How To Form A Sole Proprietorship In Illinois

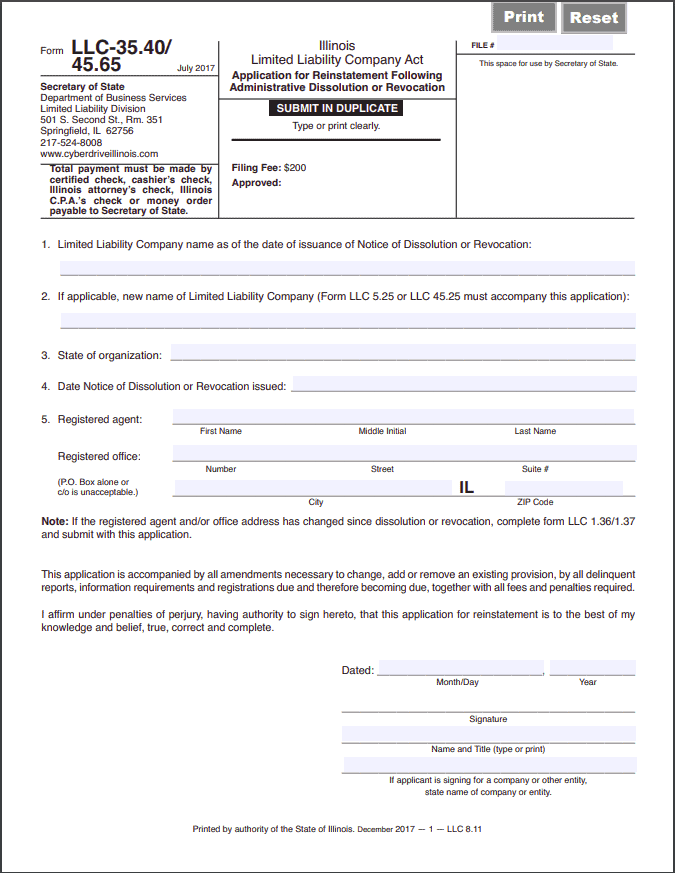

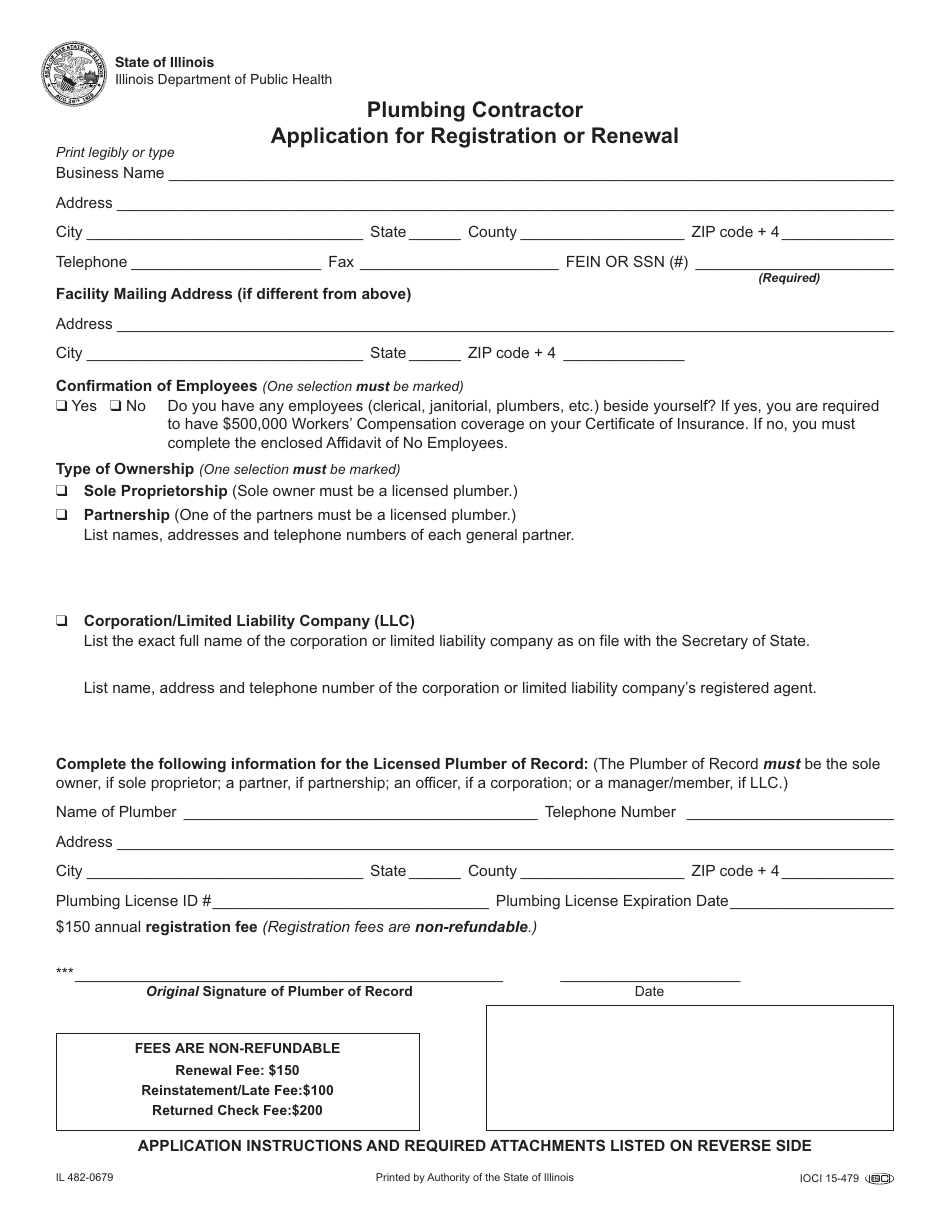

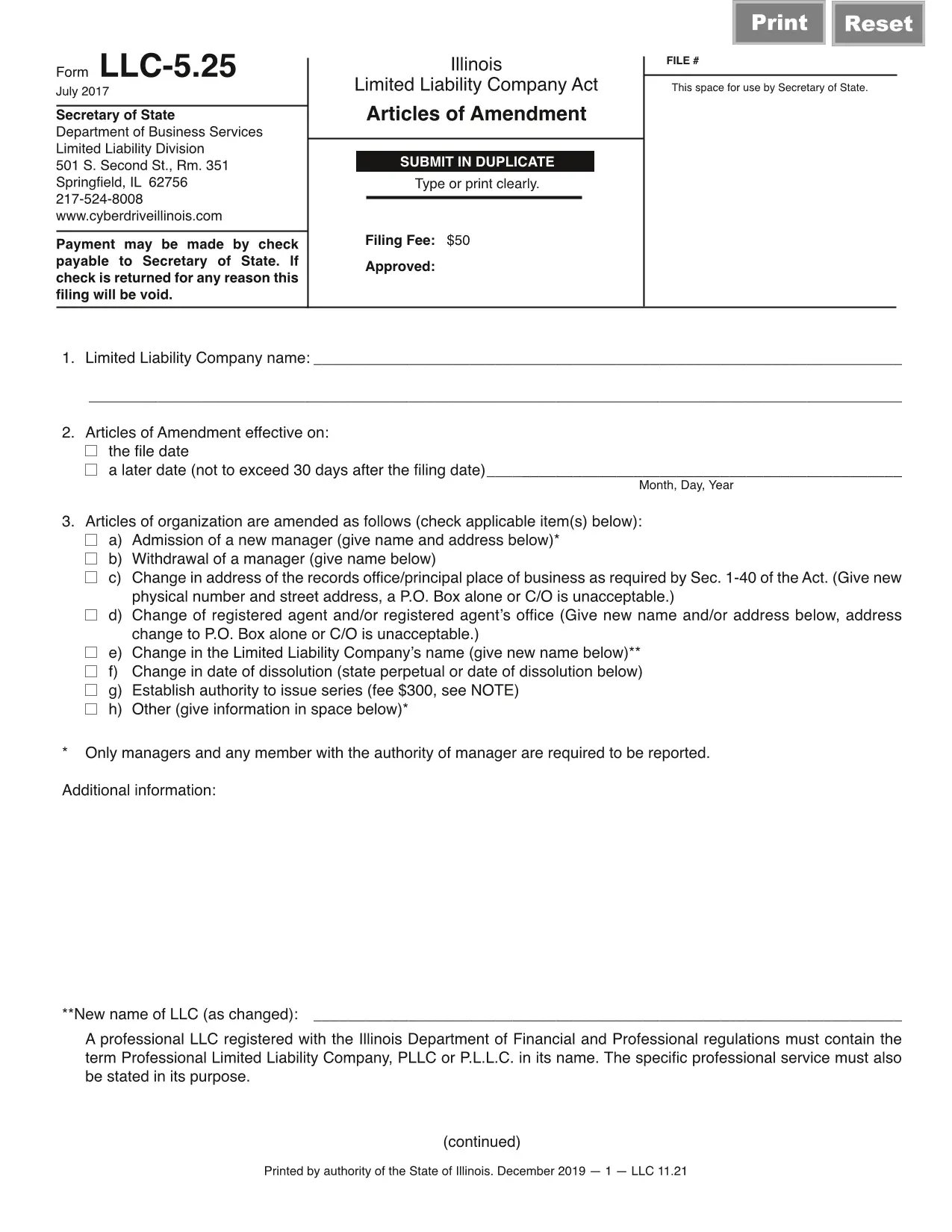

How To Form A Sole Proprietorship In Illinois - Web you will need to register with the illinois department of revenue business registration. Web start an llc ready to form an llc? Web the most common forms today are sole proprietorship, partnership, limited partnership, limited liability company and corporation. When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Sole proprietorship advantages sole proprietorship disadvantages how to start an illinois sole. Sole proprietorship provides you with complete authority over the. Web sole proprietorship and general partnership. Web step 1 #1: Get started today w/ us. This guide assumes you have selected.

Web you will need to register with the illinois department of revenue business registration. Plus, get a registered agent, bylaws, tax id/ein, business license, and more. If you are the only owner of the business, you are a sole proprietor. Web sole proprietorship and general partnership. Web sole proprietorships are filed only at the county level. When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Tax registration and insurance all illinois businesses, including sole proprietorships, must register with the. Web you can apply for an ein online at the irs website (see resources). Web illinois secretary of state securities department 421 e. The business owner puts in all the money, makes all decisions, pays federal income tax on net income using schedule c to form.

Sole proprietorship provides you with complete authority over the. Once you have a business idea and have decided to operate as a sole. Web you can apply for an ein online at the irs website (see resources). The business owner puts in all the money, makes all decisions, pays federal income tax on net income using schedule c to form. Web sole proprietorships are filed only at the county level. Web start an llc ready to form an llc? Web you will need to register with the illinois department of revenue business registration. After you obtain the name certificate, the next step sole proprietors need to. Web filing & payment requirements. Tax registration and insurance all illinois businesses, including sole proprietorships, must register with the.

Form Sole Proprietorship Illinois Armando Friend's Template

Ad have plans to get investors & go public? Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or with illinois customers. After you obtain the name certificate, the next step sole proprietors need to. Check with your county recorder's office to determine filing requirements. Web you can apply for.

Form Sole Proprietorship Illinois Armando Friend's Template

Web you will need to register with the illinois department of revenue business registration. The requirements are similar to federal income tax procedures, including withholding and payments of estimated tax. Tax registration and insurance all illinois businesses, including sole proprietorships, must register with the. Web considerations control do you feel the need to have total control of your business? Get.

Form Sole Proprietorship Illinois Armando Friend's Template

Web filing & payment requirements. Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Web you can apply for an ein online at the irs website (see resources). Please see our section on choosing and checking the availability of a name for your small. Web learn.

How To A Sole Proprietor In Illinois

Tax registration and insurance all illinois businesses, including sole proprietorships, must register with the. Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or with illinois customers. Choose a business name for your sole proprietorship and check for availability. Ad have plans to get investors & go public? If you.

How to an Illinois Sole Proprietorship in 2022

When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Sole proprietorship provides you with complete authority over the. Web you will need to register with the illinois department of revenue business registration. If you are the only owner of the business, you are a sole proprietor. Web step.

Choosing the Best Legal Structure for Your Business Gentle Care

Web you can apply for an ein online at the irs website (see resources). Web considerations control do you feel the need to have total control of your business? When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. If you are the only owner of the business, you.

Form Sole Proprietorship Illinois Armando Friend's Template

Web start an llc ready to form an llc? After you obtain the name certificate, the next step sole proprietors need to. Web you will need to register with the illinois department of revenue business registration. Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Check.

Form Sole Proprietorship Illinois Armando Friend's Template

Choose a business name for your sole proprietorship and check for availability. Check with your county recorder's office to determine filing requirements. Web sole proprietorships are filed only at the county level. Web how to start an illinois sole proprietorship. Web learn about hide what is a sole proprietorship?

Form Sole Proprietorship Illinois Armando Friend's Template

There is usually no government filing or approval required to operate your business as a. Please see our section on choosing and checking the availability of a name for your small. Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Web businesses business registration you must.

Sole Proprietorship In Delhi Process Documents Require

Sole proprietorship provides you with complete authority over the. Select an appropriate business name a sole proprietor in illinois can use his/her own given name or may opt for a trade or assumed business. When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Web illinois secretary of state.

Tax Registration And Insurance All Illinois Businesses, Including Sole Proprietorships, Must Register With The.

Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or with illinois customers. Web 7 steps to start a sole proprietorship bottom line frequently asked questions (faqs) if you’ve been feeling an inner pull to start your own business, then. For more information on corporations and not for.

Plus, Get A Registered Agent, Bylaws, Tax Id/Ein, Business License, And More.

The requirements are similar to federal income tax procedures, including withholding and payments of estimated tax. If you are the only owner of the business, you are a sole proprietor. Select an appropriate business name a sole proprietor in illinois can use his/her own given name or may opt for a trade or assumed business. Web how to start an illinois sole proprietorship.

Web Filing & Payment Requirements.

Web learn about hide what is a sole proprietorship? Web considerations control do you feel the need to have total control of your business? Web sole proprietorship and general partnership. Sole proprietorship advantages sole proprietorship disadvantages how to start an illinois sole.

The Business Owner Puts In All The Money, Makes All Decisions, Pays Federal Income Tax On Net Income Using Schedule C To Form.

After you obtain the name certificate, the next step sole proprietors need to. This is a business entity that doesn’t elect to separate business finances and liabilities from the business owner’s personal matters. Please see our section on choosing and checking the availability of a name for your small. Ad have plans to get investors & go public?