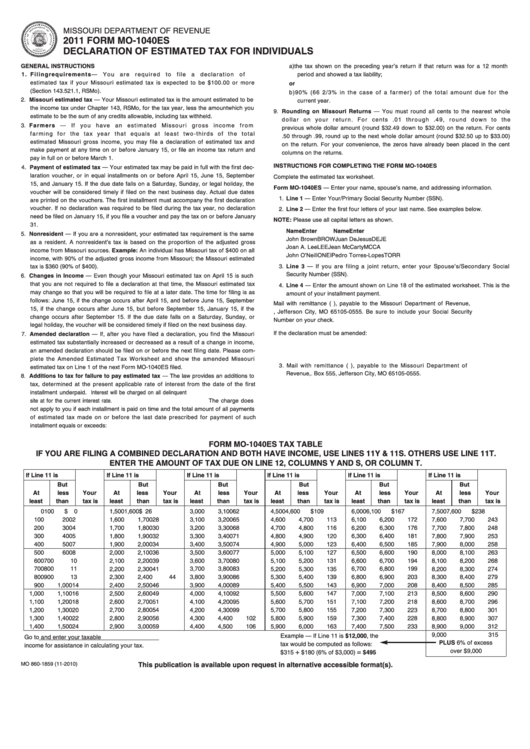

Form Mo 1040Es

Form Mo 1040Es - Funds only), payable to the missouri department of revenue, p.o. Fill out and file vouchers. Form mo‑1040es — enter your name, spouse’s name, and. You must file your taxes yearly by april 15. Estimated tax declaration for individuals: Web instructions for completing the form mo‑1040es complete the estimated tax worksheet (see instructions). You must file your taxes yearly by april 15. Funds only), payable to the missouri department of revenue, p.o. Web the missouri department of revenue dec. Estimated tax declaration for individuals:

Estimated tax declaration for individuals: We last updated the individual. We last updated the information to complete mo. Funds only), payable to the missouri department of revenue, p.o. Single/married with one income tax return: Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Estimated tax declaration for individuals: You must file your taxes yearly by april 15. You must file your taxes yearly by april 15.

Estimated tax declaration for individuals: Web individual income tax return. Single/married with one income tax return: Web instructions for completing the form mo‑1040es complete the estimated tax worksheet (see instructions). Fill out and file vouchers. Web the missouri department of revenue dec. Estimated tax declaration for individuals: You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Funds only), payable to the missouri department of revenue, p.o. Form mo‑1040es — enter your name, spouse’s name, and.

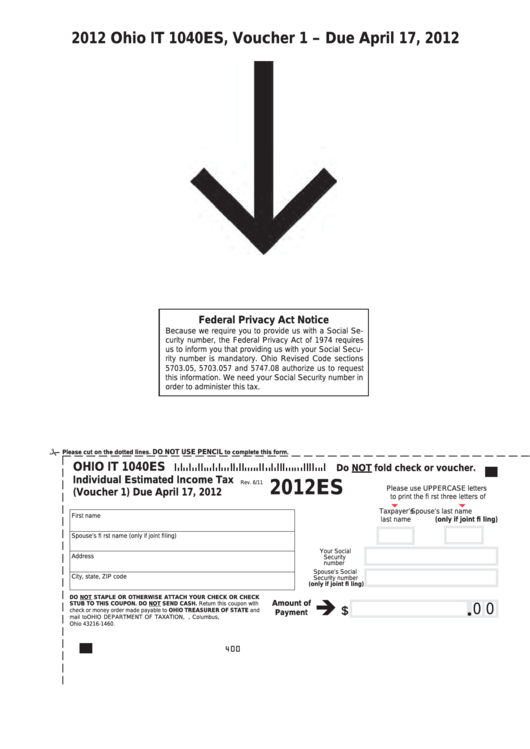

Fillable Ohio Form It 1040es Individual Estimated Tax 2012

You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. You must file your taxes yearly by april 15. Web the missouri department of revenue dec. Estimated tax declaration for individuals: Form mo‑1040es — enter your name, spouse’s name, and.

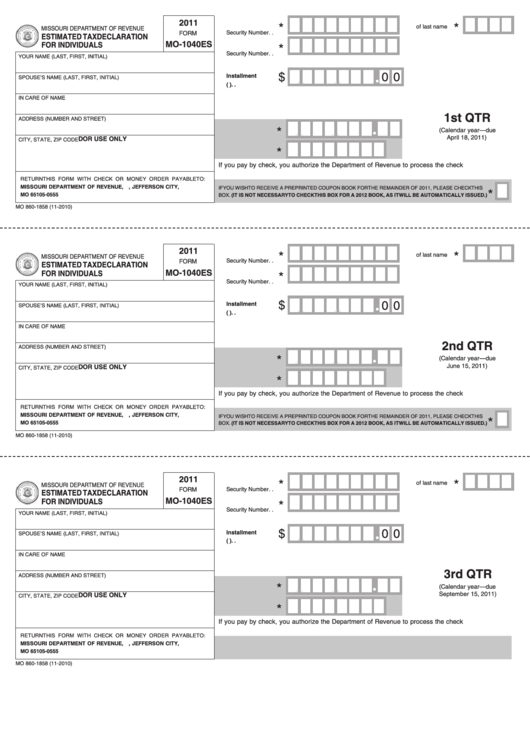

Fillable Form Mo1040es Estimated Tax Declaration For Individuals

Form mo‑1040es — enter your name, spouse’s name, and. Fill out and file vouchers. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. You must file your taxes yearly by april 15. Web individual income tax return.

Fillable Form Mo1040es Estimated Tax Declaration For Individuals

Web use this instructional booklet to help you fill out, file, and pay your estimated individual income taxes on a quarterly basis. Funds only), payable to the missouri department of revenue, p.o. We last updated the individual. Fill out and file vouchers. Web the missouri department of revenue dec.

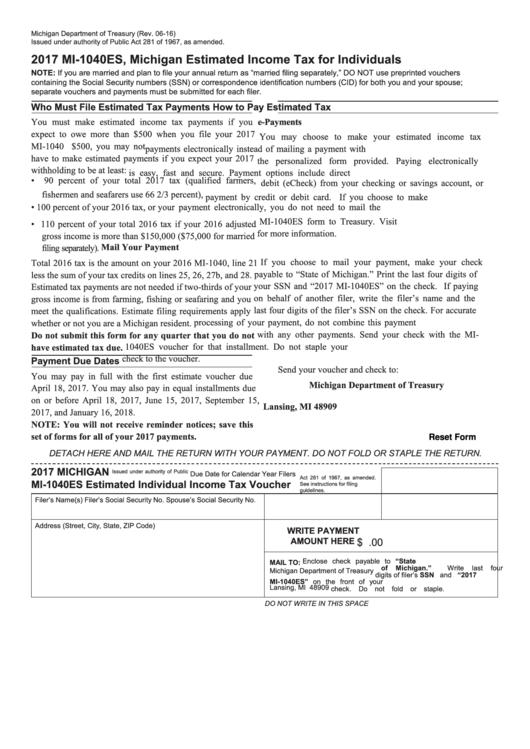

Fillable Form Mi1040es Michigan Estimated Tax For Individuals

Funds only), payable to the missouri department of revenue, p.o. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Estimated tax declaration for individuals: Estimated tax declaration for individuals: Web instructions for completing the form mo‑1040es complete the estimated tax worksheet (see instructions).

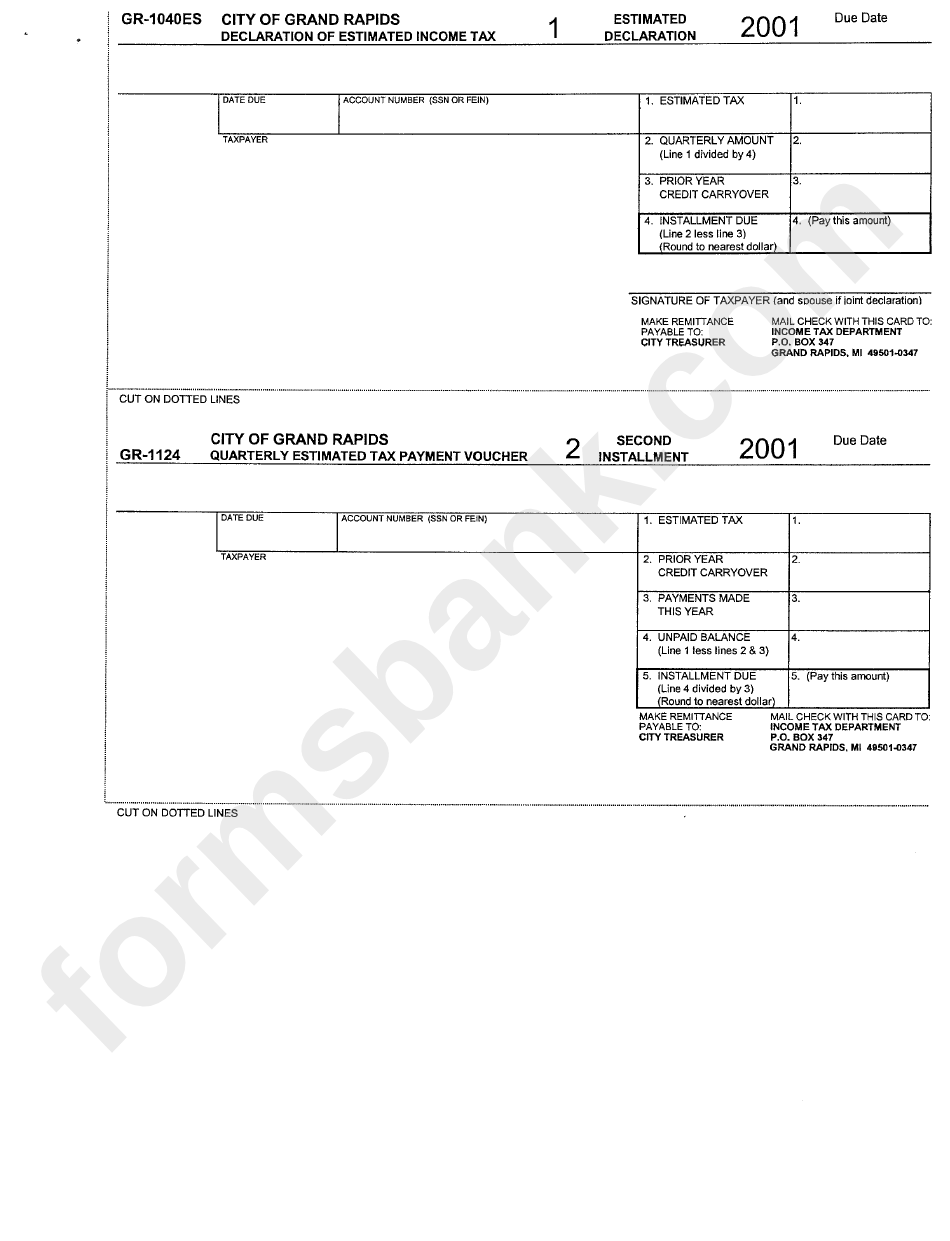

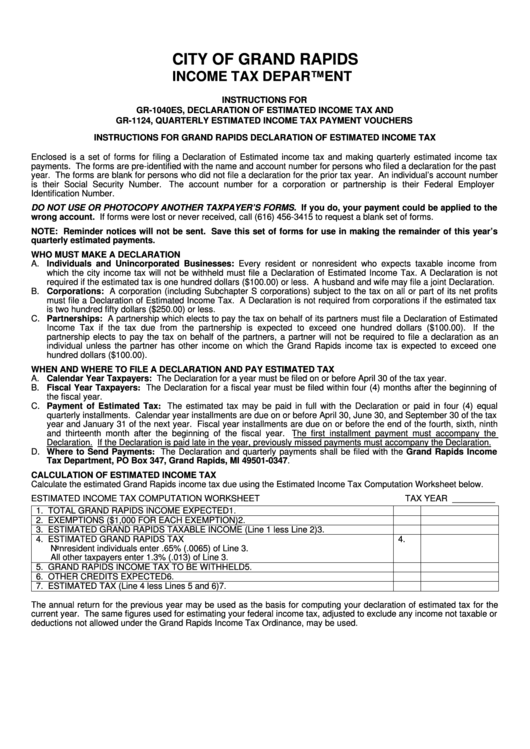

Form Gr1040es Declaration Of Estimated Tax City Of Grand

Funds only), payable to the missouri department of revenue, p.o. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Estimated tax declaration for individuals: Estimated tax declaration for individuals: We last updated the individual.

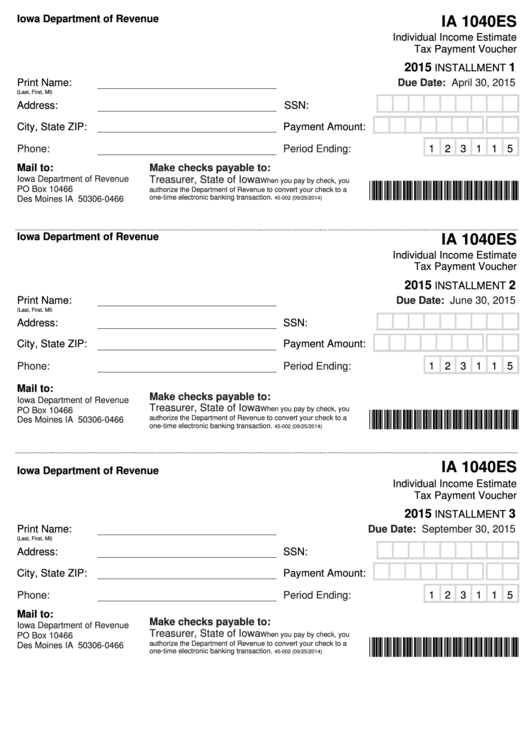

Fillable Form Ia 1040es Individual Estimate Tax Payment

You expect your withholding and refundable credits to be less than. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web individual income tax return. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Estimated tax declaration for individuals:

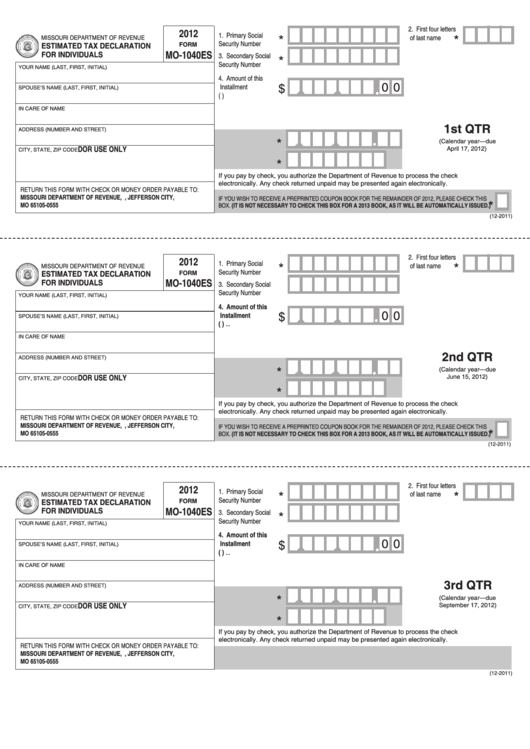

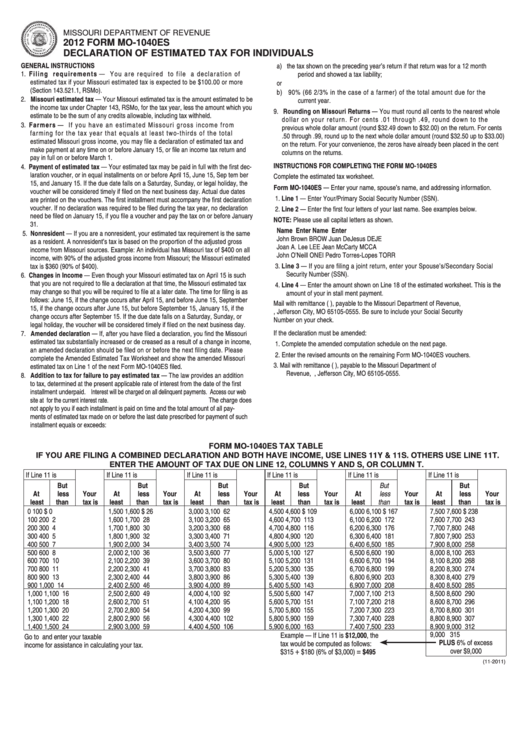

Form Mo1040es Declaration Of Estimated Tax For Individuals 2012

We last updated the individual. You must file your taxes yearly by april 15. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self. You must file your taxes yearly by april 15. Estimated tax declaration for individuals:

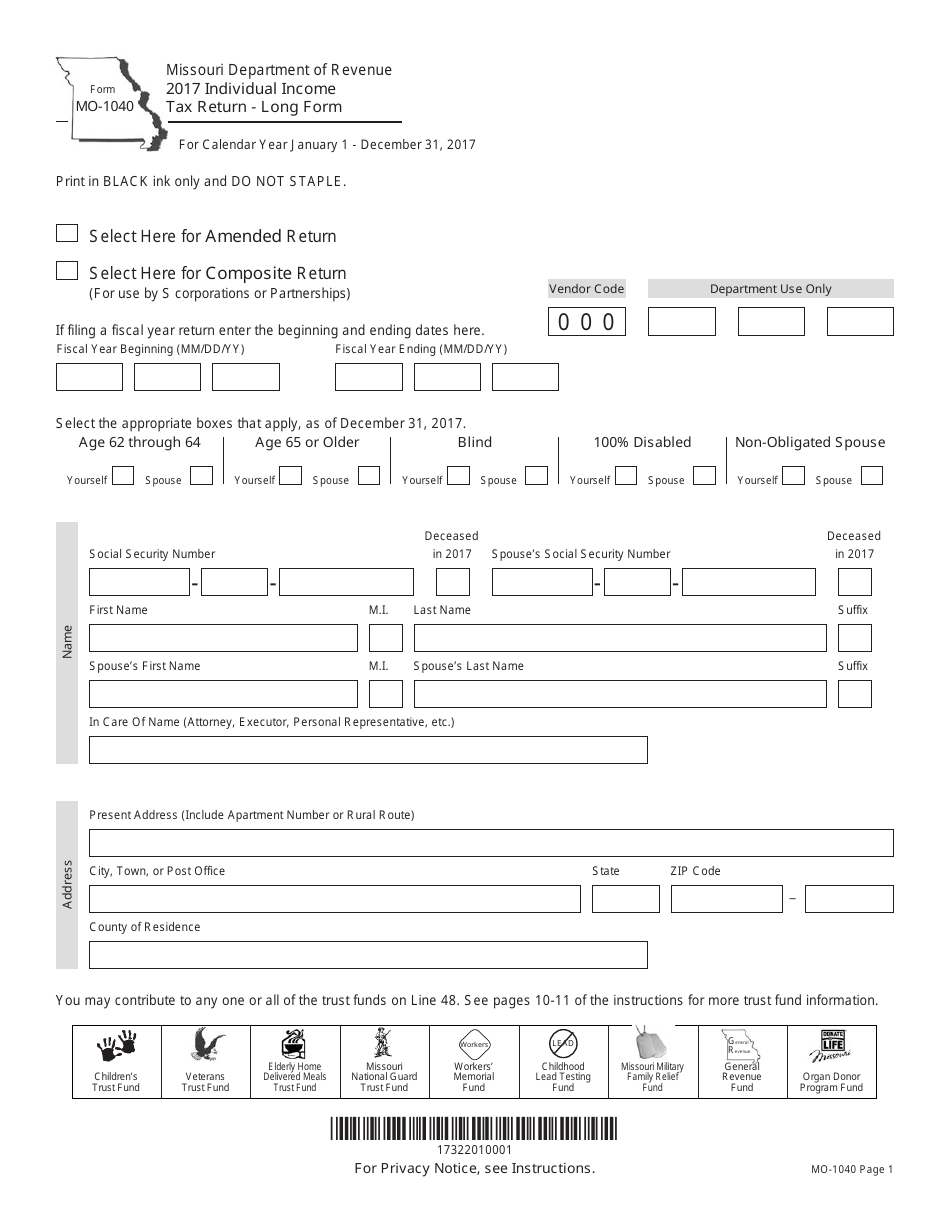

Form MO1040 Download Printable PDF or Fill Online Individual

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Estimated tax declaration for individuals: Web instructions for completing the form mo‑1040es complete the estimated tax worksheet (see instructions). Estimated tax declaration for individuals: Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64.

Form Mo1040es Declaration Of Estimated Tax For Individuals 2011

Web the missouri department of revenue dec. Fill out and file vouchers. Web individual income tax return. Estimated tax declaration for individuals: Funds only), payable to the missouri department of revenue, p.o.

Fiscal Year Beginning (Mm/Dd/Yy) Fiscal Year Ending (Mm/Dd/Yy) Age 62 Through 64.

We last updated the information to complete mo. Form mo‑1040es — enter your name, spouse’s name, and. Web the missouri department of revenue dec. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self.

Fill Out And File Vouchers.

You must file your taxes yearly by april 15. Funds only), payable to the missouri department of revenue, p.o. Estimated tax declaration for individuals: You must file your taxes yearly by april 15.

You Expect Your Withholding And Refundable Credits To Be Less Than.

Funds only), payable to the missouri department of revenue, p.o. Web instructions for completing the form mo‑1040es complete the estimated tax worksheet (see instructions). Web use this instructional booklet to help you fill out, file, and pay your estimated individual income taxes on a quarterly basis. We last updated the individual.

You Expect To Owe At Least $1,000 In Tax For 2023, After Subtracting Your Withholding And Refundable Credits.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Single/married with one income tax return: Estimated tax declaration for individuals: Web individual income tax return.