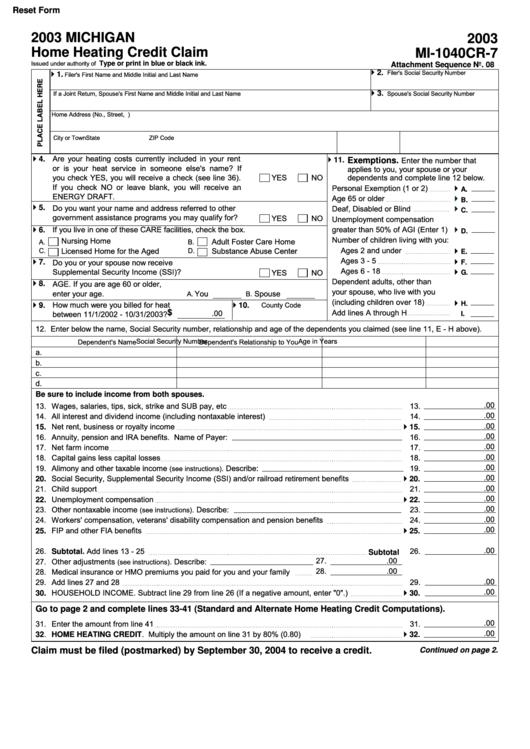

Form Mi-1040Cr-7

Form Mi-1040Cr-7 - Web include form 5049) 7. *if you checked box “c,” enter dates of michigan residency in 2020. On the federal elf screen, check the box to suppress the creation of: This form is for income earned in tax year 2022, with. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. From within your taxact return ( online or. If you lived in your homestead for less than 12. *if you checked box “c,” enter dates of michigan residency in 2022. Homestead property tax credit claim for. Web individual income tax credits and exemptions table a:

Web individual income tax credits and exemptions table a: Web include form 5049) 7. For the latest update on forms, check michigan individual form availability. Homestead property tax credit claim. From within your taxact return ( online or. Type or print in blue or black ink. This form is for income earned in tax year 2022, with. If you lived in your homestead for less than 12. On the federal elf screen, check the box to suppress the creation of: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

Both www.michigan.gov/incometax must be completed and filed to be processed find the following information on this web site: Type or print in blue or black ink. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. From within your taxact return ( online or. Type or print in blue or black ink. If you lived in your homestead for less than 12. Web include form 5049) 7. For the latest update on forms, check michigan individual form availability. Web individual income tax credits and exemptions table a: Homestead property tax credit claim.

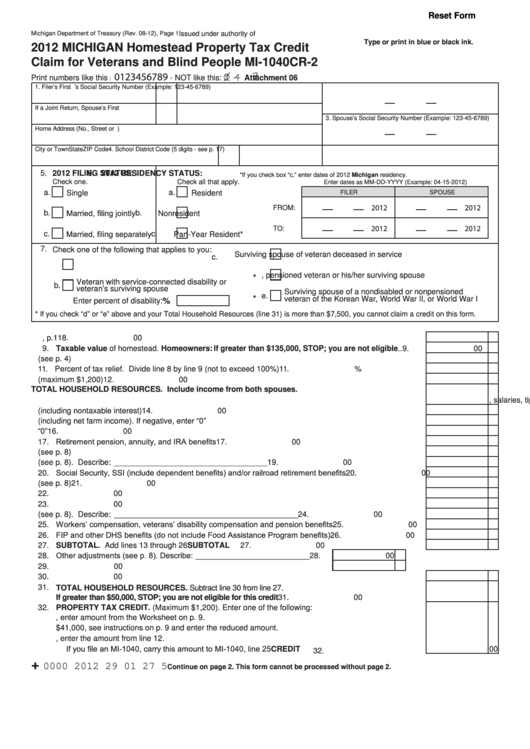

Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit

Type or print in blue or black ink. From within your taxact return ( online or. Type or print in blue or black ink. Web individual income tax credits and exemptions table a: Web include form 5049) 7.

2017 Form MI DoT MI1040CR2 Fill Online, Printable, Fillable, Blank

*if you checked box “c,” enter dates of michigan residency in 2022. For the latest update on forms, check michigan individual form availability. Type or print in blue or black ink. We last updated the home heating credit instruction. From within your taxact return ( online or.

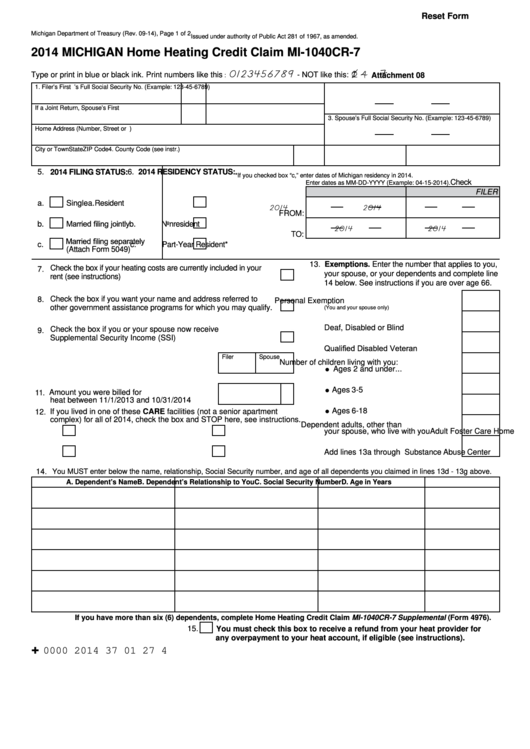

Fillable Form Mi1040cr7 Michigan Home Heating Credit Claim 2014

For the latest update on forms, check michigan individual form availability. We last updated the home heating credit instruction. Type or print in blue or black ink. This form is for income earned in tax year 2022, with. Both www.michigan.gov/incometax must be completed and filed to be processed find the following information on this web site:

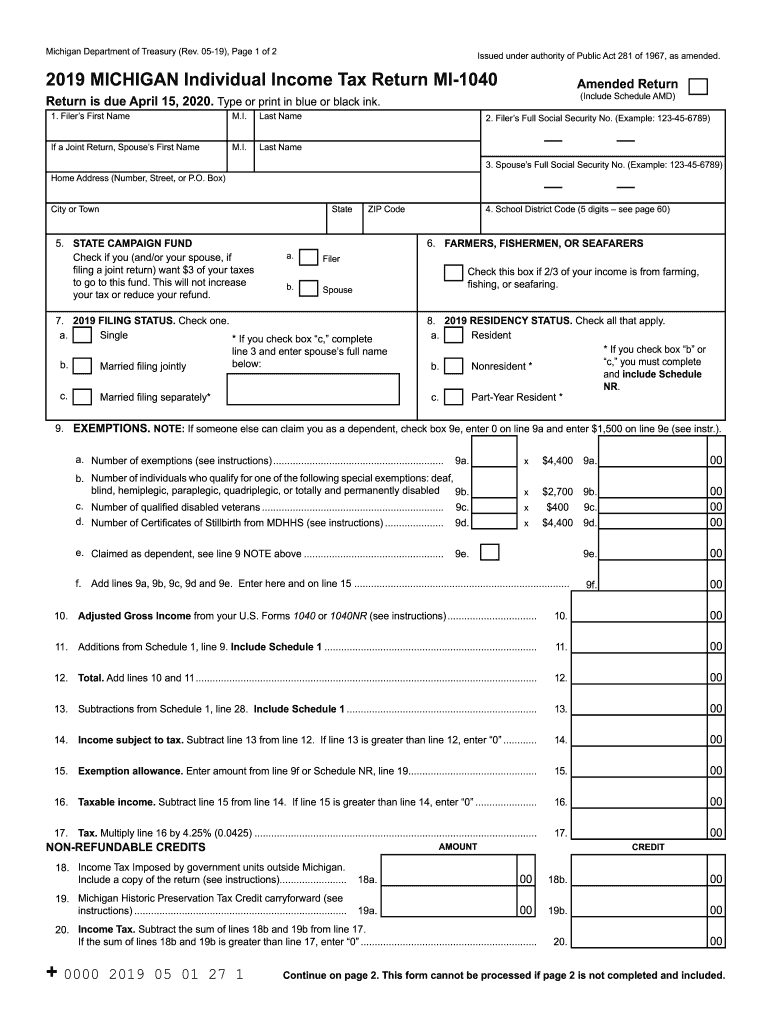

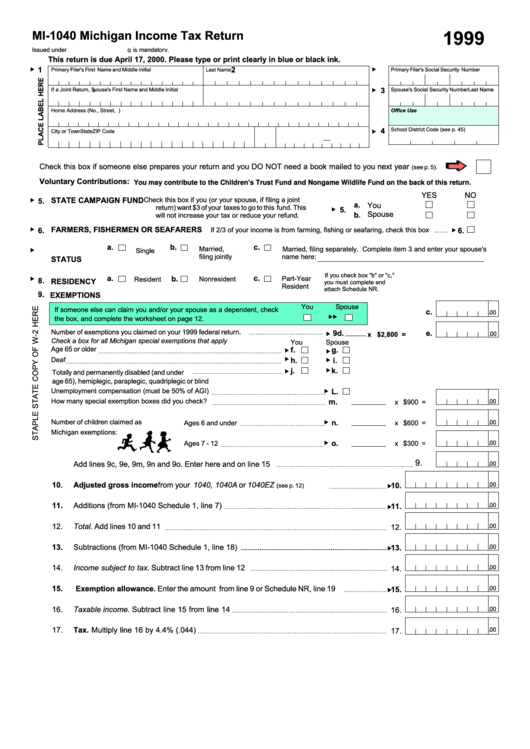

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

For the latest update on forms, check michigan individual form availability. Web include form 5049) 7. Homestead property tax credit claim for. *if you checked box “c,” enter dates of michigan residency in 2022. Web include form 5049) 7.

MI1040CR7booklet_michigan.gov documents taxes

Both www.michigan.gov/incometax must be completed and filed to be processed find the following information on this web site: Web include form 5049) 7. We last updated the home heating credit instruction. Type or print in blue or black ink. On the federal elf screen, check the box to suppress the creation of:

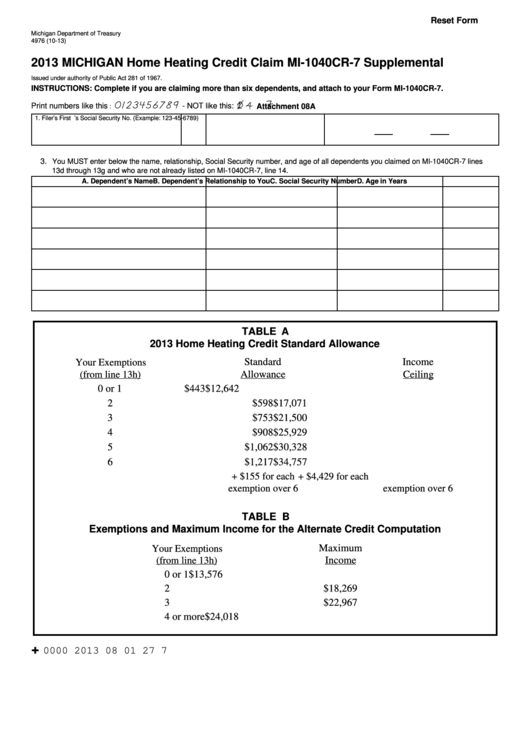

Fillable Form 4976 Michigan Home Heating Credit Claim Mi1040cr7

If you lived in your homestead for less than 12. This form is for income earned in tax year 2022, with. Homestead property tax credit claim. On the federal elf screen, check the box to suppress the creation of: Type or print in blue or black ink.

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

Web include form 5049) 7. We last updated the home heating credit instruction. Type or print in blue or black ink. *if you checked box “c,” enter dates of michigan residency in 2020. Web include form 5049) 7.

2018 Michigan Homestead Property Tax Credit Claim Mi1040cr

If you lived in your homestead for less than 12. Homestead property tax credit claim for. This form is for income earned in tax year 2022, with. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Type.

MI1040CR7booklet_michigan.gov documents taxes

Type or print in blue or black ink. If you lived in your homestead for less than 12. On the federal elf screen, check the box to suppress the creation of: This form is for income earned in tax year 2022, with tax. We last updated the home heating credit instruction.

Homestead Property Tax Credit Claim.

Web include form 5049) 7. If you lived in your homestead for less than 12. *if you checked box “c,” enter dates of michigan residency in 2022. Type or print in blue or black ink.

Type Or Print In Blue Or Black Ink.

For the latest update on forms, check michigan individual form availability. *if you checked box “c,” enter dates of michigan residency in 2020. From within your taxact return ( online or. We last updated the home heating credit instruction.

Web Individual Income Tax Credits And Exemptions Table A:

This form is for income earned in tax year 2022, with. Both www.michigan.gov/incometax must be completed and filed to be processed find the following information on this web site: Web include form 5049) 7. Homestead property tax credit claim for.

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In Either A Tax.

On the federal elf screen, check the box to suppress the creation of: This form is for income earned in tax year 2022, with tax.