax returns are due on april 18, 2023. Irs use only—do not write or staple in this space.

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Enter the amount of total income reported on your current income tax return (form 1040, line 22). Individual income tax return 2022 department of the treasury—internal revenue service omb no. Figure your tax on line 3 by using the. Quarterly payroll and excise tax returns normally due on may 1. If you answered “yes” to a, b, or c, enter.

If You Answered “Yes” To A, B, Or C, Enter Your Federal Adjusted Gross Income From Line 1 Of.

Irs use only—do not write or. Individual income tax return 2022 department of the treasury—internal revenue service omb no. 2022 tax returns are due on april 18, 2023. Enter the amount of total income reported on your current income tax return (form 1040, line 22).

Web To Avoid A Penalty, Make Your Payment With Your 2022 Form 940 Only If Your Futa Tax For The Fourth Quarter (Plus Any Undeposited Amounts From Earlier Quarters) Is $500 Or Less.

Web irs income tax forms, schedules and publications for tax year 2022: Figure your tax on line 3 by using the. Use any tax tables, worksheets, or schedules in the 2021 instructions for. 1) your kansas income tax balance due, after.

You Do Not Qualify For This Credit.

Nonresident alien income tax return. Enter the amount of money you remitted to the kansas department of revenue with your original. Web your current in come tax return (form 1040, line 6d). Web yes if you answered “no” to a, b and c, stop here;

Individual Income Tax Return 2022 Department Of The Treasury—Internal Revenue Service.

Irs use only—do not write or staple in this space. Web if you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the marketplace for 2022 and advance payments of the premium tax. Quarterly payroll and excise tax returns normally due on may 1. Person filing form 8865, any required statements to qualify for the.