Idaho Withholding Form

Idaho Withholding Form - The annual amount, per exemption allowance, has changed from. The income tax withholding formula for the state of idaho has changed as follows: Over $24,800 but not over $27,936. Web calculate your idaho allowances and any additional amount you need withheld from each paycheck. See page 2 for more information on each step, who can claim. Over $0 but not over $24,800. Employee's withholding certificate form 941; Over $27,936 but not over $31,072. 11/2022 page 1 of 1. You can do this either.

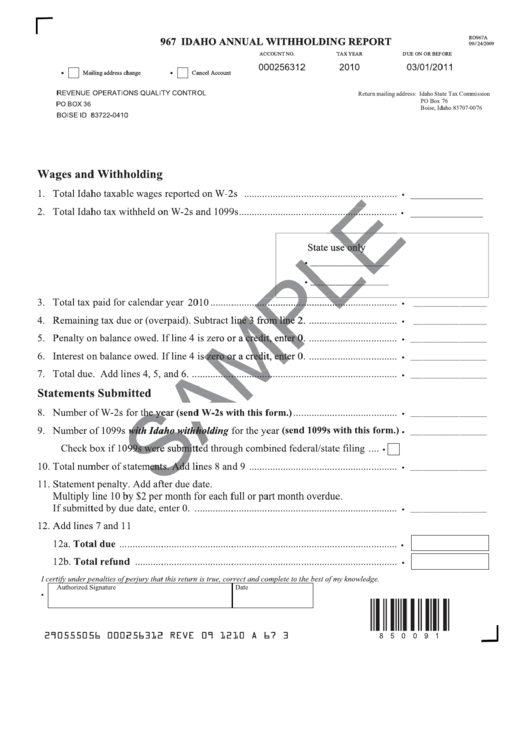

Boise, idaho — august 1, 2023 — you might qualify to have your. Employers are required by idaho law to withhold income tax from their employees’ wages. Calculate idaho employer payroll taxes new! Sign the form and give it to your employer. Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year. Over $27,936 but not over $31,072. Over $24,800 but not over $27,936. Otherwise, skip to step 5. You can do this either. If you’re an employee, your employer probably withholds.

Web calculate your idaho net pay or take home pay by entering your pay information, w4, and idaho state w4 information. Employee's withholding certificate form 941; Sign the form and give it to your employer. Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year. Web withholding because you have failed to report all interest and dividends on your tax return. Web the withholdings you indicate on this form will replace your current withholdings. Web download or print the 2022 idaho (idaho annual withholding report instructions ) (2022) and other income tax forms from the idaho state tax commission. Boise, idaho — august 1, 2023 — you might qualify to have your. Web the amount of idaho tax withholding should be: You can do this either.

Idaho Tax Commission offers help calculating withholding

You may obtain the following forms at unemployment insurance tax. The income tax withholding formula for the state of idaho has changed as follows: Web download or print the 2022 idaho (idaho annual withholding report instructions ) (2022) and other income tax forms from the idaho state tax commission. Over $27,936 but not over $31,072. Web you may apply for.

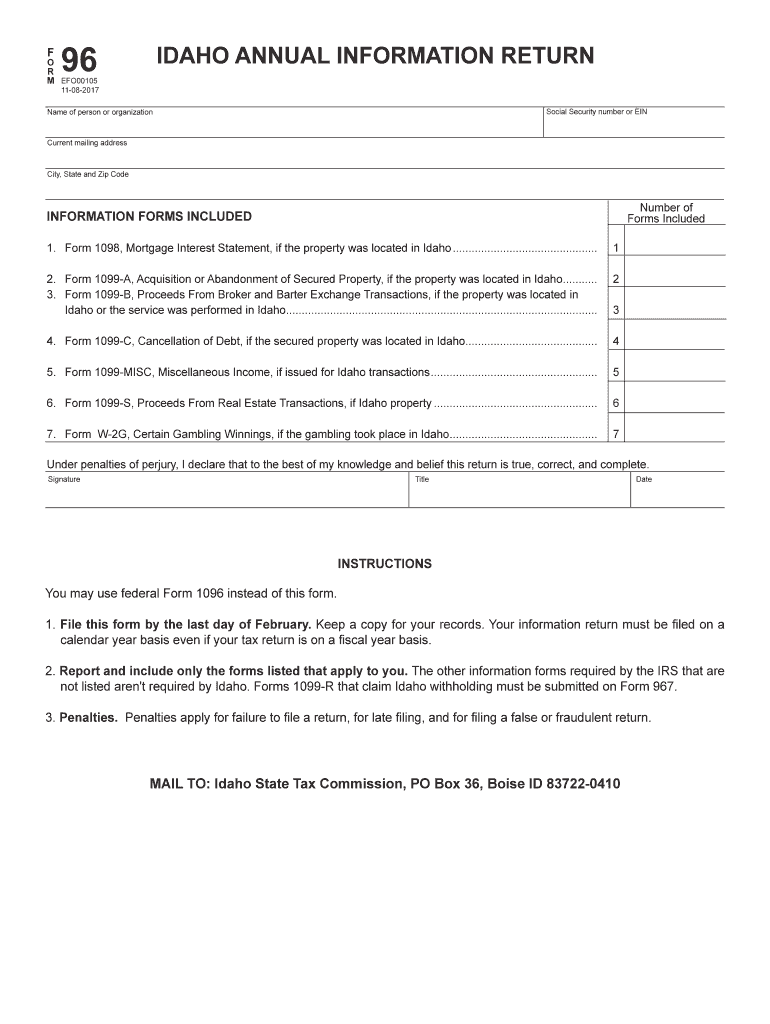

20172020 ID Form 96 Fill Online, Printable, Fillable, Blank pdfFiller

11/2022 page 1 of 1. We’ve updated the income tax withholding tables for 2023 due to. Sign the form and give it to your employer. The annual amount, per exemption allowance, has changed from. If you’re an employee, your employer probably withholds.

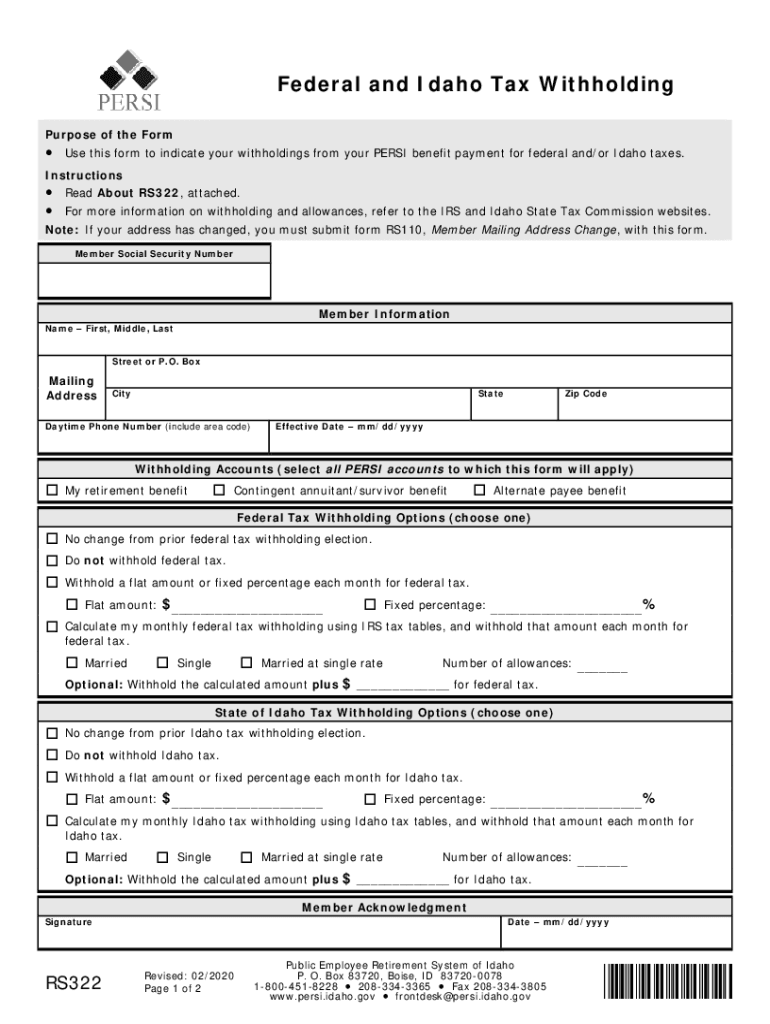

Federal & Idaho Tax Withholding Form Fill Out and Sign Printable PDF

Web withholding tables updated for 2023. Web eligible homeowners can now apply online for property tax deferral. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. For real estate transactions, item 2 does not apply. Web withholding because you have failed.

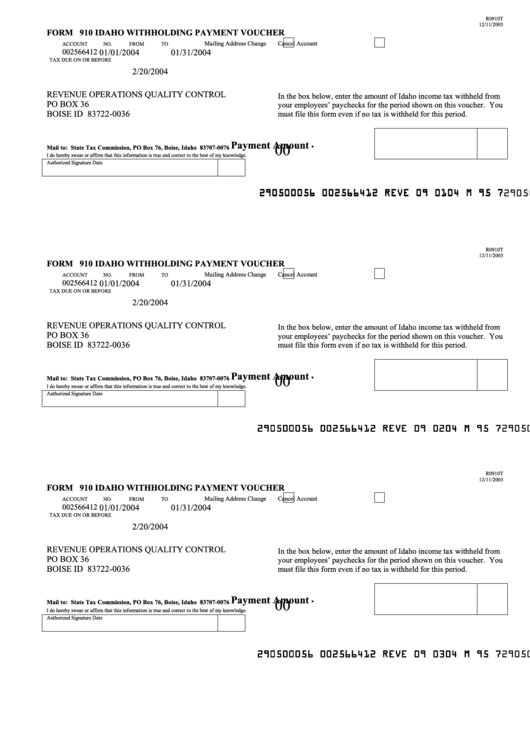

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

Web the amount of idaho tax withholding should be: Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year. Web withholding tables updated for 2023. Over $27,936 but not over $31,072. You can do this either.

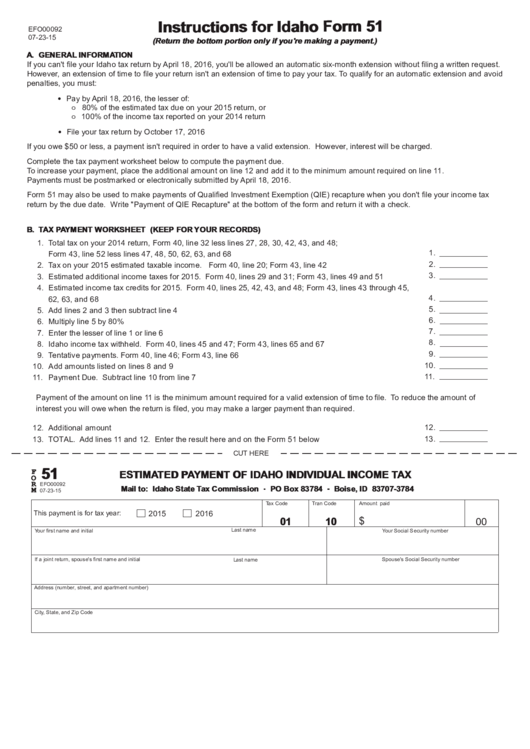

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

The income tax withholding formula for the state of idaho has changed as follows: 11/2022 page 1 of 1. You may obtain the following forms at unemployment insurance tax. Employers engaged in a trade or business who. Employers are required by idaho law to withhold income tax from their employees’ wages.

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

If you’re an employee, your employer probably withholds. Web withholding because you have failed to report all interest and dividends on your tax return. Web you may apply for the following: Employee's withholding certificate form 941; Employers are required by idaho law to withhold income tax from their employees’ wages.

1+ Idaho Offer to Purchase Real Estate Form Free Download

11/2022 page 1 of 1. Otherwise, skip to step 5. Web the amount of idaho tax withholding should be: Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year. Web the withholdings you indicate on this form will replace your current withholdings.

Form Ro967a Idaho Annual Withholding Report printable pdf download

If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4 If you’re an employee, your employer probably withholds. Sign the form and give it to your employer. For real estate transactions, item 2 does not apply. 11/2022 page 1 of 1.

Idaho State Withholding Form 2022

For real estate transactions, item 2 does not apply. 11/2022 page 1 of 1. Web the amount of idaho tax withholding should be: Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. Employers engaged in a trade or business who.

Form Ro967a Idaho Annual Withholding Report printable pdf download

The annual amount, per exemption allowance, has changed from. Calculate idaho employer payroll taxes new! Employers engaged in a trade or business who. You may obtain the following forms at unemployment insurance tax. Sign the form and give it to your employer.

See Page 2 For More Information On Each Step, Who Can Claim.

Employee's withholding certificate form 941; 11/2022 page 1 of 1. Web download or print the 2022 idaho (idaho annual withholding report instructions ) (2022) and other income tax forms from the idaho state tax commission. Employers are required by idaho law to withhold income tax from their employees’ wages.

For Real Estate Transactions, Item 2 Does Not Apply.

If you’re an employee, your employer probably withholds. Sign the form and give it to your employer. Employers engaged in a trade or business who. Sign the form and give it to your employer.

Web Calculate Your Idaho Net Pay Or Take Home Pay By Entering Your Pay Information, W4, And Idaho State W4 Information.

You can do this either. You may obtain the following forms at unemployment insurance tax. Web eligible homeowners can now apply online for property tax deferral. If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4

Web Use This Form To Report The Idaho Income Tax You Withheld, Reconcile Payments You Made During The Year With The Amount Of Tax You Withheld, And Submit.

The annual amount, per exemption allowance, has changed from. Web you may apply for the following: We’ve updated the income tax withholding tables for 2023 due to. Calculate idaho employer payroll taxes new!