Homestead Exemption Form Oklahoma

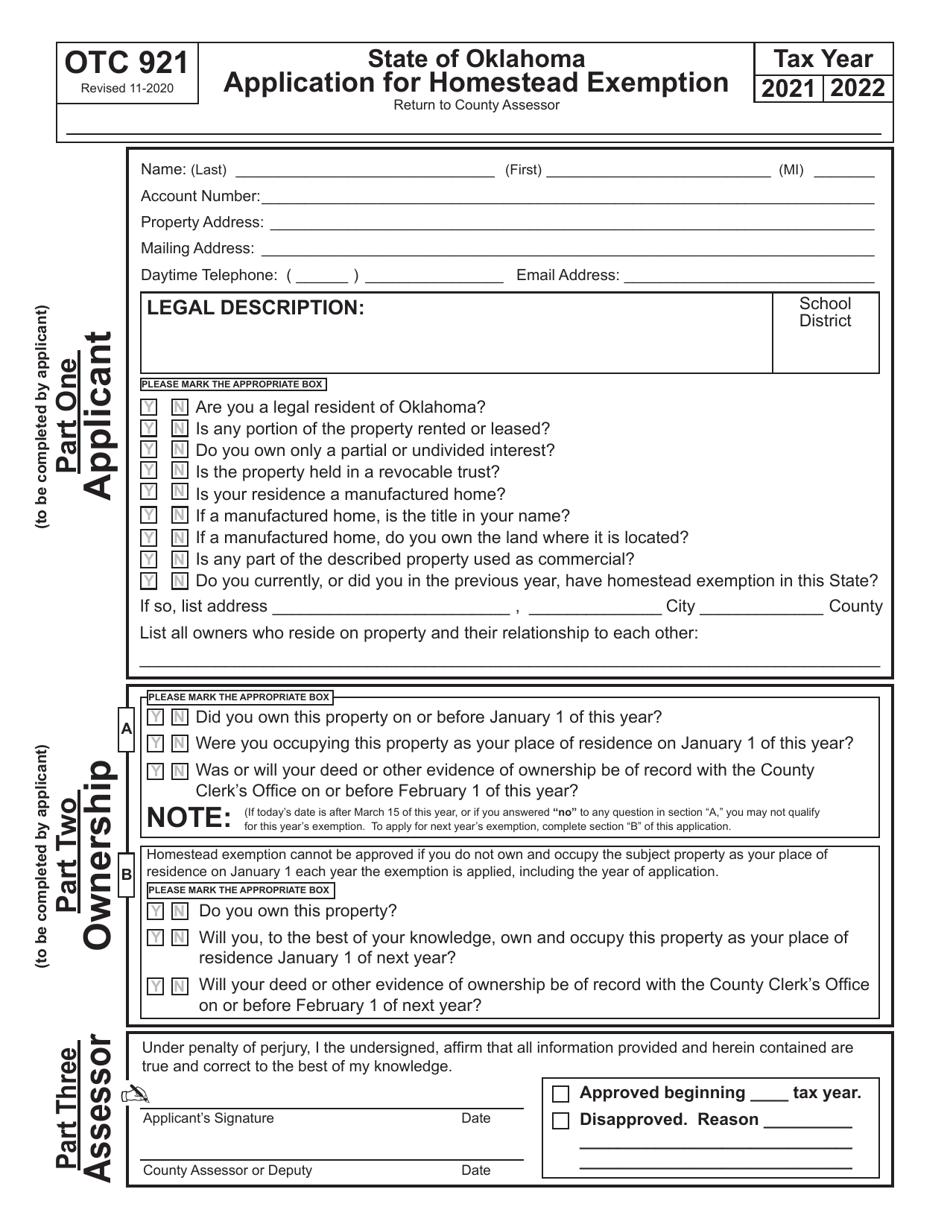

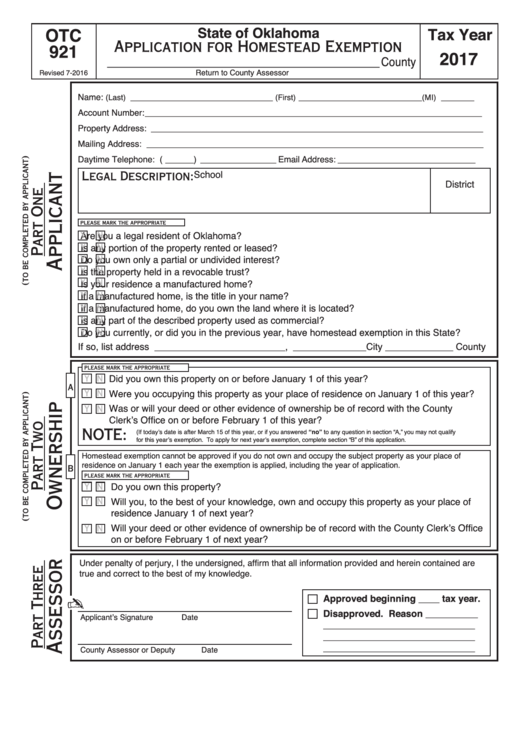

Homestead Exemption Form Oklahoma - If approved, this document will grant an exemption on property tax for this primary. Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: In most cases this will result in between $80 & $120 in tax savings. You can apply for homestead exemption during the hours of 8 a.m. Web applications for the additional homestead exemption and senior valuation freeze are available from january 1 to march 15 or within 30 days from and after receipt of notice of. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. However, the homestead application must be filed on or before march 15th of the. In tax year 2019, this was a savings of $91 to $142 depending on. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: To apply for a job.

Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: If your property is valued at $100,000, the assessed value of your home is $11,000, since the. In tax year 2019, this was a savings of $91 to $142 depending on. If approved, this document will grant an exemption on property tax for this primary. In most cases this will result in between $80 and $120 in tax savings. Web how do i file for homestead exemption in oklahoma? Web homestead exemption exempts $1,000 from the assessed value of your property. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Web application for homestead exemption is made with the county assessor at any time. Web applications for the additional homestead exemption and senior valuation freeze are available from january 1 to march 15 or within 30 days from and after receipt of notice of.

Web homestead exemption is a $1,000 deduction from the gross assessed value of your home. To apply for a job. You must fill out form 921 and mail it to: Web homestead exemption is a $1,000 deduction from the gross assessed value of your home. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web you must be a resident of oklahoma. Web homestead exemption exempts $1,000 from the assessed value of your property. Choose the correct version of. Any taxpayer who has been granted a homestead exemption and who continues to occupy such homestead property as a homestead, shall not be required to reapply for.

What is Homestead Exemption

Web homestead exemption exempts $1,000 from the assessed value of your property. However, the homestead application must be filed on or before march 15th of the. In tax year 2019, this was a savings of $91 to $142 depending on. Web homestead exemption is a $1,000 deduction from the gross assessed value of your home. To apply for a job.

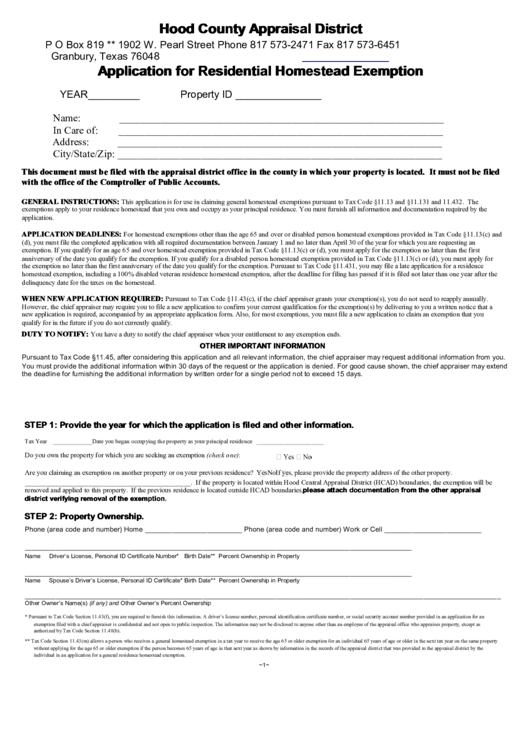

Application For Residential Homestead Exemption Hood County Appraisal

To apply for a job. However, the homestead application must be filed on or before march 15th of the. Web such application may be filed at any time; Web to receive homestead exemption, a taxpayer shall be required to file an application for homestead exemption with the county assessor in which their property is located. In tax year 2019, this.

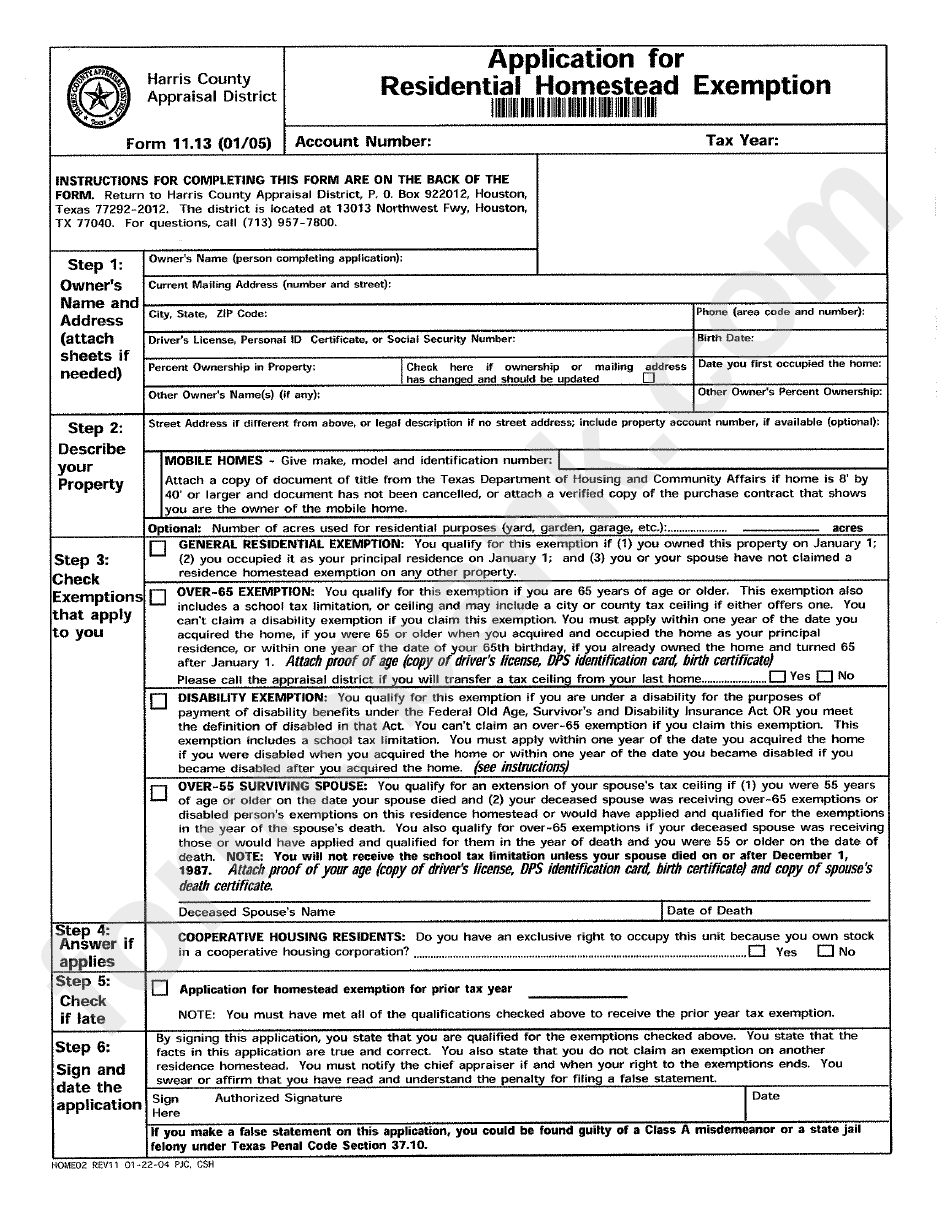

Harris County Homestead Exemption Form printable pdf download

Provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax year only if the. You must fill out form 921 and mail it to: However, the homestead application must be filed on or before march 15th of the. 315 sw 5th street, suite 301 lawton, ok 73501 renewing if you have. Choose the.

Homestead Exemption (Explained) YouTube

Web homestead exemption exempts $1,000 from the assessed value of your property. Web to receive homestead exemption, a taxpayer shall be required to file an application for homestead exemption with the county assessor in which their property is located. Web how do i file for homestead exemption in oklahoma? Web you must be a resident of oklahoma. In most cases.

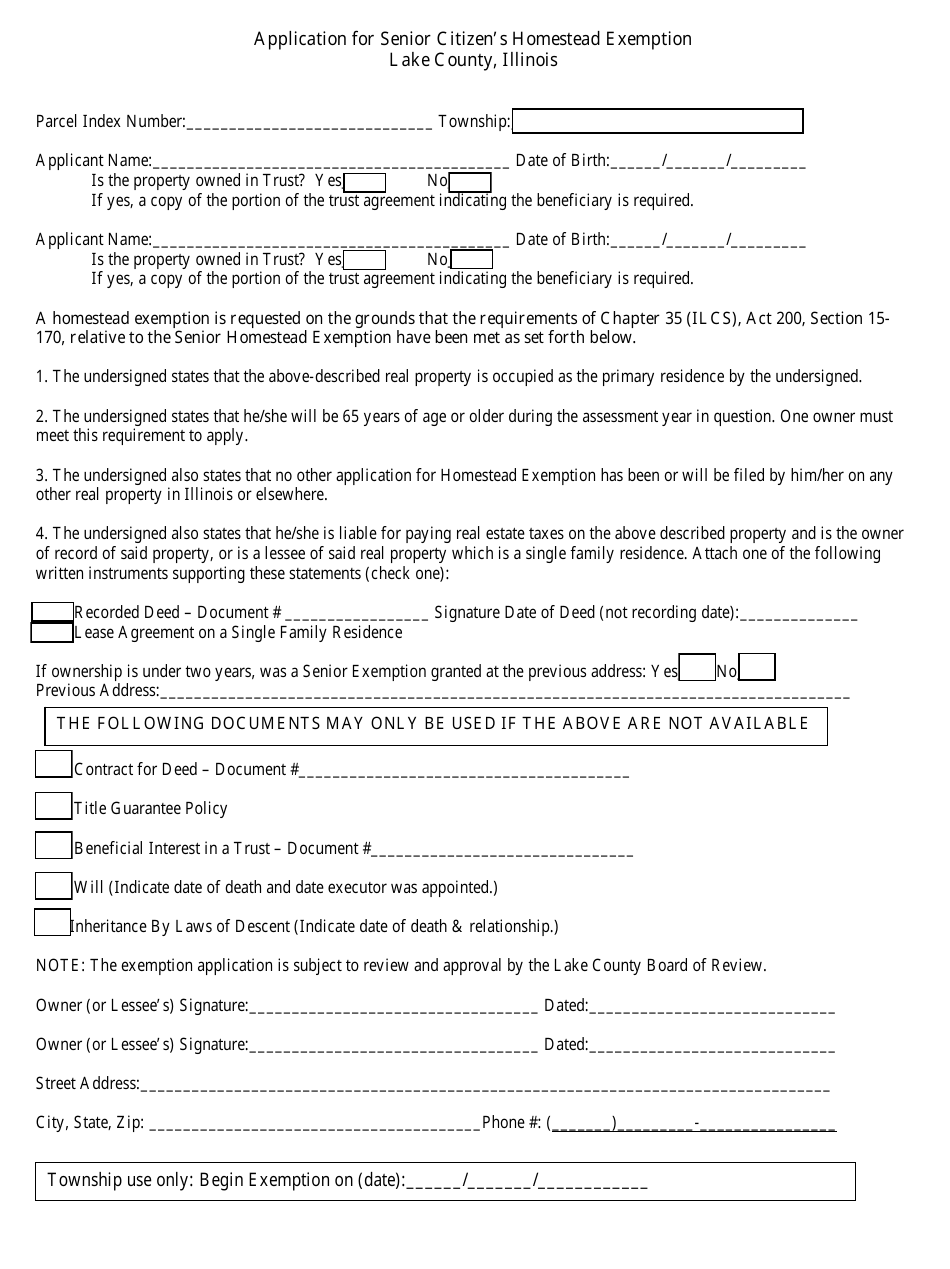

Lake County, Illinois Application for Senior Citizen's Homestead

Web such application may be filed at any time; Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web find and fill out the correct oklahoma homestead exemption file online 2011 form. Web homestead exemption exempts $1,000 from the assessed value of your property. In most cases this will result in between $80.

How Do You Qualify For Florida's Homestead Exemption?

Web such application may be filed at any time; Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web you must be a resident of oklahoma. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. Web up to 25% cash back in oklahoma, the homestead.

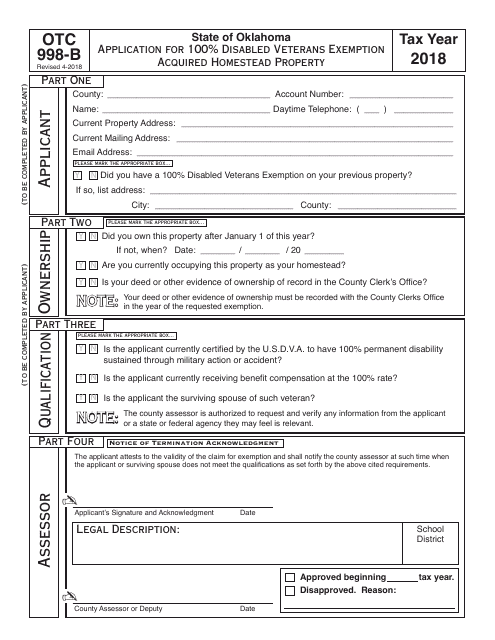

OTC Form OTC 998B Download Fillable PDF 2018, Application for 100

Web oklahoma real estate owners may choose the federal homestead exemption instead of (but not in addition to) state homestead protections. Web you must be a resident of oklahoma. Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have to file a homestead declaration to claim the homestead. 315 sw 5th street, suite 301 lawton,.

Gustavo A. Fernandez, P.A. Homestead Exemption Filing Deadline

Web you must be a resident of oklahoma. You must fill out form 921 and mail it to: Web homestead exemption exempts $1,000 from the assessed value of your property. 315 sw 5th street, suite 301 lawton, ok 73501 renewing if you have. Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains:

OTC Form 921 Download Fillable PDF or Fill Online Application for

315 sw 5th street, suite 301 lawton, ok 73501 renewing if you have. In tax year 2019, this was a savings of $91 to $142 depending on. Web to receive homestead exemption, a taxpayer shall be required to file an application for homestead exemption with the county assessor in which their property is located. You must fill out form 921.

915 Oklahoma Tax Forms And Templates free to download in PDF

Web applications for the additional homestead exemption and senior valuation freeze are available from january 1 to march 15 or within 30 days from and after receipt of notice of. Web homestead exemption is a $1,000 deduction from the gross assessed value of your home. Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have.

You Can Apply For Homestead Exemption During The Hours Of 8 A.m.

Web homestead exemption exempts $1,000 from the assessed value of your property. In most cases this will result in between $80 & $120 in tax savings. In most cases this will result in between $80 and $120 in tax savings. Choose the correct version of.

Provided, The County Assessor Shall, If Such Applicant Otherwise Qualifies, Grant A Homestead Exemption For A Tax Year Only If The.

In tax year 2019, this was a savings of $91 to $142 depending on. 315 sw 5th street, suite 301 lawton, ok 73501 renewing if you have. Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have to file a homestead declaration to claim the homestead. Web how do i file for homestead exemption in oklahoma?

Web 2023 Form 998 Application For 100% Disabled Veterans Real Property Tax Exemption County:

Web find and fill out the correct oklahoma homestead exemption file online 2011 form. However, the homestead application must be filed on or before march 15th of the. Web applications for the additional homestead exemption and senior valuation freeze are available from january 1 to march 15 or within 30 days from and after receipt of notice of. Web you must be a resident of oklahoma.

If Approved, This Document Will Grant An Exemption On Property Tax For This Primary.

You must fill out form 921 and mail it to: Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web homestead exemption is a $1,000 deduction from the gross assessed value of your home. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence.