Is Form 7203 Required

Is Form 7203 Required - December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your. This form is required to be. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. Web the new form 7203 calculates distributions in excess of basis directly on the face of the form, which will carry automatically to schedule d, capital gains and losses, as capital. As we know, correct basis enables shareholders to properly. Web up to 10% cash back the irs recommends that shareholders complete (and hold onto) form 7203 even in years in which they are not required to file it, simply to keep. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis.

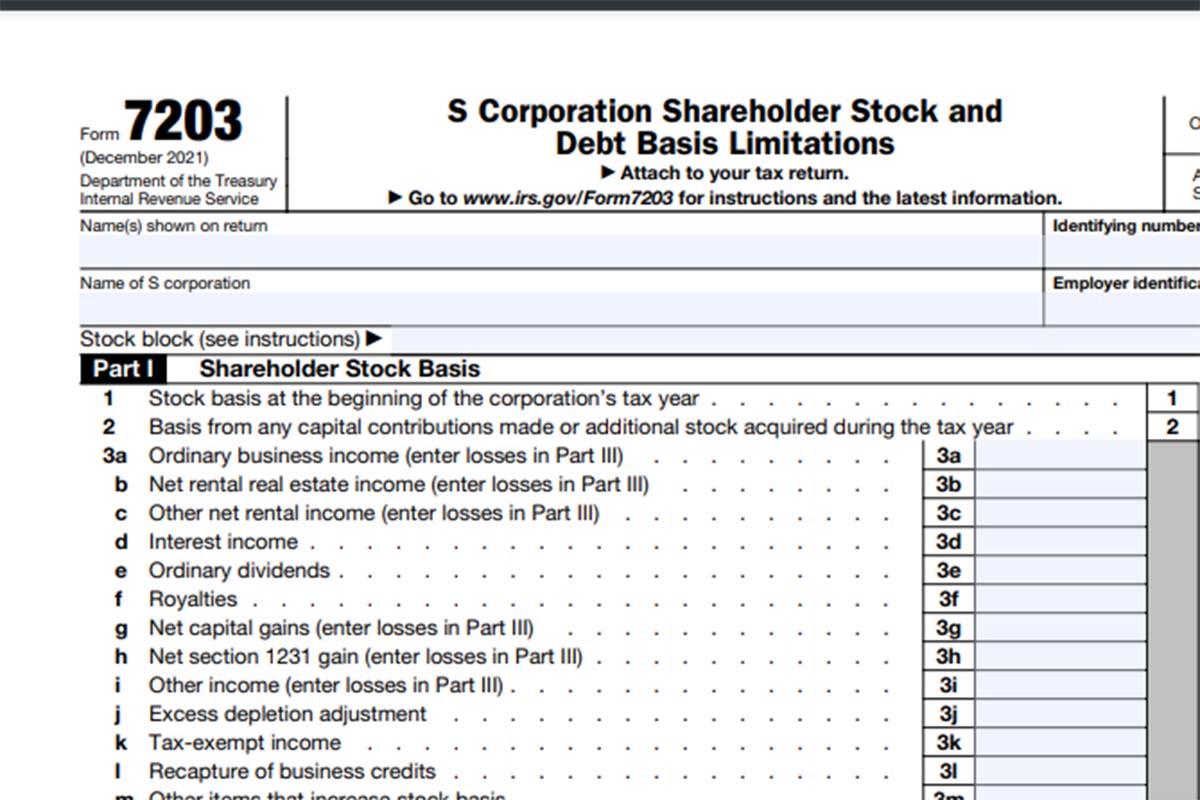

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: This form is required to be. Web form 7203 is a new proposed form that shareholders will use to calculate their stock and debt basis. Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. Web the new form 7203 calculates distributions in excess of basis directly on the face of the form, which will carry automatically to schedule d, capital gains and losses, as capital. Web now, the calculations to determine your tax basis are included on the form, so that the irs can verify. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. As we know, correct basis enables shareholders to properly.

S corporation shareholders use form 7203 to figure the potential limitations. Web as far as your husband's reporting requirements, if you received a k1 issued in both your names or the name of your business, you would report stock block 1 as one. Web up to 10% cash back the irs recommends that shareholders complete (and hold onto) form 7203 even in years in which they are not required to file it, simply to keep. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. Web form 7203 is a new proposed form that shareholders will use to calculate their stock and debt basis. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web now, the calculations to determine your tax basis are included on the form, so that the irs can verify.

Form7203PartI PBMares

Web about form 7203, s corporation shareholder stock and debt basis limitations. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet.

National Association of Tax Professionals Blog

As we know, correct basis enables shareholders to properly. Who has to use the form? Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. Web form 7203 is a new proposed form that shareholders will use to.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web about form 7203, s corporation shareholder stock and debt basis limitations. Web as far as your husband's reporting requirements, if you received a k1 issued in both your names or the name of your business, you would report stock block 1 as one. Who has to use the form? The final form is expected to be available. Web the.

National Association of Tax Professionals Blog

Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. Web about form 7203,.

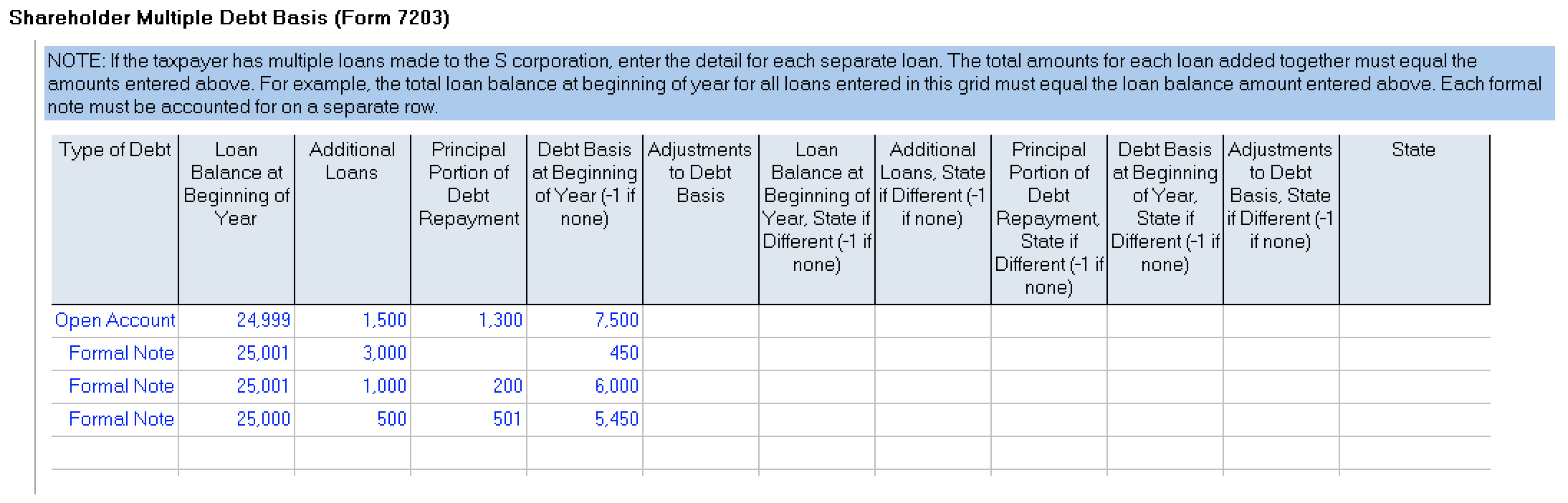

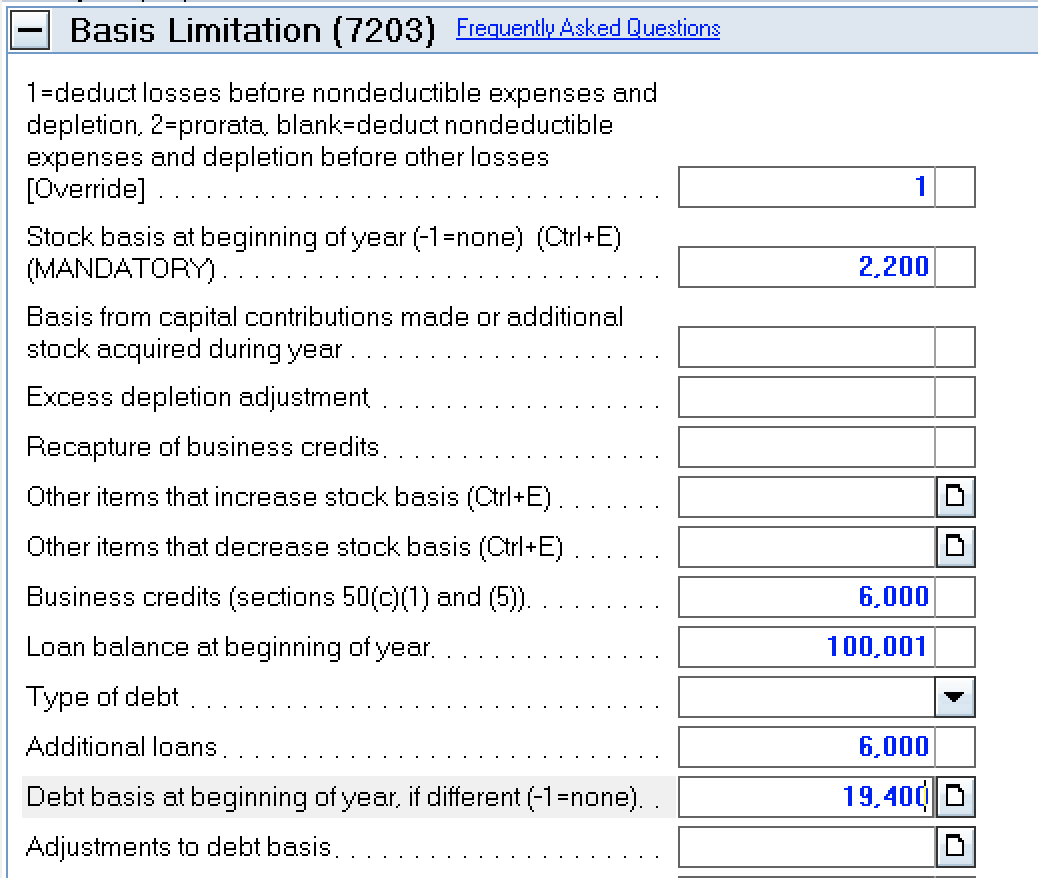

How to complete Form 7203 in Lacerte

Web as far as your husband's reporting requirements, if you received a k1 issued in both your names or the name of your business, you would report stock block 1 as one. Web up to 10% cash back the irs recommends that shareholders complete (and hold onto) form 7203 even in years in which they are not required to file.

More Basis Disclosures This Year for S corporation Shareholders Need

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 is a new proposed form that shareholders will use to calculate their stock and debt basis. Web you must.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Claiming a deduction for their share. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. Who has to use the form? Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios:.

How to complete Form 7203 in Lacerte

Web now, the calculations to determine your tax basis are included on the form, so that the irs can verify. This form is required to be. Who has to use the form? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Web.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. The final form is expected to be available. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Who.

IRS Issues New Form 7203 for Farmers and Fishermen

Claiming a deduction for their share. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web we mentioned in last weeks post that farmers who needed to file by march 1.

Web About Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. The final form is expected to be available. Web up to 10% cash back the irs recommends that shareholders complete (and hold onto) form 7203 even in years in which they are not required to file it, simply to keep.

December 2022) S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury Internal Revenue Service Attach To Your Tax.

Web form 7203 is a new proposed form that shareholders will use to calculate their stock and debt basis. Who has to use the form? General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. This form is required to be.

Web The Irs Recently Issued The Official Draft Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Claiming a deduction for their share. Web we mentioned in last weeks post that farmers who needed to file by march 1 with a form 7203 requirement now have until april 18, 2022 to file their tax return. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your. Web you must complete and file form 7203 if you’re an s corporation shareholder and you:

Web The New Form 7203 Calculates Distributions In Excess Of Basis Directly On The Face Of The Form, Which Will Carry Automatically To Schedule D, Capital Gains And Losses, As Capital.

Web now, the calculations to determine your tax basis are included on the form, so that the irs can verify. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, to be used to report s. Web as far as your husband's reporting requirements, if you received a k1 issued in both your names or the name of your business, you would report stock block 1 as one. As we know, correct basis enables shareholders to properly.