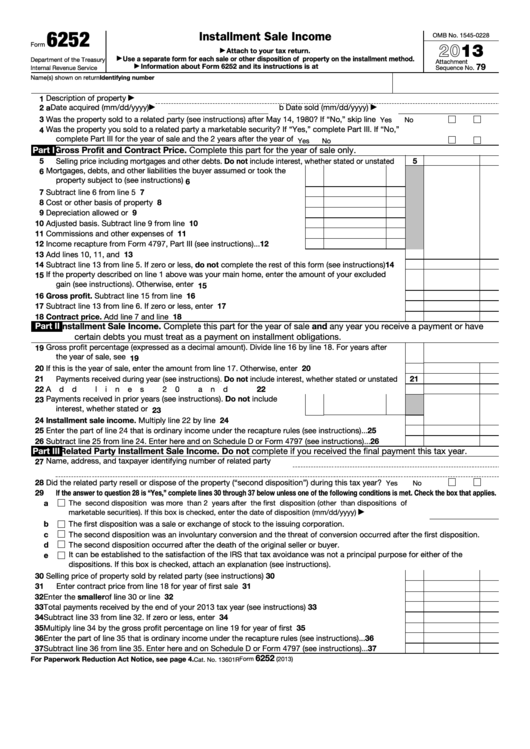

Installment Sale Form 6252

Installment Sale Form 6252 - Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Each payment you receive has three parts: Complete any other necessary entries. You need to enable javascript to run this app. When you sell something for more than you paid for it, you report the income on your taxes for the year in which the sale took place. Web taxpayers use form 6252 to report income from installment sales. Ask question asked 9 years, 9 months ago modified 9 years, 9 months ago viewed 2k times 4 i have an installment sale that began in 2008 and ended in 2012 in which i was projected to earn a gain on the sale of $1,000 each year for five years. Dispositions (sch d, etc.) > Sign in products lacerte proconnect. Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the.

Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Web about form 6252, installment sale income. The first is that if an asset is sold and payments will be made over time that at least one payment be received in a year following the tax year of the sale. Web taxpayers use form 6252 to report income from installment sales. Go to the input return tab. Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Web how to reconcile final payment on installment sale for irs form 6252? Complete any other necessary entries. Web there are two requirements for an installment sale. Web purpose of form use form 6252 to report income from an installment sale on the installment method.

For each year you receive a payment or are treated as receiving a payment, you must include in your income both. If the installment sale consists of a group of assets or a bulk sale, complete this information in the main asset only. Web there are two requirements for an installment sale. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Web reporting installment sale income. Ask question asked 9 years, 9 months ago modified 9 years, 9 months ago viewed 2k times 4 i have an installment sale that began in 2008 and ended in 2012 in which i was projected to earn a gain on the sale of $1,000 each year for five years. Web how to enter a prior or current year installment sale (form 6252) in proconnect tax to enter a current year installment sale follow these steps: Web purpose of form use form 6252 to report income from an installment sale on the installment method. Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. You’ll use form 6252 to report installment sale income from casual sales of real or personal property.

Installment Sales YouTube

You’ll use form 6252 to report installment sale income from casual sales of real or personal property. Ask question asked 9 years, 9 months ago modified 9 years, 9 months ago viewed 2k times 4 i have an installment sale that began in 2008 and ended in 2012 in which i was projected to earn a gain on the sale.

I need some assistance in filing out a 2005 form 6252 Installment Sale

The first is that if an asset is sold and payments will be made over time that at least one payment be received in a year following the tax year of the sale. Each payment you receive has three parts: Web how is form 6252 used? For each year you receive a payment or are treated as receiving a payment,.

Form 6252 Installment Sale (2015) Free Download

If the installment sale consists of a group of assets or a bulk sale, complete this information in the main asset only. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Complete any other necessary entries. Web about form 6252, installment.

Installment Sale Form Fill Online, Printable, Fillable, Blank pdfFiller

Sometimes, though, the buyer spreads the payments out over more than one year. Sign in products lacerte proconnect. Each payment you receive has three parts: Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Ask question asked 9 years, 9 months ago modified 9 years, 9.

Fillable Form 6252 Installment Sale 2013 printable pdf download

Web there are two requirements for an installment sale. Web reporting installment sale income. Dispositions (sch d, etc.) > Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Complete any other necessary entries.

Form 6252 Installment Sale (2015) Free Download

Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. You’ll use form 6252 to report installment sale income from casual sales of real or personal property. You will also have to report the installment sale income on schedule d (form 1040), form 4797, or both. You.

Form 6252Installment Sale

Go to the input return tab. You will also have to report the installment sale income on schedule d (form 1040), form 4797, or both. Dispositions (sch d, etc.) > Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Generally, you.

Form 6252Installment Sale

You need to enable javascript to run this app. For each year you receive a payment or are treated as receiving a payment, you must include in your income both. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Ordinarily, an.

Installment Sale Agreement Free Download

Ask question asked 9 years, 9 months ago modified 9 years, 9 months ago viewed 2k times 4 i have an installment sale that began in 2008 and ended in 2012 in which i was projected to earn a gain on the sale of $1,000 each year for five years. Web reporting installment sale income. Web how to reconcile final.

Generally, An Installment Sale Is A Disposition Of Property Where At Least One Payment Is Received After The End Of The Tax Year In Which The Disposition Occurs.

Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Each payment you receive has three parts: Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. You need to enable javascript to run this app.

Sign In Products Lacerte Proconnect.

Web about form 6252, installment sale income. Web how to reconcile final payment on installment sale for irs form 6252? Ordinarily, an installment sale doesn’t include a disposition Web how is form 6252 used?

For Each Year You Receive A Payment Or Are Treated As Receiving A Payment, You Must Include In Your Income Both.

Generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Web purpose of form use form 6252 to report income from an installment sale on the installment method. You will also have to report the installment sale income on schedule d (form 1040), form 4797, or both. Go to the input return tab.

Web Taxpayers Use Form 6252 To Report Income From Installment Sales.

Complete any other necessary entries. Sometimes, though, the buyer spreads the payments out over more than one year. When you sell something for more than you paid for it, you report the income on your taxes for the year in which the sale took place. Use this form to report income from an installment sale on the installment method.