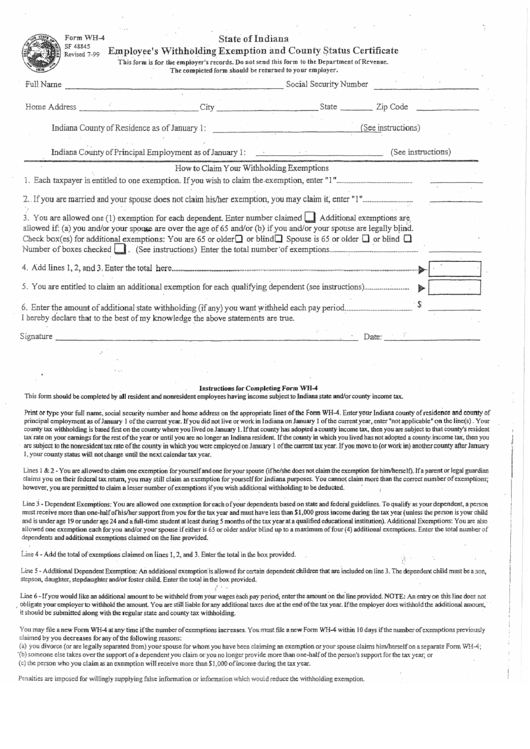

Form Wh-4 Indiana

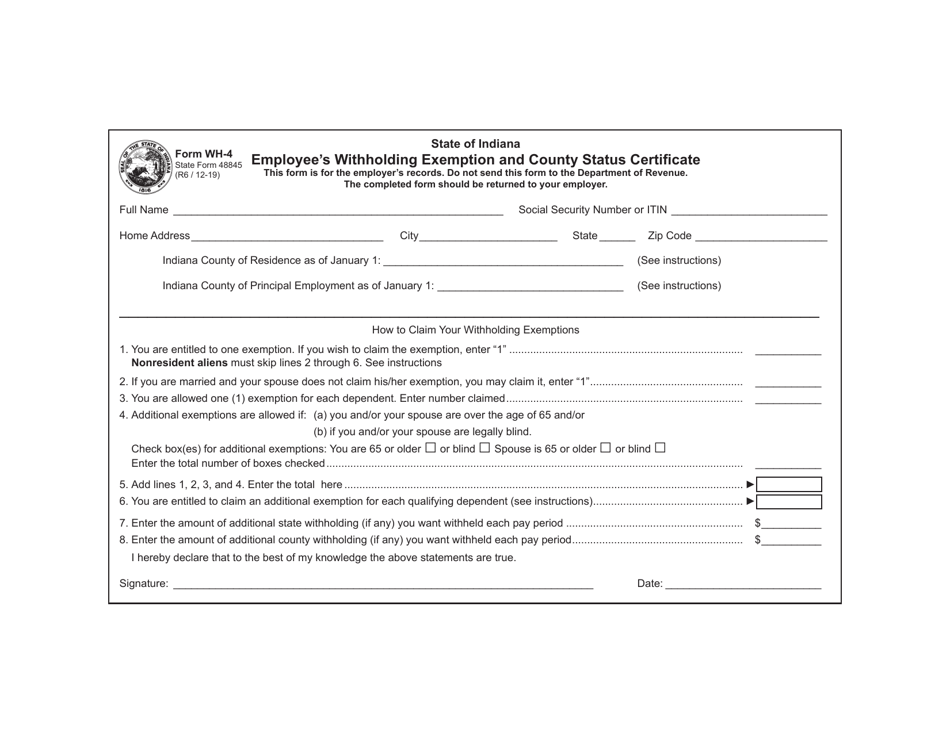

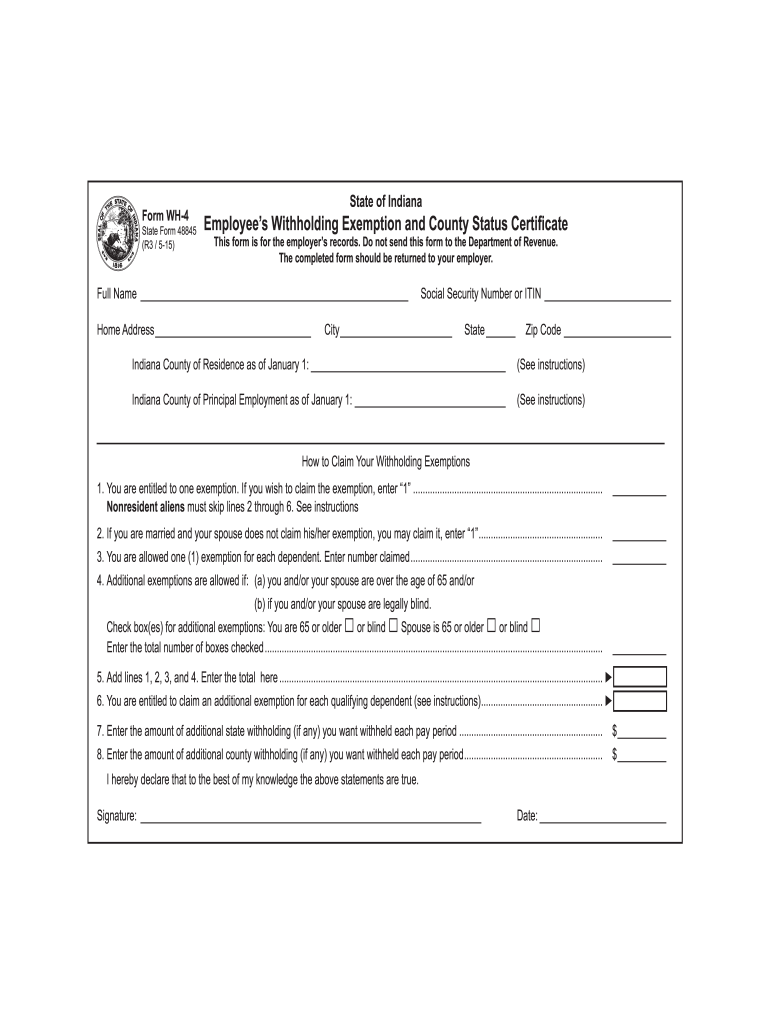

Form Wh-4 Indiana - Print or type your full name, social. Get your online template and fill it in using progressive features. If you have employees working at your business, you’ll need to collect withholding taxes. Sign online button or tick the preview image of. State of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. These are state and county taxes that are withheld from your. The first question is 1. Do not send this form to the department of revenue. Enjoy smart fillable fields and interactivity. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Print or type your full name, social. The first question is 1. Enjoy smart fillable fields and interactivity. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. You are entitled to one exemption. These are state and county taxes that are withheld from your. Web how to fill out and sign form wh4 online? The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. If too little is withheld, you will generally owe tax when. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

You are entitled to one exemption. If you have employees working at your business, you’ll need to collect withholding taxes. Print or type your full name, social. Sign online button or tick the preview image of. Do not send this form to the. Do not send this form to the department of revenue. Print or type your full name, social. Print or type your full name, social. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. To get started on the blank, utilize the fill camp;

Form Wh4 Employee'S Withholding Exemption And County Status

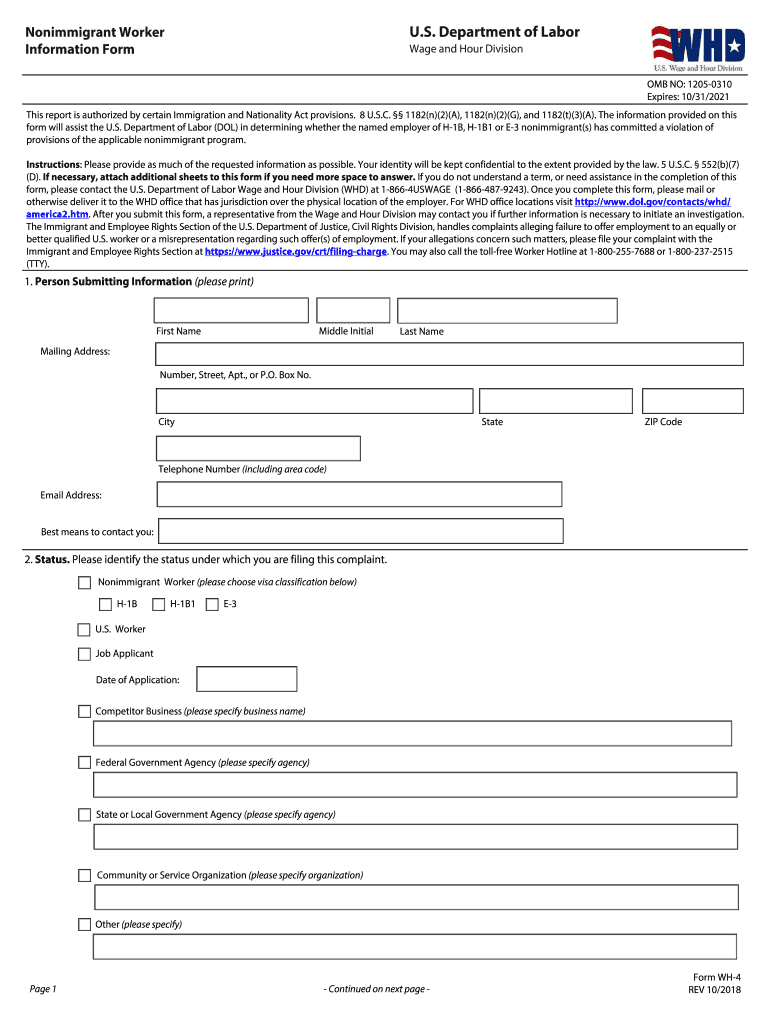

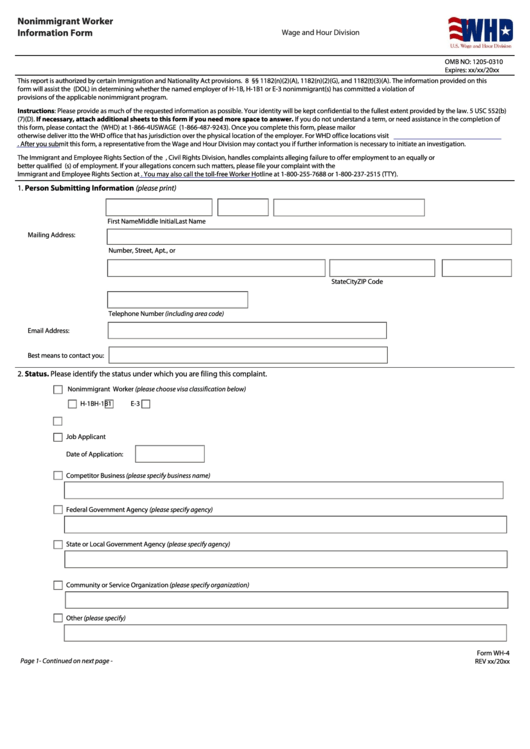

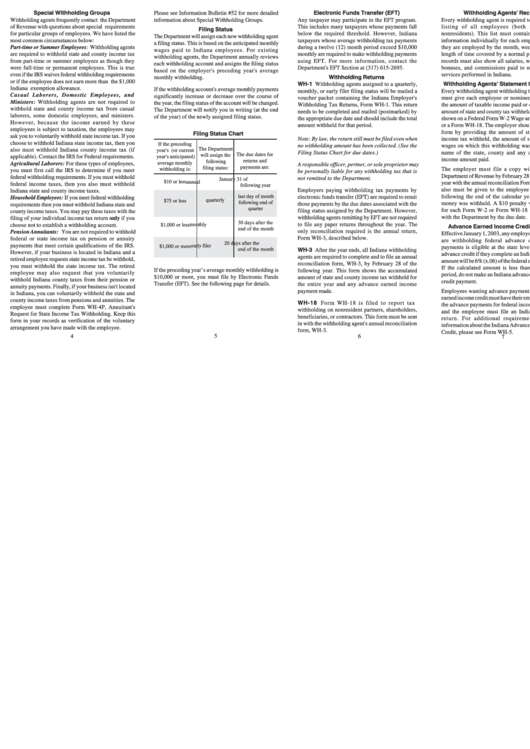

The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. If you have employees working at your business, you’ll need to collect withholding taxes. You are entitled to one exemption. Table b is used to figure additional dependent exemptions. Web how to fill out and sign form wh4 online?

Resources The HR Connection HR Resources

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social. Do not send this form to the department of revenue. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. You are entitled to one exemption.

Form Wh 4 Fill Out and Sign Printable PDF Template signNow

State of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If you have employees working at your business, you’ll need to collect withholding taxes. If too little is withheld, you will.

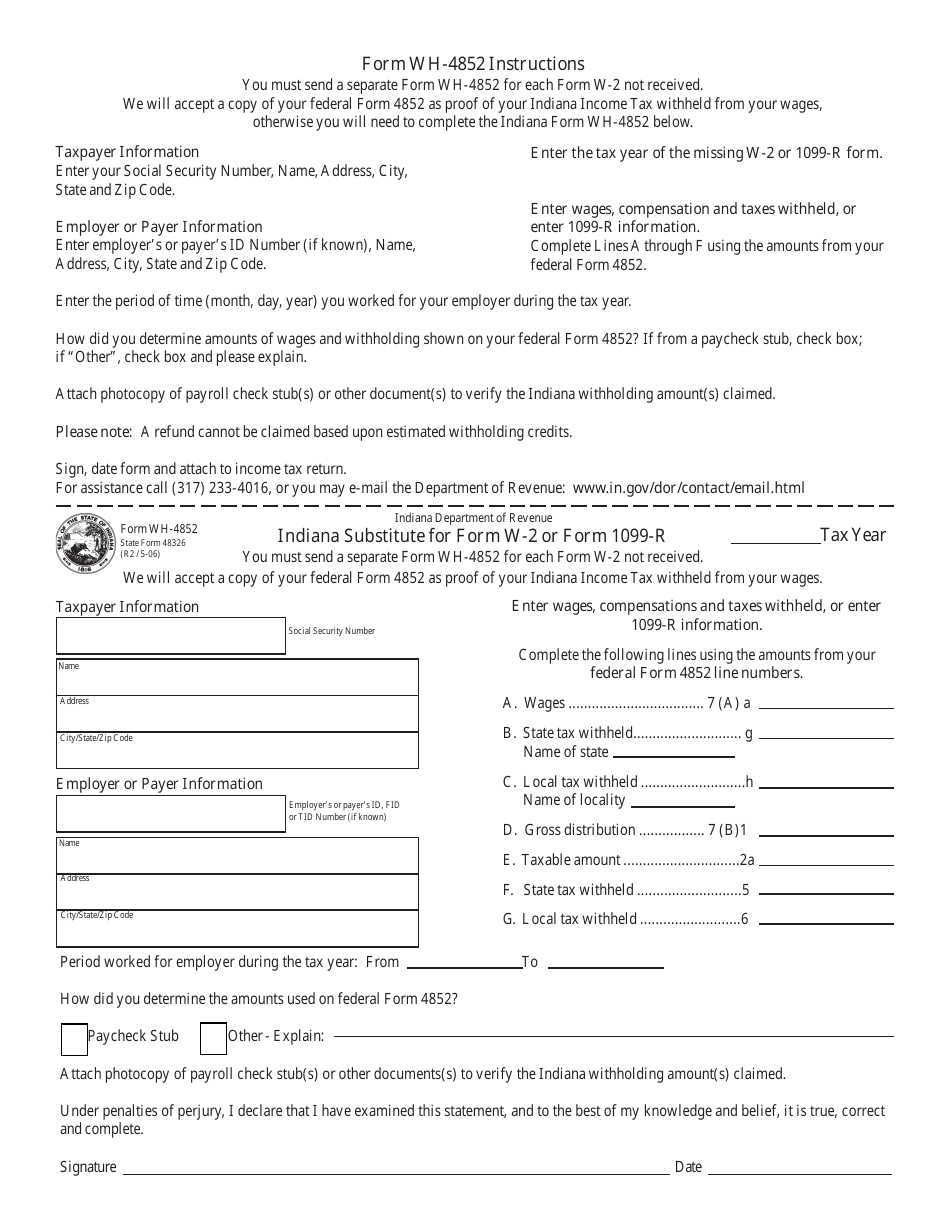

Form WH4852 Download Fillable PDF or Fill Online Indiana Substitute

Do not send this form to the. If too little is withheld, you will generally owe tax when. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. If you have employees working at your business, you’ll need to collect withholding taxes. Table b is used to figure additional dependent exemptions.

Resources The HR Connection HR Resources

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If you have employees working at your business, you’ll need to collect withholding taxes. If too little is withheld, you will generally owe tax when. Sign online button or tick the preview image of. Web this form should.

Fillable Form Wh4 Nonimmigrant Worker Information U.s. Department

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Do not send this form to the department of revenue. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Sign online button or tick the.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

If too little is withheld, you will generally owe tax when. Enjoy smart fillable fields and interactivity. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. The first question is 1. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records.

Form Wh13 Withholding Instructions For Indiana State And County

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Print or type your full name, social. Sign online button or tick the preview image of. Web this form should be completed.

2021 DOL Gov Forms Fillable, Printable PDF & Forms Handypdf

The first question is 1. Enjoy smart fillable fields and interactivity. Web how to fill out and sign form wh4 online? These are state and county taxes that are withheld from your. To get started on the blank, utilize the fill camp;

Form wh 4 2019 indiana Fill Out and Sign Printable PDF Template SignNow

Enjoy smart fillable fields and interactivity. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. You are entitled to one exemption. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your.

You Are Entitled To One Exemption.

Get your online template and fill it in using progressive features. Sign online button or tick the preview image of. To get started on the blank, utilize the fill camp; State of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records.

Table B Is Used To Figure Additional Dependent Exemptions.

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social. Print or type your full name, social. Print or type your full name, social.

The First Question Is 1.

Enjoy smart fillable fields and interactivity. Do not send this form to the department of revenue. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption.

The Form Must Be Forwarded To The Wage And Hour Division (Whd) Office Which Has Jurisdiction.

If you have employees working at your business, you’ll need to collect withholding taxes. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If too little is withheld, you will generally owe tax when. Web how to fill out and sign form wh4 online?