Injured Spouse Form Instructions

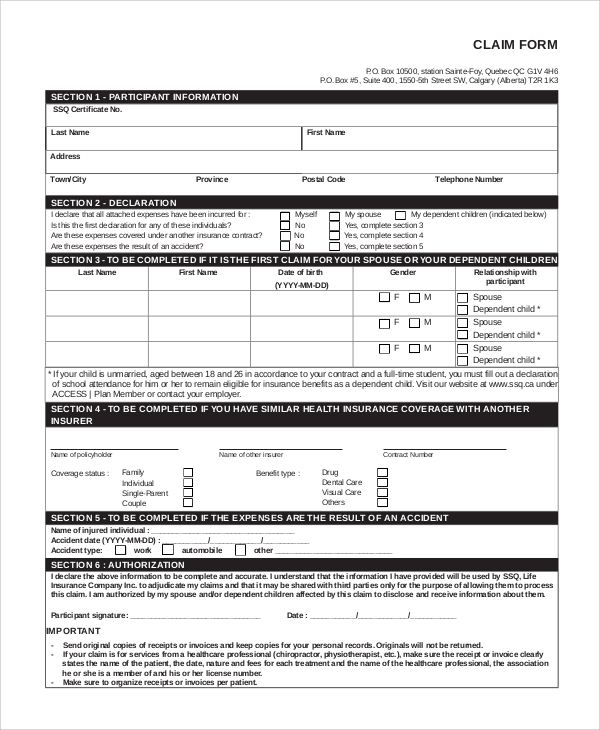

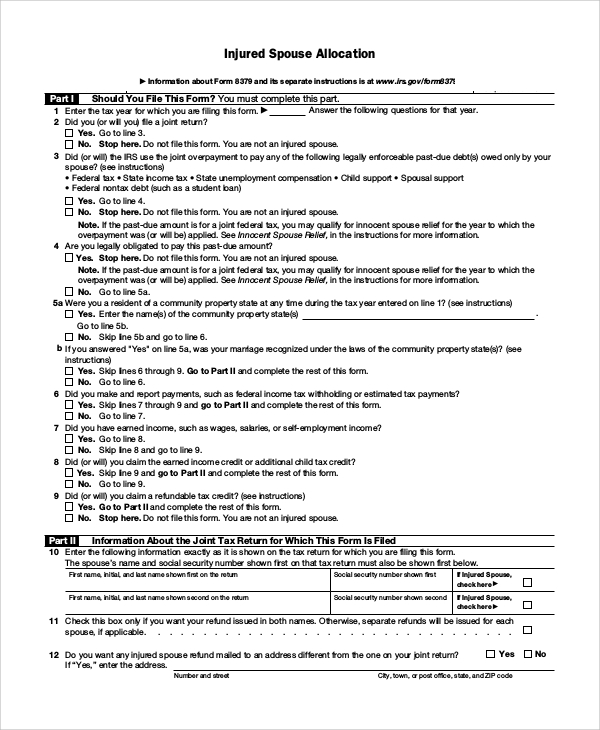

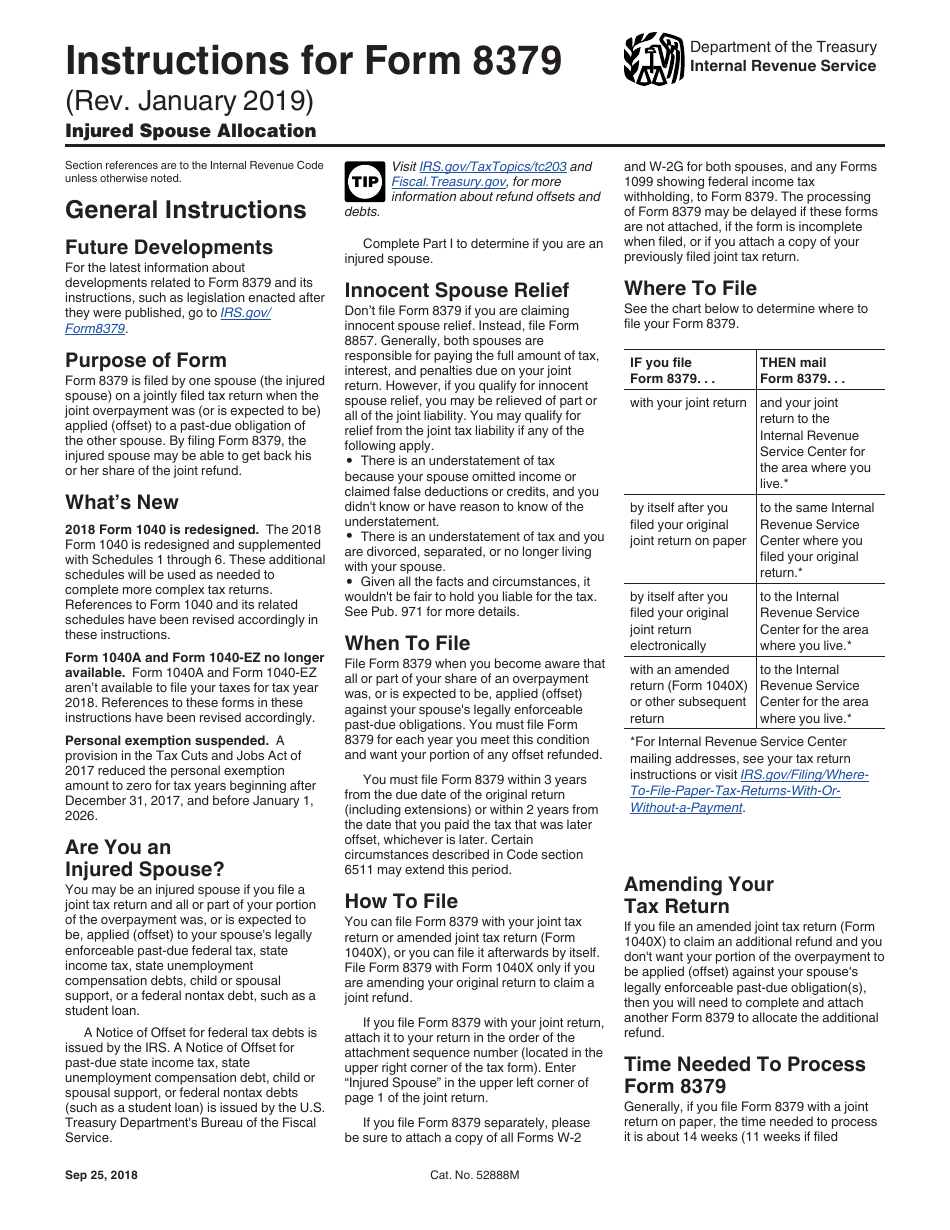

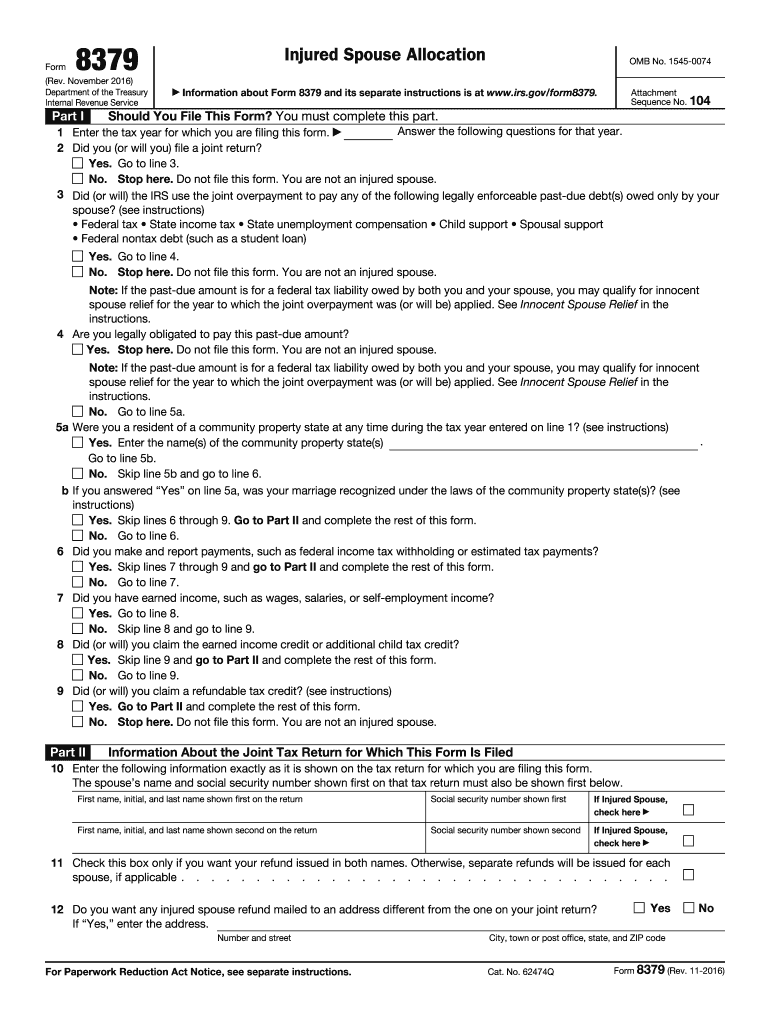

Injured Spouse Form Instructions - Injured spouse claim and allocation. The request for mail order forms may be used to order one copy or. It includes your name, social security number, address, and phone number. Complete, edit or print tax forms instantly. Web as an injured spouse, you can request your part of the tax refund by filing form 8379, injured spouse allocation, using the instructions for this form. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Upload, modify or create forms. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to. Try it for free now! If you file form 8379 with a joint return on paper, the time.

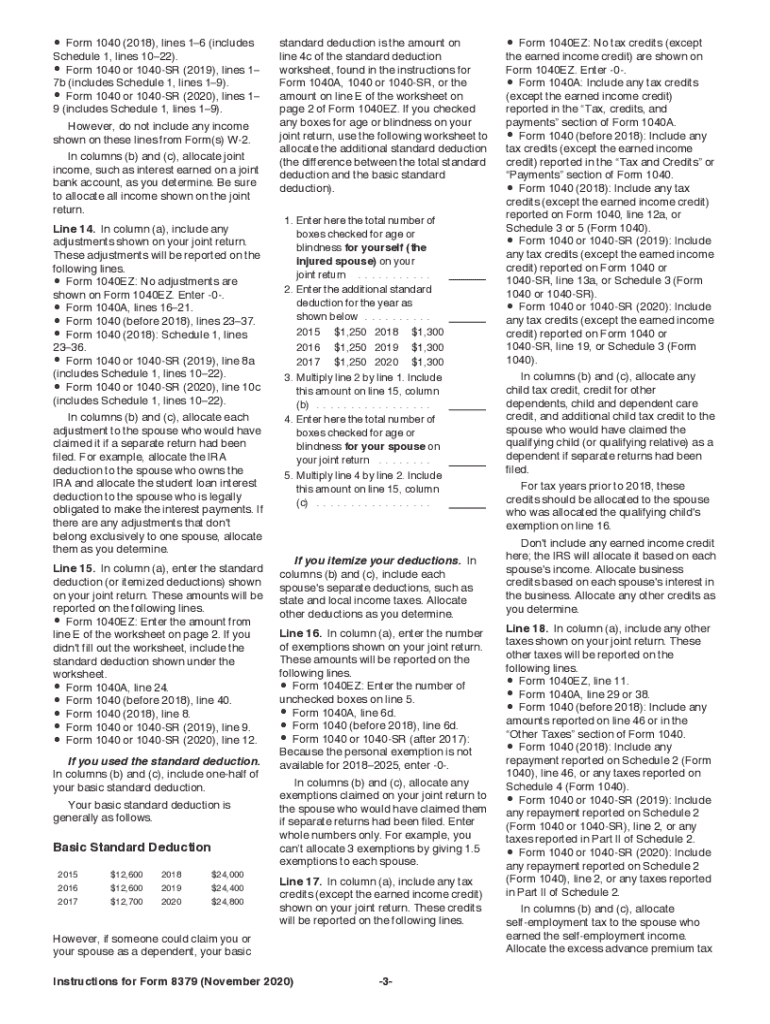

Are you an injured spouse? Injured spouse claim and allocation. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. Ad upload, modify or create forms. You, the “injured” spouse, must. Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Web if you file form 8379 with a joint return electronically, the time needed to process it is about 11 weeks. Additional information instructions for form 8379,. The form will be filed with your tax return, due on tax day.

You will need to check a box. Are you an injured spouse? It must show both spouses’ social security numbers in the same order they appeared on your joint tax. To file an injured spouse claim, the injured spouse must have: Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Irs 8379 inst & more fillable forms, register and subscribe now! Ad upload, modify or create forms. Additional information instructions for form 8379,. The form will be filed with your tax return, due on tax day.

FREE 7+ Sample Injured Spouse Forms in PDF

Try it for free now! Otherwise, in order to claim. Web if you file form 8379 with a joint return electronically, the time needed to process it is about 11 weeks. November 2021) department of the treasury internal revenue service. Web as an injured spouse, you can request your part of the tax refund by filing form 8379, injured spouse.

FREE 7+ Sample Injured Spouse Forms in PDF

The form will be filed with your tax return, due on tax day. Web after an offset happens, you can file form 8379 by itself. You will need to check a box. Otherwise, in order to claim. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes.

FREE 9+ Sample Injured Spouse Forms in PDF

Otherwise, in order to claim. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Irs 8379 inst & more fillable forms, register and subscribe now! Ad access irs tax forms. Are you an injured spouse?

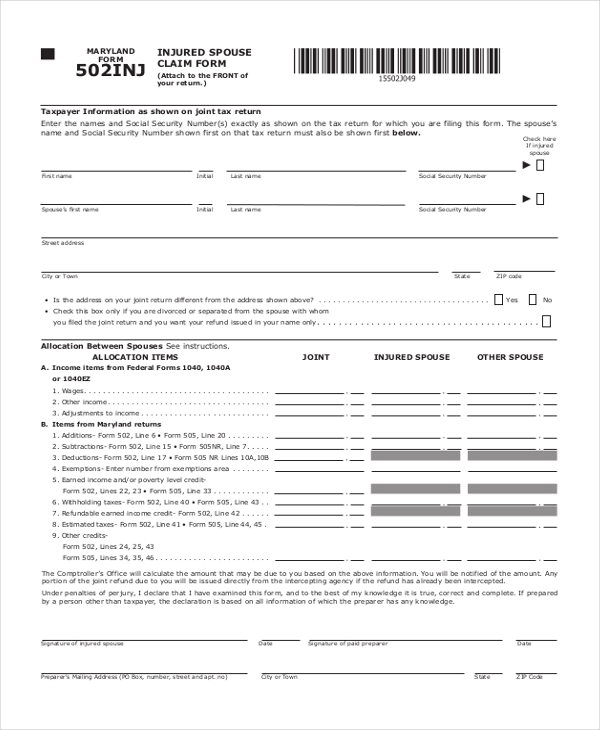

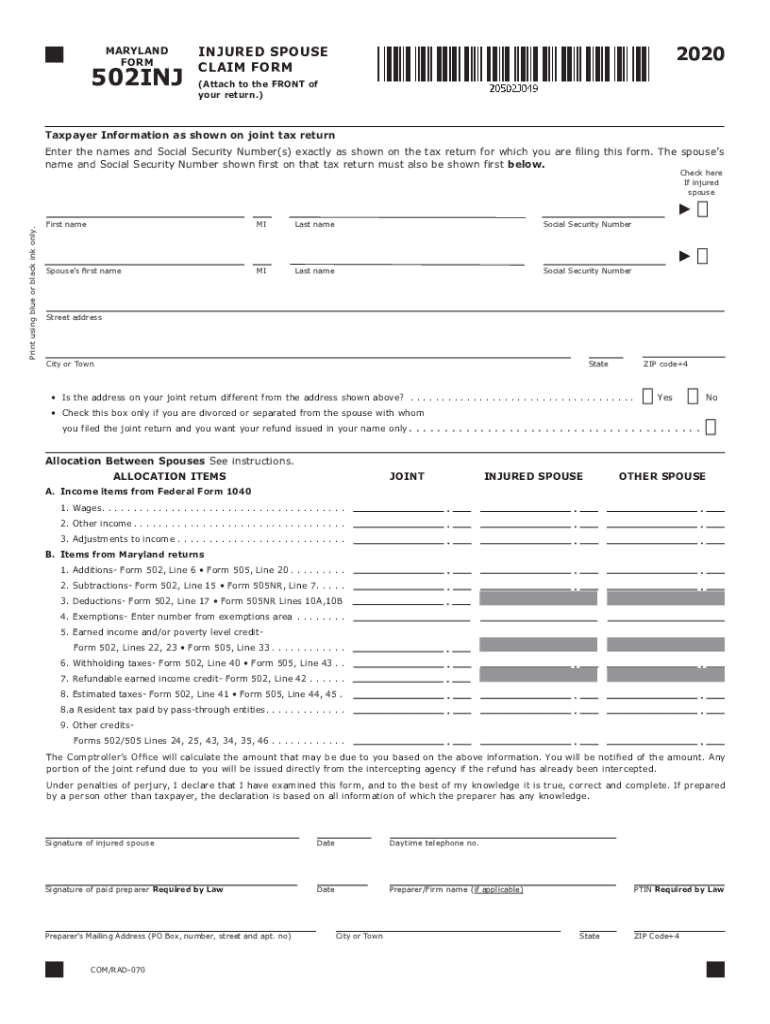

maryland injured spouse form Fill out & sign online DocHub

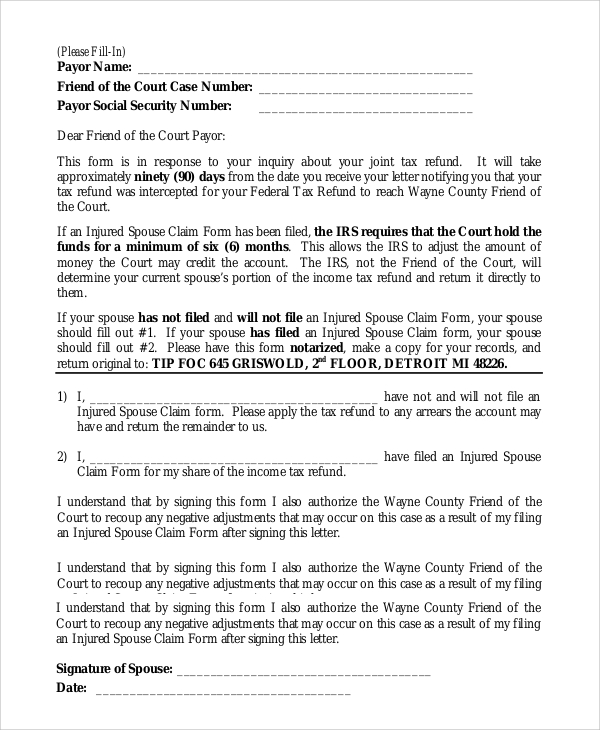

If you file form 8379 with a joint return on paper, the time. Web instructions please note this form is to be used when a spouse of a person owing child support agrees to voluntarily waive his or her right to claim a portion. Additional information instructions for form 8379,. Form 8379 is used by injured. Web you may qualify.

FREE 7+ Sample Injured Spouse Forms in PDF

If you’re filing with h&r block, you won’t need to complete this form on. Web the app will help complete and file form 8379, injured spouse allocation, in this situation. You, the “injured” spouse, must. Web if you file form 8379 with a joint return electronically, the time needed to process it is about 11 weeks. Ad access irs tax.

F8379 injure spouse form

November 2021) department of the treasury internal revenue service. Web if you file form 8379 with a joint return electronically, the time needed to process it is about 11 weeks. Complete, edit or print tax forms instantly. The form will be filed with your tax return, due on tax day. Web the app will help complete and file form 8379,.

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Web then, you will need to write some information about you and your spouse. Injured spouse claim and allocation. Additional information instructions for form 8379,. You, the “injured”.

Injured Spouse Form Fill Out and Sign Printable PDF Template signNow

Web the app will help complete and file form 8379, injured spouse allocation, in this situation. Upload, modify or create forms. Injured spouse claim and allocation. Web then, you will need to write some information about you and your spouse. Complete, edit or print tax forms instantly.

2020 Form IRS 8379 Instructions Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. Complete, edit or print tax forms instantly. Try it for free now! If you file form 8379 with a joint return on paper, the time. It includes your name, social security number, address, and phone number.

The Form Will Be Filed With Your Tax Return, Due On Tax Day.

Web the app will help complete and file form 8379, injured spouse allocation, in this situation. It includes your name, social security number, address, and phone number. Ad upload, modify or create forms. Web after an offset happens, you can file form 8379 by itself.

To File An Injured Spouse Claim, The Injured Spouse Must Have:

Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Web per irs instructions for form 8379, page 1: If you file form 8379 with a joint return on paper, the time. Ad access irs tax forms.

Additional Information Instructions For Form 8379,.

Irs 8379 inst & more fillable forms, register and subscribe now! You, the “injured” spouse, must. Are you an injured spouse? Web then, you will need to write some information about you and your spouse.

It Must Show Both Spouses’ Social Security Numbers In The Same Order They Appeared On Your Joint Tax.

If you’re filing with h&r block, you won’t need to complete this form on. Web if you file form 8379 with a joint return electronically, the time needed to process it is about 11 weeks. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to. Upload, modify or create forms.