Form De-9C

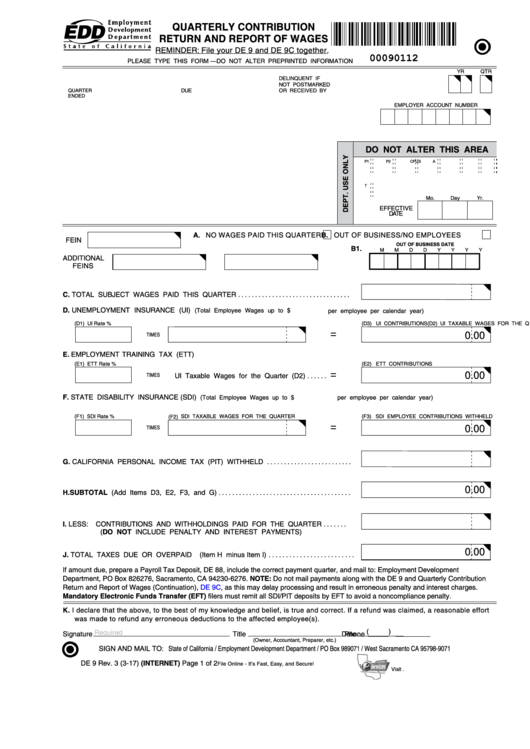

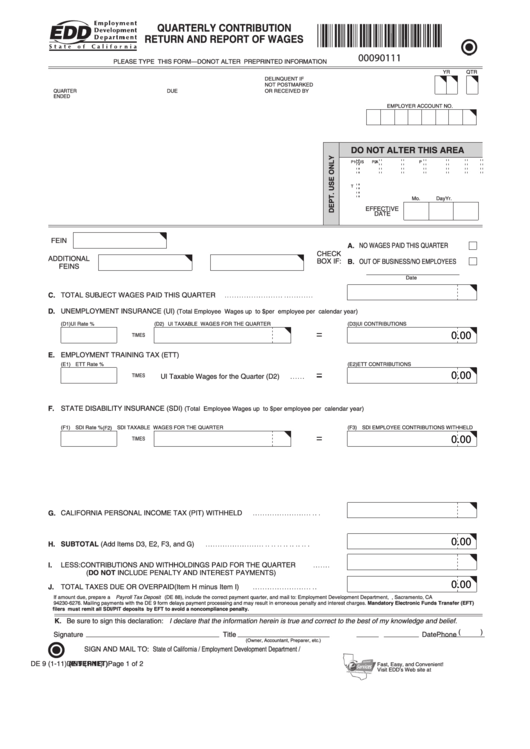

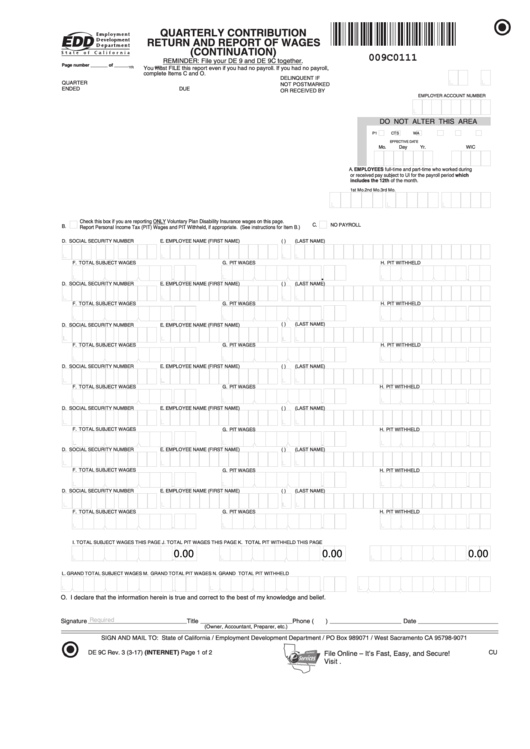

Form De-9C - This guide contains defnitions, requirements, instructions, technical specifcations, and general information for submitting the de 9c to the employment development. Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. These reports can be corrected by filing the appropriate adjustment request. Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd s website at www.edd.ca.gov. Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9). Esmart payroll's online application allows users to quickly upload a data file of. Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or employer of household worker (s) quarterly report of wages and withholdings (de. Web california state form de 9c. Web these are the most common forms that you are required to file with us:

Report of new employee(s) (de 34) report of independent contractor(s) (de 542) quarterly. Esmart payroll's online application allows users to quickly upload a data file of. You must also file a de 9c indicating no payroll for the quarter. Web these are the most common forms that you are required to file with us: ☐if adjusting andde 9c, de 9 complete all sections. This guide contains defnitions, requirements, instructions, technical specifcations, and general information for submitting the de 9c to the employment development. Save or instantly send your ready documents. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Did not report employee(s) on a previously filed. Web this article will explain how to create the electronic file for transmitting a de 9 and de 9c to the california state unemployment agency:

☐if adjusting andde 9c, de 9 complete all sections. Web de 9c for the quarter. Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9). Esmart payroll's online application allows users to quickly upload a data file of. This guide contains defnitions, requirements, instructions, technical specifcations, and general information for submitting the de 9c to the employment development. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Contact the taxpayer assistance center at (888). Web these are the most common forms that you are required to file with us: Did not report employee(s) on a previously filed. The state of california requires ca companies to file both a quarterly contribution return and report of wages.

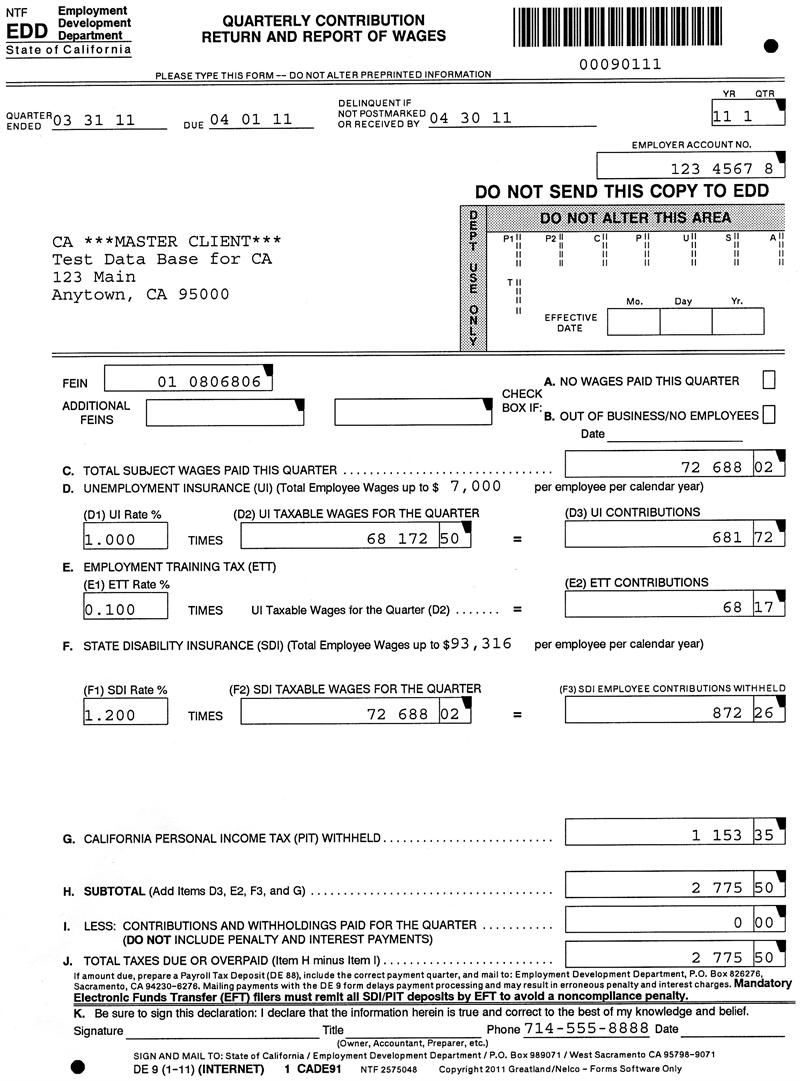

California DE 9 and DE 9C Fileable Reports

You must also file a de 9c indicating no payroll for the quarter. Web california state form de 9c. The state of california requires ca companies to file both a quarterly contribution return and report of wages. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department.

De9c Fill Online, Printable, Fillable, Blank PDFfiller

Save or instantly send your ready documents. Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. Web check item a and complete item k. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Web for a faster, easier, and more convenient method.

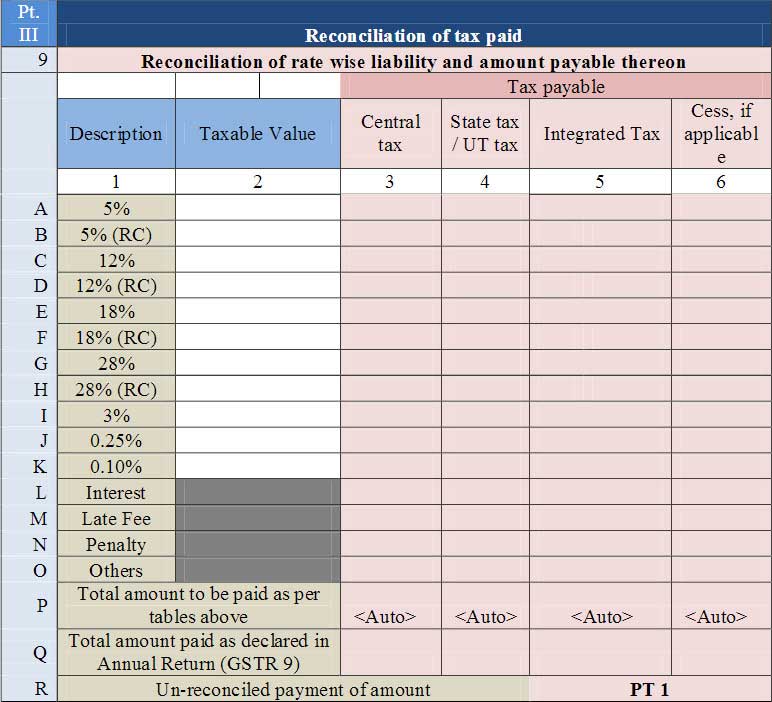

Filing FORM GSTR 9C A step by step guide LEARN TAXATION FAST AND EASY

Web california state form de 9c. These reports can be corrected by filing the appropriate adjustment request. The state of california requires ca companies to file both a quarterly contribution return and report of wages. I want to make a. Web this article will explain how to create the electronic file for transmitting a de 9 and de 9c to.

Fillable Form De 9 Quarterly Contribution Return And Report Of Wages

Esmart payroll's online application allows users to quickly upload a data file of. Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. Contact the taxpayer assistance center at (888). Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Each quarter,.

De9c Fill Online, Printable, Fillable, Blank pdfFiller

Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd s website at www.edd.ca.gov. Easily fill out pdf blank, edit, and sign them. Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. I want to make a. Report of new employee(s) (de 34) report of independent contractor(s).

De 9C Edit, Fill, Sign Online Handypdf

De 9 and de 9c. You must also file a de 9c indicating no payroll for the quarter. Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd s website at www.edd.ca.gov. Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or employer of household.

Fillable Form De 9 Quarterly Contribution Return And Report Of Wages

Esmart payroll's online application allows users to quickly upload a data file of. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): What is the de 9c? Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd.

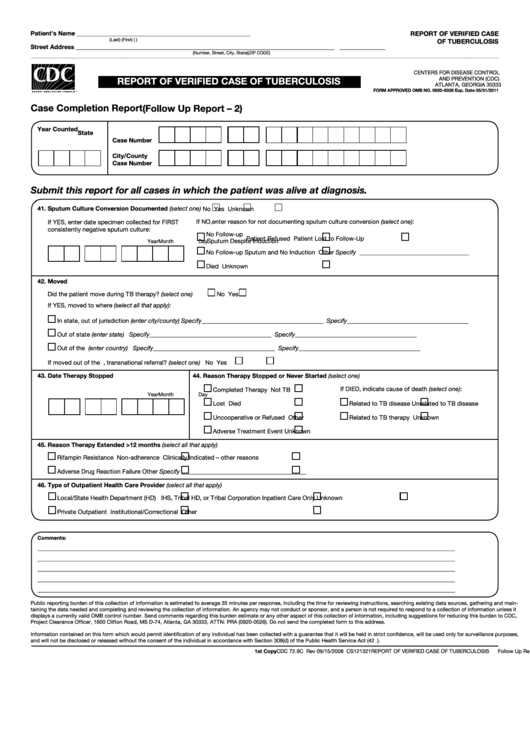

Form Cdc 72.9c Report Of Verified Case Of Tuberculosis printable pdf

Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or employer of household worker (s) quarterly report of wages and withholdings (de. Complete sections i, ii, iii, iv (items a and c), and v of the : Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. ☐if adjusting.

Fillable Form De 9c Quarterly Contribution Return And Report Of Wages

☐if adjusting andde 9c, de 9 complete all sections. Complete sections i, ii, iii, iv (items a and c), and v of the : These reports can be corrected by filing the appropriate adjustment request. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Each quarter, california.

How To Fill Out Edd Employee's Withholding Allowance Certificate 2020

Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9). Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. I want to make a. Web check item a and complete item k. De 9 and de 9c.

Complete Sections I, Ii, Iii, Iv (Items A And C), And V Of The :

What is the de 9c? Web ☐if only adjusting the de 9c, complete sections i, ii, iv, and v. De 9 and de 9c. Report of new employee(s) (de 34) report of independent contractor(s) (de 542) quarterly.

The De 9C Form Is A Form For Submitting The Necessary Documentation To The Irs When Requesting A Change In Accounting Method.

Web how to correct an employer of household worker (s) annual payroll tax return (de 3hw) or employer of household worker (s) quarterly report of wages and withholdings (de. I want to make a. Web this article will explain how to create the electronic file for transmitting a de 9 and de 9c to the california state unemployment agency: Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9).

The State Of California Requires Ca Companies To File Both A Quarterly Contribution Return And Report Of Wages.

Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. You must also file a de 9c indicating no payroll for the quarter. These reports can be corrected by filing the appropriate adjustment request. Contact the taxpayer assistance center at (888).

Web California State Form De 9C.

Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd s website at www.edd.ca.gov. Web de 9c for the quarter. Web california de 9 form | california de 9c form. Easily fill out pdf blank, edit, and sign them.