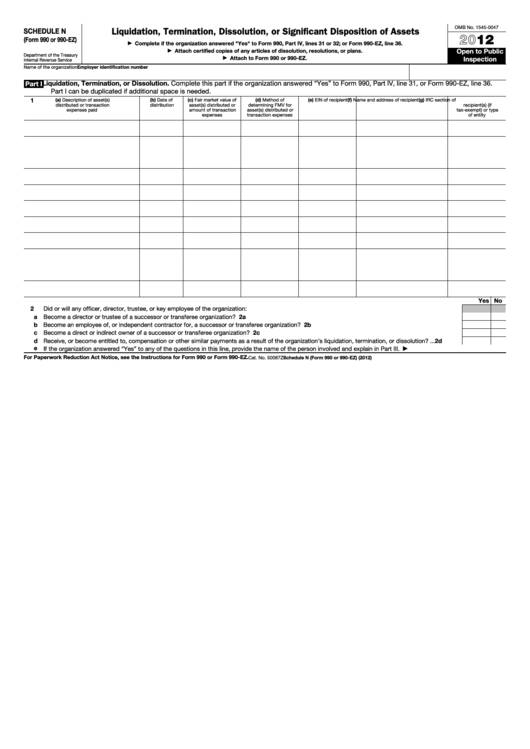

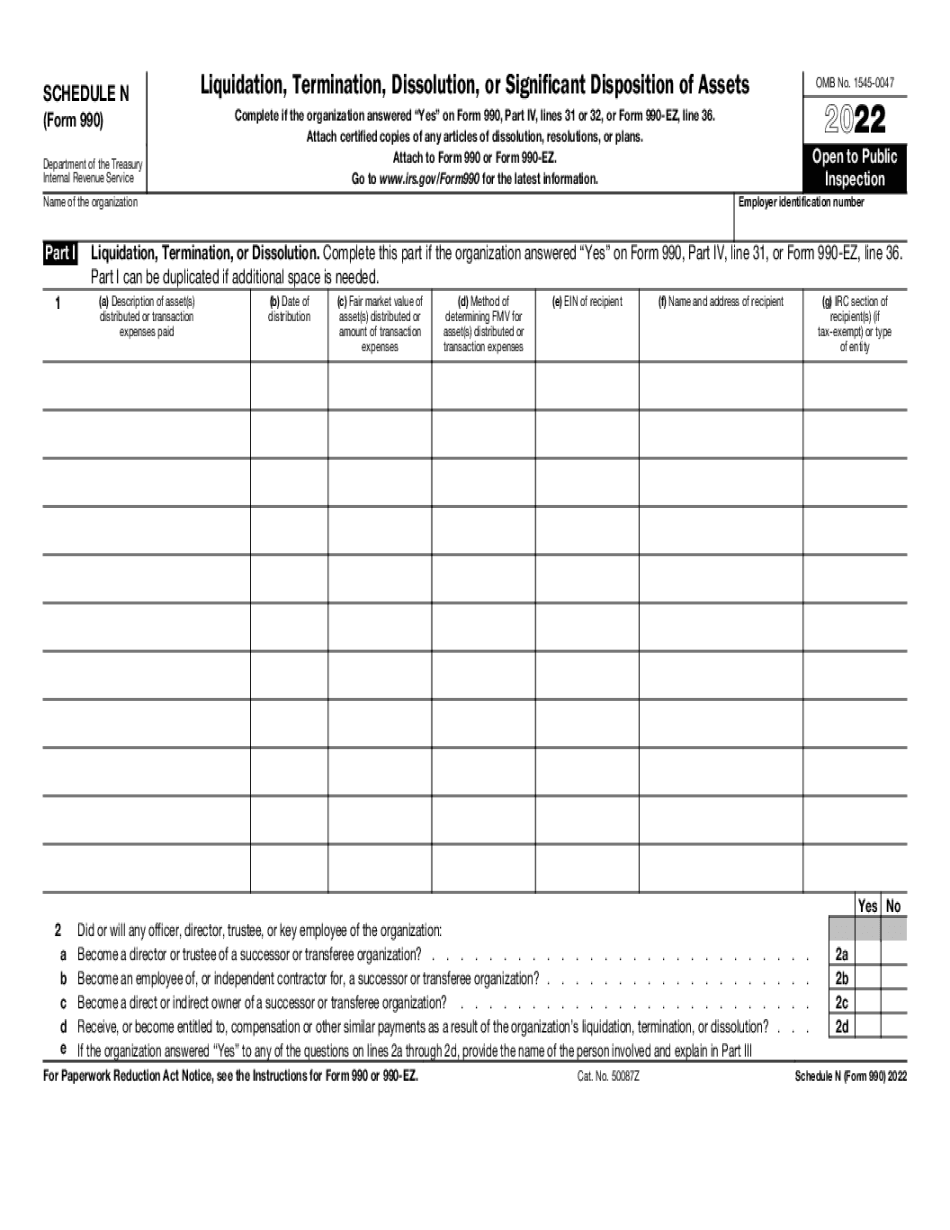

Form 990 Schedule N

Form 990 Schedule N - Web who is required to prepare and file schedule n and tax form 990 or 990ez? Nonprofit organizations and private foundations must use this schedule b to provide information. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. If you checked 12d of part i, complete sections a and d, and complete part v.). For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. This can be a bit overwhelming, so hang in. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. Reason for public charity status. On this page you may download the 990 series filings on record for 2021. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Reason for public charity status. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. There were concerns that small nonprofits were operating under the radar. The download files are organized by month. Web all private foundations, regardless of income. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. If you checked 12d of part i, complete sections a and d, and complete part v.). Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Instructions for these schedules are.

The download files are organized by month. Reason for public charity status. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. Instructions for these schedules are. Generating/preparing a short year return;. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. There were concerns that small nonprofits were operating under the radar. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. This can be a bit overwhelming, so hang in.

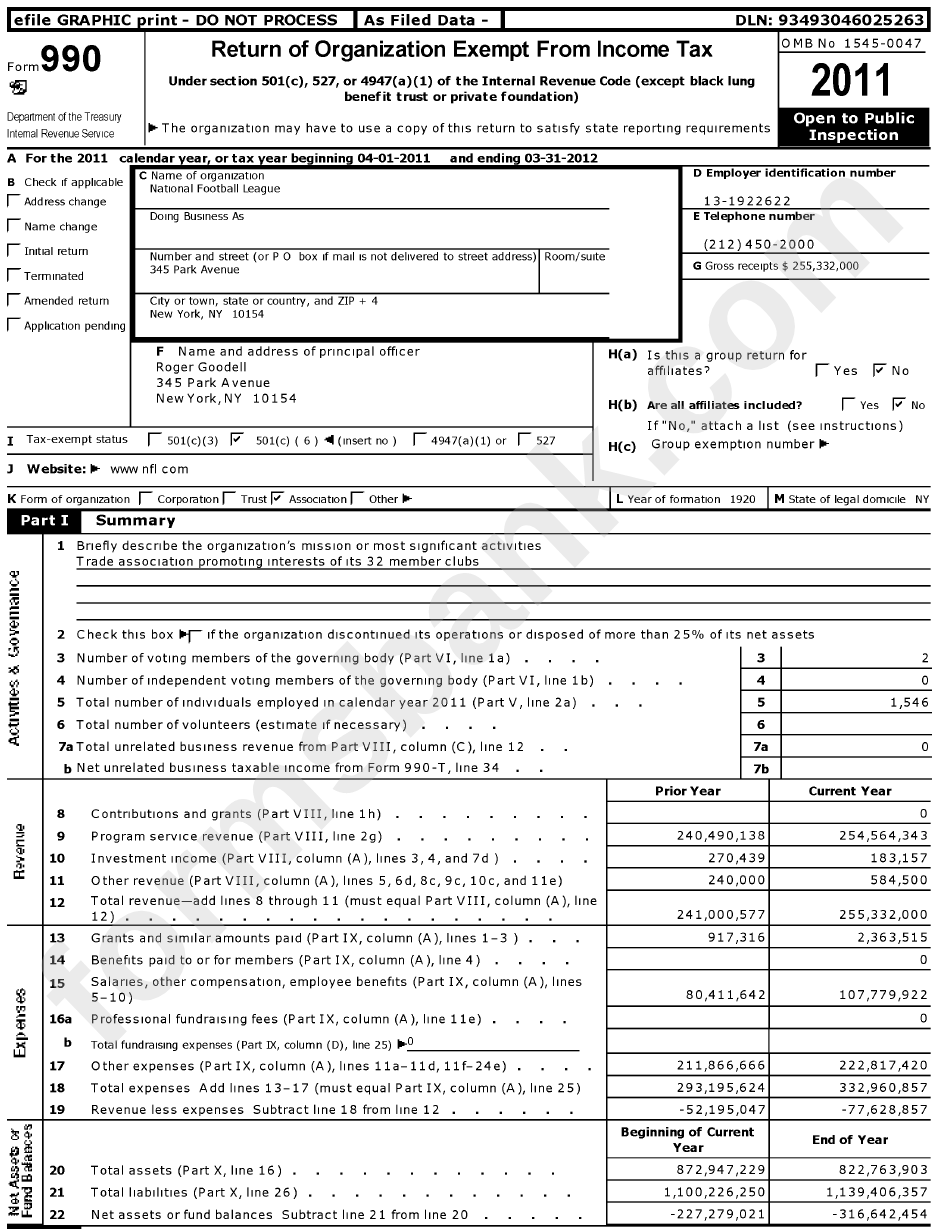

Form 990 Return of Organization Exempt From Tax Definition

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Reason for public charity status. Web form 990.

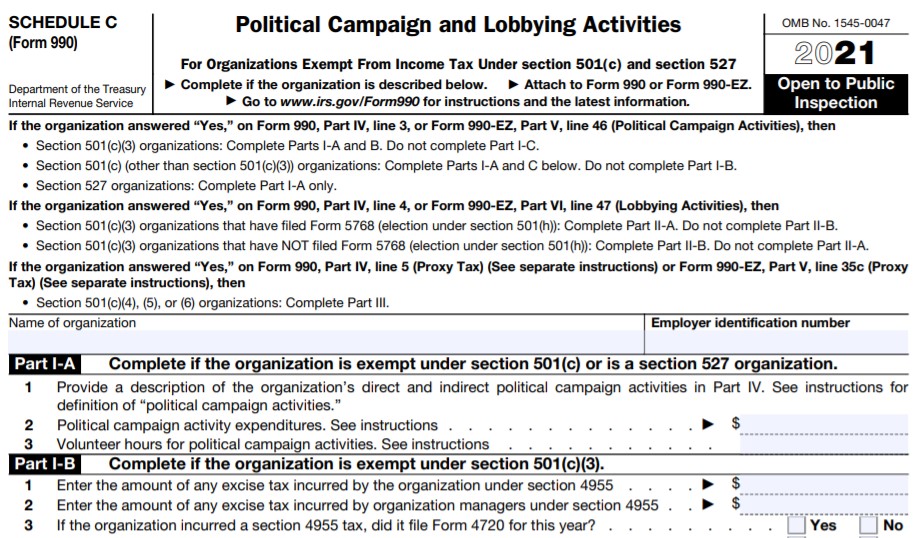

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through.

Form 990 2011 Sample printable pdf download

Web who is required to prepare and file schedule n and tax form 990 or 990ez? Generating/preparing a short year return;. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. Web all private foundations, regardless of income. There were concerns that small nonprofits were operating under the radar.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

Read the irs instructions for 990 forms. If you checked 12d of part i, complete sections a and d, and complete part v.). Reason for public charity status. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form.

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Reason for public charity status. The download files are organized by month. Nonprofit organizations and private foundations must use this schedule b to provide information. Instructions for these schedules are. Web there are 16 schedules associated with the form 990, they all report different information on an in depth level.

Fillable Schedule N (Form 990 Or 990Ez) Liquidation, Termination

Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. If you checked 12d of part i, complete sections a and d, and complete part v.). Web who is required to prepare and file schedule n and tax form 990 or 990ez? Web the following schedules to form 990,.

Form 990 schedule n 2023 Fill online, Printable, Fillable Blank

This can be a bit overwhelming, so hang in. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. On this page you may download the 990 series filings on record for 2021. Web who is required to prepare and file schedule n and tax form 990 or.

2017 IRS Form 990 or 990EZ Schedule L Editable Online Blank in PDF

If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. There are 16 schedules available. Web all private foundations, regardless of income. Web there are 16 schedules associated with the form 990,.

IRS 990 Form Schedule O Fillable and Printable in PDF

Instructions for these schedules are. Web who is required to prepare and file schedule n and tax form 990 or 990ez? There were concerns that small nonprofits were operating under the radar. Generating/preparing a short year return;. If you checked 12d of part i, complete sections a and d, and complete part v.).

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

On this page you may download the 990 series filings on record for 2021. There are 16 schedules available. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. This can be a bit overwhelming, so hang in. There were concerns that small nonprofits were operating under the.

Nonprofit Organizations And Private Foundations Must Use This Schedule B To Provide Information.

Reason for public charity status. On this page you may download the 990 series filings on record for 2021. There were concerns that small nonprofits were operating under the radar. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

The Download Files Are Organized By Month.

This can be a bit overwhelming, so hang in. Web there are 16 schedules associated with the form 990, they all report different information on an in depth level. Web who is required to prepare and file schedule n and tax form 990 or 990ez? Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules.

Web All Private Foundations, Regardless Of Income.

Read the irs instructions for 990 forms. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,.

Instructions For These Schedules Are.

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; There are 16 schedules available. If you checked 12d of part i, complete sections a and d, and complete part v.). Generating/preparing a short year return;.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)