Inheritance Beneficiary Form

Inheritance Beneficiary Form - Required documents attach the following required documents based on your relationship to the decedent: Web a beneficiary form does not have to be complicated. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. Statement for more details on whether any tax or penalty applies to your distribution. Web this form, along with a copy of every schedule a, is used to report values to the irs. Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. The simplicity of the form. If you’re the beneficiary or trust, it’s important to understand what to do.

Check box if this is a supplemental filing If you’re the beneficiary or trust, it’s important to understand what to do. Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Web application form for trust, estate, and organization beneficiaries. Web a beneficiary form does not have to be complicated. The simplicity of the form. One schedule a is provided to each beneficiary receiving property from an estate. Required documents attach the following required documents based on your relationship to the decedent: Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts.

Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. The simplicity of the form. Of course, you should consult your tax advisor Please refer to the disclosure. If you’re the beneficiary or trust, it’s important to understand what to do. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Web a beneficiary form does not have to be complicated. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts.

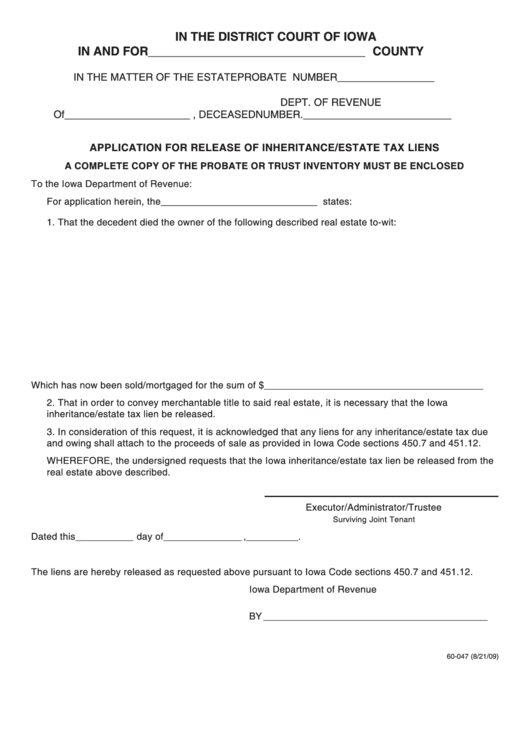

Form 60047 Application For Release Of Inheritance/estate Tax Liens

The owner must designate the beneficiary under procedures established by the plan. Web a beneficiary form does not have to be complicated. Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. One schedule a is provided to each beneficiary receiving property from.

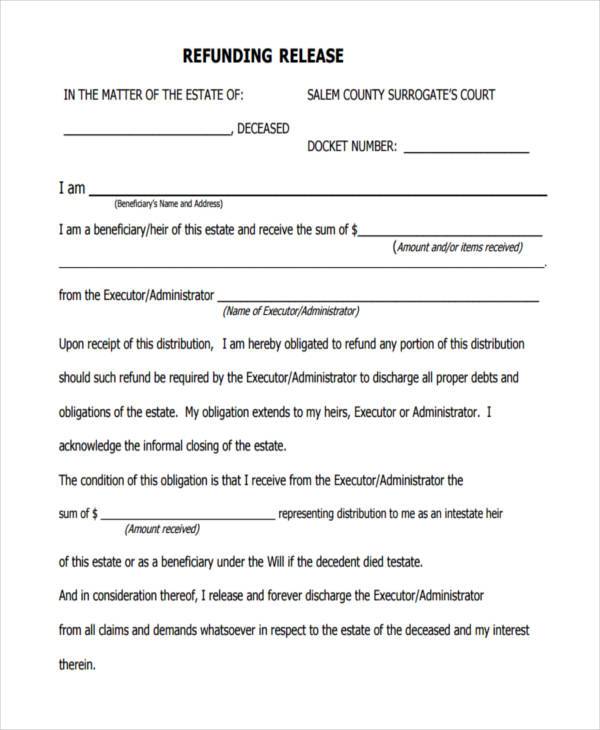

Money Inheritance Document PDF Form Fill Out and Sign Printable PDF

Web application form for trust, estate, and organization beneficiaries. Check box if this is a supplemental filing If you’re the beneficiary or trust, it’s important to understand what to do. The owner must designate the beneficiary under procedures established by the plan. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request.

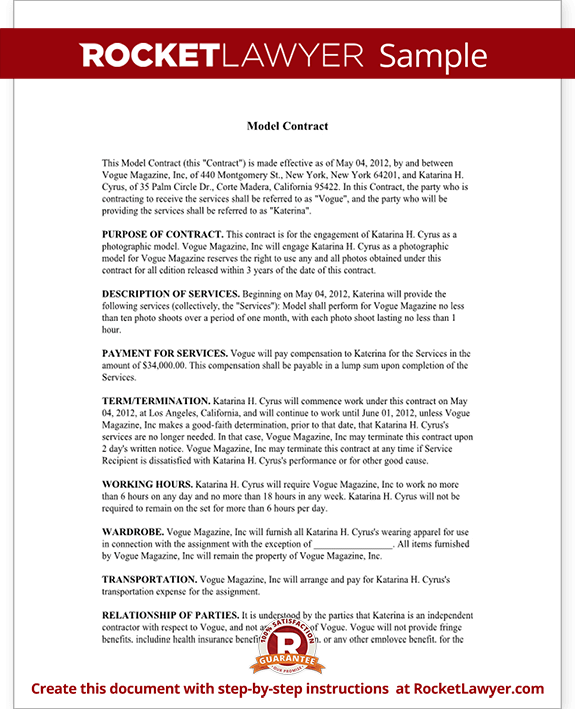

Modeling Contract Model Agreement Template (Form with Sample)

See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Web this form, along with a copy of every schedule a, is used to report values to the irs. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce..

FREE 7+ Sample Beneficiary Release Forms in PDF MS Word

Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Web this form, along with a copy of every schedule a, is used to report values to the irs. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. One schedule a.

Inherited IRA rules that nonspouse beneficiaries need to know WTOP News

Web application form for trust, estate, and organization beneficiaries. Check box if this is a supplemental filing Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Statement for more details on whether any tax or penalty applies to your distribution. Web ira.

Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation

The simplicity of the form. See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. Some retirement plans require specific beneficiaries under the.

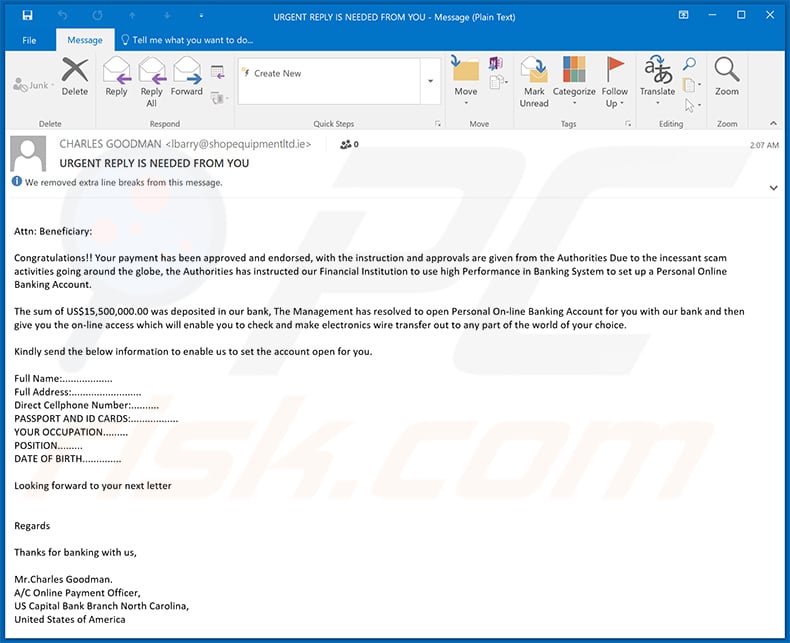

Beneficiary/Inheritance Email Scam Removal and recovery steps (updated)

Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263.

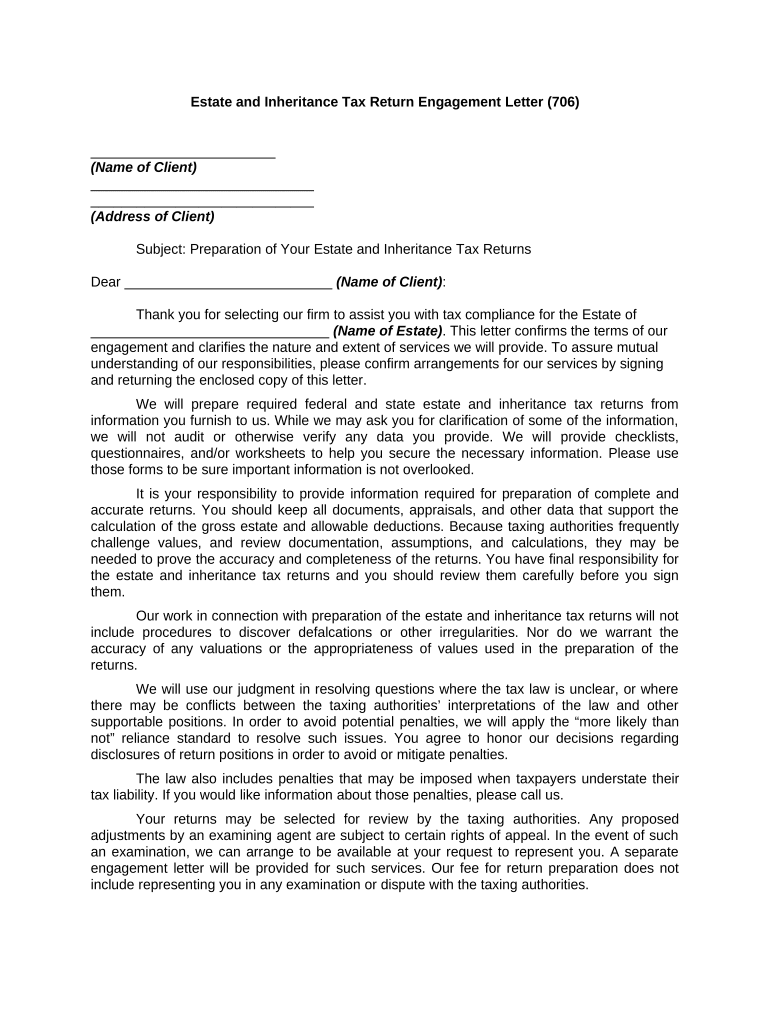

Inheritance Letter from Lawyer PDF Form Fill Out and Sign Printable

See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Check box if this is a supplemental filing Web application form for trust, estate, and organization beneficiaries. Of course, you should consult your tax.

How to Determine Inheritance if the Intended Beneficiary Is Deceased

Of course, you should consult your tax advisor Statement for more details on whether any tax or penalty applies to your distribution. Web application form for trust, estate, and organization beneficiaries. Web a beneficiary form does not have to be complicated. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent.

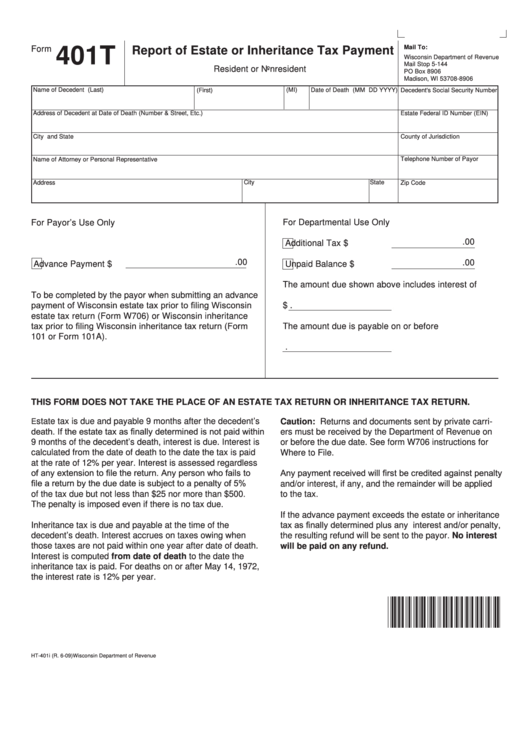

Form 401t Report Of Estate Or Inheritance Tax Payment Resident Or

Required documents attach the following required documents based on your relationship to the decedent: If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box,.

Web A Beneficiary Is Generally Any Person Or Entity The Account Owner Chooses To Receive The Benefits Of A Retirement Account Or An Ira After They Die.

Please refer to the disclosure. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. If you’re the beneficiary or trust, it’s important to understand what to do. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service

Some Retirement Plans Require Specific Beneficiaries Under The Terms Of The Plan (Such As A Spouse Or Child).

See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable.

Web Application Form For Trust, Estate, And Organization Beneficiaries.

One schedule a is provided to each beneficiary receiving property from an estate. Check box if this is a supplemental filing Of course, you should consult your tax advisor Web a beneficiary form does not have to be complicated.

The Owner Must Designate The Beneficiary Under Procedures Established By The Plan.

Statement for more details on whether any tax or penalty applies to your distribution. The simplicity of the form. Web this form, along with a copy of every schedule a, is used to report values to the irs. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce.