How To Fill Out Form 8958

How To Fill Out Form 8958 - About form 8958, allocation of tax amounts between. Do i put the clients… how to fill out form 8958, im in texas. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. From within your taxact return ( online or. Web under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Yes, loved it could be better no one. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina.

Web how do i complete the married filing separate allocation form (8958)? Yes, loved it could be better no one. Web 283 votes what makes the example of completed form 8958 legally valid? From within your taxact return ( online or. ★★★★★ how to fill out form 8958, im in texas. Enjoy smart fillable fields and interactivity. Web to generate form 8958, follow these steps: Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web ask an expert tax questions this answer was rated:

Yes, loved it could be better no one. Enter amounts in the income allocation details subsection. Get your online template and fill it in using progressive features. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web to access form 8958 in the taxact program (the form won't be accessible if your address and filing status don't meet the requirements): ★★★★★ how to fill out form 8958, im in texas. Go to screen 3.1, community property income allocation. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. My wife and i are filing married, filing. Enjoy smart fillable fields and interactivity.

Chapter 14 12c Army Discharge Army Military

On your separate returns, each of you must report. I got married in nov 2021. From within your taxact return ( online or. Web under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. Go to screen 3.1, community property income allocation.

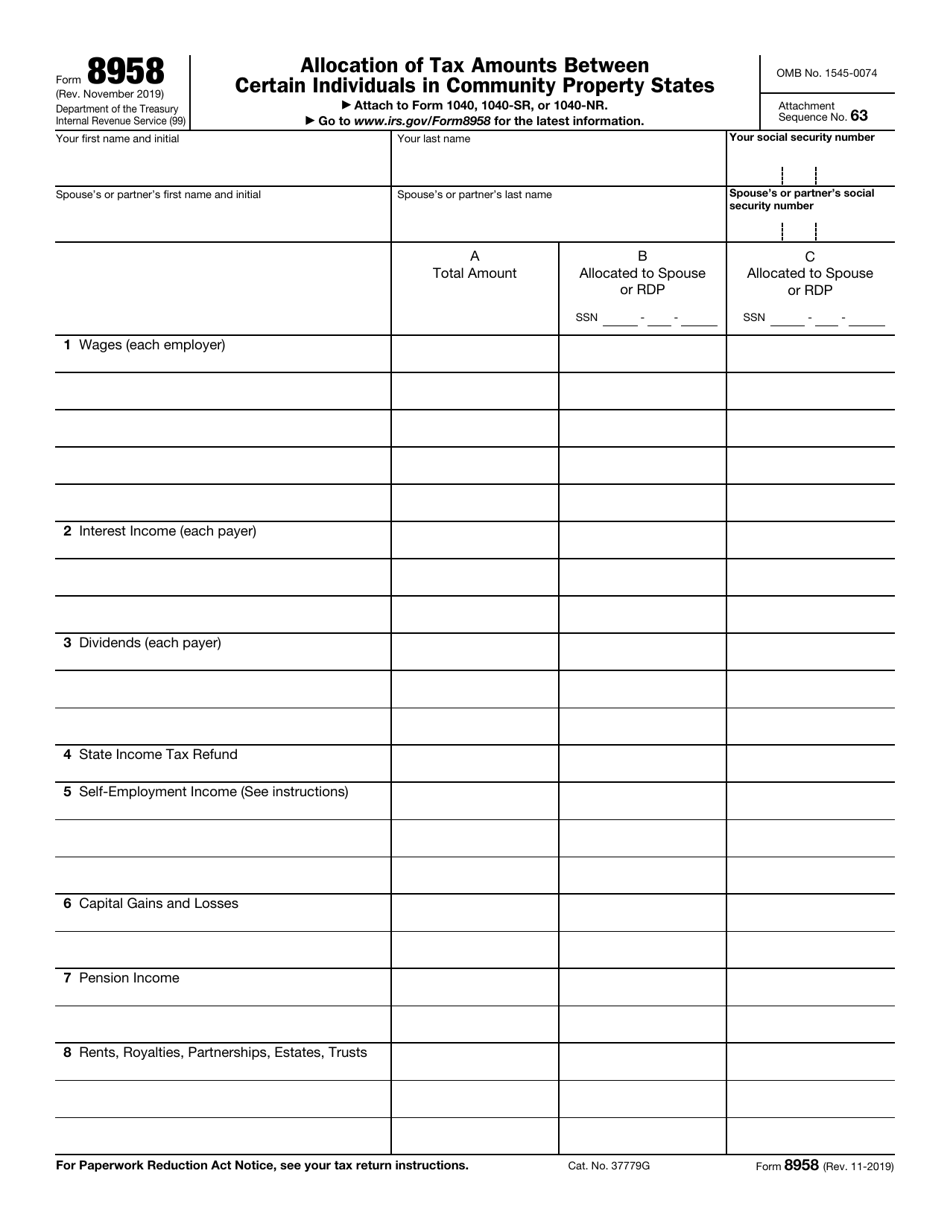

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web to.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

From within your taxact return ( online or. Web to generate form 8958, follow these steps: Web how to fill out and sign form 8958 instructions example online? ★★★★★ how to fill out form 8958, im in texas. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only.

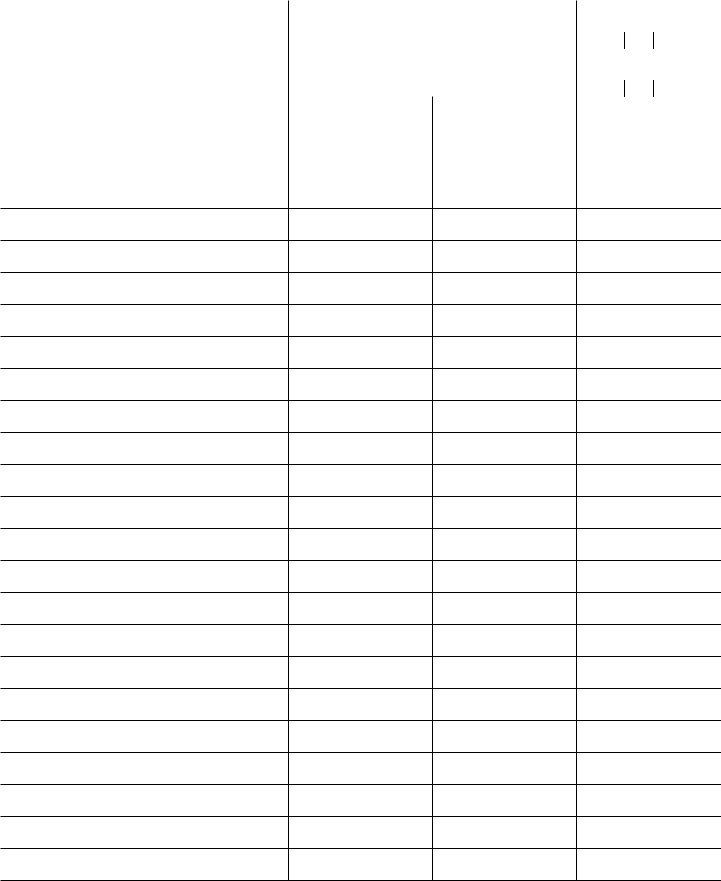

IRS Form 8822 The Best Way to Fill it

Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web to access form 8958 in the taxact program (the form won't be accessible if your address and filing status don't meet the requirements): Web form 8958 is also needed for the two separately.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web form 8958 only explains how you allocated.

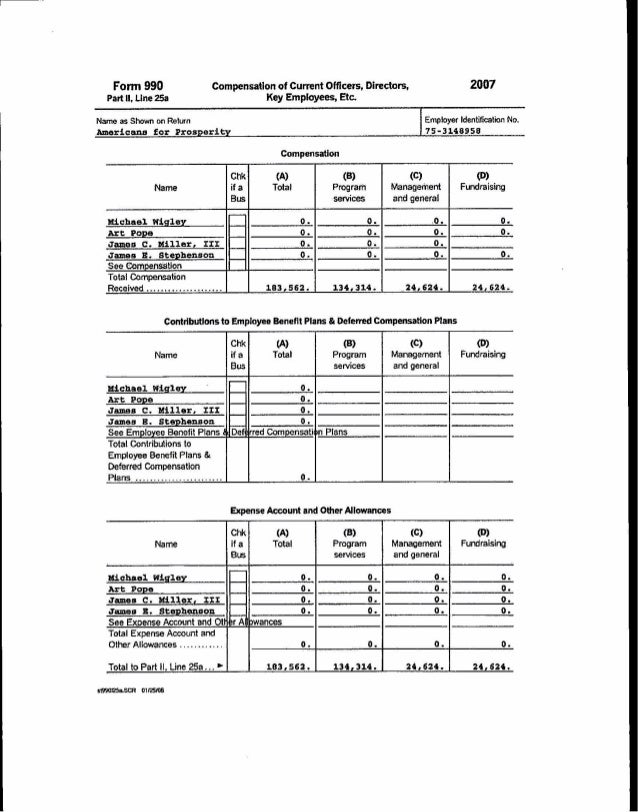

Americans forprosperity2007

About form 8958, allocation of tax amounts between. Yes, loved it could be better no one. Web form 8958 only explains how you allocated income. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web use this form.

Quick Tips Filling Out IRS Form 8821 Tax Information Authorization

Enter amounts in the income allocation details subsection. Web to access form 8958 in the taxact program (the form won't be accessible if your address and filing status don't meet the requirements): Web under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. Web the form 8958 essentially reconciles the.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web form 8958 only explains how you allocated income. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Do i put the clients… how to fill out form 8958, im in texas. Web to generate form 8958, follow these steps: Web ask an expert tax questions this answer was rated:

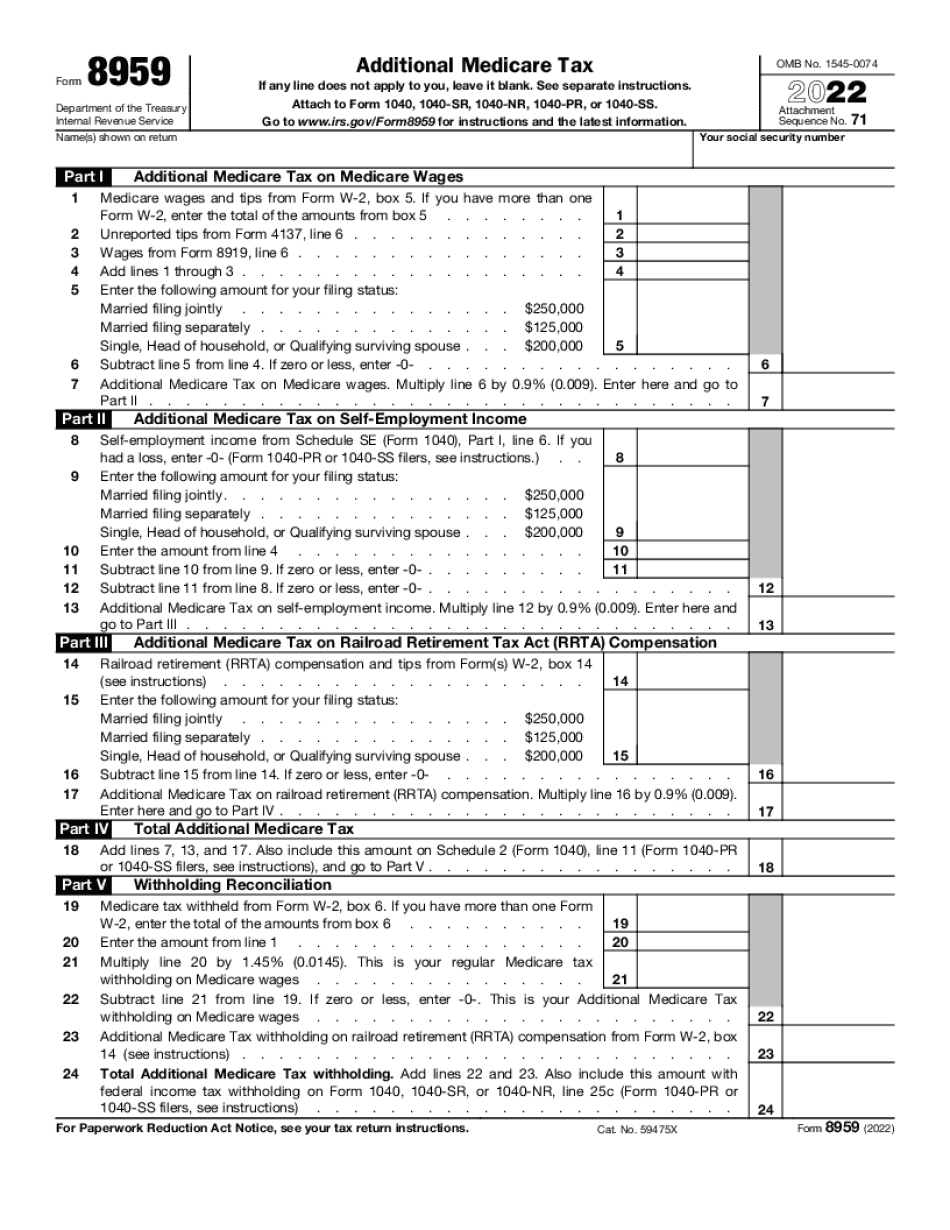

Form Steps to Fill out Digital 8959 Fill online, Printable, Fillable

Web 283 votes what makes the example of completed form 8958 legally valid? Web how to fill out and sign form 8958 instructions example online? If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web to access form 8958 in the taxact program (the form won't be accessible if your address.

How to Fill out IRS Form 1040 (with Form) wikiHow

Web 283 votes what makes the example of completed form 8958 legally valid? Web to access form 8958 in the taxact program (the form won't be accessible if your address and filing status don't meet the requirements): Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing.

Web To Access Form 8958 In The Taxact Program (The Form Won't Be Accessible If Your Address And Filing Status Don't Meet The Requirements):

Do i put the clients… how to fill out form 8958, im in texas. Go to screen 3.1, community property income allocation. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. I got married in nov 2021.

Enter Amounts In The Income Allocation Details Subsection.

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web ask an expert tax questions this answer was rated: Web how do i complete the married filing separate allocation form (8958)?

Web The Form 8958 Essentially Reconciles The Difference Between What Employers (And Other Income Sources) Have Reported To The Irs And What The Spouses Will Be.

Yes, loved it could be better no one. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. Web how to fill out and sign form 8958 instructions example online?

Web You Must Attach Form 8958 To Your Tax Form Showing How You Figured The Amount You’re Reporting On Your Return.

My wife and i are filing married, filing. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web to generate form 8958, follow these steps: Web under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property.