Instructions Form 1042

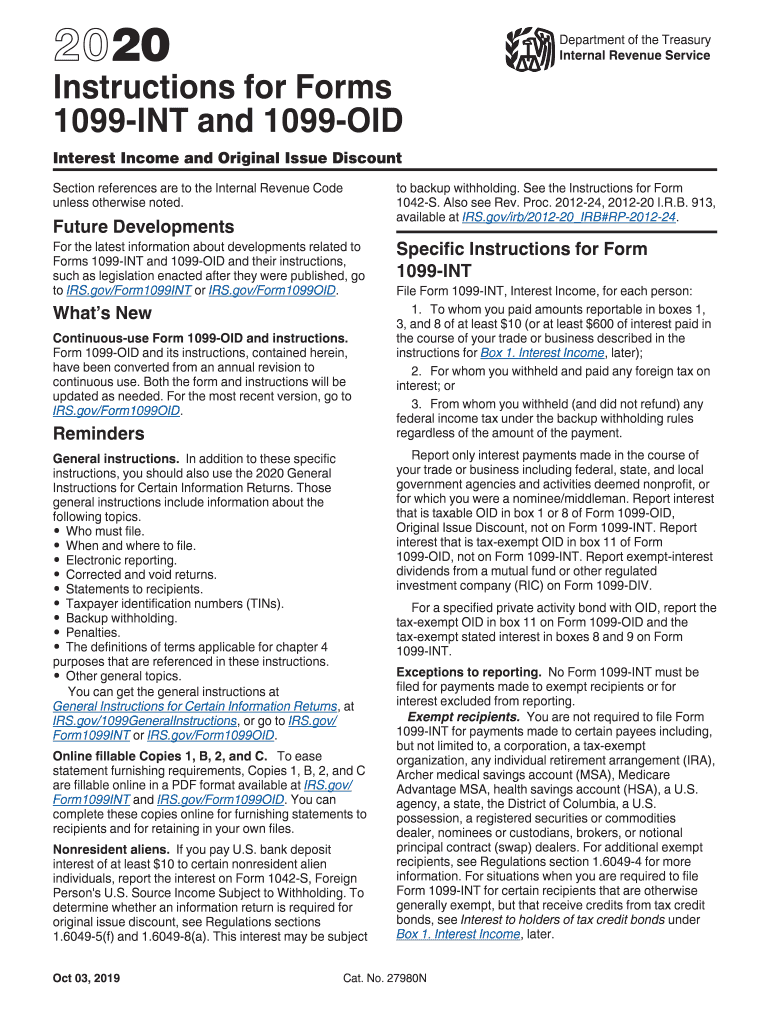

Instructions Form 1042 - The form should reflect payments made to the individual in the year prior. A 1042 is required even if no tax was withheld. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web form 1042, also annual withholding tax return for u.s. Source income subject to withholding, make clear that these. Box 16a through 16e, report the payer's. Source income subject to withholding, to the. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for the application for automatic extension of time to file certain business income. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Revised reporting with respect to territory financial institutions.

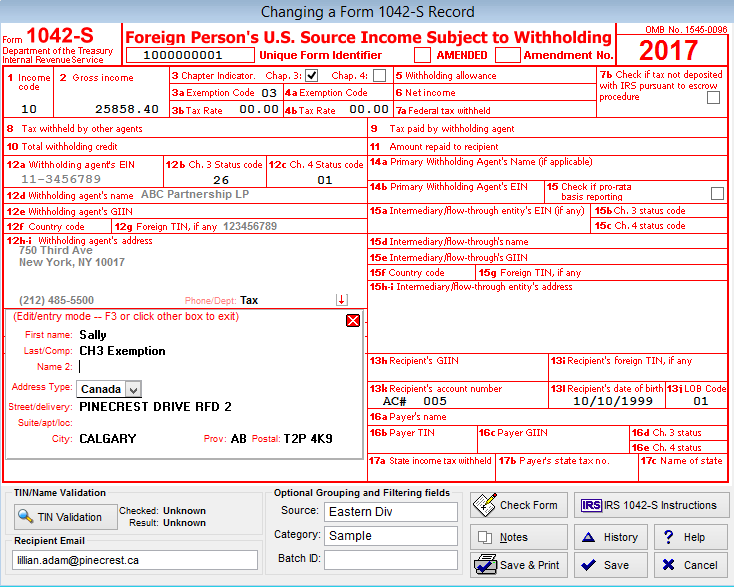

Complete, edit or print tax forms instantly. It identifies the two parties involved and the amount that will be withheld. Web for purposes of deposits and reporting, the instru ctions for form 1042, annual withholding tax return for u.s. The aggregate amount of gross income paid and the tax withheld as reported. Source income of foreign persons. A withholding agent must ensure that all required fields are completed. Web you must file form 1042 if any of the following apply. Box 16a through 16e, report the payer's. Web use form 1042 to report the following. A 1042 is required even if no tax was withheld.

Web use form 1042 to report the following. Box 16a through 16e, report the payer's. Form 1042 is due by march 15 and is prepared on a. The employer only needs to submit form 1042 to the irs, not to their employee. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations,. If you are making payments to a. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. The form should reflect payments made to the individual in the year prior. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for the application for automatic extension of time to file certain business income. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s.

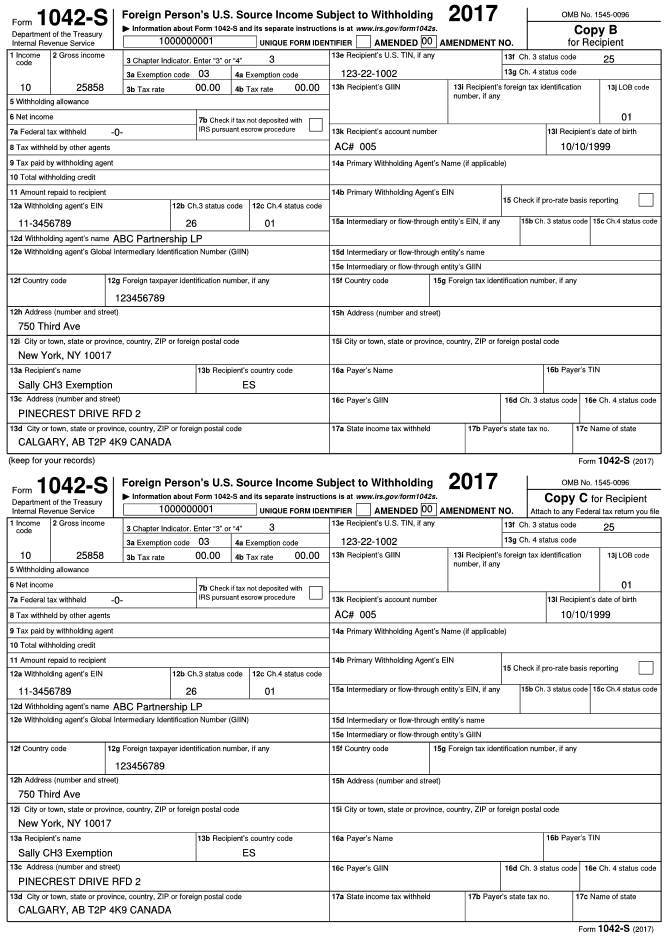

2020 form 1042s instructions Fill Online, Printable, Fillable Blank

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web for purposes of deposits and reporting, the instru ctions for form 1042, annual withholding tax return for u.s. Withholding and reporting under sections 1446(a) and (f) starting in 2023. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except.

Download Instructions for IRS Form 1042S Foreign Person's U.S. Source

If you are making payments to a. Withholding and reporting under sections 1446(a) and (f) starting in 2023. Box 16a through 16e, report the payer's. Both nonresident withholding forms must be filed by march 15 of the following year. Web you must file form 1042 if any of the following apply.

Irs 1042 s instructions 2019

A 1042 is required even if no tax was withheld. Form 1042 is due by march 15 and is prepared on a. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for the application for automatic extension of time to file certain business.

1042 S Form slideshare

The employer only needs to submit form 1042 to the irs, not to their employee. Source income of foreign persons. The form should reflect payments made to the individual in the year prior. A 1042 is required even if no tax was withheld. Web you must file form 1042 if any of the following apply.

1099 Form 2019 Printable Form Fill Out and Sign Printable PDF

If you are making payments to a. The employer only needs to submit form 1042 to the irs, not to their employee. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. Source income subject to withholding, to the. It identifies the two parties involved and.

Form 1042 s instructions United States guide User Examples

Web form 1042, also annual withholding tax return for u.s. The irs specifies that you must submit a separate form for:. Complete, edit or print tax forms instantly. The form should reflect payments made to the individual in the year prior. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual.

2015 Form 1042S Edit, Fill, Sign Online Handypdf

Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web form 1042, also annual withholding tax return for u.s. A withholding agent must ensure that all required fields are completed. Persons under fatca and chapter 3. Withholding and reporting under sections 1446(a) and (f) starting in 2023.

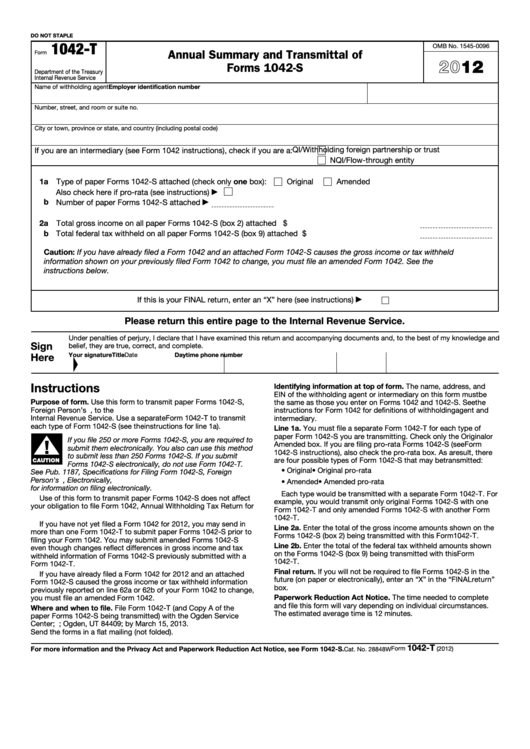

Fillable Form 1042T Annual Summary And Transmittal Of Forms 1042S

The irs specifies that you must submit a separate form for:. The form should reflect payments made to the individual in the year prior. Revised reporting with respect to territory financial institutions. A withholding agent must ensure that all required fields are completed. Source income subject to withholding, make clear that these.

Irs 1042 s instructions 2019

Form 1042 is due by march 15 and is prepared on a. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations,. Persons under fatca and chapter 3. Box 16a through 16e, report the payer's. A 1042 is required even.

form 1042s instructions 2021 Fill Online, Printable, Fillable Blank

A 1042 is required even if no tax was withheld. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Box 16a through 16e, report the payer's. Source income subject to withholding, make clear that these. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident.

Web Use Form 1042 To Report The Following.

If you are making payments to a. Get ready for tax season deadlines by completing any required tax forms today. Web for purposes of deposits and reporting, the instru ctions for form 1042, annual withholding tax return for u.s. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons.

Source Income Subject To Withholding, Including Recent Updates, Related Forms, And Instructions On How To File.

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations,. A 1042 is required even if no tax was withheld. Withholding and reporting under sections 1446(a) and (f) starting in 2023. The irs specifies that you must submit a separate form for:.

Persons Under Fatca And Chapter 3.

A withholding agent must ensure that all required fields are completed. The employer only needs to submit form 1042 to the irs, not to their employee. Web form 1042, also annual withholding tax return for u.s. Web you must file form 1042 if any of the following apply.

Persons 4 Who Make Fdap Payments To Those Foreign Persons Noted Above Are Required To File Form 1042, Annual Withholding Tax Return For U.s.

Source income subject to withholding, make clear that these. It identifies the two parties involved and the amount that will be withheld. Form 1042 is due by march 15 and is prepared on a. The aggregate amount of gross income paid and the tax withheld as reported.