Form 990 Schedule R Instructions

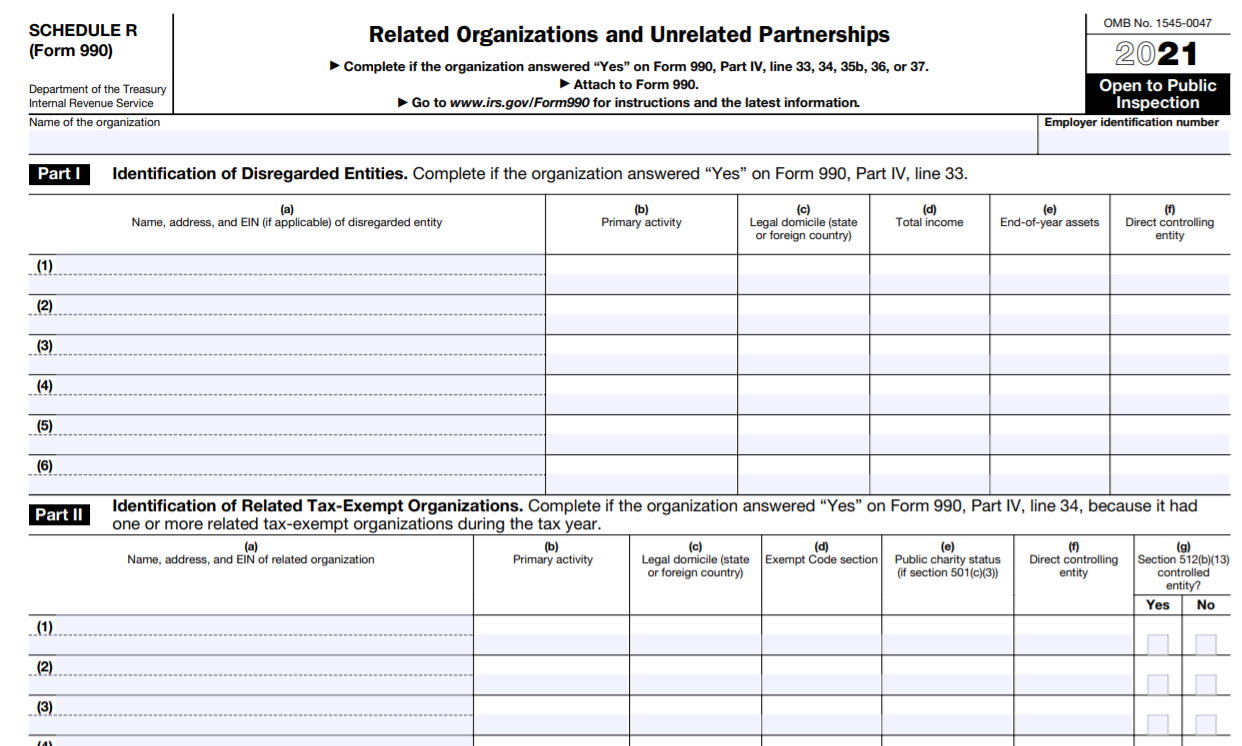

Form 990 Schedule R Instructions - The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii). Schedule r (form 990) 2022: Web purpose of schedule. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships through which the organization conducts significant activities. (column (b) must equal form 990, part x, col. Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences. Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization. 2022 schedule r (form 990) author: Schedule r (form 990) 2022:

Instructions for these schedules are combined with the schedules. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships through which the organization conducts significant activities. Schedule r (form 990) 2022: Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Enter the details of each disregarded entity on separate lines of part i. Complete if the organization answered yes on form 990, part iv, line 11b. Related organizations and unrelated partnerships keywords: 2022 schedule r (form 990) author: Schedule r (form 990) 2022: Organizations that file form 990 may be required to attach schedule r to report additional information regarding related organizations and.

Organizations that file form 990 may be required to attach schedule r to report additional information regarding related organizations and. Complete if the organization answered yes on form 990, part iv, line 11b. Enter the details of each disregarded entity on separate lines of part i. Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences. For more information, see schedule ca (540). (column (b) must equal form 990, part x, col. 2022 schedule r (form 990) author: The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web for paperwork reduction act notice, see the instructions for form 990. Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization.

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

Web for paperwork reduction act notice, see the instructions for form 990. Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization. (column (b) must equal form 990, part x, col. Web if yes, form 990 and schedule r may need to.

IRS Form 990 Schedule R Instructions Related Organizations and

Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization. Organizations that file form 990 may be required to attach schedule r to report additional information regarding related organizations and. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii). Name, address, and ein of the disregarded entity. Web schedule d (form 990) 2022.

Form 990 (Schedule I) Grants and Other Assistance to Organizations

Web purpose of schedule. Name, address, and ein of the disregarded entity. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences. (column (b) must equal form 990, part x, col.

2020 form 990 schedule r instructions Fill out & sign online DocHub

Web if yes, form 990 and schedule r may need to be completed instead of 45a did the organization have a controlled entity within the meaning of section 512(b). Enter the details of each disregarded entity on separate lines of part i. Name, address, and ein of the disregarded entity. Schedule r (form 990) is used by an organization that.

Irs Form 990 Ez Instructions Universal Network

Schedule r (form 990) 2022: (column (b) must equal form 990, part x, col. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships through which the organization conducts significant activities. Web if yes, form 990 and schedule r may.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Name, address, and ein of the disregarded entity. (column (b) must equal form 990, part x, col. Web purpose of schedule. Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences. Schedule r (form 990) 2022:

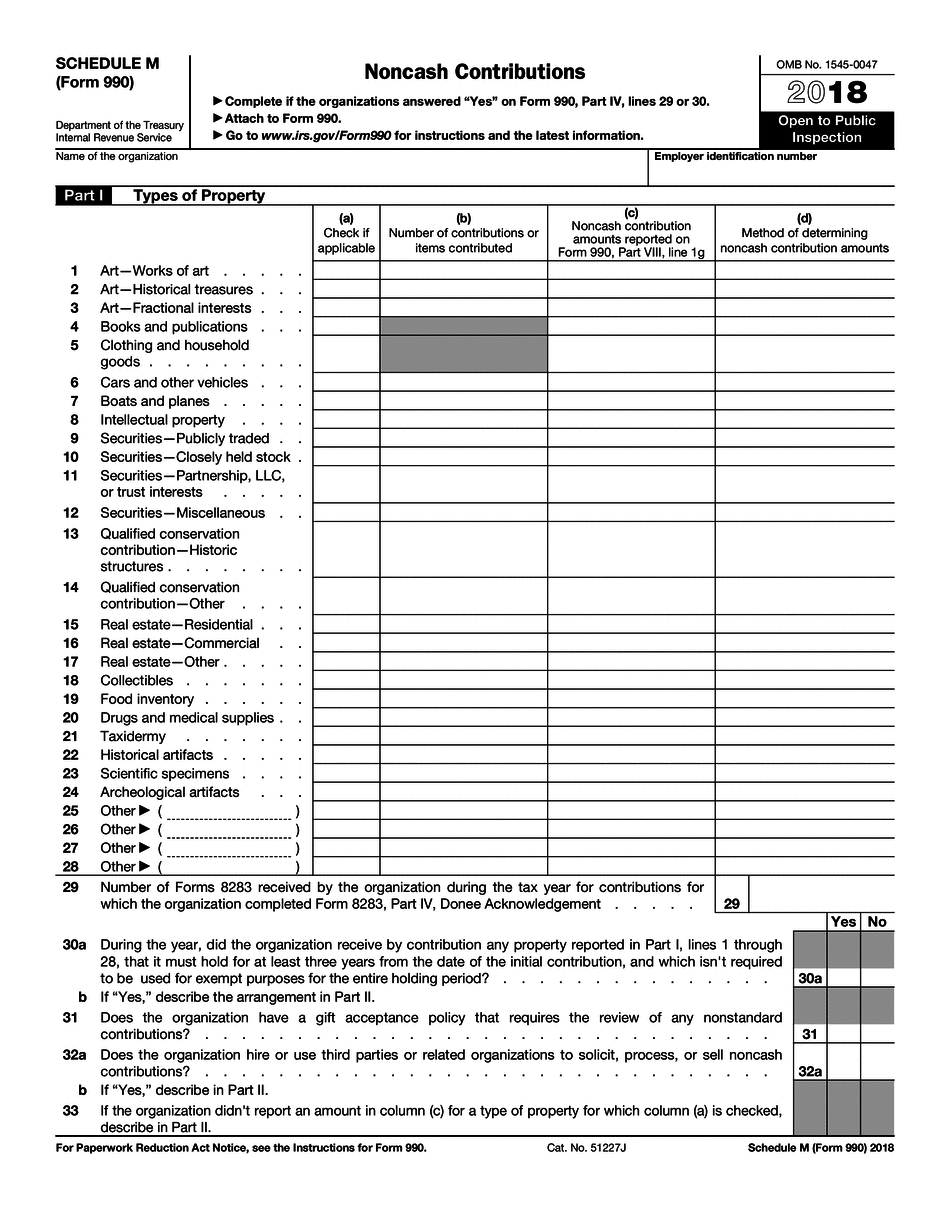

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

Schedule r (form 990) 2022: The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization. Web form 990 schedules with instructions. (column (b) must.

Form 990 (Schedule R) Related Organizations and Unrelated

Name, address, and ein of the disregarded entity. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. (column (b) must equal form 990, part x, col. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the.

Form 990 (Schedule R1) Related Organizations and Unrelated

Web for paperwork reduction act notice, see the instructions for form 990. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. 2022 schedule r (form 990) author: For more information, see schedule ca (540). Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year.

Schedule R (Form 990) 2022:

Related organizations and unrelated partnerships keywords: Enter the details of each disregarded entity on separate lines of part i. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships through which the organization conducts significant activities. For more information, see schedule ca (540).

Complete If The Organization Answered Yes On Form 990, Part Iv, Line 11B.

Web purpose of schedule. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue statement (part viii, line 1e) and public support calculations (schedule a, parts ii and iii). (column (b) must equal form 990, part x, col. 2022 schedule r (form 990) author:

Web Form 990 Schedules With Instructions.

Web part i of form 990 schedule r requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization. Schedule r (form 990) 2022: Web if yes, form 990 and schedule r may need to be completed instead of 45a did the organization have a controlled entity within the meaning of section 512(b). Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences.

Organizations That File Form 990 May Be Required To Attach Schedule R To Report Additional Information Regarding Related Organizations And.

Web for paperwork reduction act notice, see the instructions for form 990. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Instructions for these schedules are combined with the schedules. Name, address, and ein of the disregarded entity.