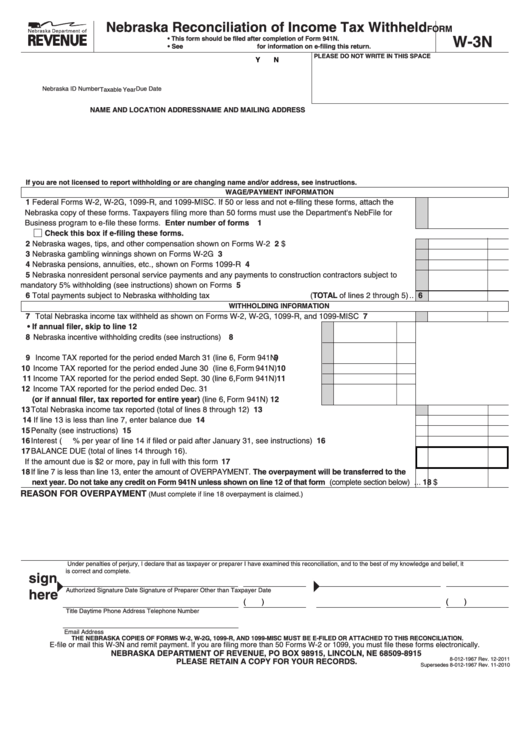

Form W 3N

Form W 3N - Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web nebraska income tax withholding online filing. Nebraska income tax withholding return, form 941n. Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. Use fill to complete blank. O' the be transferred to the next. To start the form, use the fill camp; Sign online button or tick the preview image of the blank.

Use fill to complete blank. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Sign online button or tick the preview image of the blank. To start the form, use the fill camp; Nebraska monthly income tax withholding deposit, form 501n. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. O' the be transferred to the next. (withholding payment/deposit uses same nebraska id number and pin) step 2. Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. The advanced tools of the editor will lead.

Nebraska monthly income tax withholding deposit, form 501n. The advanced tools of the editor will lead. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web what is a form w 3n? (withholding payment/deposit uses same nebraska id number and pin) step 2. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. O' the be transferred to the next. Nebraska income tax withholding return, form 941n. To start the form, use the fill camp;

IRS Form W3 2019 2020 Printable & Fillable Sample in PDF

Use fill to complete blank. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. The advanced tools of.

Form W3n Nebraska Reconciliation Of Tax Withheld printable

Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. O' the be transferred to the next. Nebraska income tax withholding return, form 941n. Web what is a form w 3n? Form w ‑3n is due on or before january 31, following the close of the.

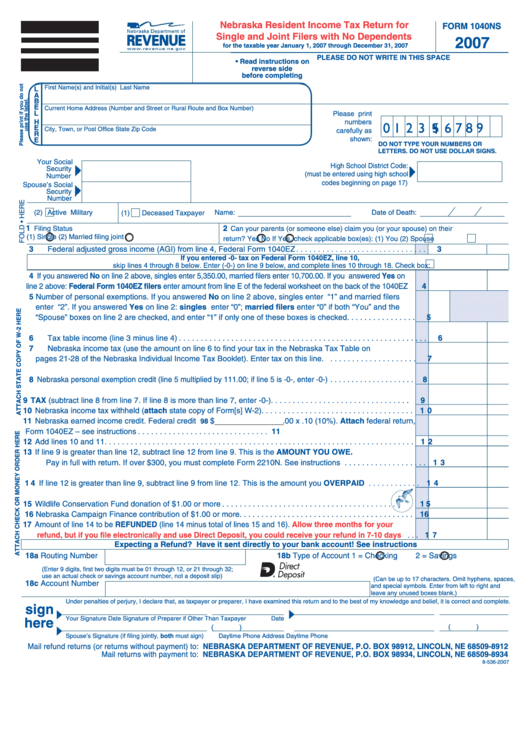

Top 94 Nebraska Tax Forms And Templates free to download in PDF

Form w ‑3n is due on or before january 31, following the close of the tax year, along. The advanced tools of the editor will lead. O' the be transferred to the next. (withholding payment/deposit uses same nebraska id number and pin) step 2. Sign online button or tick the preview image of the blank.

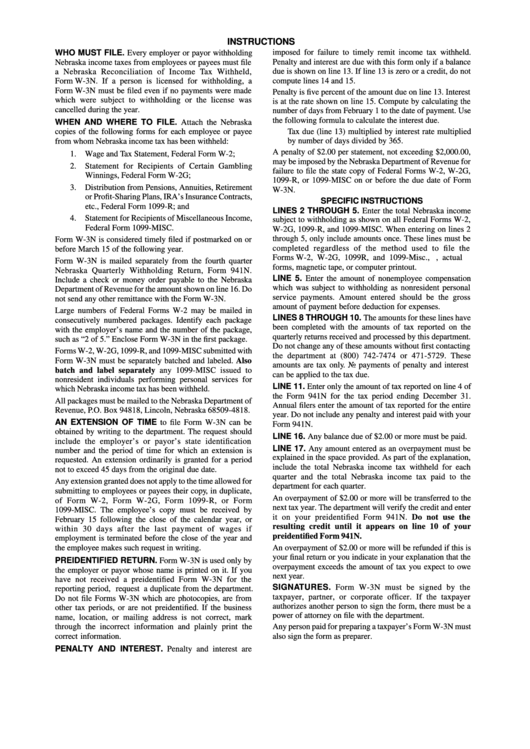

Instructions For Form W3n Nebraska Reconciliation Of Tax

Use fill to complete blank. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Web nebraska income tax withholding online filing. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Web how.

2017 w3 fillable form Fill Online, Printable, Fillable Blank form

The advanced tools of the editor will lead. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. (withholding payment/deposit uses same nebraska id number and pin) step 2. Sign.

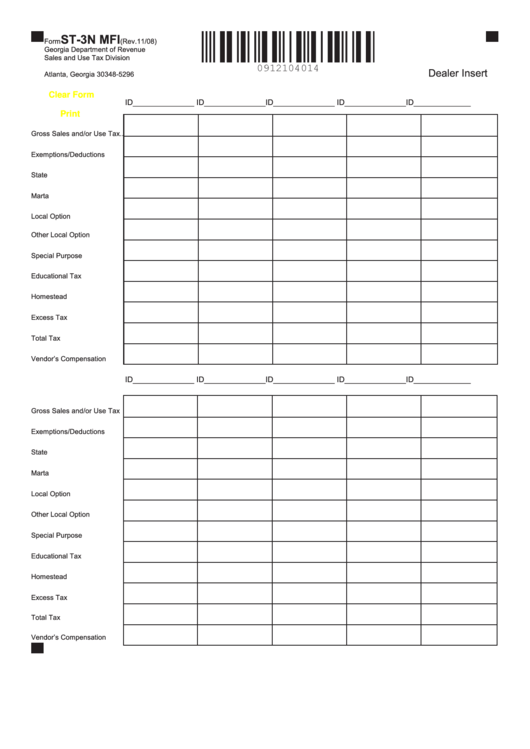

Fillable Form St3n Mfi Sales And Use Tax Division printable pdf download

Web nebraska income tax withholding online filing. To start the form, use the fill camp; (withholding payment/deposit uses same nebraska id number and pin) step 2. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Form w ‑3n is due on or before january 31, following the.

Form 3 Entry 1879 Fileupload 2 (72462) TheArtHunters

Form w ‑3n is due on or before january 31, following the close of the tax year, along. Use fill to complete blank. Nebraska monthly income tax withholding deposit, form 501n. (withholding payment/deposit uses same nebraska id number and pin) step 2. Sign online button or tick the preview image of the blank.

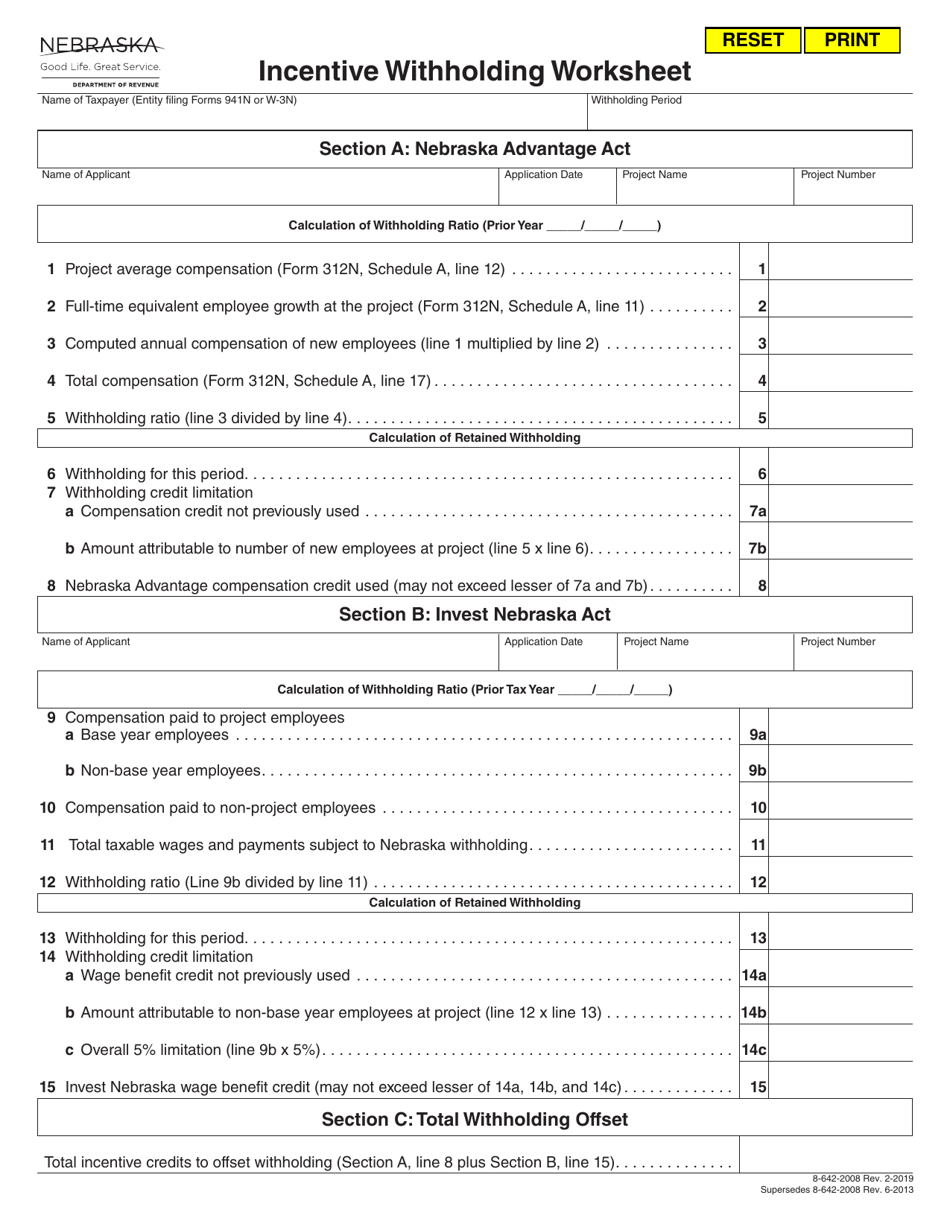

Nebraska Incentive Withholding Worksheet Download Fillable PDF

Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Web nebraska.

W3 Form 2022 2023 IRS Forms Zrivo

Sign online button or tick the preview image of the blank. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Nebraska income tax withholding return, form 941n. Web nebraska income tax withholding online filing. Web form 941n name and location address name and mailing address if you are.

Form 3 Entry 1279 Fileupload 2 (69821) TheArtHunters

O' the be transferred to the next. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Sign online button or tick the preview image of the blank. Nebraska income tax withholding return, form 941n. Web nebraska income tax withholding online filing.

Oonot Taxe Credit On Form 941 N Unless Shwm On Line 12 Ot Mat Form Reason For Overpayment 1B Sig He 18 S Of.

The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. (withholding payment/deposit uses same nebraska id number and pin) step 2. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. O' the be transferred to the next.

Sign Online Button Or Tick The Preview Image Of The Blank.

Web nebraska income tax withholding online filing. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Nebraska income tax withholding return, form 941n. Web how you can fill out the form w3n online:

To Start The Form, Use The Fill Camp;

Nebraska monthly income tax withholding deposit, form 501n. Web what is a form w 3n? Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. The advanced tools of the editor will lead.

Web The Income Tax Withholding Is Reported To The Person Performing The Personal Services And The Department In The Same Manner As Wages Or Other Payments Subject To Income Tax.

Use fill to complete blank. Form w ‑3n is due on or before january 31, following the close of the tax year, along.